Note: This website was automatically translated, so some terms or nuances may not be completely accurate.

How to Increase Corporate Value from an Investor's Perspective? Strategic IR Support Program "IR For Growth" (Part 1)

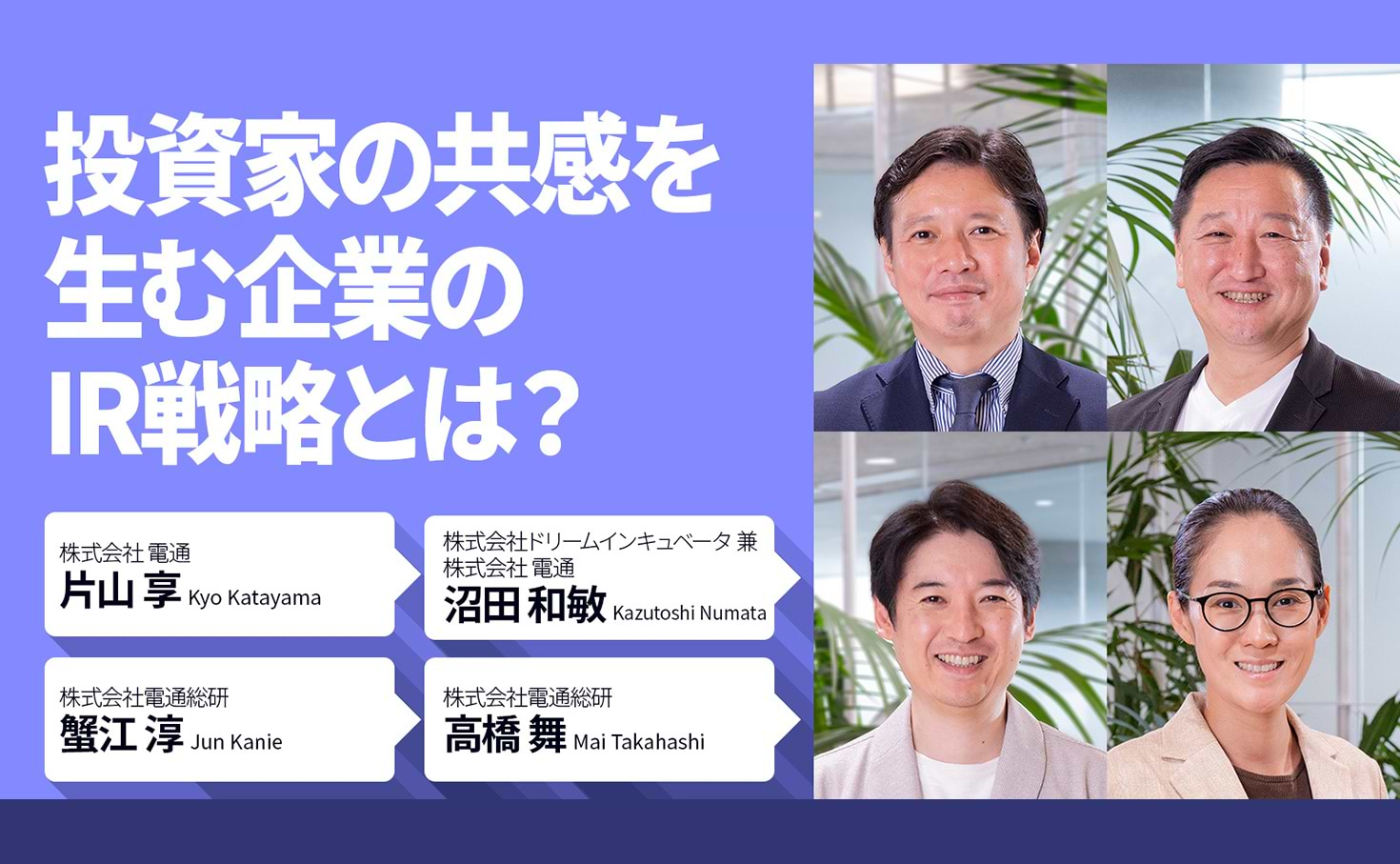

Kyou Katayama

Dentsu Inc.

Kazutoshi Numata

Dream Incubator Inc.

Jun Kanie

DENTSU SOKEN INC.

Mai Takahashi

Dentsu Inc.

Against the backdrop of trends in sustainability management and human capital disclosure, more companies are focusing on IR communication. IR activities are now a critical factor in enhancing corporate value. Nevertheless, many companies still struggle to effectively communicate non-financial value that resonates with stakeholders.

To address these challenges, the Dentsu Group in Japan (dentsu Japan ) has launched "IR For Growth," a program that supports companies in enhancing their long-term corporate value. This program combines IR support with consulting services covering both financial and non-financial aspects. This project involves the participation of Mr. Takashi Katayama, General Manager of the Business Transformation Division at Dentsu Inc.; Mr. Kazutoshi Numata, Executive Officer at Dream Incubator Inc. and also of the Dentsu Business Transformation Division, who supports the creation of new businesses and industries and corporate growth; and Mr. Jun Kanie of the Consulting Division at DENTSU SOKEN INC., who has developed consulting menus focused on enhancing both financial and non-financial value . Joined by Mai Takahashi from DENTSU SOKEN INC.'s DENTSU Consulting Inc., who has handled numerous human capital management projects, we discussed approaches to enhancing corporate value from an investor's perspective.

Why? The Reason Sustainable Corporate Value Enhancement is Being Reevaluated from an IR Perspective

Q. Why is IR being reevaluated now from the perspective of sustainable corporate value enhancement?

Q. Currently, about half of listed companies face the so-called "PBR (Price Book-value Ratio) 1.0 barrier," where their stock price falls below their net asset value per share. Could you explain the reasons for this and the challenges Japanese companies face?

Q. What approaches can be considered to raise PBR?

A Growth Story Integrating Financial and Non-Financial Value to Resonate with Investors

Q. You interact daily with many corporate executives. What challenges do you frequently encounter?

Strengths of dentsu Japan's One-Stop Support

Q. Against this backdrop, the Dentsu Group developed the strategic IR support program "IR For Growth." What are its strengths?

Due to revisions in the TOPIX selection rules, the current approximately 2,100 constituent companies are expected to decrease to around 1,200 by July 2028. Amid this demand for enhancing corporate value, "IR For Growth" provides end-to-end support—from IR assistance to financial and non-financial consulting, and the creation and dissemination of growth narratives. This process also provides an opportunity to clarify your company's strengths and challenges. If you're interested, why not consult with us? In the second part, we'll introduce successful case studies that integrated financial and non-financial value to drive corporate value enhancement.

Was this article helpful?

Newsletter registration is here

We select and publish important news every day

For inquiries about this article

Author

Kyou Katayama

Dentsu Inc.

Transformation Production Bureau

Director

Long-time account manager for a major telecommunications group within the Business Production Bureau. Produced numerous projects end-to-end, from service concept design to branding and campaign execution. Recently engaged in production work within the BX domain, supporting clients' corporate and business transformation. Also leads and promotes the Dentsu Group-wide strategic IR support program "IR For Growth."

Kazutoshi Numata

Dream Incubator Inc.

Executive Officer, Dentsu Inc. / Transformation Produce Bureau, Integrated Transformation Produce Division 1

Strategy and Installation Practice Leader, Graduate School of Shizenkan / Specially Appointed Associate Professor

Starting January 2025, concurrently serving as Business Development Director at Dentsu Inc., Transformation Produce Bureau. At Dream Incubator Inc., engaged in business production for various large corporations and venture companies, formulating growth strategies and new business strategies, and launching and supporting new businesses by involving/collaborating multiple large corporations and venture companies.

Jun Kanie

DENTSU SOKEN INC.

Consulting Division Future Business Development Unit

Unit Leader

With extensive experience in strategic planning and business transformation/BPR (Business Process Reengineering) across diverse industries including manufacturing, publishing, and restaurant chains, he also has broad involvement in solving people and organizational issues such as talent management and organizational revitalization. He transforms businesses by addressing both the value creation process and the human/organizational aspects, supporting clients in enhancing their value delivery capabilities. In recent years, he has intensified his focus on advancing sustainability management, economic security, and cybersecurity initiatives.

Mai Takahashi

Dentsu Inc.

Dentsu Inc. Business Design Square

Business Designer

After leaving Dentsu Inc. in 2010, she moved to the United States. Following the completion of her MBA and the birth and raising of her child, she returned to Dentsu Inc. in 2018. Drawing on extensive business experience—including her time as a systems analyst at a bank and her role in corporate strategy planning at an automotive company—she supports corporate transformation.