Note: This website was automatically translated, so some terms or nuances may not be completely accurate.

Learning from Three Major Companies: Approaches to Carbon Neutrality

Sustainable Actions Webinar Report

As interest in achieving "carbon neutrality" grows both domestically and internationally, initiatives within each company are accelerating.

On August 24, 2021, Dentsu Inc. Japan Network's Sustainability Promotion Office and Dentsu Inc. Team SDGs hosted the "Carbon Neutral Business Webinar: The Crisis and Business Opportunities of Carbon Neutrality Facing Companies."

This report highlights case studies from the webinar featuring companies actively pursuing carbon neutrality. Guests included Aeon from the retail sector, Tokyu Land Corporation from real estate, and Sumitomo Mitsui Financial Group from finance, with Professor Yukari Takamura of the University of Tokyo Future Vision Research Center serving as commentator.

AEON: Changing Consumer Values Through Products and Services

■ Examples of Aeon's Initiatives (

)

・Announced the "Decarbonization Vision 2050" in 2018. Aims to achieve net-zero CO2 emissions from stores by 2040 and reduce CO2 emissions by 35% (compared to 2010 levels) by 2030.

・Achieved a group-wide reduction of approximately 3% compared to the previous fiscal year (FY2018). Compared to FY2010, this represents a reduction of approximately 10%. ・Cumulative solar power generation installations reached 1,040 stores and 74,000 kWh by 2019.

・Aims for 100% renewable energy at AEON Malls by 2025, and 100% renewable energy including small and medium-sized malls by 2030.

・Purchases surplus electricity from households whose FIT(※1) contracts have ended, achieving an annual renewable energy procurement volume of 16 million kWh in the Chubu region.

・Utilizes EVs to purchase renewable energy from households, using it for store operations and as power during disasters.

※1 FIT (Feed-in Tariff): A system obligating power companies to purchase electricity generated from renewable energy sources at a fixed price set by the government. FIT expiration refers to the end of the 10-year purchase period when the FIT application ceases.

The first speaker was Kaori Miyake from Aeon. Aeon, whose fundamental philosophy includes "peace," has long prioritized environmental and sustainability initiatives, believing peace cannot be achieved without environmental conservation.

While Aeon originally advocated for a "low-carbon society" in 2008, the significant impact of recent natural disasters on its business led to the realization that "unless we take the lead in addressing climate change, we may not be able to continue our business." Consequently, in 2018, Aeon shifted its focus toward achieving a "decarbonized society."

AEON was also an early supporter of the Task Force on Climate-related Financial Disclosures (TCFD), an international body promoting disclosure of climate-related risks affecting corporate activities. Mr. Miyake explained the benefits of TCFD endorsement: "Implementing it not only helps us identify our own climate risks but also provides a serious opportunity to consider measures to mitigate them. This results in recognition from investors and facilitates communication within the company, such as with the merchandise department." He also noted that the announcement of decarbonization efforts generated significant response, leading to outreach from companies with which AEON previously had no connection.

However, decarbonization requires collaboration not only within retail but also with suppliers and consumers. Miyake stated, "As retailers positioned between suppliers and consumers, we feel we play a crucial role in communicating with both sides and connecting their perspectives. A particularly important point is how we can change the awareness and lifestyles of our customers who visit our stores daily. We want to think more deeply and be more creative about what products and services are needed to convey our concepts and philosophy."

Professor Yukari Takamura from the University of Tokyo's Future Vision Research Center, serving as a commentator, remarked on the significance for the industry: "The idea of changing consumers' values and society through products and services is very interesting. Considering it could also lead to new business opportunities, this seems like a highly rewarding endeavor for retailers."

Tokyu Land Corporation: Declares 100% Renewable Energy for Its Own Operations by 2025, or Achieving RE100!

■Tokyu Land Corporation Initiatives (Examples)

・Aims for carbon negativity for its own operations by 2025, a 46.2% reduction in CO2 emissions including the supply chain by 2030, and net-zero emissions by 2050.

・Fully entered the renewable energy business in 2016. Expanded to 67 projects nationwide, with a rated capacity of 1,197 MW, equivalent to the electricity consumption of 413,000 households. (As of end of June 2021)

・Signed an agreement with Matsumae Town, Hokkaido, on "Regional Revitalization through Renewable Energy," aiming to eventually meet 100% of Matsumae Town's electricity consumption with renewable energy using electricity from its own wind power plants.

・Declared its membership in RE100 (an international initiative aiming for companies to source 100% of their operational electricity from renewable energy), the first in the real estate industry. Aims to achieve 100% renewable energy for electricity consumed in business activities by fiscal year 2025.

・Considering the introduction of an internal carbon tax to promote CO2 reduction awareness and improve ESG ratings.

・Established the "Renewable Energy Regional Revitalization Association (FOURE)", an industry group aiming for a decarbonized society through the coexistence of regions and renewable energy.

※2 Carbon Negative: Company's CO2 emissions < Reduction contributions through renewable energy generation, etc.

Next to take the stage was Mr. Takashi Ikeuchi of Tokyu Land Corporation. Tokyu Land Corporation is committed to environmental management company-wide under the slogan "WE ARE GREEN." Leveraging its expertise in residential land development and know-how in collaborating with local communities, the company fully entered the renewable energy business in 2016. As a result, it became feasible to supply all its own electricity, including that for tenants, with renewable energy. This led to the significant decision to advance its RE100 target from 2050 to 2025.

"The president's strong conviction that 'as a renewable energy provider, we must be the first to act,' combined with our company's inherently proactive social contribution culture, led us to commit to achieving 100% renewable energy early," stated Mr. Ikeuchi. This announcement generated significant attention, and in recent years, inquiries about renewable energy from business partners, including tenants, have reportedly increased considerably.

Simultaneously, recognizing the limitations of what can be achieved alone, the company established "FOURE," an organization aiming to realize a decarbonized society through collaboration with regional businesses. "Though still in its early stages, FOURE is a place where we share various ideas and explore measures to advance decarbonization while building mutually beneficial relationships with the community," stated Mr. Ikeuchi.

He continued, "For instance, installing sensors to collect data in public spaces for smart city initiatives requires dialogue with nearby residents, businesses, and local government to gain their understanding. Pioneering efforts cannot succeed without community support. We intend to continue proposing solutions and engaging in dialogue, leveraging the expertise we've developed through land readjustment and urban development projects."

Mr. Takamura expressed his expectations for the company, stating, "I believe the real estate industry has a significant role to play in achieving a decarbonized society. This is because achieving carbon neutrality requires changing the awareness and actions of each individual, and one major factor influencing that transformation is the design and management of the spaces we inhabit. Tokyu Real Estate, in particular, possesses extensive experience and knowledge in co-creation with local stakeholders. We sincerely hope you will collaborate with local communities to create 'comfortable, decarbonized living spaces.'"

Mitsui Sumitomo Financial Group: Collaborating through careful dialogue and support to track and reduce GHG emissions at investment and financing destinations

■Examples of Mitsui Sumitomo Financial Group Initiatives

・Announced mid-to-long-term GHG emissions reduction targets for its investment portfolio in 2023, aiming for net-zero GHG emissions within the group by 2030 and net-zero GHG emissions in its investment portfolio by 2050.

・Established a Group Chief Sustainability Officer (CSuO) as a Group CxO to advance the sophistication of management systems.

・Identifies climate change as one of the top risks and aims to understand and disclose customers' GHG emissions.

・Sets a target of 30 trillion yen in sustainable finance execution by 2030.

※3 GHG (Greenhouse Gas) emissions: Emissions of greenhouse gases such as carbon dioxide and methane.

The final speaker was Mr. Tatsuya Takeda of Sumitomo Mitsui Financial Group. Since the adoption of the Paris Agreement, discussions within the global financial industry have actively progressed on recognizing climate change as a risk to financial markets. In recent years, climate-related policies, centered on the EU, have emerged one after another, and this momentum has accelerated further.

Sumitomo Mitsui Financial Group is responsible for reducing CO2 emissions as a group, of course, but also for promoting transition (the shift to decarbonization and the financing for it) while standing between financial regulators and industry. In this role, it is responsible for comprehensively promoting the identification of GHG emissions from investment and financing destinations, setting medium- to long-term targets, strengthening risk management, and promoting decarbonization businesses.

Particularly noteworthy is the upward revision of the amount of sustainable finance, including green finance, to be implemented. The group had originally set a target of 10 trillion yen for green finance implementation in 2020, but due to strong global demand, the amount implemented reached 2.7 trillion yen in just one year. "Inquiries from customers regarding sustainability in particular increased seven to nine times compared to last year, clearly reflecting changes in market conditions. We decided to interpret this as a shift in the tide and to implement sustainable finance more aggressively," said Mr. Takeda.

Meanwhile, Mr. Takeda described the management and reduction of GHG emissions at investment and financing destinations as "a major project." The scale and business types of the companies receiving investment and financing vary, and their supply chain structures and product life cycles also differ. "We need to respond appropriately to each customer, and in that sense, we also need to transform the skills of our bank employees. For example, it will be important to see if we can engage in dialogue from the perspective of non-financial information, including environmental issues, not just financial conditions," said Mr. Takeda.

He further emphasized, "We must not proceed solely based on the convenience of financial institutions; we need to change together to create a carbon-neutral world. To assist in this, we are developing tools to track GHG emissions and aim to move forward with minimal burden."

Another key issue is overcoming the challenges of transition. Transition often requires investment in technological innovation. While this can eventually generate cash flow if products are successfully developed, pure R&D involves continuous cash outflows, making it a challenging investment. "Transitions involving uncertainty are difficult to manage solely through the risk-return framework of indirect finance. We believe mechanisms to diversify risk are necessary, such as combining support with public finance," he stated, highlighting the importance of support from governments and public institutions.

Mr. Takamura stated, "The support provided by Sumitomo Mitsui Financial Group to its investee and lending companies regarding GHG emissions measurement and disclosure ultimately strengthens corporate strategy and is a vital initiative for enhancing medium- to long-term corporate resilience. Considering the societal demand for emissions reduction across entire supply chains, the role of financial institutions supporting not only large corporations but also SMEs is significant."

Furthermore, as you highlighted as a challenge at the end, financing transitions involving uncertainty, such as new technology development, may carry high risks. I feel your message underscored the importance of establishing mechanisms for how the state and society will share these risks."

Opportunities exist not only for our own company but also in supporting our business partners and customers toward carbon neutrality.

This webinar provided insights into three distinct, pioneering initiatives. To conclude, here are Mr. Takamura's final remarks:

"All three companies are pioneers in Japan's carbon neutrality efforts, and it was striking to see how they've further strengthened their initiatives in response to recent societal trends. I found it particularly interesting that all three share the mindset of not just reducing their own emissions, but also supporting the carbon neutrality of their business partners and customers."

He also offered this advice for companies considering carbon neutrality initiatives:

"I believe the crucial first step is integrating carbon neutrality into your own business operations. This inherently requires considering the risks and business opportunities climate change presents from a medium-to-long-term perspective, making it an excellent opportunity to reassess your company's business and management challenges. Furthermore, since your customers likely face carbon neutrality challenges too, it's key to consider how your business can support them. Significant business opportunities may well lie there."

After the Webinar...

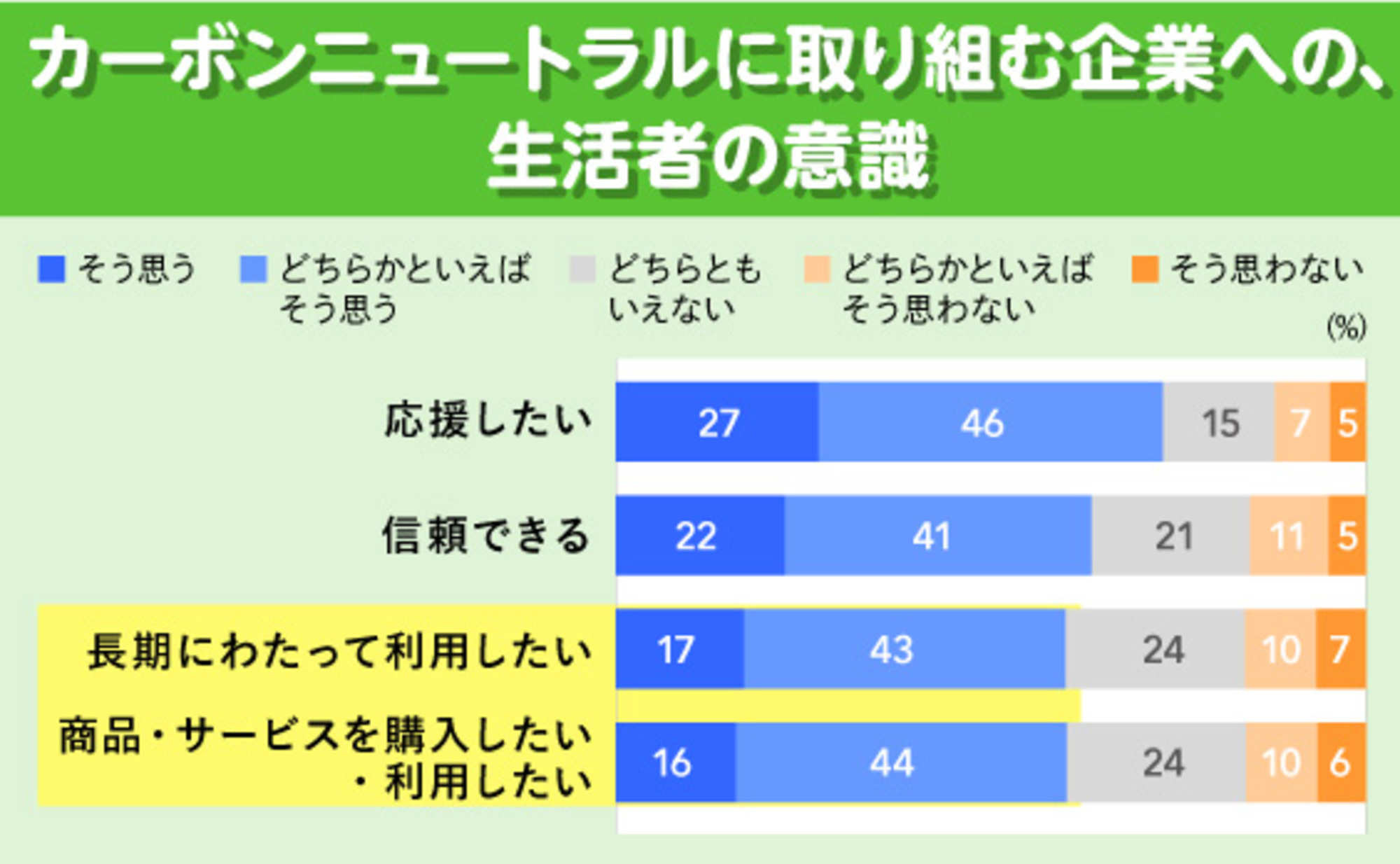

We heard valuable insights from Professor Takamura and the participating companies, each sharing perspectives on "carbon neutrality" – a challenge Japan must collectively address moving forward. As survey results indicate, consumer support for carbon neutrality initiatives is already strong. However, when it comes to specific corporate actions, these remain difficult for consumers to grasp and may still be poorly understood.

To achieve carbon neutrality, I believe it is essential for companies to clearly communicate the purpose and goals of their efforts, along with the value they bring to society and consumers. Gaining this understanding will help shift societal and consumer awareness and behavior. We hope this webinar provides useful insights as you embark on your carbon neutrality initiatives.

The Dentsu Group intends to continue collaborating with companies and media organizations to regularly create opportunities for information sharing and discussion on themes requiring nationwide effort in Japan. As the situation evolves rapidly, we aim to contribute by staying attuned to consumer and societal trends.

Dentsu Inc. Team SDGs, Rie Takeshima

Was this article helpful?

Newsletter registration is here

We select and publish important news every day

For inquiries about this article

Back Numbers

Author

Sustainable Actions Webinar Report

Report on the webinar conducted by Dentsu Inc. Japan Network's Sustainability Promotion Office and Dentsu Inc. Team SDGs, aimed at achieving the SDGs and realizing a sustainable society.