How is today's rapidly changing Japan perceived by people around the world? What kind of reputation do Japan's tourism, food, products, and other "Japan brands" enjoy overseas?

This article introduces results from the "Japan Brand Survey 2017," conducted in 20 countries and regions worldwide from February to March 2017. This installment focuses on "Comparing Chinese Metropolitan Areas and Regional Cities."

A. "Experience" consumption is preferred in the three major metropolitan areas, while "shopping" motivation is strong in regional cities.

While "eating Japanese food" ranked first in both major metropolitan areas and regional cities, preferences diverged beyond the top three.

In the three major metropolitan areas, consumption preferences lean toward "experiences" such as "visiting scenic natural spots" and "experiencing the four seasons." Conversely, in regional cities, "shopping" ranks third, indicating a continued strong preference for "shopping" consumption.

Experience visiting Japan is nearly the same at 71.5% in the three major metropolitan areas and 70.0% in regional cities. However, differences in the number of visits and trends within each area may be emerging. New trends in how to enjoy Japan may be emerging from the rapidly growing regional cities.

<Japan Brand Survey 2017 Overview>

● Purpose: To understand overseas consumers' perceptions and actual behavior regarding "Japan Brand" products and experiences (including food, tourism, and Japanese goods), supporting corporate marketing activities.

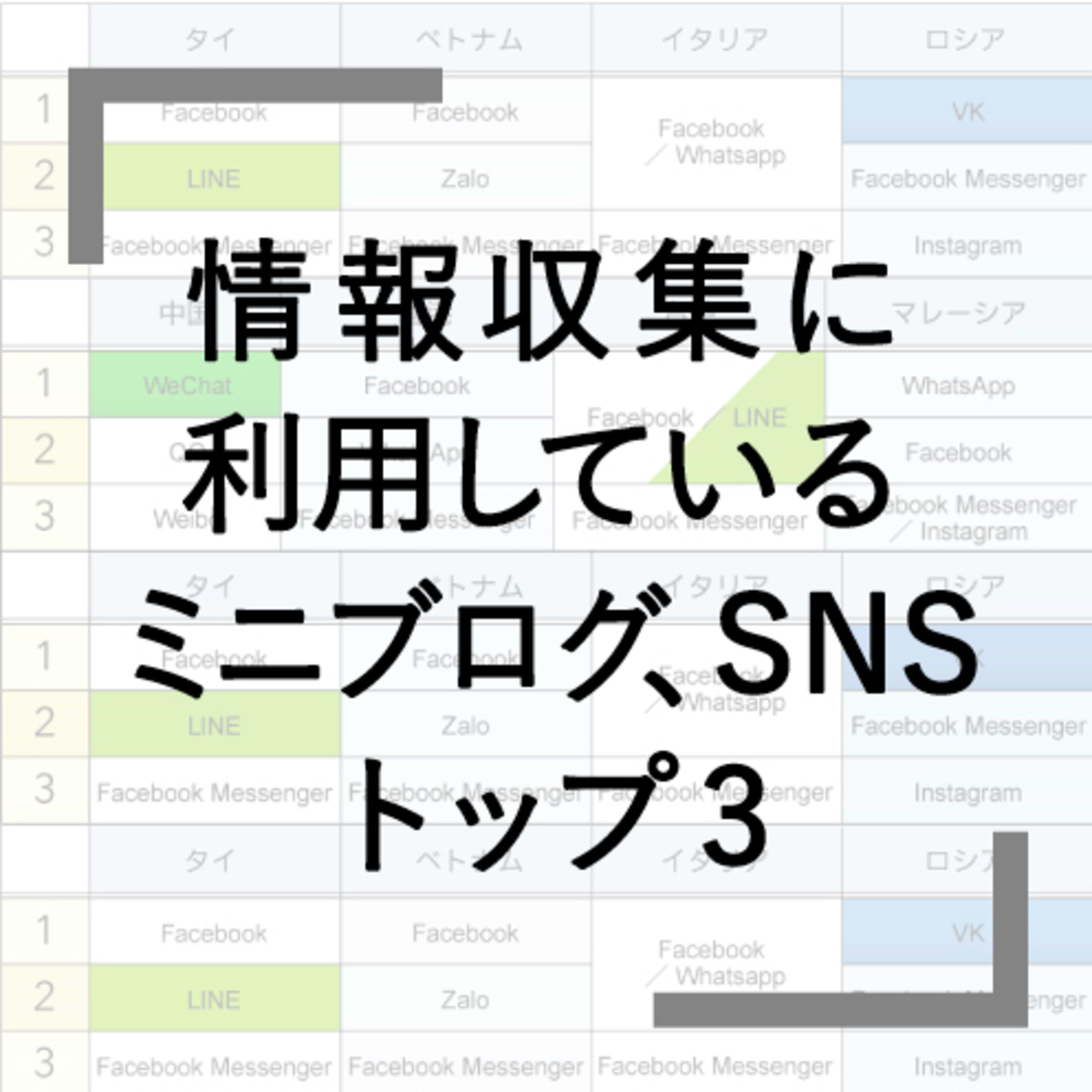

●Target Areas: 20 countries and regions

China (Group A = Beijing, Shanghai, Guangzhou; Group B = Shenzhen, Tianjin, Chongqing, Suzhou, Wuhan, Chengdu, Hangzhou, Dalian, Xi'an, Qingdao), Hong Kong, Taiwan, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Vietnam, Philippines, Australia, USA, Canada, Brazil, UK, France, Germany, Italy, Russia

※East Asia (China, Hong Kong, Taiwan, South Korea)

※ASEAN (Singapore, Thailand, Indonesia, Malaysia, Vietnam, Philippines)

●Survey Method: Internet survey

●Respondent criteria: Men and women aged 20–59 in the middle-income bracket and above

※Definition of "middle-income": Conditions set per country based on national average income (OECD statistics) and social class classification (SEC)

●Sample size: China: 200 respondents each for A and B groups, total 400 respondents; USA: 400 respondents; Other regions: 200 respondents each, total 4,400 respondents

●Survey Period: February 13 to March 10, 2017

Dentsu Inc. Team Cool Japan

A cross-functional project team established by Dentsu Inc. to promote 'Cool Japan-related initiatives'—expanding products and services leveraging Japanese culture and strengths into overseas markets. Dentsu Inc. also invests in the Ministry of Economy, Trade and Industry's Cool Japan Organization (fund). The team brings together client company representatives for overseas expansion, media and content specialists, overseas subsidiary network managers, producers, and planners to work on initiatives promoting Japan's appeal globally.