How is today's rapidly changing Japan perceived by people around the world? What kind of reputation do Japan's tourism, food, products, and other "Japan brands" enjoy overseas?

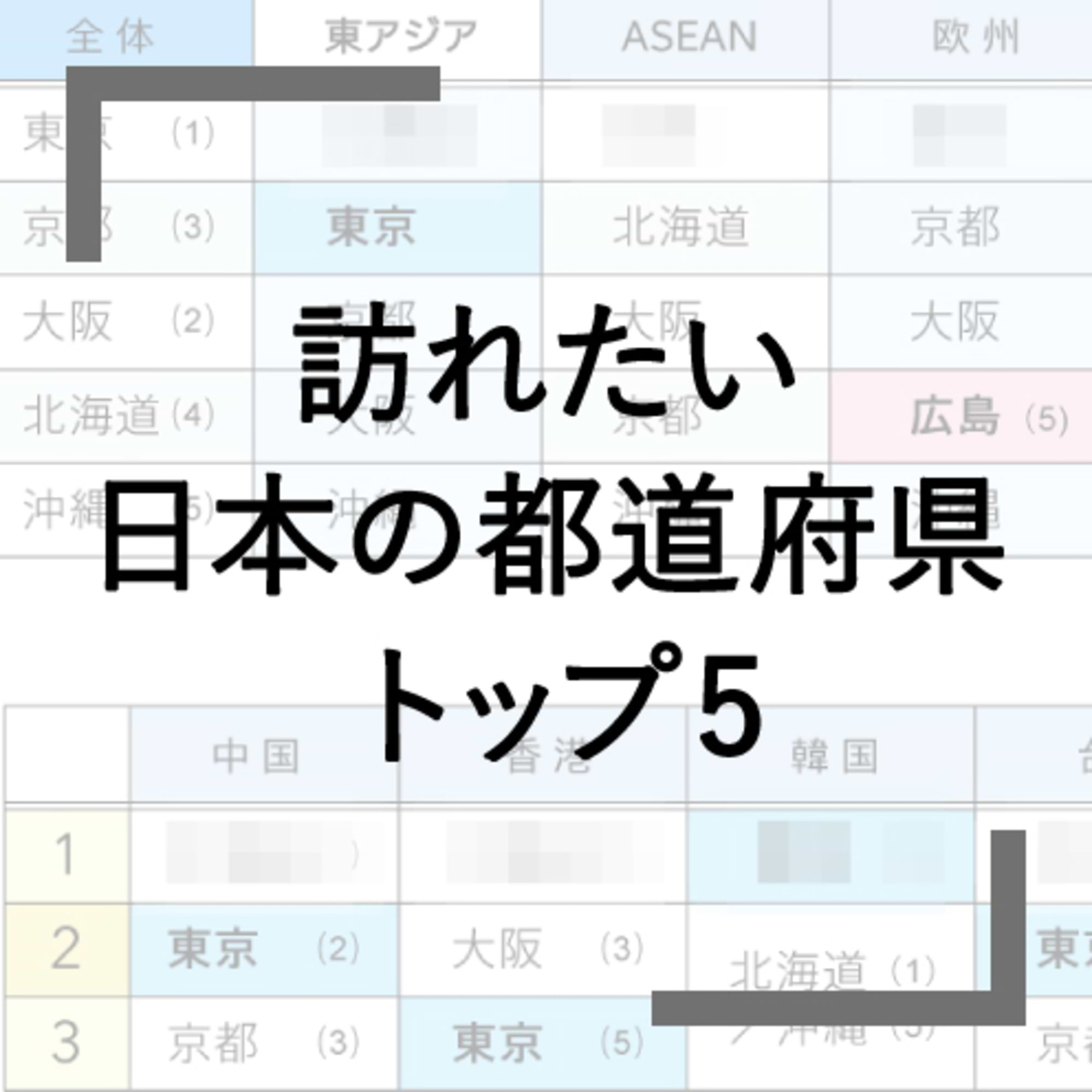

This article introduces results from the "Japan Brand Survey 2017," conducted in 20 countries and regions worldwide from February to March 2017. This time, we focus on "Experiences people want to have in Japan's regions."

A. "Hot Springs" and "Nature" ranked high in nearly every country. In Europe and America, interest in traditional culture is evident, with "Castles/Castle Ruins" and "Japanese Gardens" also popular.

The top three remained unchanged from last year: "hot springs," "nature," and "cherry blossoms."

The author personally sees more foreign visitors in yukata at hot spring towns, feeling the popularity of hot springs firsthand.

In Europe and America, where "Visiting historical sites and buildings" also ranked high in "Things to do in Japan," interest in Japanese culture and history remains strong, with "Castles/Castle Ruins" and "Japanese Gardens" proving popular.

Additionally, distinctive items by region included "skiing" (9th in Hong Kong, 10th in Taiwan and Vietnam), "seafood" (7th in Russia), and "ancient burial mounds" (20th in Italy), all scoring high points.

By creating mechanisms to spread the voices of people who have actually experienced these tourism resources in each region, we can further boost the dissemination of Japan's appeal.

<Japan Brand Survey 2017 Overview>

● Purpose: To understand overseas consumers' perceptions and actual experiences regarding the overall "Japan Brand"—including Japanese food, tourism, and Japanese products—and support corporate marketing activities.

●Target Areas: 20 countries and regions

China (Group A = Beijing, Shanghai, Guangzhou; Group B = Shenzhen, Tianjin, Chongqing, Suzhou, Wuhan, Chengdu, Hangzhou, Dalian, Xi'an, Qingdao), Hong Kong, Taiwan, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Vietnam, Philippines, Australia, USA, Canada, Brazil, UK, France, Germany, Italy, Russia

※East Asia (China, Hong Kong, Taiwan, South Korea)

※ASEAN (Singapore, Thailand, Indonesia, Malaysia, Vietnam, Philippines)

●Survey Method: Internet survey

● Target Population: Men and women aged 20–59 in the middle-income bracket and above

※Definition of "middle-income": Conditions set per country based on national average income (OECD statistics) and social class classification (SEC)

●Sample size: China: 200 respondents each for A and B groups, total 400 respondents; USA: 400 respondents; Other regions: 200 respondents each, total 4,400 respondents

●Survey Period: February 13 to March 10, 2017

Dentsu Inc. Team Cool Japan

A cross-functional project team established by Dentsu Inc. to promote 'Cool Japan-related initiatives'—expanding products and services leveraging Japanese culture and strengths into overseas markets. Dentsu Inc. also invests in the Ministry of Economy, Trade and Industry's Cool Japan Organization (fund). The team brings together client company representatives for overseas expansion, media and content specialists, overseas subsidiary network managers, producers, and planners to work on initiatives promoting Japan's appeal globally.