Connected TVs—television sets connected to the internet—have seen rapid adoption in recent years.

This series examines how companies and broadcasters should perceive and engage with connected TV going forward, incorporating results from our original survey on usage patterns and advertising effectiveness.

Part 1 introduced the "viewing style of video streaming services," distinct from traditional TV broadcasting. Part 2 covered connected TV user analysis and challenges in marketing utilization.

This installment focuses on connected TV from the perspective of a platform provider. Dentsu Inc. Radio,TV Business Produce Division, Data Promotion Department's Takayuki Matsutomo interviewed Hisaya Suga, Director of TVer, about the actual viewing patterns of their content on connected TV and their future platform strategy.

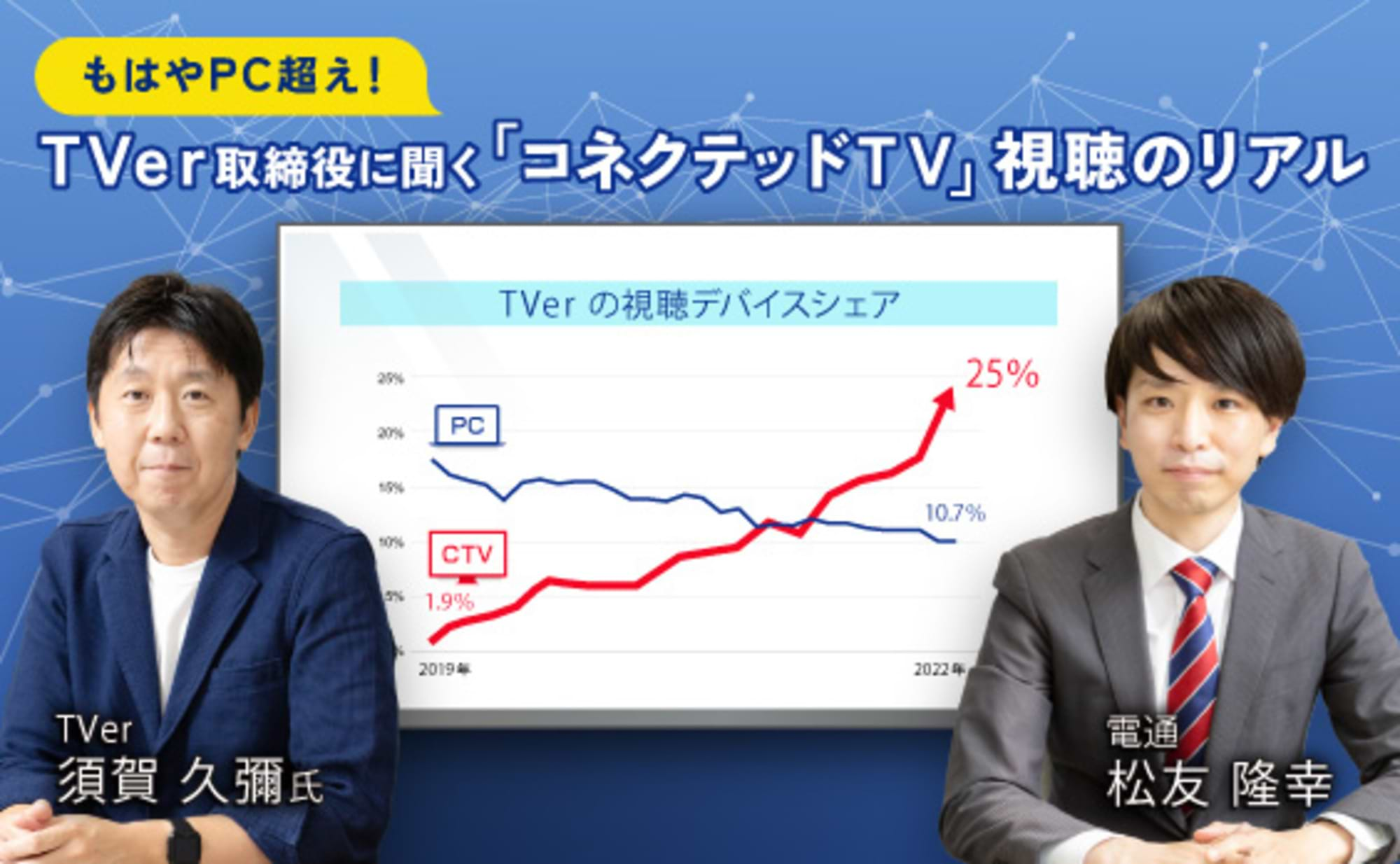

TVer's viewing device share has surpassed PCs, reaching approximately 25%!

Matsutomo: Thank you for having me today. First, could you introduce TVer?

Suga: TVer is a free video streaming service launched in 2015 by Japan's commercial broadcasters.

Suga: In addition to providing catch-up streaming for about 500 programs weekly, we also distribute past content, offer real-time streaming (simulcasts with terrestrial broadcasts), and conduct live streaming. Total app downloads across all devices exceed 45 million, and monthly unique browsers surpass 18 million.

Matsutomo: What devices can be used for viewing?

Suga: The service initially launched on PCs, smartphones (SP), and tablets, but since April 2019, it has also been available on connected TVs.

Matsutomo: What percentage of viewers are using connected TVs?

Suga: As of March 2022, the device share reached about 25%, already surpassing PC playback numbers. In terms of playback volume, TVer as a whole grew 2.9 times over the past two years, but connected TV usage grew 8.3 times. While the proliferation of connected TVs is a factor, I believe the increased time spent at home due to the pandemic, leading to more viewing opportunities on TV sets, was a major reason.

Matsutomo: It's surprising that it's already surpassed PC share. Compared to other free video streaming services, the connected TV ratio seems high. Is this because the content originates from TV, making it naturally compatible with TV sets?

Suga: Yes, that influence is definitely there. When watching on connected TVs, viewers likely experience the content and commercials with the same natural feel as watching live broadcasts. Above all, the steady increase in compatible devices over the past year is a major factor. Recently, we've also seen more TV manufacturers approaching us, expressing interest in "pre-installing TVer on their products" or "clearly stating that it comes packaged with their devices." This really shows the market is heating up.

"Long viewing times" and "high completion rates" are characteristics of connected TV viewing

Matsutomo: Let's delve into more detailed viewing patterns. First, what are the characteristics of TVer users' age composition?

Suga: Across all devices, compared to terrestrial broadcasts, we see a higher proportion of MF1 and MF2 demographics. This trend is even stronger among connected TV users, indicating a relatively younger audience.

Matsutomo: Are there differences in the content watched depending on the device?

Suga: Dramas are popular across all devices. However, variety shows tend to rank relatively higher on connected TV. Recently, economic programs have been well-received, particularly among business professionals, and we feel the user base is broadening.

Matsutomo: Are there any distinctive differences in viewing styles compared to smartphone or PC users?

Suga: First, there's a difference in viewing time. While TVer is characterized by long viewing times across all devices, connected TV shows a longer trend: approximately 29 minutes per episode compared to about 22 minutes on smartphones. Furthermore, the average playback time per device is also longer on connected TV—about 10 hours and 15 minutes per quarter (3 months) compared to about 9 hours and 38 minutes on smartphones.

Matsutomo: This trend aligns with our survey results introduced in the first article. Even for the same video streaming service, we observed longer viewing times on Connected TV compared to PC and SP.

Suga: Another characteristic is the high completion rate for content. While TVer maintains a high completion rate of over 60% across all devices, connected TV stands out with a particularly high rate of 71.8%. The completion rate for commercials also reaches a high level of approximately 96%.

Matsutomo: It's impressive that completion rates are so high despite the content being primarily long-form. It seems to be viewed in a manner similar to Amazon Prime Video or Netflix. Regarding commercial completion rates, we previously analyzed completion rates for terrestrial commercials on STADIA (*1), and the scores are nearly equivalent.

Suga: Since TVer's content originates from TV broadcasts and is produced with commercials as an integral part, viewers seem to accept that skipping them isn't an option.

Matsutomo: I see. Dentsu Inc.'s proprietary survey (※2) also showed TVer elicits fewer negative reactions to ads, so that background might be a factor. Are there any notable patterns regarding viewing times?

Suga: Viewing times tend to differ by device. On smartphones, nighttime viewing is high regardless of weekday or weekend, while connected TVs show higher viewing in the morning and evening on weekdays, and throughout the day on weekends.

Matsutomo: It's interesting that trends differ by device. Connected TVs have the characteristic of household viewing, so they're likely watched when families gather in the living room. Smartphones, being more individual viewing, tend to be watched in private rooms at night. Dentsu Inc.'s proprietary survey also looked at viewing locations. For video streaming services, private room use is high when viewed on smartphones. For TVer, private room use was also the highest at 53.1%.

※1 = STADIA

An on/off integrated solution that combines data from "offline" media like TV with "online" media on smartphones and PCs to enable more effective marketing.

※2 = Dentsu Inc.'s proprietary survey

"Connected TV Usage Survey" Survey subjects: Men and women aged 15-69 Survey sample size: 2,400 samples Survey agency: Video Research Ltd. Survey period: August 2021

Leveraging "First-Party Data" is Key!! TVer's Platform Strategy

Matsutomo: Finally, could you share TVer's outlook for connected TV moving forward?

Suga: We believe users appreciate being able to watch TVer on their TV sets. Going forward, we aim to enhance the convenience of viewing on connected TVs to increase usage even further. Consequently, this will also increase advertising inventory on connected TVs, providing advertisers with more communication opportunities on this platform.

Matsutomo: Currently, from a personal information protection perspective, utilizing third-party cookies and IDFA (※3) for ad delivery is becoming increasingly difficult. In this environment, what initiatives is TVer undertaking?

※3 = IDFA

iOS device advertising identifier

Suga: TVer collects user data through surveys, including birthdate, gender, postal code, and interests. By leveraging this first-party data (※4), we achieve high-precision targeting without relying on third-party cookies or IDFA.

※4 = First-party data

Data that a company independently collects and possesses regarding its own customers, etc.

Matsutomo: For platform operators, I believe the key lies in how much first-party data they can hold, so such initiatives are certainly valuable.

Suga: Additionally, starting April 1, 2022, we launched a new initiative called "TVer ID" to manage TVer users under a single "OneID." One goal is to enhance user convenience. We aim to enable cross-device sharing of favorites and paused playback positions across PCs, smartphones, tablets, and connected TVs, realizing "anytime, anywhere" access.

Another goal is providing data that supports corporate marketing efforts. By integrating with external services, we plan to enrich first-party data to improve targeting accuracy, optimize cross-device advertising, and enhance reporting capabilities. Naturally, we will explicitly present our privacy policy to users and proceed only after obtaining their consent.

Matsutomo: So, the goal is to create benefits for both users and businesses while enabling cross-device communication. "TVer ID" seems like a crucial initiative.

A key focus area for platform operators too! Expanding data-driven communication

This time, we heard about the current state of connected TV and related initiatives from the perspective of TVer, a platform provider.

Given that TVer's connected TV viewership has already surpassed PC viewing, it's clear that connected TV is also a key focus area for platform operators. Connected TV users predominantly belong to MF1 and MF2 demographics, and their viewing content and time slots show distinct patterns compared to PC and smartphone users. "Long viewing duration" and "high completion rates" are unique characteristics of connected TV viewing, aligning with our previous research and analysis.

Furthermore, regarding future strategies, while prioritizing enhanced user convenience, efforts are beginning to focus on data-driven marketing, such as expanding first-party data and implementing user management via OneID. This suggests the potential for expanded communication activities on connected TV in the future.

Next time, we will discuss the effectiveness of ad delivery on connected TV, based on findings from actual campaigns.

[Contact Information]

Dentsu Inc. Radio,TV Business Produce Division

Data Promotion Department: Park, Matsutomo

Email: connectedtv@dentsu.co.jp