Note: This website was automatically translated, so some terms or nuances may not be completely accurate.

Can Art Be Marketed?

Hiroshi Onishi

Tokyo University of Science

Takuma Uehara

Dentsu Inc.

1. Is Art an Asset?

On May 10th, news broke that Yusaku Maezawa, president of Start Today, the company operating ZOZOTOWN, had won a Basquiat painting at a Christie's auction for approximately 6.2 billion yen. Typically, when we hear about art in the news, it's often when such high-value auction wins occur, isn't it?

Perhaps because of this, I suspect more people lately are forming the impression that "art apparently generates enormous money." The image of art as something an artist creates in solitude, only to be recognized for its value a hundred years later and see the light of day in a museum... that perception of art may now be quite outdated. In reality, art is recognized as a financial product (an asset) circulating in the market.

At Dentsu Inc., we receive art-related inquiries from companies, and I feel the number is increasing year by year. I believe it's time to consider art from the perspective of art and marketing, which is why I decided to start this series. This article was co-authored by Uehara, who works on art-related projects like museums at Dentsu Inc., with the cooperation of Associate Professor Hiroshi Onishi from Tokyo University of Science, who researches art marketing.

※Authors: 1, 3, 4, 6... Takuma Uehara; 2, 5... Hiroshi Onishi

2. World vs. Japan: The Current State of the Art Market

But is marketing truly possible for art? It might seem like oil and water to the general public.

The global art market was estimated at approximately ¥7.6 trillion in 2014. Considering the global home video game market was around ¥8 trillion that same year, this indicates a comparable market size—a substantial amount of money is in motion. Moreover, since art transactions cannot be measured solely by publicly recorded sales, the actual market is likely even larger. In contrast, research on the art market in Japan is very limited, revealing a reality where it cannot be considered industrialized.

Furthermore, art investment in Japan is extremely minimal. While we mentioned at the beginning that Mr. Maezawa purchased a Basquiat for 6.2 billion yen, this remains an exceptional case. Japanese collectors are very few compared to the rest of the world, and buying art is not deeply rooted as a cultural practice. Overseas, many homes display art, and it's not uncommon to buy art as a gift for anniversaries or celebrations. It seems that because people feel art is valuable from childhood, there is fertile ground for viewing it as an investment.

Looking at Figure 1 below, the top three countries—the US, China, and the UK—dominate the global art market share, leaving Japan with only 0.7%. However, Figure 2 shows that Japanese citizens possess substantial assets. The U.S. middle class has assets commensurate with its share of the art market, while China and the UK hold larger shares despite having fewer assets than Japan (*). This suggests that Japanese people, despite having assets, either do not buy art or do not view art as an asset.

※ Experts suggest the UK's high art market share may also be due to many collectors from neighboring countries purchasing art in London. Furthermore, concerns exist that the UK's future departure from the EU could significantly impact its art market.

That said, Japan also had a period around the peak of the bubble economy in 1990 when business tycoons continuously purchased Impressionist paintings by artists like Van Gogh and Renoir for over 10 billion yen, creating a massive market. Corporate patronage (cultural support activities) flourished, and numerous companies built art museums. Now, with the bubble gone, museums are selling masterpieces and closing... the boom seems to have vanished like the wind.

However, several recent developments suggest the Japanese art market wasn't merely a bubble-driven, transient phenomenon. Fundamentally, the Japanese people are a nation that loves art. For a long time, the number of people visiting museums has been among the highest in the world. For example, recently, the Jakuchu exhibition at the Tokyo Metropolitan Art Museum became a hot topic when visitors faced five-hour waits just to enter. Furthermore, the number of people buying artworks, especially among the younger generation, is increasing year by year (we, the authors, have also started buying a few pieces personally). As mentioned later, there are also several cases where companies are once again investing in art.

3. The Rising Art Market Felt at Art Basel Hong Kong

The global art market is booming. While the market itself has been sluggish, Japanese art has regained attention. There are several reasons we decided to start this series, but the primary one is our belief that Dentsu Inc. can apply its accumulated marketing expertise to maximize the value of art.

Of course, the creative process itself—separate from market forces and demand—remains art's greatest appeal. Yet this doesn't mean elevating art's value requires waiting solely for an artist's genius. Those who support and manage artists should employ every possible strategy to expand the market and stimulate economic circulation.

Marketing—the activity of analyzing markets, discovering customers, driving consumption cycles, and elevating brands—is established through the mutual engagement of all players: curators, galleries, critics, collectors, and more. While it's often said that "art can't be marketed," we firmly believe this is not the case. Isn't art something that should be collectively elevated in value through the accumulated effort and logic of those gathered around the artist? Without marketing, the market won't grow, and without a market, artists cannot make a living. Art and marketing are inextricably linked.

I recently had the opportunity to visit Art Basel Hong Kong, the Asian edition of the world's largest contemporary art fair. While it's a venue where celebrities from around the world gather and top galleries showcase and sell their prized works, what struck me was the variety of events happening not just at the main venue but also in the surrounding areas.

At the Hong Kong Arts Centre next door, an exhibition featured works from Japanese collectors, while galleries across Hong Kong were opening new shows. Numerous exhibitions and events were also happening at alternative spaces and NPOs seemingly unrelated to commercial activity. Furthermore, M+, Asia's largest public museum scheduled to open in 2019, held a preview event showcasing its collection of Chinese contemporary art.

And then there was Art Basel Hong Kong itself—a dazzling space where numerous companies sponsored lavish booths to entertain VIPs, and parties filled with lively art conversations unfolded night after night. While in Japan it's often said that "museums (non-profit) and galleries (for-profit) don't collaborate," in Hong Kong, for-profit and non-profit entities were all interconnected, collectively creating a massive art space.

4. New Engagements Between Japanese Companies and Art: Corporate Collections

While I mentioned that many companies sponsor Art Basel Hong Kong, Japan isn't without its own fertile ground for such involvement. In fact, many major Japanese corporations actively sponsor art.

Take automobile manufacturers, for example. Toyota operates the " TAM: Toyota Art Management " website, which disseminates art-related information and functions as a job board for art-related positions. Nissan Motor hosts the " Nissan Art Award," discovering and producing promising young artists in Japan while also providing financial support. MINI (a BMW automotive brand) resonates with the regional revitalization activities of the " Echigo-Tsumari Art Triennale " and provides official cars.

Beyond the automotive industry, Start Today's President Yusaku Maezawa, introduced earlier, is globally renowned as a collector and serves as chairman of the contemporary art promotion foundation he established. Stripe International's President Yasuharu Ishikawa is also a collector and producer of the " Okayama Art Summit," which revitalizes Okayama Prefecture through contemporary art. Numerous other examples exist, including Obayashi Corporation, Benesse, Shiseido, Panasonic, Seiko, and Yaskawa Electric.

Why do companies support art? The reasons vary, but symbolically, Monex Securities believes that "art challenges the direction and thinking of the company, providing great inspiration to employees." Every year, the company opens its press room for an event called "ART IN THE OFFICE," where artists selected through a public call for entries stay and create works that are exhibited for a year. During the production period, Monex employees interact with the artists. This allows them to engage with people from different fields than their own, providing an opportunity to broaden their perspectives.

Regional revitalization, branding, educational outreach. Companies pursue diverse objectives through art, finding new significance beyond the bubble era.

Tax regulations have also changed. Previously, the upper limit for art qualifying as a depreciation expense for companies was ¥200,000 per piece. Starting in 2015, this limit was raised to ¥1,000,000. Art purchased for under ¥1,000,000 can be expensed over a few years. With stories of works bought for hundreds of thousands of yen transforming into hundreds of millions becoming increasingly common, art is also beginning to gain attention as an asset.

5. Can the Olympics invigorate art?

The 2020 Tokyo Olympics will bring a flood of tourists from around the world. I believe art has the potential to be one of the most anticipated attractions then. While the Olympics are a celebration of sports, the Olympic Charter mandates the implementation of cultural programs, known as the "Cultural Olympiad."

The 2012 London Olympics are often cited as a successful example of such a cultural program. Over the four years leading up to the Games, approximately 180,000 events were held, attracting 43 million participants and generating enormous economic benefits. London's brand value improved, and tourist numbers have continued to rise even after the Olympics concluded.

More importantly, the people of London and the UK who participated in the cultural program continue their activities to this day and have developed a greater sense of pride in British contemporary culture. Similarly, for the Tokyo Olympics, culture and its core element, art, will likely be essential to continue energizing local communities beyond 2020.

6. Delving Deep into Japan's Art Market

We explored how art has become a massive capital-driven industry, the art economy hub supported by Hong Kong authorities where key players have gathered, corporate approaches to art investment, and the role of art in the Olympics. Using concrete examples, we showed that art is no longer just for appreciation; it has become a powerful force driving markets and ecosystems.

Incidentally, Japan has many outstanding artists. Yayoi Kusama, Takashi Murakami, Yoshitomo Nara, and Hiroshi Sugimoto are internationally renowned. Many young artists also exist, showcasing diverse styles. Yet, when speaking with art industry professionals, one often hears: "Art markets exist globally, but not in Japan (though antique art does have a market)." As we delved deeper into why, it became clear that Japanese art possesses ample monetization potential from a marketer's perspective.

Globally, art is an asset whose value is enhanced through marketing. As we approach 2020, this series aims to present answers from the perspective of Dentsu Inc.—seen as an "outsider" by the industry—regarding the path Japanese art should take.

Furthermore, we launched an internal Dentsu Inc. initiative called "Art Circuit." Its members include not just art enthusiasts, but also university researchers, collectors, and artists themselves. As the name suggests, we aspire to connect individual dots—people, events—and weave together the value of art. This series aims not only to provide analysis and articles but also to take the first steps toward realizing that goal.

However, we might lose our way if we proceed alone. Therefore, we have enlisted the assistance of Arts Initiative Tokyo (AIT) as our guide. For over 15 years, AIT has been at the forefront of Japanese art management and has educated numerous players active in the art world through contemporary art education. Next time, we will deepen our discussion with Yuko Shiomi, representative of AIT, and Hiroyasu Wakabayashi, who researches art marketing at Dentsu Inc. Through this process, we hope to explore the hidden potential of art together with you.

Contact: Bijutsu Kōro &kairo@dentsu.co.jp

Was this article helpful?

Newsletter registration is here

We select and publish important news every day

For inquiries about this article

Author

Hiroshi Onishi

Tokyo University of Science

School of Business Administration

Associate Professor

Earned a Ph.D. in Marketing from the Ross School of Business at the University of Michigan. Assumed current position in April 2016. Specializes in research on the application of social media in marketing. Also developed an interest in contemporary art during his time in the United States and is engaged in scientific research on the art market using marketing theory. Recipient of numerous awards including the Japan Operations Research Society's "Case Study Award," the ESOMAR Asia Pacific Conference's "Best International Research Presentation Award," and the Leo Burnett Fellowship.

Takuma Uehara

Dentsu Inc.

Data & Technology Center

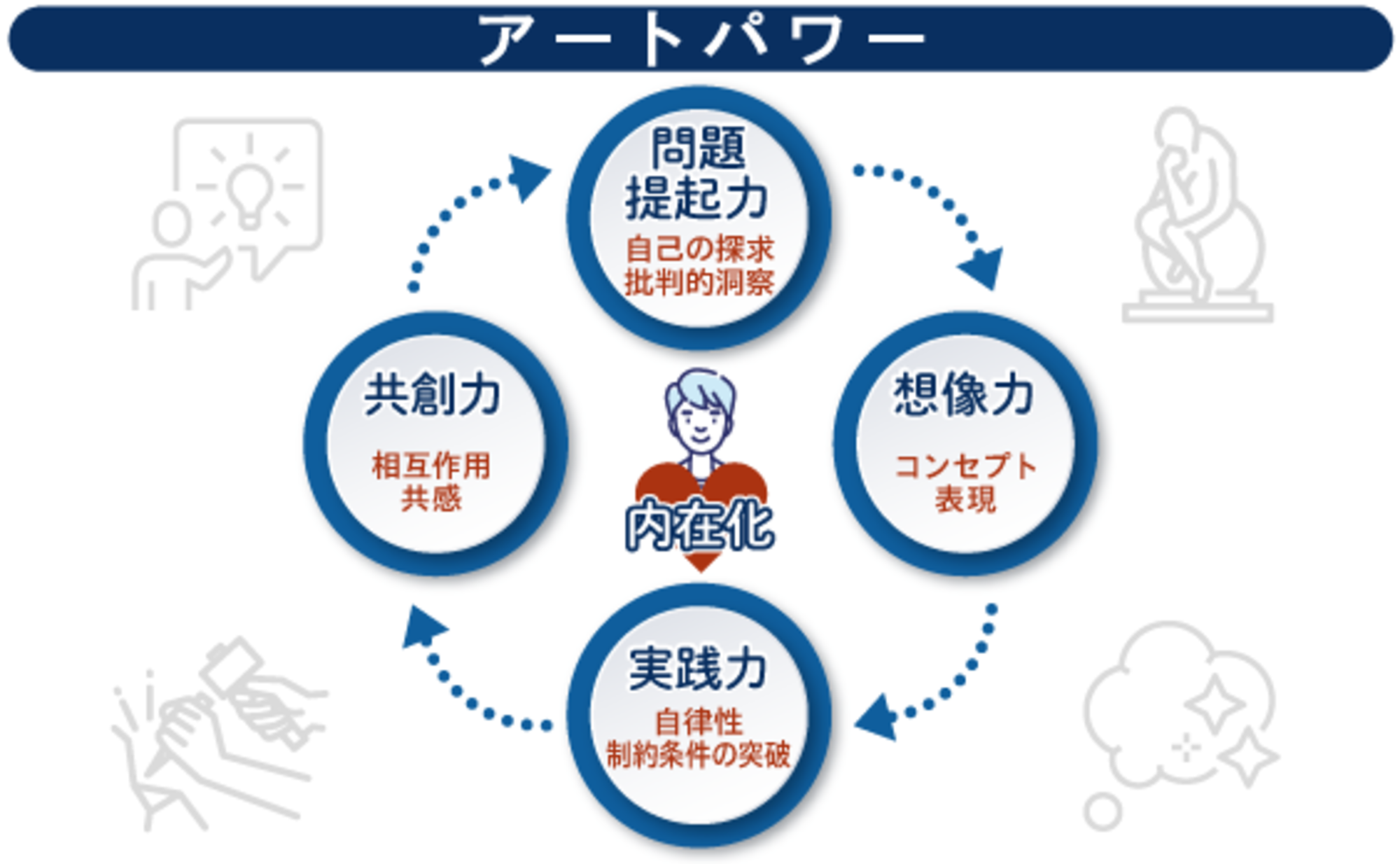

Majored in Art Management at university. Joined Dentsu Inc. after working at an advertising agency, think tank, and business consulting firm. Engaged in DMP development, location-based analytics, omnichannel strategies, and UI/UX design. Hosts the "Art Telling Tour RUNDA," which allows participants to experience the thought processes of artists, holding tours nationwide. Currently researching methodologies for art thinking based on data science at graduate school. Co-author of 'Art in Business: The Power of Art That Works for Business'.