From left: Jun Naito and Takayuki Dobashi of MyBest; Masahiro Fukuda and Rongrong Ma of Dentsu Inc.; Miki Sakado of Dentsu Digital Inc.

Many companies possess a wealth of "first-party data" yet struggle to utilize it effectively.

This article introduces a Proof of Concept (PoC) case study demonstrating how to leverage a data clean room to uncover value in proprietary data and create new data-driven business opportunities.

Participating in the PoC was MyBest Inc., operator of the product comparison site "MyBest." The company linked its user behavior data with the joint analysis project "HAKONIWA" by LINE Yahoo and Dentsu Inc. to implement initiatives contributing to product purchases.

HAKONIWA Image

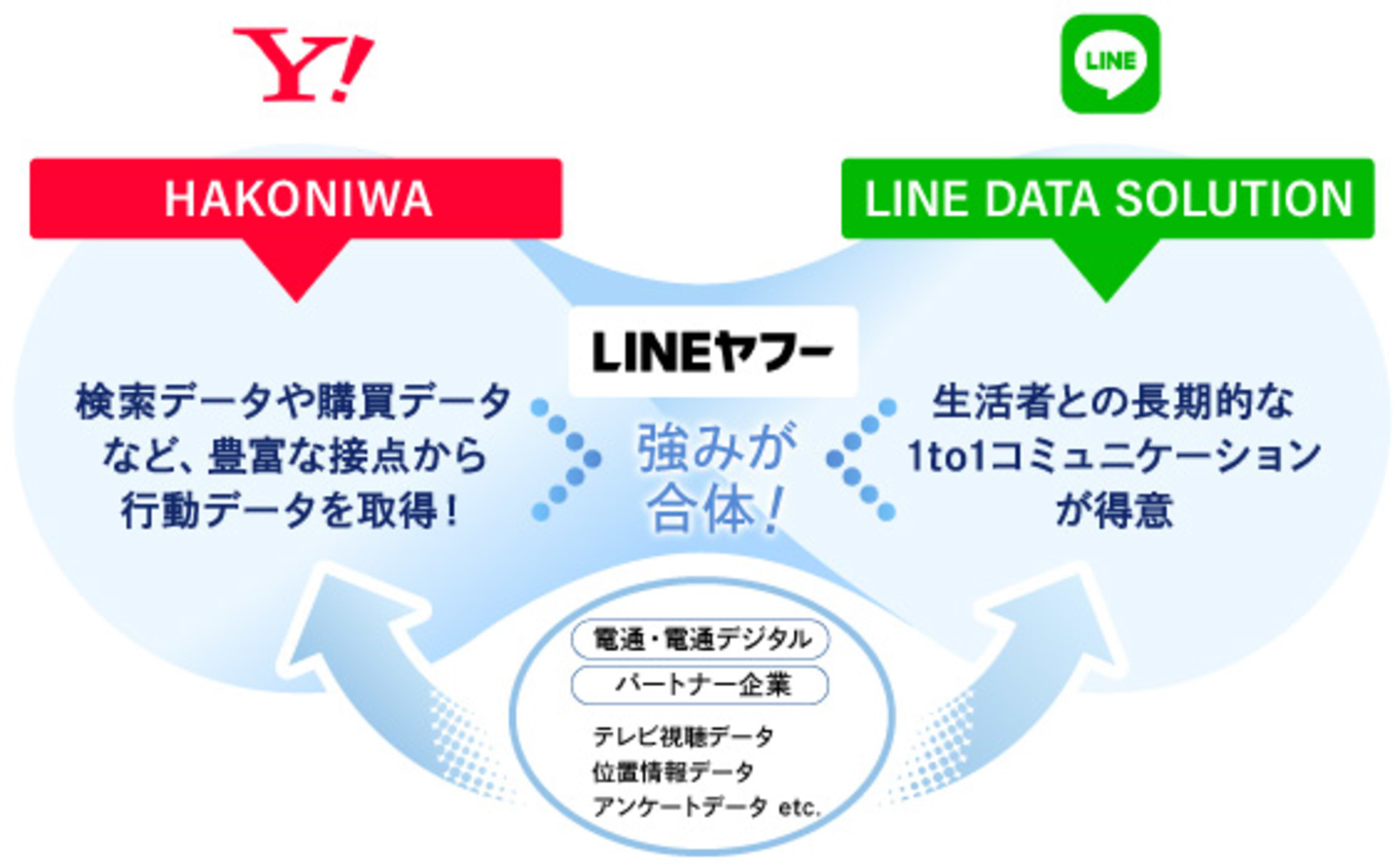

HAKONIWA

A joint data analysis project launched in 2019 by Dentsu Inc., Dentsu Digital Inc., and the former Yahoo Japan Corporation. It enables analysis centered on Yahoo! JAPAN IDs by securely linking data from Dentsu Inc., LINE Yahoo, and client data.

Regarding the PoC and future prospects for data utilization, we invited Takayuki Dobashi and Jun Naito from MyBest as guests. They discussed the topic with Dentsu Inc.'s Masahiro Fukuda and Rongrong Ma, along with Dentsu Digital Inc.'s Miki Sakado.

*All case studies introduced in this article utilize data analyzed and applied in a manner that does not identify individuals, with user privacy protection as the top priority.

Leveraging Vast Behavioral Data from the "Comparison and Consideration Segment"

Mr. Fukuda, Dentsu Inc.

──First, please introduce yourself and describe your role in this project.

Fukuda: I lead the Joint Data Growth Accelerator (JDGA) at Dentsu Inc. Data & Technology Center (DTC), which promotes the utilization of first-party data.

JDGA is a team that supports companies in creating business opportunities by leveraging their own data, utilizing Dentsu Inc.'s assets and network. For this PoC, I participated as the leader of HAKONIWA's data analysis team.

Ma: I'm also part of DTC and a member of JDGA. For this project, I served as the PoC project manager after receiving a request from MyBest.

Sakado: I belong to the Platform Division at Dentsu Digital Inc. and am responsible for LINE Yahoo. My primary role involves promoting advertising products, alongside driving commerce initiatives and data utilization. This includes the HAKONIWA project, which led to my participation in this PoC.

Dobashi: While MyBest primarily offers B2C services, as an Executive Officer, I oversee the B2B division and manage overall revenue. Our business model combines performance-based compensation and advertising. I develop overall business strategies and utilize our company's data to support client marketing efforts.

Naito: I manage the data science team at MyBest. Our team handles all aspects of data-related work, including A/B testing for sites and ads, and effectiveness verification. We are also currently building the data infrastructure for MyBest user behavior data.

──Could you explain the overview of MyBest's services?

Tsuchihashi: "MyBest," the service we operate, is a product comparison site now in its eighth year since launch. Rather than simply publishing rankings based on user reviews, we involve experts across various product categories to verify and research products ourselves. We regularly publish the latest rankings and comparison information. Through this process, we've accumulated original data unmatched anywhere else.

MyBest has over 30 million monthly unique users, making it a service used by one in four Japanese people.

Mr. Tsuchihashi, MyBest

──What kind of first-party data does MyBest possess?

Dobashi: There are two main types: data accumulated through product verification and research, and behavioral data from our 30 million monthly users within the site. Since the site features a wide variety of products, we have cross-category behavioral data spanning everything from home appliances to cosmetics. Additionally, since MyBest offers member registration, we also hold data for each registered member. Data accumulated through member registration is utilized within the scope of user consent, and during analysis, it is always processed statistically to ensure individuals cannot be identified.

From a marketing perspective, we position MyBest within the middle funnel, specifically targeting the "comparison and consideration stage" rather than just the "awareness stage." In fact, many companies struggle to effectively position their products within this middle funnel.

N aito: User behavior data and product verification data are core assets for our company and are uniquely proprietary. However, the sheer volume of data we can obtain is enormous and challenging to handle; we are still far from fully utilizing it.

Deliver ads to audiences interested in our products and verify whether they led to purchases

Mr. Naito, MyBest

──Please explain the PoC overview.

Ma: At MyBest, while we could identify the comparison-shopping segment, tracking their purchasing behavior after visiting the site was challenging. Visualizing the "subsequent purchase contribution" resulting from viewing MyBest would demonstrate how MyBest can drive user purchases.

Therefore, this time, by leveraging HAKONIWA, which possesses purchase data and diverse affinity data (characteristics such as what users prefer), we extracted the "affinity of users who compared products on MyBest." We built a MyBest × HAKONIWA analysis and delivery package that visualizes subsequent purchase contribution by targeting people with that affinity.

Sakado: For the PoC, led by Momoka Onuma of Dentsu Japan International Brands Inc., we collaborated with a global consumer goods manufacturer. Aiming to lift purchases of the client's own products, we delivered ads to "users viewing competitor products on MyBest" and verified whether this led to actual purchases.

Ma: More specifically, we analyzed the differences in characteristics (affinity) between "users considering our products" and "users considering competitor products" on MyBest, cross-referenced with HAKONIWA data. We then segmented users and delivered LINE Yahoo ads to those exhibiting characteristics common among the competitor consideration group. This allowed us to visualize whether it actually led to purchases.

Sakado: HAKONIWA can analyze various data held by LINE Yahoo. For example, it can link user IDs to data like "searches," "interests," and of course "purchases" on Yahoo! Shopping to reveal user characteristics. By combining this with user behavior data held by MyBest this time, we were able to increase the resolution.

Naito: Using HAKONIWA, we can statistically analyze—without identifying individuals—whether users who viewed specific products on MyBest's site subsequently made purchases on Yahoo! Shopping. Since MyBest is part of the LINE Yahoo Group, integrating with HAKONIWA was seamless.

Mr. Sakado, Dentsu Digital Inc.

──How did you define the "competitor consideration segment"?

Sakado: MyBest features not only product categories but also product detail pages and a search bar. We created "Own Product Consideration Segments" and "Competitor Product Consideration Segments" based on data from users viewing competitor products or searching for them by keyword.

──Did you deliver ads to "users researching competing products" during the PoC?

Sakado: Yes. To be precise, we listed the interests and preferences—particularly the high ones—for each segment and examined their inclusion rates. The results showed that users viewing competitor products had high inclusion rates for interests like "gourmet" and "finance."

──How did you measure the change in purchase lift after delivering the ads?

Sakado: HAKONIWA also receives ad exposure data, so we could calculate the final purchase rate on Yahoo! Shopping for both those exposed to ads and those not exposed within this segment. The results showed a very high lift value for "purchases" among users who received ads utilizing MyBest data.

──It's clear that linking first-party data with HAKONIWA increases purchase lift. What benefits does this data utilization offer to companies holding first-party data, in this case MyBest?

Fukuda: There are several. First, it creates demand for advertising placements on MyBest. This increases user engagement within MyBest. Beyond direct advertising, companies can also provide data to clients and earn data usage fees. Many companies want to analyze their competitors' users.

──What were the challenging or interesting aspects of this initiative?

Dobashi: Providing user behavior data externally was a new endeavor, so we proceeded very cautiously and meticulously with the contracts. We also spent considerable time selecting clients.

A key takeaway from this PoC was gaining insights into whether users who purchased products had interacted with MyBest and measuring the purchase lift value. In fact, MyBest holds vast amounts of "data not publicly available online," including monitor data and product verification metrics.

Internally, our data science team, led by Naito, is organizing the data infrastructure. We are now able to centrally manage both user behavior data and this "data not publicly available online." Moving forward, we want to be even more proactive in implementing data utilization strategies.

Naito: Currently, we are focused solely on refining our data management systems. Even from my perspective, there is a vast amount of interesting and unique data that we are not yet fully utilizing. I believe this underscores the significant business potential it holds.

Dobashi: As Mr. Fukuda mentioned earlier, we already have clients expressing interest in utilizing our company's data. Therefore, Naito's team is currently developing a dashboard to allow clients to view the data themselves.

This system displays data about who is viewing the site when you input a PC ID or URL. It only shows aggregated information, such as visit trends; it absolutely does not include any personally identifiable information or individual user histories. Moving forward, we are working to make various data easily understandable, tailored to the needs of corporate marketers.

──When utilizing first-party data, setting privacy policies becomes crucial. What aspects are you paying particular attention to?

Dobashi: At MyBest, we place the utmost importance on user trust and utilize data according to the following principles:

- We never use data in ways that identify individuals or reveal personal information.

- All analysis is conducted on an anonymous and aggregated basis

- Data sharing is conducted in environments compliant with laws, contracts, and security standards

- We prioritize usage that benefits users

We will continue to prioritize transparency and strive to build services that users can use with peace of mind.

Manage everything from competitor analysis to 1-to-1 marketing with HAKONIWA!

Dentsu Inc., Ma

──As JDGA, how do you plan to utilize first-party data going forward?

Ma: This time, we selected HAKONIWA as the platform for first-party data utilization specifically aligned with Yahoo! Ads as the campaign outlet. Going forward, we will advance integration to support a wider range of outlets.

Furthermore, we believe the comparison and consideration data held by MyBest has potential applications beyond advertising. Therefore, we aim to develop solutions that can be leveraged in retail, sales promotions, and various product development initiatives.

──From MyBest's perspective, what is the appeal of the HAKONIWA platform?

Dobashi: Integrating MyBest's data accumulation with HAKONIWA enables us to paint a more multidimensional picture of data. We see HAKONIWA as a starting point for creating new value and plan to utilize it as a hub connecting diverse data streams.

Fukuda: The Dentsu Group has various data specialists. Some members focus purely on analysis, while others consider how to efficiently utilize data and what kind of verification can be done after utilization. We believe we can respond to the diverse needs of MyBest and other client companies.

Ma: A major strength of the Dentsu Group is that, by engaging with such a diverse range of clients, we have developed a significant ability to aggregate client needs. By incorporating these real needs, I believe we can create new business opportunities with companies like MyBest.

Dobashi: We also conduct thorough reviews from a marketer's perspective. Against that backdrop, the advice we receive from Dentsu Inc., with its broad industry expertise, is extremely valuable.

──Please share your outlook on future user data utilization.

Naito: MyBest has 30 million monthly users, enabling us to analyze vast amounts of data. For example, we recently discovered that the peak pollen season is shifting about two weeks later than usual, possibly due to global warming. This naturally shifts the peak purchasing period for related products. Depending on how it's utilized, this data could potentially be applied to economic forecasting.

Sakado: HAKONIWA possesses the vast data held by LINE Yahoo. Its strength lies not just in the sheer number of IDs, but in reflecting LINE Yahoo's wide range of services, enabling insights into diverse user attributes and behaviors. Connecting this with clients' first-party data and user IDs increases user resolution, thereby improving output quality.

If LINE data can be connected to HAKONIWA in the future, it could be linked with data from companies' LINE Official Account friends, accelerating 1-to-1 marketing.

──Combining first-party data with HAKONIWA seems to open up possibilities that weren't feasible before. Thank you for your time today.

*For an overview of Dentsu Group's data clean room solution "TOBIRAS," click here