Note: This website was automatically translated, so some terms or nuances may not be completely accurate.

[COVID-19 Pandemic] What is the "Real" Life of Consumers Revealed by This Honest Survey?

The COVID-19 pandemic has brought the greatest crisis of the 21st century on a global scale. In Japan too, economic activity has stagnated as infections spread. Each individual consumer, who supports this economy, is now experiencing an unprecedented way of life, almost by force.

While reports from overseas often felt somewhat detached, the pandemic truly became a personal reality for people in Japan starting in April, when the state of emergency was declared.

The world cannot return to a time before the novel coronavirus. The reality of Japanese consumers' lives during the pandemic cannot be erased. While countermeasures are being driven by national and local governments, what can "businesses" do? To find clues, Dentsu Inc. urgently launched the project we introduce here: the "Consumer Deep Insight" project during the COVID-19 pandemic.

What is the Pandemic "Deep Insights into People's Lives" Survey?

An unprecedented state of emergency faced by Japanese consumers. What do they feel in the midst of it? What suffering and struggles do they endure each day? These are not things easily recalled and recounted later.

Amidst rapidly changing information flows, we needed to accurately capture and document the fluctuating consciousness and behaviors of consumers in each moment, while staying attuned to their feelings. We believed this was essential for companies and brands wanting to do something for consumers.

To achieve this, we launched this project immediately after the state of emergency declaration was issued. Starting with a survey on April 10th, we began conducting internet surveys every ten days, navigating the rapidly changing landscape: the nationwide expansion of the declaration, an unprecedented Golden Week, and the extension of the state of emergency.

We surveyed 600 men and women nationwide aged 20 to 70 on April 10, 20, 30, and May 8. Rather than meticulously refining the survey content, we prioritized designing and advancing the survey quickly, focusing on addressing the anxieties of society and consumers at each moment.

We captured lifestyle changes across 5 stages and 10 levels

By gauging living conditions and insights every 10 days, we began to see the present state of Japanese consumers and the shifts toward living with COVID-19. We captured not only the current situation but also mindsets—anxieties and expectations—regarding what will change and what will return as we move toward the New Normal.

One metric visualizes consumers' adaptation to COVID-19 across 5 stages and 10 levels. By tracking shifts in mental health impacts and adaptation to restricted lifestyles amid ongoing disruptions, we highlighted evolving behaviors. Recent findings from our May 8th survey, immediately after Golden Week, finally show positive signs emerging.

Following the state of emergency declaration, the proportion of people reporting "no impact on daily life" decreased significantly by April 20. From April 20 to April 30, people began to adapt to "strict self-restraint." By May 8, a group reporting "seeing brighter signs in society" began to emerge.

Overwhelming social tension. Quantifying and visualizing consumers' anxiety and stress

Amid the COVID-19 pandemic, information flooded in from various perspectives—expert commentary, media reports, social media reactions—offering suggestions, proposals, complaints, and anxieties about how to navigate and overcome the crisis. Qualitative information on consumer reactions also circulated widely.

Rather than focusing on individual feelings, what is needed to drive action by companies and organizations is quantitative data from the consumer perspective to provide that backing. Moreover, wouldn't it be better to obtain raw, vivid reactions that truly capture the reality of consumers' lives? With this in mind, the survey poses various questions to consumers.

We received many comments like: "The societal trends I'd vaguely sensed before finally felt real when quantified," and "Quantification makes it easier to establish judgment criteria. I want to keep watching future developments."

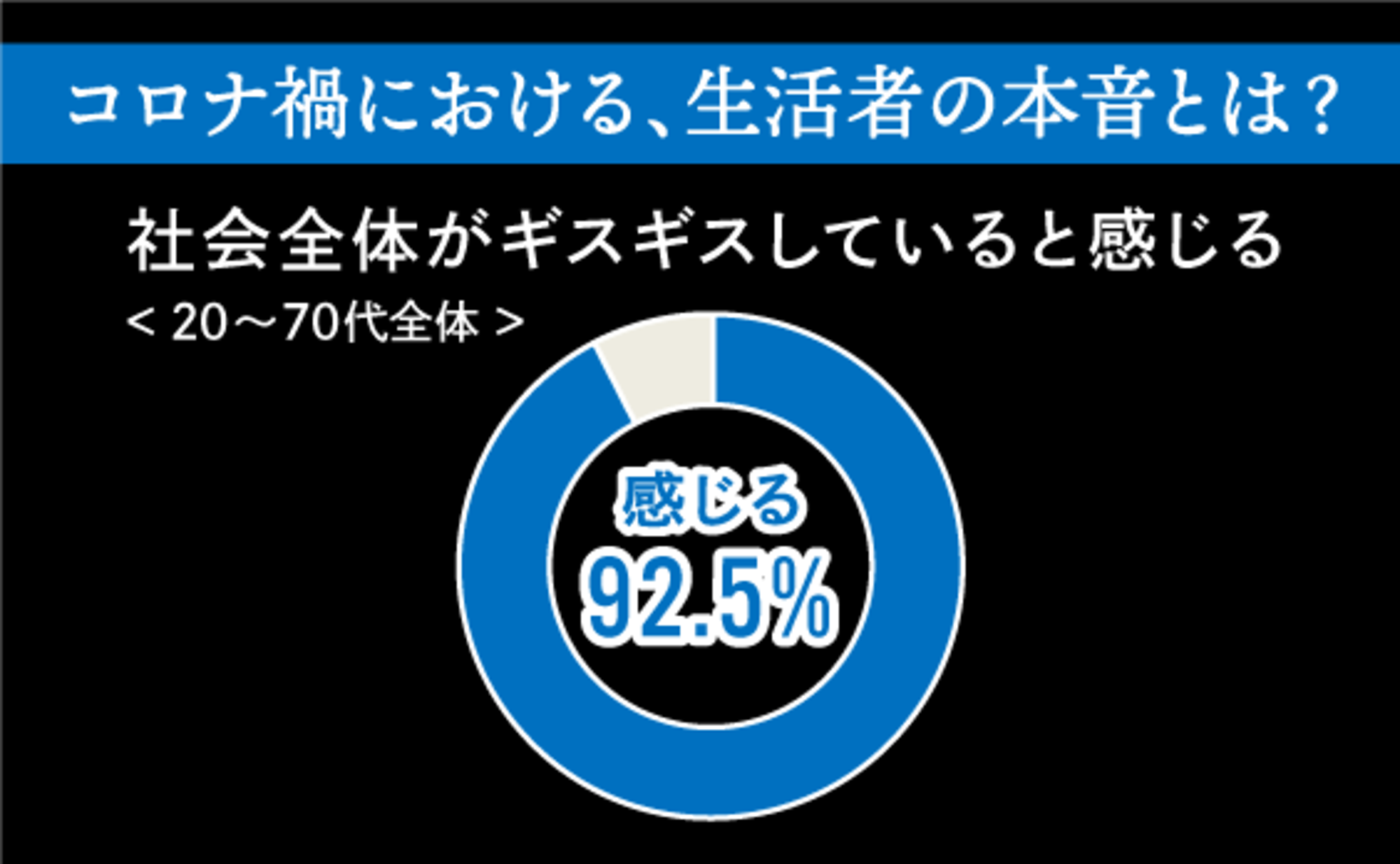

The most significant challenge emerging is a sense of social friction felt across generations. As of April 30th, 92.5% reported feeling this tension, with those in their 20s and 30s experiencing it most strongly.

Surveying feelings people can't even share with family. Extracting deep consumer insights.

We believe the key difference between this pandemic and past societal hardships is that "everyone is directly affected." Precisely because they are affected, people sometimes find it difficult to share their feelings even with close family or friends, swallowing them instead. What if I were infected... I'm a healthcare worker treating COVID-19 patients but can't tell anyone... To hear these unspoken truths, which can only be revealed in this time of conflict, we included extensive open-ended responses.

What are people feeling during this pandemic? We're gathering insights through both qualitative and quantitative research, using slightly more probing questions. This covers thoughts on the expansion and extension of emergency declarations, feelings and conflicts about the unprecedented Golden Week, as well as shifts in values and behaviors expected after the pandemic subsides.

In a survey asking about things people want to do after the novel coronavirus subsides, compared to 20 days ago, scores increased for desires related to things currently impossible, such as "Want to visit tourist attractions," "Want to enjoy eating out," and "Want to enjoy shopping for non-essential items." Scores also rose for desires like "Want to gather with friends and have fun" and "Want to let loose and party." Regarding travel, domestic travel remained steady at over 70%, but scores for overseas travel decreased.

What do consumers expect from companies?

Japan is gradually shifting from a subdued atmosphere dominated by self-restraint to one where a more positive mood is beginning to emerge. While hoping for fundamental improvements in the medical system, consumers' expectations for economic revitalization, particularly in sectors like the food service and tourism industries, are undoubtedly rising.

We recognize that the challenge ahead is to explore what companies and brands can do to support the efforts of those working in essential fields like government, administration, and healthcare, who are sustaining our daily lives.

Indeed, our survey found that as of May 8th, 85.2% of respondents agreed that "to revitalize society, corporate initiatives are needed alongside government efforts." It's not just about what we communicate, but what we can do and what we intend to do. Through our tracking survey during the pandemic, we have come to realize that empathy for a company or brand's stance and aspirations not only encourages consumers but also lays the foundation for medium-to-long-term corporate growth.

As we move toward the New Normal, society and the economy are expected to gradually begin shifting. However, the struggles, conflicts, and new life experiences of this pandemic cannot be erased. As of May 8th, 78.5% of respondents expressed a desire to somehow view this environment positively, as an opportunity to reevaluate how we live and work.

Build Back Better. Consumer expectations for corporate and brand initiatives are rising significantly. We hope the insights from this project can help companies consider what they can do in this environment and what they must do precisely because of it.

[Survey Overview]

・Target Area: Nationwide

・Survey Method: Online survey

・Respondent Criteria and Sample Size: Individuals aged 20–79, general consumers (both men and women)

・Total Samples: 600

・Survey Period:

① April 10 (Fri) to April 11 (Sat), 2020

② Monday, April 20, 2020 – Tuesday, April 21, 2020

③ Thursday, April 30, 2020 – Friday, May 1, 2020

④ May 8 (Fri) – May 9 (Sat), 2020

・Research Agency: Dentsu Macromill Insight, Inc.

Was this article helpful?

Newsletter registration is here

We select and publish important news every day

For inquiries about this article

Author

Hiroki Sugimoto

Dentsu Inc.

First Integrated Solutions Bureau

Solution Director

After working in the HR systems planning and operations section, I have consistently been responsible for planning in the marketing and promotion domain. I have worked on numerous projects advancing consulting and communication planning in domestic and global brand domains—including brand strategy, brand management, and portfolio strategy—combining practical knowledge with hands-on experience.