Note: This website was automatically translated, so some terms or nuances may not be completely accurate.

What's Next for Omnichannel? Q3. How Will Manufacturers Change?

Junichi Kanno

Yukihiro Horikita

Dentsu Inc.

Hisashi Matsunaga

Dentsu Group Inc.

Yuji Maruyama

Dentsu Inc.

Takuma Uehara

Dentsu Inc.

Hiroki Watanabe

TOYOTA CONIQ, Inc. Co., Ltd.

Was this article helpful?

Newsletter registration is here

We select and publish important news every day

For inquiries about this article

Back Numbers

Author

Junichi Kanno

After gaining experience managing e-commerce operations at a major IT company, I became convinced of the diversification of retail space value as a customer touchpoint and returned to Dentsu Inc. Leveraging my comprehensive experience in business valuation and other areas from a consulting firm, I currently work in the Promotion Design Bureau, where I develop and implement numerous sales promotion initiatives through reverse-engineering planning starting from the purchasing perspective. Holds an MBA from the Wharton School of the University of Pennsylvania. Left Dentsu Inc. at the end of December 2022.

Yukihiro Horikita

Dentsu Inc.

Second Integrated Solutions Bureau

Joined Dentsu Inc. in 2000. Since then, has worked across marketing and promotion fields without limiting categories, focusing on solving client challenges. Since 2014, has been primarily engaged in planning and executing initiatives at the current bureau that meet the needs of both retailers and manufacturers in the omnichannel domain.

Hisashi Matsunaga

Dentsu Group Inc.

dentsu Japan Growth Officer

After joining Dentsu Inc., he worked on planning and consulting for client companies utilizing data, as well as developing Dentsu Inc.'s planning systems. He was involved in numerous new business development initiatives with media companies, retailers, and digital platform operators. From 2016, he worked at the Dentsu Data & Technology Center, responsible for formulating Dentsu Inc.'s data strategy and developing its data infrastructure. In 2023, he was appointed Growth Officer/Chief Data Officer at Dentsu Japan. He is responsible for formulating Dentsu Japan's data strategy, forming alliances with data holders and digital platform operators, and developing solutions and products leveraging data and technology (Ph.D. in Engineering).

Yuji Maruyama

Dentsu Inc.

Data & Technology Center Data Science Camp

Since 2000, engaged in big data analysis at a major think tank. After joining Dentsu Inc. in 2005, worked in marketing effectiveness verification and consulting before transitioning to providing solutions based on service and business development with domestic and international technology companies. Primary areas of responsibility include media companies, digital platforms, and retail distribution.

Takuma Uehara

Dentsu Inc.

Data & Technology Center

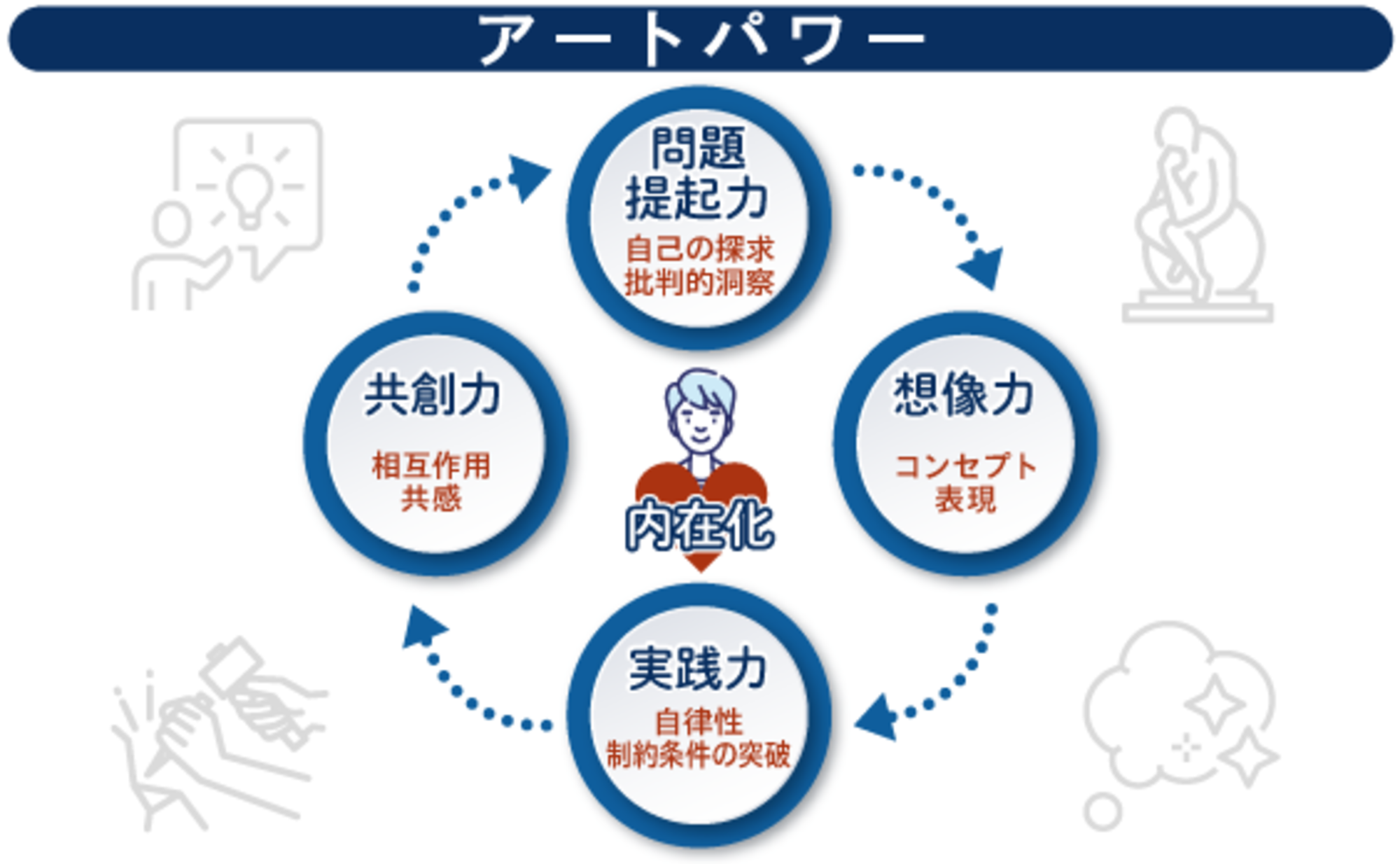

Majored in Art Management at university. Joined Dentsu Inc. after working at an advertising agency, think tank, and business consulting firm. Engaged in DMP development, location-based analytics, omnichannel strategies, and UI/UX design. Hosts the "Art Telling Tour RUNDA," which allows participants to experience the thought processes of artists, holding tours nationwide. Currently researching methodologies for art thinking based on data science at graduate school. Co-author of 'Art in Business: The Power of Art That Works for Business'.

Hiroki Watanabe

TOYOTA CONIQ, Inc. Co., Ltd.

Just Right Club

Department Manager

Joined Dentsu Inc. in 2008. Assigned to the Sales Division as a new employee. Subsequently, from 2014, worked on-site for two years on an omnichannel project for a retail distribution company. From 2016, worked on-site for six years on a DX promotion project for an automobile manufacturer. Finds fulfillment in the bold yet smooth progress of work in an on-site environment. My love for clients reached its peak, leading me to realize my dream of founding TOYOTA CONIQ, Inc. in January 2021, immediately transitioning to a secondment there. Both professionally and personally, I adore things that are easy and feel good. I can't stop wearing shorts to work and ear cleaning.