Note: This website was automatically translated, so some terms or nuances may not be completely accurate.

User Profiles of Connected TV and Future Utilization Challenges

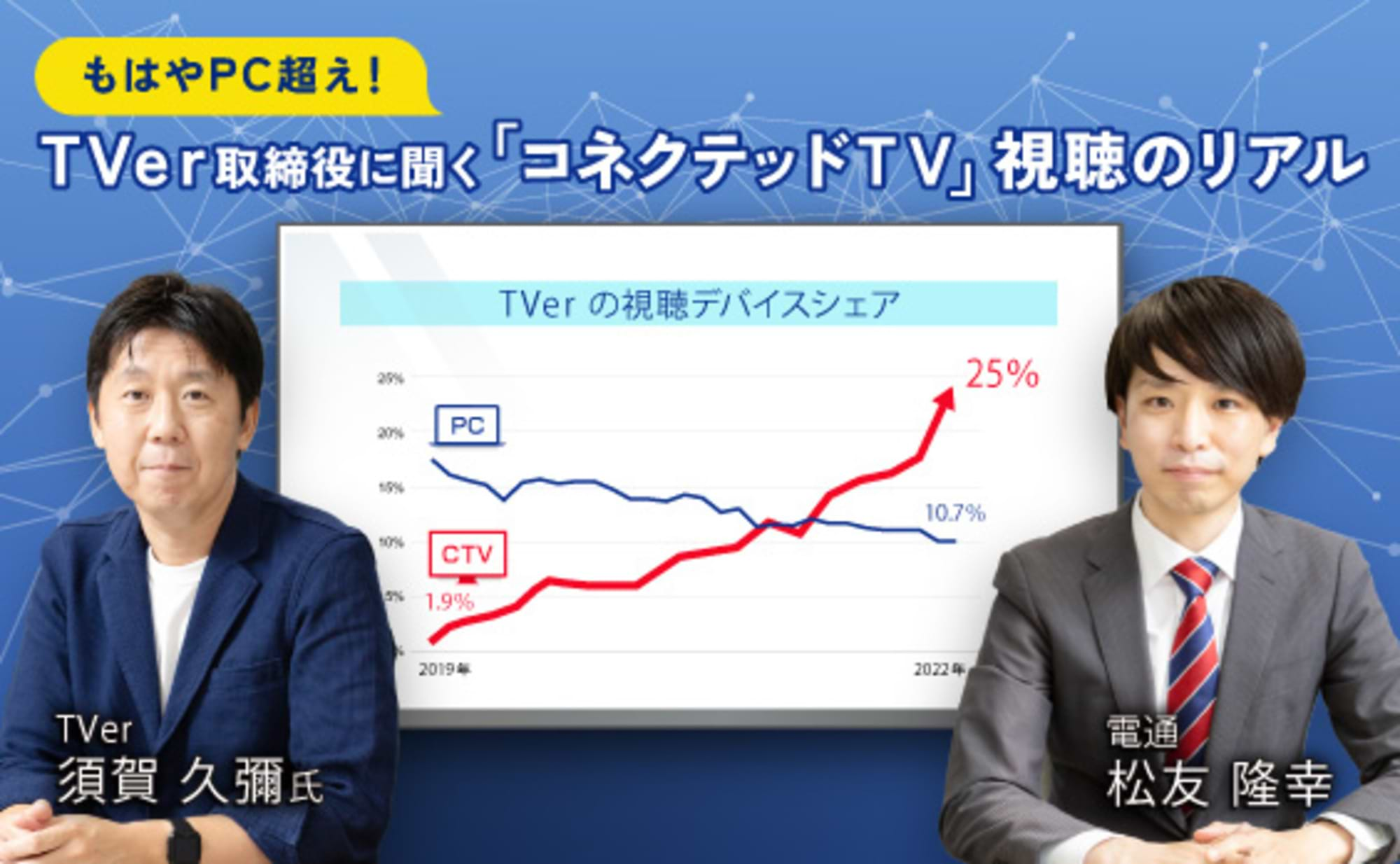

Connected TVs have seen rapid adoption in recent years. This series examines how companies and broadcasters should perceive and engage with Connected TV going forward, incorporating results from our proprietary survey on usage patterns and advertising effectiveness.

The previous article covered the distinct viewing styles of video streaming services compared to traditional broadcast TV viewing.

In Part 2, Takayuki Matsutomo from Dentsu Group's Radio,TV Business Produce Division, Data Promotion Department, presents analysis results utilizing Dentsu Group's proprietary solutions regarding the characteristics and user profiles of Connected TV users. We will also touch on challenges in utilizing Connected TV for marketing, an area where demand is expected to grow significantly.

Who are connected TV users?

From January to February, with the cooperation of TBS Television, we analyzed users of the TV app for "TVer" (*1), the official commercial TV portal accessible on connected TVs.

※1 = TVer

A free video streaming service provided by Japan's commercial broadcasters, offering completely free access to safe and reliable content produced by these stations. Users can watch approximately 400 programs weekly for free on PCs, smartphones, tablets, and TV apps after broadcast. It also streams popular past content and offers numerous live sports broadcasts.

TVer collects three attributes—date of birth, gender, and postal code—via surveys, enabling broadcasters to understand the demographic composition of users. Examining the gender and age distribution of TVer TV app users during the analysis period reveals that F1, F2, and M2 form the volume zone. Compared to terrestrial broadcast viewers, a higher proportion of younger users appears to be a characteristic of the TVer TV app.

Within this context, broadcasters sought to "gain a more detailed understanding of users beyond just gender and age" (Rintaro Fujiwara, DX Sales Department, DX Business Division, TBS Television General Planning Headquarters). Therefore, by leveraging various data from the Dentsu Group Inc.'s proprietary data platform, "People Driven DMP®" (*2), we conducted a detailed user analysis of TVer TV app users.

※2 = People Driven DMP®

A People Driven Marketing data platform that enables the utilization of audience data from PCs and smartphones, combined with TV viewing log data (STADIA), web ad exposure data, OOH ad exposure data, radio listening logs, panel data, purchase data, location data, etc., all centered around the individual (People). Note: People Driven DMP® does not handle personal information as defined by the Act on the Protection of Personal Information.

First, let's look at occupation and household income. Occupations showed a higher proportion of payroll/HR staff, homemakers, and students, while household income tended to be slightly higher compared to the overall population.

Next, let's examine interest categories. Looking at the ranking of items showing significant differences compared to the overall survey panel, TV programs ranked 1st and movies ranked 2nd. Paid broadcasting also ranked highly, indicating strong interest in video content.

We also analyzed purchasing tendencies. Examining spending amounts by category based on purchase data reveals that these users spend more on clothing/fashion and beauty.

From this analysis, we see that TVer TV app users are relatively young individuals with higher household incomes, who are interested in video content and spend money on fashion and beauty.

Digging deeper into connected TV users through profiling!

To capture a more detailed user profile, we statistically analyzed the vast survey results within "People Driven DMPⓇ"—comprising approximately 23,000 items—using the "significance test" method. This allowed us to profile user characteristics from various angles, including values, media exposure, interests, and product engagement.

Key characteristics emerging from this analysis include a strong focus on self-improvement, such as interest in cooking classes and English conversation lessons, along with awareness of body care and building a healthy physique.

Additionally, while they exhibit a strong work ethic, desiring career advancement through meritocracy and ability-based systems, they also place high value on personal relationships with family and friends. This indicates a tendency toward active individuals seeking to balance both work and private life.

Furthermore, they hold various financial assets like domestic stocks and are proactive in asset management. This likely stems from their high household income, a trend noted in the previous chapter.

Furthermore, as expected of TVer app users, they showed high levels of TV interest, evidenced by longer viewing times, frequent playback of recorded content, and diverse favorite program genres.

Two Key Challenges to Address in Connected TV Utilization

So far, we've shared analysis results on connected TV users. Moving forward, we'll touch on evaluating advertising effectiveness, which is crucial for leveraging connected TV in marketing.

The advertising effectiveness survey scheme for connected TV developed by Dentsu Inc. ( release here ) enables measuring advertising and brand awareness, as well as attitude change effects, by surveying individuals exposed to ads on the TVer TV app. While initially implemented only for TBS Television, the framework is now ready for deployment across the five major commercial broadcasters.

Here, we introduce two key points that are frequently requested by corporate advertisers regarding connected TV advertising effectiveness surveys and which we also consider important challenges to address.

1. Establishing a survey scheme that accurately evaluates advertising effectiveness across multiple media

For example, when evaluating the effectiveness of an advertising campaign that uses multiple media, such as terrestrial TV commercials alongside TVer or YouTube, it was previously necessary to compare results by artificially combining data from different survey panels. This approach often led to problems: the differing characteristics and conditions of the panels made accurate comparisons difficult, and it was impossible to clarify the overlap between media audiences. To correctly evaluate the effectiveness of each individual ad, it is essential to establish a survey methodology using a single panel.

2.Feasibility of Surveys at Typical Campaign Ad Spend Levels

When utilizing contact logs for surveys, securing sufficient sample sizes often requires large ad spend due to factors like panel appearance rates. Since "advertising solely for research" defeats the purpose, we need to establish survey methods that enable PDCA cycles at typical campaign scale.

To address these challenges, we are currently collaborating with various video platform providers to develop a new advertising effectiveness research scheme.

Toward Marketing Activities in the Connected TV Domain

This time, we introduced the challenges involved in analyzing connected TV users and leveraging this data for marketing.

The connected TV market is still in its infancy, leaving many aspects unexplored. By leveraging and analyzing various data to visualize previously ambiguous elements, we believe we can uncover valuable insights for future marketing applications.

Regarding the analysis of TVer TV app users, TBS Television's Fujiwara stated, "We find it highly significant that detailed user profiles have emerged based on data." He added, "Amid concerns about young people turning away from television, we feel it is crucial to capture their interest in content and create opportunities for viewing. Moving forward, TBS Television aims to design and improve viewing environments for consumers while contributing to the marketing efforts of our corporate advertisers." (Mr. Fujiwara, TBS Television, previously quoted) This statement also reveals the broadcaster's proactive stance in the connected TV domain.

Furthermore, a pressing challenge in utilizing connected TV is establishing a research framework that enables accurate evaluation of advertising effectiveness across multiple media and allows for PDCA cycles within standard campaigns. While addressing these challenges, the entire industry must work together toward the growing marketing applications of connected TV. We also intend to continue disseminating information.

【Contact】

Dentsu Inc. Radio,TV Business Produce Division

Data Promotion Department: Park, Matsutomo

Email: connectedtv@dentsu.co.jp

Was this article helpful?

Newsletter registration is here

We select and publish important news every day

For inquiries about this article

Back Numbers

Author

Takayuki Matsutomo

Dentsu Inc.

Radio,TV Business Produce Division Data Promotion Department

As a media planner, I am engaged in all aspects of media planning centered on client KPIs. Since 2021, I have been working in my current department, driving the digital transformation of the television business through analysis utilizing various data and the development of new solutions.