Note: This website was automatically translated, so some terms or nuances may not be completely accurate.

Does ESG Contribute to Corporate Growth? An Expert Explains the Relationship with Stock Prices and the Importance of "Communication"

Soichi Ono

Dentsu Inc.

Jun Kanie

DENTSU SOKEN INC.

Yosuke Yasuda

National Graduate Institute for Policy Studies

Tatsuyoshi Okimoto

Keio University

Makoto Imai

Economics Design Co., Ltd.

Yasutoshi Sumida

Dentsu Inc.

Takaaki Houda

Keio University

ESG has become an indispensable concept when considering corporate growth. While it has seen rapid expansion over the past decade, how exactly does ESG influence a company's stock price and market value? And what kind of initiatives are truly effective? Many companies likely harbor such questions.

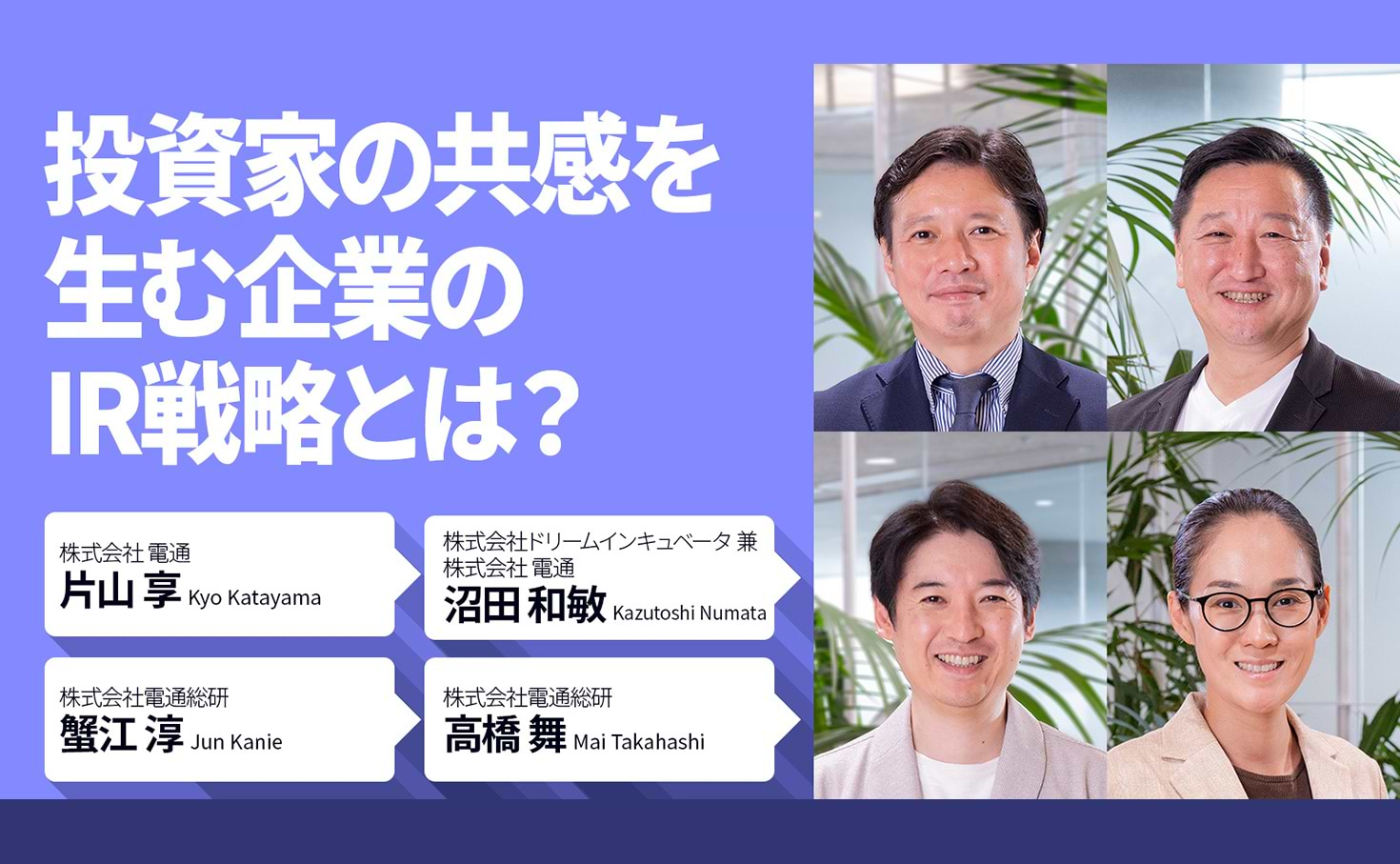

The webinar " The Relationship Between ESG and Stock Prices: What You Need to Know Now," co-hosted by Economics Design Inc. and Dentsu Inc. Sustainability Consulting Office, began with opening remarks by Mr. Makoto Imai, Co-founder and Representative Director of Economics Design, and Mr. Yasutoshi Sumida, Head of Dentsu Inc. Sustainability Consulting Office. This was followed by presentations from Mr. Tatsuyoshi Okimoto (Professor, Faculty of Economics, Keio University / Principal, Economics Design), Takaaki Yasuda (Professor, Faculty of Policy Management, Keio University), and Yosuke Yasuda (Professor, Faculty of Economics, Osaka University / Co-founder, Economics Design), along with Atsushi Kanie and Soichi Ono from Dentsu Inc. Part 1 explored the relationship between ESG and stock prices based on recent research findings. Part 2 discussed challenges faced by companies implementing ESG initiatives and the importance of storytelling in communicating business value. Here is a recap of the proceedings.

What is the relationship between ESG and corporate value? Unraveling industry-specific trends

In Part 1 of the webinar, Ryuji Okimoto, a renowned authority in financial econometrics, and Jun Kanie of Dentsu Inc. took the stage. Under the theme "ESG Evaluation and Corporate Value," Okimoto introduced three recent research findings. One of these investigated the relationship between carbon dioxide emissions—a topic representative of the "Environment" aspect of ESG—and corporate credit risk.

This result varies significantly by sector. Okimoto pointed out that sectors with high costs for reducing emissions, such as energy and materials, tend to have lower CRP, while sectors where reduction is relatively easier, like healthcare and telecommunications, have higher CRP.

How to Communicate Corporate Value? Effective Storytelling

While ESG is suggested to contribute to enhancing corporate value, looking at individual companies, whether specific initiatives succeed or fail is thought to be significantly influenced by how their story is "told." In Part 2 of the webinar, three speakers took the stage: management scholar Takaaki Yasuda, economist Yosuke Yasuda, and Soichi Ono from Dentsu Inc. They held a panel discussion under the theme "Storytelling in an Age of Communication Challenges."

Mr. Yasuda, who has long worked in capital markets and now researches ESG and corporate financial strategy in academia, introduced the concept of PPM (Product Portfolio Management) using the diagram below. He proposed that ESG falls into the "problem child" category—areas with high market growth rates but low market share—and suggested Japanese companies should invest human capital into such businesses.

On the other hand, it's said that among ESG ventures, there are cases where ESG initiatives haven't translated into improved profit margins or stock market valuation.

Given this situation, Mr. Yasuda posed the question: "Is ESG ultimately just a tool for large corporations to tell convenient stories?"

Next, Mr. Yasuda, who also serves on government committees related to carbon pricing, GX (green transformation), and ESG, presented the chart below to point out the challenges faced by companies from the perspective of the difference between ESG-investing companies and purpose-driven companies.

The key difference, Mr. Yasuda explains, is that while the former has its social value imposed externally by investors or rating agencies, the latter can define its shared value independently.

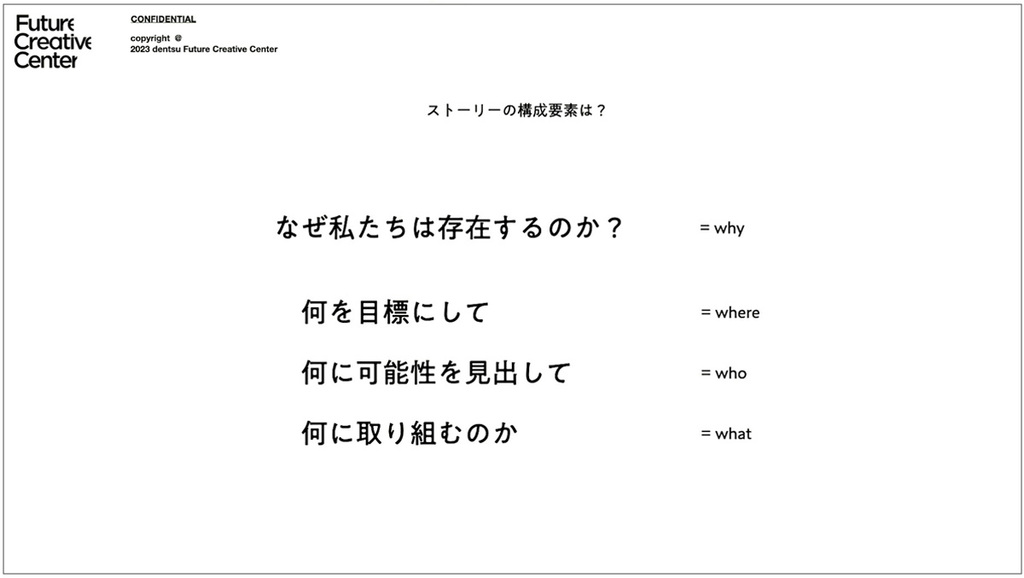

Amidst the presentation of ESG challenges specific to each corporate type, Mr. Ono, Creative Director at Dentsu Inc., emphasizes the importance of storytelling.

ESG, in essence, is a non-financial metric. It's also an initiative that's difficult to quantify numerically. How can the expertise cultivated in advertising creative be leveraged to communicate its value to stakeholders?

Deepening our understanding of the relationship between ESG and corporate value will be crucial for companies considering which ESG areas to prioritize and what approaches to take moving forward. Correctly grasping the connection between ESG and stock prices could even lead to greater enjoyment in business and new challenges. It seems clear that engaging, exciting communication is needed to continuously convey a company's unique selling points.

The information published at this time is as follows.

Was this article helpful?

Newsletter registration is here

We select and publish important news every day

For inquiries about this article

Author

Soichi Ono

Dentsu Inc.

Sustainability Consulting Office

Chief Creative Director

As a hybrid professional with 10 years in marketing strategy and 10 years in creative, I plan and provide solutions across business strategy, product development, commercials, promotions, web, retail, strategic PR, and events with planning neutrality. Recently, I've expanded beyond advertising, notably working alongside executive leadership and engaging in business development and facility development. Awards: ACC Grand Prix, ADC Grand Prix, Galaxy Awards, Cannes Lions, AdFest, One Show, Clio Awards, Mobile Advertising Grand Prix, Digital Signage Awards, Transportation Advertising Grand Prix, Good Design Award, Kids Design Award

Jun Kanie

DENTSU SOKEN INC.

Consulting Division Future Business Development Unit

Unit Leader

With extensive experience in strategic planning and business transformation/BPR (Business Process Reengineering) across diverse industries including manufacturing, publishing, and restaurant chains, he also has broad involvement in solving people and organizational issues such as talent management and organizational revitalization. He transforms businesses by addressing both the value creation process and the human/organizational aspects, supporting clients in enhancing their value delivery capabilities. In recent years, he has intensified his focus on advancing sustainability management, economic security, and cybersecurity initiatives.

Yosuke Yasuda

National Graduate Institute for Policy Studies

Professor

Born in Tokyo in 1980. Graduated from the University of Tokyo in 2002. Received the Ouchi Hyoe Award for the best undergraduate thesis and served as the graduate representative for the Faculty of Economics. Studied at Princeton University, USA, earning a Ph.D. in Economics in 2007. After positions including Associate Professor at Osaka University, assumed current position in October 2025.Specializes in game theory and market design. Published numerous papers in international economics journals, including the American Economic Review. Also serves as a government committee member and television commentator. Co-founded Economics Design Inc. in 2020 to "apply economics to business." Major publications (co-authored) include "Is Japan's Future Really Okay? Conference" (Nihon Jitsugyo Publishing, 2024).

Tatsuyoshi Okimoto

Keio University

School of Economics

Professor, Economics Design Co., Ltd.

In 2005, he earned his Ph.D. in Economics from the University of California, San Diego. After serving as Associate Professor at the Graduate School of International Social Sciences, Yokohama National University; Associate Professor at the Graduate School of International Corporate Strategy, Hitotsubashi University; and Associate Professor at the Crawford School of Public Policy, Australian National University, he assumed his current position in 2022. Also serves as Principal at Economics Design, Inc. Specializes in quantitative finance and macroeconometrics, with over 30 papers published in international academic journals. Recipient of the GPIF Finance Awards, the Marujunko Research Encouragement Award from the Japan Finance Association, and the Securities Analyst Journal Award. Author of: Quantitative Time Series Analysis of Economic and Financial Data (Asakura Shoten, 2010), among others.

Makoto Imai

Economics Design Co., Ltd.

Co-founder, Representative Director

Graduated from Kwansei Gakuin University's School of Commerce in 1998. After working at a financial institution, engaged in real estate auctions at IDU Co., Ltd. (now Japan Asset Marketing Co., Ltd.), then worked at a real estate fund before becoming independent. In 2018, became Representative Director of Diable Co., Ltd. and Director of Due Diligence & Deal Co., Ltd., working on implementing economics in real estate auctions while operating "Auction Lab," an exchange space for business professionals and researchers to consider the business application of auction knowledge. In 2020, he co-founded Economics Design Inc. Author: 'That Business Problem? It's Already Solved by the Latest Economics. Ending "Intuition," "Ad Hoc Approaches," "Degraded Copies," and "Grit" in Work' (Co-edited, Nikkei BP, 2022)

Yasutoshi Sumida

Dentsu Inc.

Sustainability Consulting Office

Section Chief

Assumed current position in January 2023. From 2018 to 2022, served as head of a business consulting team supporting executive decision-making, responsible for industries including automotive, precision equipment, food, factory automation, telecommunications, transportation, and finance, committed to business transformation and growth. Possesses a unique creativity that generates growth in non-linear areas, rather than merely improving or streamlining operations. Supports sustainability management by designing bold winning strategies, shaping narratives, and building foundational frameworks. Recipient of numerous awards, including a Cannes Lions Gold Award.

Takaaki Houda

Keio University

School of Policy Studies

Professor

Born in Hyogo Prefecture in 1974. Earned a Ph.D. in Commerce from Waseda University. Engaged in investment banking at Lehman Brothers Securities Co., Ltd. and UBS Securities Japan Ltd. before founding an SNS operating company. After selling that company, held positions including venture capitalist, researcher at the Financial Research Center of the Financial Services Agency, and Professor at Kobe University Graduate School of Business Administration. Assumed current position in April 2022.Resided in Silicon Valley as a Visiting Scholar at Stanford University from August 2019 to March 2021, researching corporate transformation through ESG. Also serves as an outside director and auditor for multiple listed companies.Publications include: Winning in the SDGs Era: ESG Financial Strategy (Diamond Inc., 2022); New Finance for Regional Management: The Impact of "Furusato Nozei" and "Crowdfunding" (Chuo Keizai Sha, 2021); Corporate Finance: Strategy and Practice (Diamond Inc., 2019); among others.