Note: This website was automatically translated, so some terms or nuances may not be completely accurate.

Visualizing the Effects of ESG Management: An Attempt to Unravel Complex Issues with AI (Part 2)

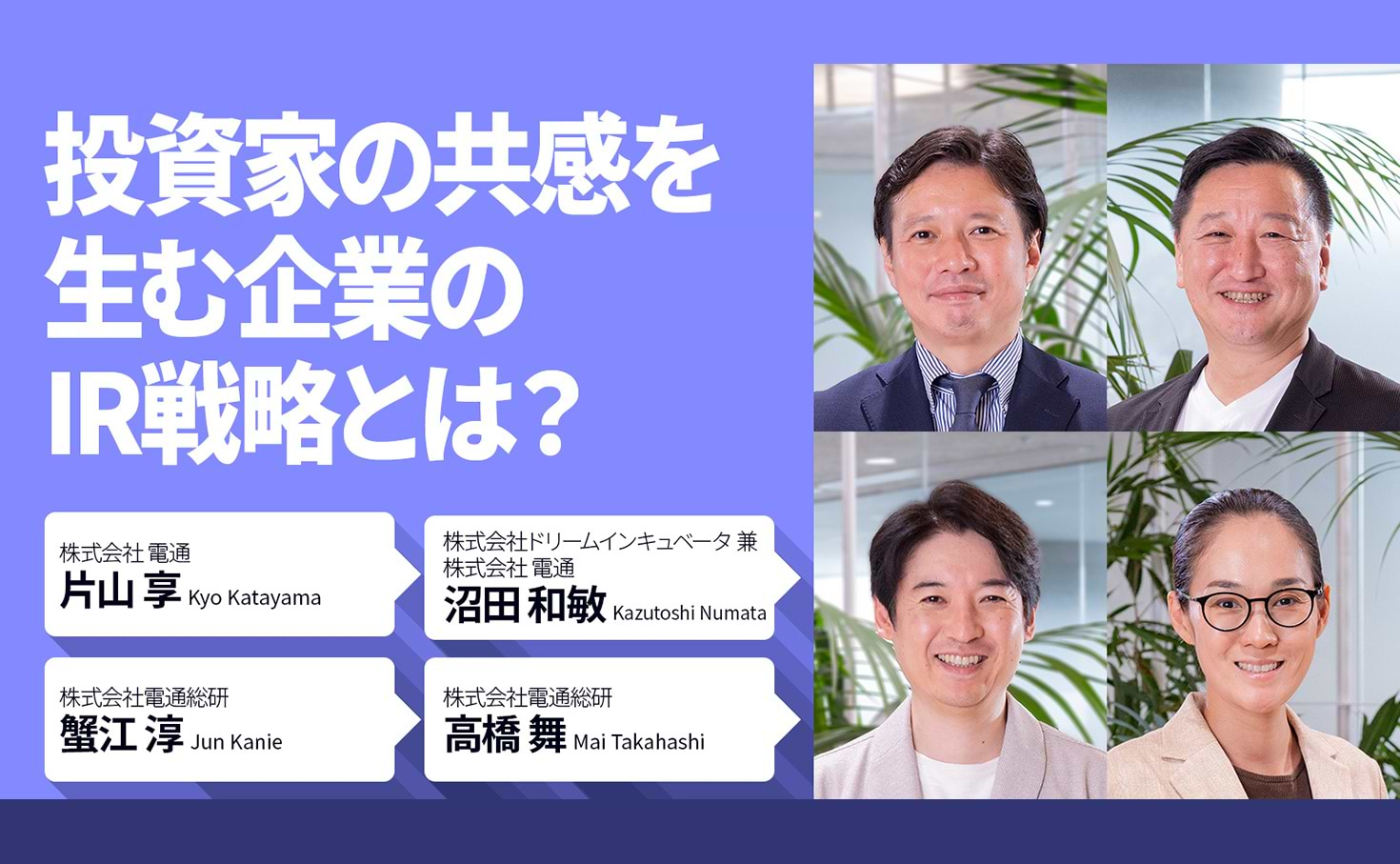

As the demand for ESG (Environment, Social, Governance) management grows, one challenge in considering its adoption is the difficulty in seeing its effects.To address this, Dentsu Inc. (ISID) Open Innovation Lab (InnoLab), which handles corporate system development, and ITID Co., Ltd., which provides corporate consulting services, are conducting joint research to analyze and visualize the effects of ESG management using AI.In the second part of our interview with Kuniharu Sakai, Director of InnoLab; Fumiichi Matsuyama, Senior Consultant; and Jun Kanie, who was Unit Director of ITID's R&CD Unit at the time of the interview, we discussed the current research findings and future prospects.

Data analysis enables ESG management strategies tailored to specific target audiences

Q. We understand you presented the joint research findings at an event held in 2022. What were the key points?

Visualizing effects through data analysis drives corporate ESG adoption

Q. It was surprising to learn that effective ESG elements differ by target audience. For example, knowing that focusing on a specific item helps attract more job applicants would be highly useful for corporate strategy.

Q. Isn't presenting such analysis results with concrete data a new initiative for the industry?

By preparing the external environment, more convenient and user-friendly data analysis becomes possible

Q. Could you share your future outlook? For example, will it be possible to address requests like "We want to simulate the effects of this ESG initiative on specific segments"?

Combining CALC with machine learning for ESG management data analysis has shown it can clearly identify effective ESG initiatives tailored to specific targets. Visualizing such data should clarify what companies should prioritize now and what information they should communicate, enabling them to implement more effective measures. As data analysis advances, we can expect Japanese companies' ESG management to develop further.

※CALC is a registered trademark of Sony Group Corporation.

※CALC is a technology developed by Sony Computer Science Laboratories, Inc.

The information published at this time is as follows.

Newsletter registration is here

We select and publish important news every day

For inquiries about this article

Author

Kuniharu Sakai

Dentsu Inc. International Information Services Co., Ltd.

X Innovation Division

Head of Technology & Innovation Unit and Director of Open Innovation Lab

After serving as the planning manager for digital business initiatives supporting advanced technology development in the automotive industry, he assumed the role of Open Innovation Lab Director in 2022. Within the company-wide R&D department, he focuses on implementing cutting-edge technologies through real-world social verification, creating new value through cross-industry open innovation, and fostering new businesses rooted in solving societal challenges. He has held his current position since 2023.

Fumikazu Matsuyama

Dentsu Inc. International Information Services, Inc. (ISID)

X Innovation Headquarters Technology & Innovation Unit Open Innovation Lab

Senior Consultant

I began my career as a researcher in economics and statistics at academic institutions both domestically and internationally, and have held my current position since 2018. I engage in research and development to solve societal challenges by applying my skills in economics and data analysis. In recent years, I have been interested in understanding the relationship between non-financial and financial data, as well as mathematical optimization using quantum computers. I spend my days immersed in a sea of data and code.

Jun Kanie

DENTSU SOKEN INC.

Consulting Division Future Business Development Unit

Unit Leader

With extensive experience in strategic planning and business transformation/BPR (Business Process Reengineering) across diverse industries including manufacturing, publishing, and restaurant chains, he also has broad involvement in solving people and organizational issues such as talent management and organizational revitalization. He transforms businesses by addressing both the value creation process and the human/organizational aspects, supporting clients in enhancing their value delivery capabilities. In recent years, he has intensified his focus on advancing sustainability management, economic security, and cybersecurity initiatives.