The number of international tourists visiting Japan has been increasing year by year, reaching a record high in 2017.

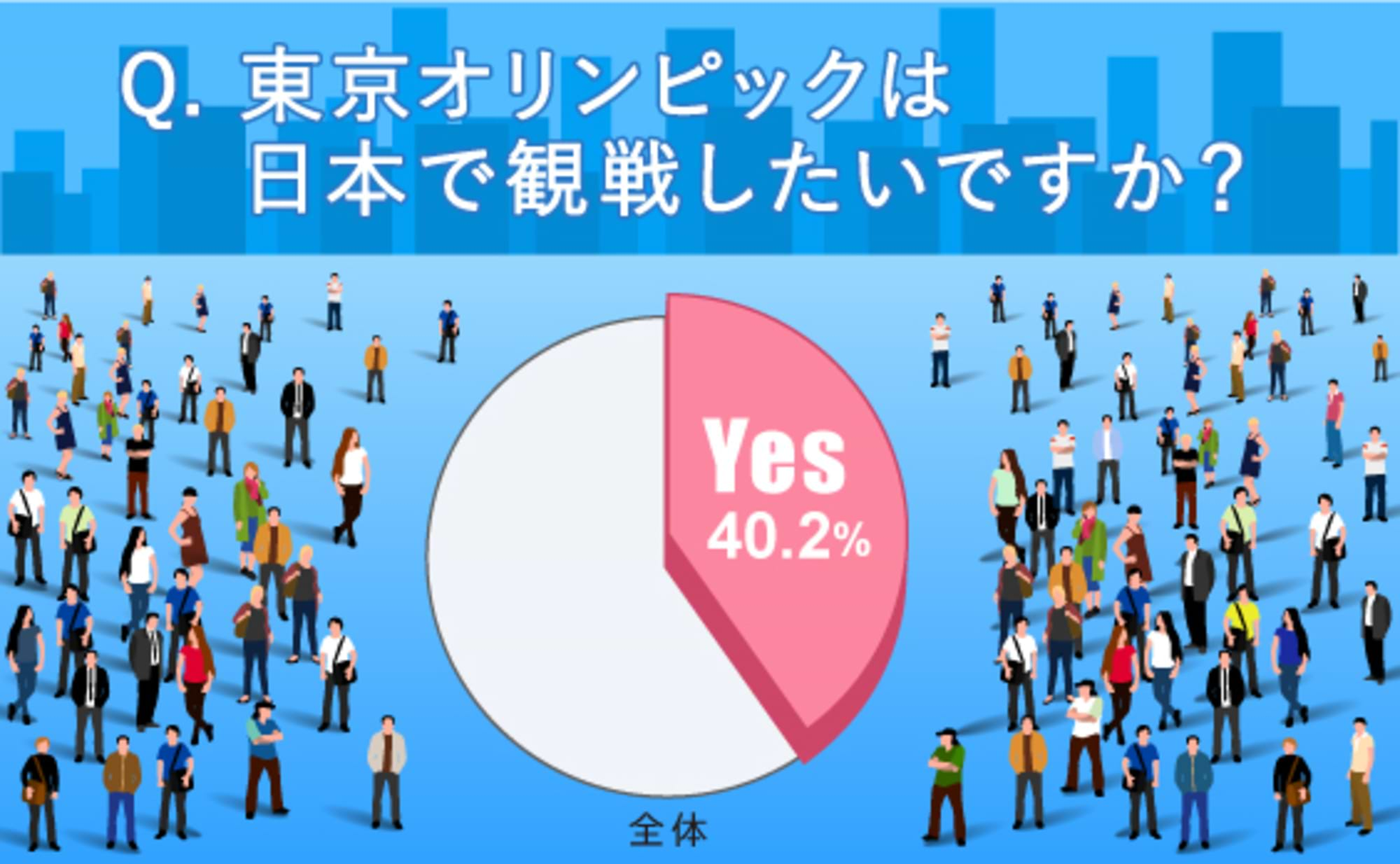

Furthermore, 2019 brought the Rugby World Cup, 2020 the Tokyo Olympic and Paralympic Games, and 2021 the World Masters Games Kansai, marking the "Golden Sports Years."

These major sporting events are expected to further increase the number of foreign visitors to Japan and stimulate more active initiatives by government, local authorities, and companies. Against this backdrop, how is Japan perceived globally?

In which countries and regions is the intention to visit Japan growing, and for what reasons? Furthermore, how is "Made in Japan" currently perceived? Dentsu Inc.'s "Team Cool Japan" conducted the "Japan Brand Survey 2018" in 20 countries and regions worldwide from January to February 2018.

This series will introduce survey findings that will be key points for future businesses targeting visitors to Japan.

In Part 6, "What Japanese Products Do You Want to Buy? And Why?", "Quality" ranked first as the most important factor when purchasing, while "Whether it was developed considering the environment and society" ranked third. In light of these findings, we focused on the SDGs※1, which are frequently discussed as a social issue these days.

Therefore, Part 7, titled "Keywords for Visitor-Oriented Business," highlights the SDGs. We will introduce their recognition and awareness levels.

※1 "Sustainable Development Goals." Goals adopted by the United Nations to address environmental and social challenges.

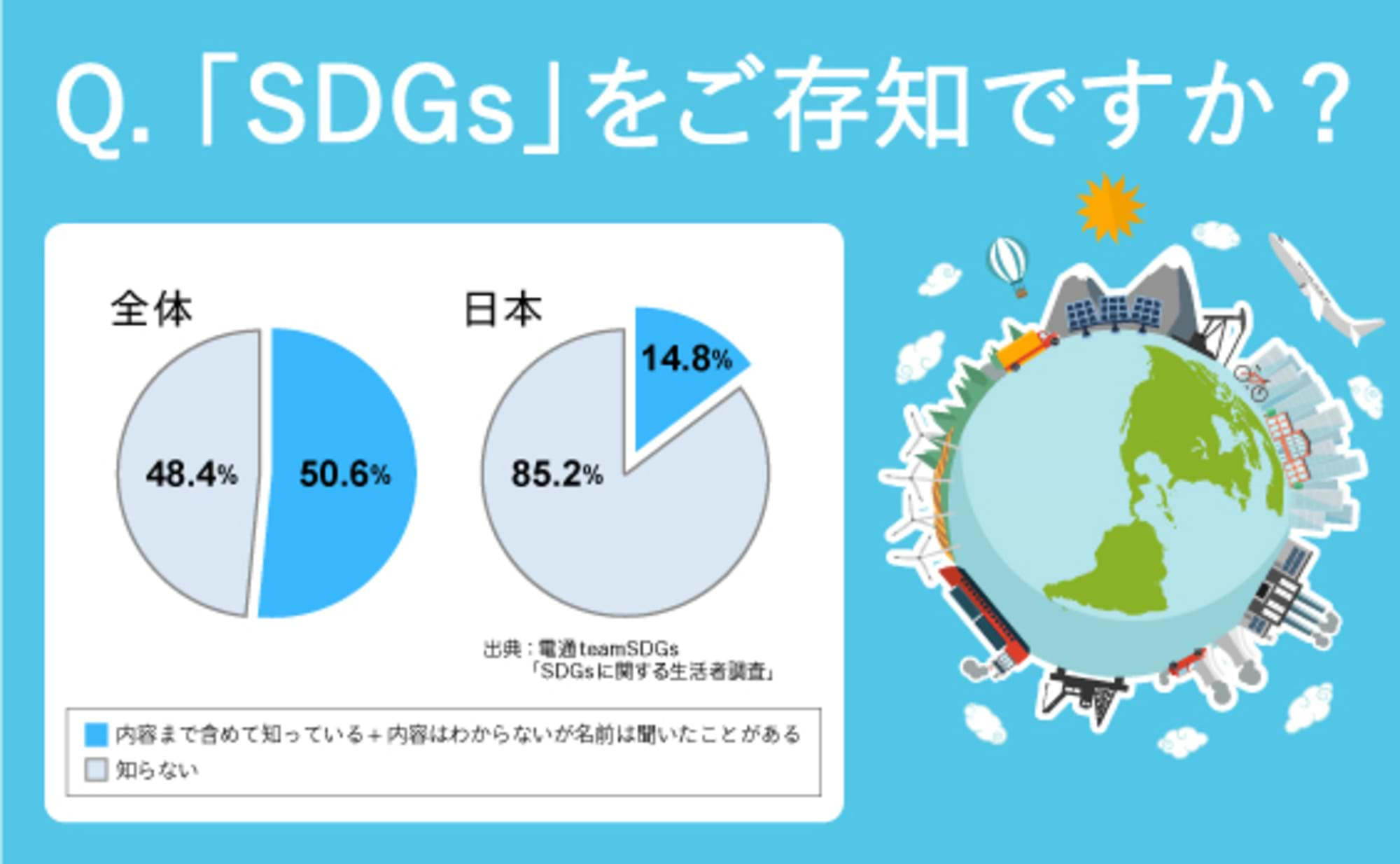

Q Do you know about the SDGs?

A The average awareness rate in 20 countries and regions outside Japan is 51.6%, while Japan's is 14.8% (※2).

Among these 20 countries and regions, India, Indonesia, the Philippines, Vietnam, and Italy exceeded 70%, reaching a very high level of awareness. On the other hand, awareness was low in France and Germany, at just under 30%.

Japan's SDGs awareness falls even further below this, ranking among the lowest globally. Three years after the SDGs were adopted by the UN in 2015, Japan lags behind with its low awareness, while in many countries they are becoming standard thinking.

*2 Japan's data is for reference only. Domestic SDGs data comes from a survey conducted by Dentsu Inc.'s "teamSDGs," which differs from the Japan Brand Survey in that it did not set specific income criteria for respondents.

Q What kind of awareness or actions do you take regarding the SDGs?

Q What are your thoughts and actions regarding the SDGs?

A "I agree with the concept" was the most common response. Answers indicating actual action, such as "I choose products or services from companies related to the SDGs," also ranked highly.

The response "I agree with the concept" ranked highly in every country surveyed and was the top response overall. This indicates that people who understand the SDGs perceive them as increasingly important and are using them as a guiding principle when selecting products and services.

Meanwhile, despite Japan receiving an evaluation in July 2017 from the SDSN (Sustainable Development Solutions Network) placing it 11th out of 157 countries globally in SDG achievement progress, corporate initiatives still largely seem positioned as part of CSR (Corporate Social Responsibility).

Considering the heightened awareness and importance overseas, the SDGs are likely to become an indispensable perspective in marketing and strategic planning going forward.

Japan Brand Survey 2018 Overview

● Purpose: To understand overseas consumers' perceptions and actual behavior regarding the overall "Japan Brand"—including Japanese food, tourism, and Japanese products—and support corporate marketing activities.

●Target Areas: 20 countries and regions

China (Group A = Beijing, Shanghai, Guangzhou; Group B = Shenzhen, Tianjin, Chongqing, Suzhou, Wuhan, Chengdu, Hangzhou, Dalian, Xi'an, Qingdao), Hong Kong, Taiwan, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Vietnam, Philippines, Australia, USA (Northeast, Midwest, South, West), Canada, Brazil, UK, France, Germany, Italy, Russia

※East Asia (China, Hong Kong, Taiwan, South Korea)

※ASEAN (Singapore, Thailand, Indonesia, Malaysia, Vietnam, Philippines)

●Survey Method: Internet survey

●Respondent criteria: Men and women aged 20-59 in the middle-income bracket and above

※Definition of "middle-income": Conditions set per country based on national average income (OECD statistics, etc.) and social class classification (SEC)

●Sample size: China: 300 each for A and B groups, total 600; USA: 600; Other regions: 300 each, total 6,600

●Survey Period: January 12 to February 16, 2018

Dentsu Inc. Team Cool Japan

A cross-functional project team established by Dentsu Inc. to promote 'Cool Japan-related initiatives'—expanding products and services leveraging Japanese culture and strengths into overseas markets. It brings together client company representatives handling overseas expansion, media and content specialists, overseas subsidiary network managers, producers, and planners to work on initiatives that project Japan's appeal to the world.