Note: This website was automatically translated, so some terms or nuances may not be completely accurate.

Dentsu Inc. Announces Consolidated Financial Results for the First Quarter of the Fiscal Year Ending December 2017 (IFRS)

The text of the Dentsu Inc. news release distributed on May 15 is as follows.

Consolidated Financial Results for the First Quarter of the Fiscal Year Ending December 2017 (IFRS)

― Strong Performance in Both Domestic and Overseas Operations Drives Revenue and Profit Growth ―

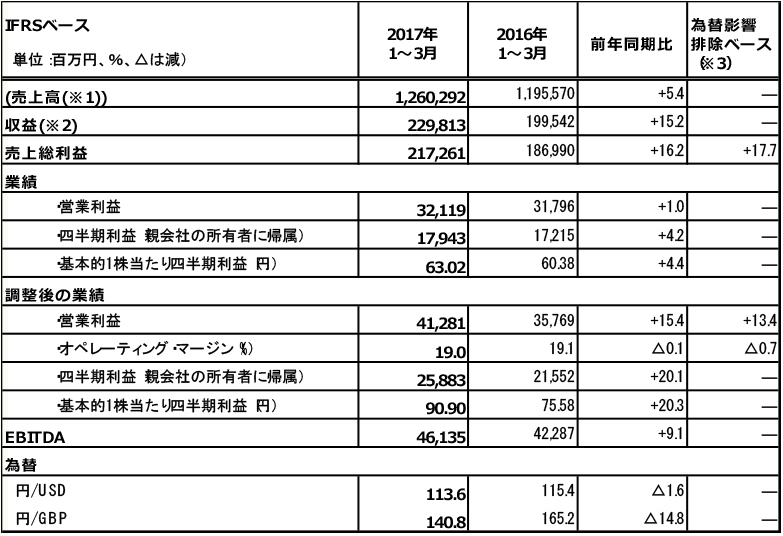

■Consolidated Results

Revenue: ¥229,813 million (up 15.2% year-on-year)

Gross Profit: ¥217,261 million (up 16.2% YoY)

Adjusted Operating Income: ¥41,281 million (up 15.4% YoY)

Operating profit: ¥32,119 million (up 1.0% YoY)

Adjusted quarterly profit (attributable to owners of the parent): ¥25,883 million (up 20.1% YoY)

Net income attributable to owners of parent: ¥17,943 million (up 4.2% YoY)

Dentsu Inc. (Head Office: Minato-ku, Tokyo; President and CEO: Toshihiro Yamamoto; Capital: ¥74,609.81 million) held a Board of Directors meeting today at the Dentsu Head Office Building in Shiodome, Tokyo, and finalized its consolidated financial results for the first quarter of the fiscal year ending December 2017 (January 1, 2017 to March 31, 2017).

<Financial Results Overview>

During the first quarter consolidated period, the Japanese economy showed a moderate recovery trend, supported by improvements in corporate earnings, employment, and income. Globally, however, uncertainty increased due to the transition to the new U.S. administration, developments toward the UK's withdrawal from the EU, and unstable international conditions.

Under these conditions, the Group's performance for the first quarter cumulative period showed robust gross profit of ¥103,966 million (up 4.7% year-on-year) for domestic operations, driven by contributions such as the 2017 WORLD BASEBALL CLASSIC. For overseas operations, the organic growth rate of gross profit by region was as follows: Europe, Middle East, and Africa (EMEA) increased 5.8% year-on-year, the Americas increased 0.6%, and Asia-Pacific (excluding Japan; APAC) increased 4.5%. Overall, the organic growth rate for overseas operations was 3.1%. Contributions from M&A also led to a significant increase in overseas gross profit, which reached ¥113,329 million (up 29.2% year-on-year).

As a result, revenue for the first quarter consolidated period was ¥229,813 million (up 15.2% year-on-year), gross profit was ¥217,261 million (up 16.2%), adjusted operating profit*1 was ¥41,281 million (up 15.4%), Operating profit was ¥32,119 million (up 1.0% YoY). Adjusted quarterly profit attributable to owners of the parent company※2 was ¥25,883 million (up 20.1% YoY), while quarterly profit attributable to owners of the parent company was ¥17,943 million (up 4.2% YoY).

※1 Adjusted operating profit is a profit metric that measures the performance of recurring business operations by excluding from operating profit the amortization of intangible assets related to acquisitions, M&A-related expenses, impairment losses, gains or losses on sales of fixed assets, and other temporary factors.

※2 Adjusted quarterly profit attributable to owners of the parent is an indicator measuring recurring profit attributable to owners of the parent, derived by excluding from quarterly profit: adjustments related to operating profit, revaluation gains/losses on earn-out obligations and acquisition-related put options, and the related tax effect and non-controlling interest share.

The performance of the reportable segments for the first quarter of the current fiscal year is as follows:

a. Domestic Business

Gross profit for Domestic Operations was ¥103,966 million (up 4.7% year-on-year), and adjusted operating profit was ¥36,589 million (up 10.1% year-on-year).

b. Overseas Business

Gross profit for Overseas Operations was ¥113,329 million (up 29.2% year-on-year), and adjusted operating profit was ¥4,698 million (up 84.6% year-on-year).

For the Company's non-consolidated results (Japanese GAAP): ordinary income was ¥36,399 million (down 20.3% YoY), and net income was ¥28,108 million (down 26.0% YoY).

(Reference: Scope of Consolidated Financial Statements)

The scope of consolidated financial statements includes 860 consolidated subsidiaries and 61 equity-method affiliates. The breakdown by reporting segment is as follows: for consolidated subsidiaries, 84 domestic and 776 overseas; for equity-method affiliates, 32 domestic and 29 overseas.

For detailed results for the first quarter of the current fiscal year, please refer to http://www.dentsu.co.jp/ir/.

.

<Consolidated Performance Forecast for Fiscal Year 2017>

As the results for the first quarter of the current fiscal year were largely in line with expectations, the full-year (January 1, 2017 to December 31, 2017) performance outlook announced on February 14, 2017 remains unchanged.

(Reference: Consolidated Performance Highlights for the First Quarter of Fiscal Year 2017)

※1 Revenue represents the total amount billed to customers by our group and the total amount billable to customers (excluding discounts and related taxes such as consumption tax). Although not required under IFRS, we voluntarily disclose this information as it is considered useful to financial statement users.

※2 The breakdown of the Group's revenue consists primarily of commissions earned from advertising placements across various media, and fees received from advertisers and others for services such as advertising production (including creative services) and various content services. Revenue from advertising production and other advertising services is recorded as the net amount received from advertisers and other clients as compensation for these services, less costs, or as a fixed amount or fixed fee. Transactions related to businesses other than advertising are reported on a gross basis for both revenue and costs.

※3 Excluding foreign exchange effects: This refers to a comparison between actual results for the current period and comparative figures (such as results from the previous period) restated using the exchange rate at the time of the most recent settlement.

■Consolidated Performance Highlights

Gross profit for the first quarter increased 17.7% year-on-year on a currency-neutral basis.

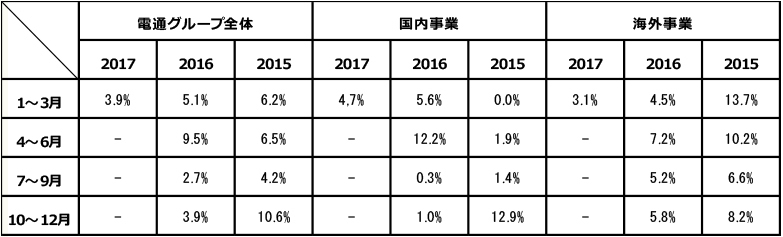

The organic growth rate of gross profit (internal growth rate excluding the effects of foreign exchange and M&A) was 3.9%.

・Organic growth rate for domestic operations: 4.7%; Organic growth rate for overseas operations: 3.1%.

・Adjusted operating profit increased by 13.4% year-on-year, excluding foreign exchange effects.

・Operating margin (adjusted operating profit ÷ gross profit) was 19.0%.

・Basic adjusted quarterly earnings per share increased 20.3% year-on-year.

・Continued focus on acquisitions to drive growth (acquired three overseas companies in January-March 2017).

■Adjustments from Adjusted Operating Profit to Operating Profit

<Performance by Region>

The organic gross profit growth rate for domestic operations in the first quarter was 4.7%, supported by contributions from businesses related to the "2017 WORLD BASEBALL CLASSIC."

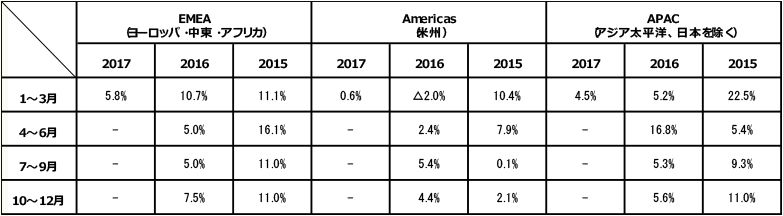

Overseas, gross profit increased 32.8% year-on-year (excluding currency effects) due to M&A contributions, with organic gross profit growth at 3.1%. All three regions—EMEA, Americas, and APAC—achieved positive growth, with overall overseas growth exceeding the mega-agency average.

By region: EMEA: Gross profit increased 18.2% year-on-year (excluding currency effects), with organic gross profit growth of 5.8%. Performance was strong across the Nordic region. In Western Europe, France, Italy, Russia, and Poland showed solid trends. The UK maintained positive growth despite uncertainty surrounding Brexit and the general election.

In the Americas, gross profit increased 63.4% year-on-year (excluding currency effects), with organic gross profit growth of 0.6%. In the US, gross profit grew at a double-digit rate, driven by contributions from iProspect and Fetch, as well as the integration effects of Merkle, acquired last year. Growth was also led by Mexico and South American countries like Argentina and Colombia. Meanwhile, Brazil continues to face an uncertain market environment due to geopolitical and economic tensions.

In APAC, gross profit increased 11.6% year-on-year (excluding currency effects), with organic gross profit growth at 4.5%. Performance was strong across many countries and regions, with particularly robust double-digit growth in Taiwan, alongside solid performance in India, Australia, Indonesia, and Singapore. While campaign execution delays impacted China in Q1, momentum is building heading into Q2, supported by new business wins.

During the first quarter, the Group completed acquisitions of three companies across three regions: EMEA, Americas, and APAC, primarily focused on the digital domain.

■ Quarterly Organic Growth Rate Trend (Based on Gross Profit)

■Trend in Organic Growth Rate by Region for Overseas Operations (Based on Gross Profit)

Was this article helpful?