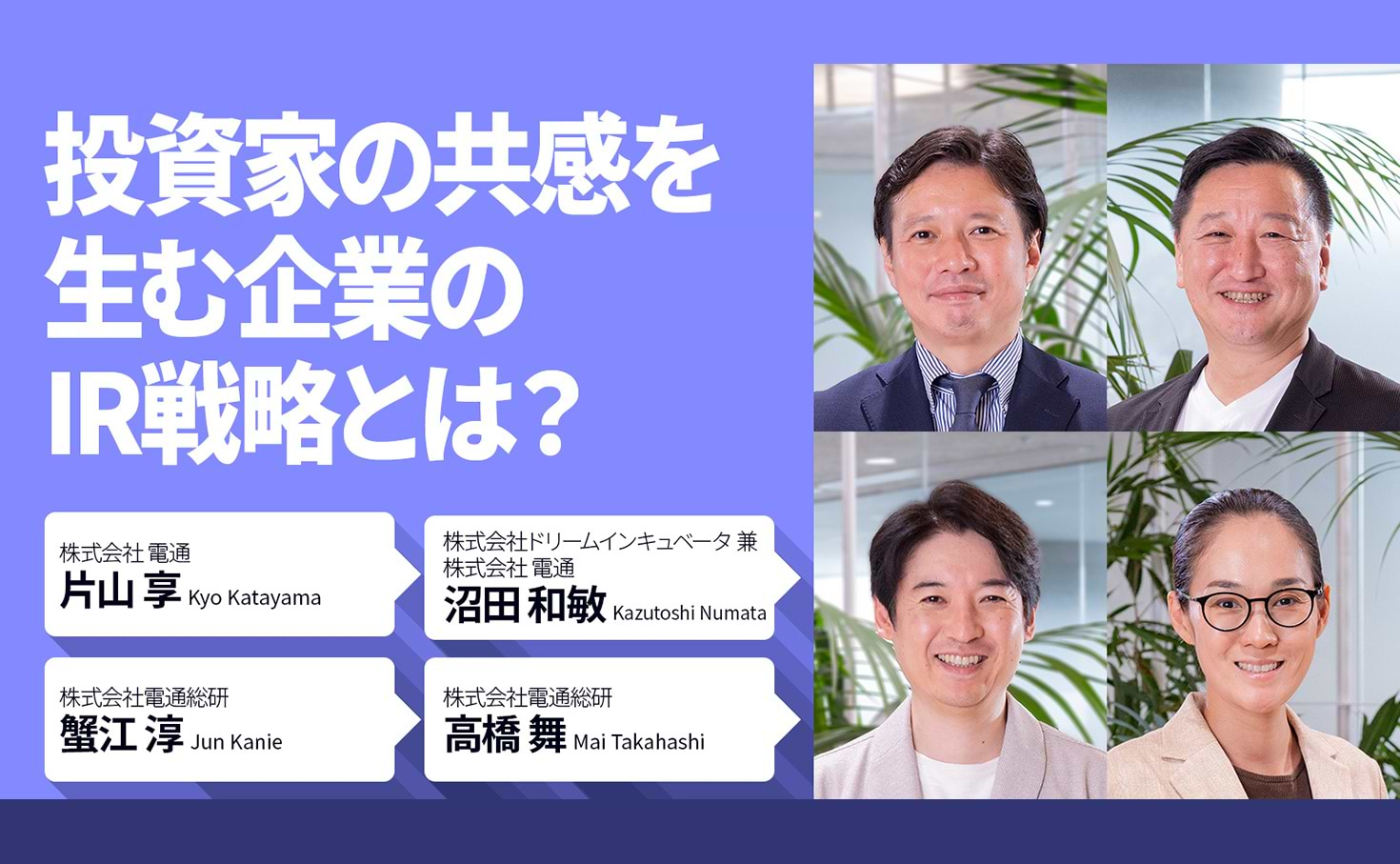

In response to heightened awareness of sustainability management, an increasing number of companies are proactively disclosing information beyond financial data. Today, such non-financial information has become a critical factor that can influence corporate value even more than financial assets. Why not accurately assess the value of this information and leverage it for sustainability management? Nagai from Dentsu Inc.'s Sustainability Consulting Office and Kanie from DENTSU SOKEN INC.'s Consulting Division introduce our unique solution for analyzing non-financial information: the "Non-Financial Value Survey."

What is "non-financial information," which has gained significant attention in recent years?

Information disclosed by companies to the outside world is broadly categorized into "financial information" and "non-financial information." While quantitative information disclosed in financial statements constitutes financial information, non-financial information refers to qualitative information that cannot be quantified. While this may be obvious to our readers, let's review its contents in a bit more detail.

Non-financial information primarily encompasses information related to the following five capitals:

- Manufacturing Capital

- Intellectual capital

- Human capital

- Social and Relational Capital

- Natural Capital

Reference: Classification in the International Integrated Reporting Council (IIRC) "International Integrated Reporting Framework (IIRC Framework)"

While the terminology may sound formal, the specific content of non-financial information essentially includes product development capabilities, technological prowess, the caliber of management and their strategic direction, employee motivation and skills, relationships with reliable suppliers and key customers, and the environmental contribution of the business. These are also referred to as intangible assets.

Today, this non-financial information holds significant meaning in corporate management. The backdrop is the global rise in sustainability awareness. As the importance of sustainability management grows, disclosure of information such as a company's approach to addressing social issues has become strongly demanded by investors.

Furthermore, such non-financial information is increasingly valued beyond investment contexts—becoming criteria for choosing employers, influencing product purchases, and determining contract decisions. Globally, intangible assets accounted for a staggering 90% of the market value of companies in the U.S. market (S&P 500) in 2020! This clearly demonstrates the shift in the source of corporate competitiveness from tangible to intangible assets.

Japan lags in utilizing non-financial information. The reason is the difficulty of quantification.

In Japan, disclosure of sustainability information in securities reports became mandatory starting with the fiscal year ending March 2023. Consequently, the number of companies publishing non-financial information in "Integrated Reports" or "Sustainability Reports" has surged in recent years. However, did you know that the proportion of intangible assets in the corporate value of Japanese companies is relatively low compared to Europe and the US?

Factors contributing to this include many Japanese companies failing to recognize the relationship between non-financial activities and performance, and struggling to identify promising sustainability themes from the multitude available. In reality, many who are actively disclosing information through integrated reports and similar documents may not fully grasp the significance of disclosing that information or the value of their own non-financial data.

Unlike financial data, non-financial information cannot be easily quantified. Precisely because it cannot be expressed numerically, it is often difficult to establish clear metrics, and common benchmarks are frequently undefined. Consequently, many companies find themselves in a situation where they "are doing it, but don't know what to do next" or "don't know where to focus efforts to enhance corporate value going forward," often resulting in non-financial disclosure remaining merely a compliance exercise.

It's important, but because it can't be quantified, its value isn't understood, and it can't be utilized. This is the current state of non-financial information surrounding Japanese companies. If this is limiting the potential of their own sustainability management, it's a tremendous waste.

Visualize it and understand the next move! What is the "Non-Financial Value Survey"?

To resolve these challenges, the first essential step is, quite simply, "accurate analysis of the value of non-financial information." By objectively and comparatively evaluating a company's non-financial value through advanced data analysis, its position becomes clear, revealing pathways and directions for leveraging this value in management.

Based on this concept, Dentsu Inc. launched its "Non-Financial Value Survey" in 2023. This proprietary Dentsu Inc. solution combines four types of big data—financial data, ESG evaluation data, image data, and employee word-of-mouth data—to analyze their impact on corporate value.

Using the Non-Financial Value Survey can clarify evaluations and causal relationships regarding issues such as the following:

1. Stakeholder Evaluation Issues

[Issue] Uncertainty about which activities resonate with which stakeholders

[Analysis Capabilities] Determine evaluations by stakeholder

2. Competitive Advantage Evaluation Issues

[Issue] Unclear where our company's initiatives outperform competitors

【What can be analyzed】Clarify our company's strengths and weaknesses by comparing against industry averages and competitors

3. Trend Identification Problem

【Issue】Uncertainty about how to review sustainability initiatives moving forward

[What can be analyzed] Identify sustainability activities most likely to enhance stakeholder evaluation

4. Internal consensus issues

【Problem】Employees hold diverse opinions, leading to unproductive discussions and a lack of consensus

【Analysis Capabilities】Using data analysis results, management and employees can review the current situation from the same perspective and reach agreement on future direction

The key point is that analysis not only helps grasp the current situation but also clearly guides us to the next step: "What issues should we prioritize moving forward?" What sustainability management will demand going forward is how effectively we engage in "activities that significantly contribute to corporate value." Surveys make the contribution of non-financial value to the company visible, enabling us to prioritize and select activities.

For example, if certain sustainability activities are trending within an industry, data-driven insights can suggest hypotheses like, "Focusing on this theme could yield future results," to companies whose efforts are insufficient.

Alternatively, for companies already pursuing advanced initiatives, we can identify the next untapped areas and present new possibilities. Securing internal agreement for actual implementation is difficult without reliable analytical data and evaluations. In such cases, the analysis results from the "Non-Financial Value Survey" serve as compelling factual data.

From diagnosis to action plans and stakeholder relationship building

If you recognize your company's sustainability efforts are lagging, continuing as is will only increase future business risks. We recommend first using the Non-Financial Value Survey to clearly understand your company's position. We also offer sessions to discuss future activities alongside the survey, enabling a seamless approach from analysis to action plan development.

For some companies, even after identifying key sustainability themes through the Non-Financial Value Survey, implementation may prove challenging. In such cases, we can break down the challenges into manageable components, like factoring a problem, to explore feasible pathways forward.

Furthermore, managing sustainable business operations requires understanding and cooperation from a wide range of stakeholders. We believe this survey can help clarify evaluations from diverse stakeholders, aiding in future communication and relationship-building efforts.

This approach should prove valuable from multiple angles for companies grappling with sustainability initiatives and future strategies. If you're struggling with your company's non-financial value or how to leverage it, please feel free to consult with us.

● Download the eBook detailing the "Non-Financial Value Survey" here