How is today's rapidly changing Japan perceived by people around the world? What kind of reputation do Japan's tourism, food, products, and other "Japan brands" enjoy overseas?

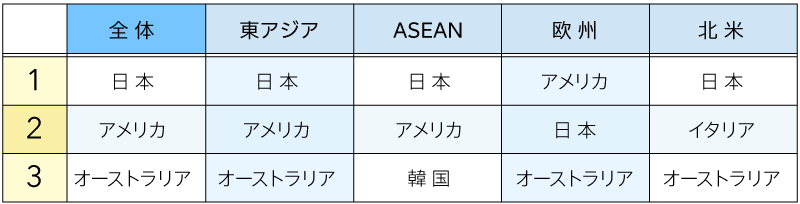

This article introduces the results of the "Japan Brand Survey 2017," conducted in 20 countries and regions worldwide from February to March 2017. This final installment covers "Countries Most Wanted to Visit in the Future."

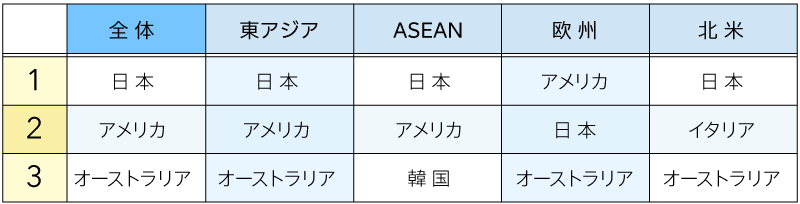

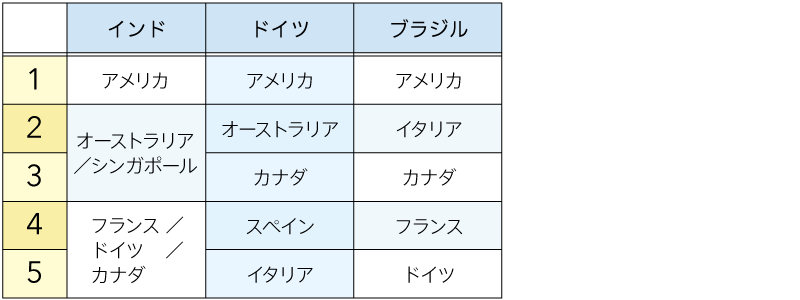

A. While Japan enjoys high popularity, it ranks second in Europe behind the United States. There's still plenty of room for growth!

*Respondents selected from the top 20 countries and regions in the 2016 World Tourism Rankings (international tourist arrivals) and from Asian countries and regions.

Compared to other countries, Japan's popularity as a travel destination is evident. Furthermore, in survey items regarding visit intentions, approximately 80% of all respondents expressed an intention to visit Japan, achieving a high score.

While Japan ranks within the top 5 in most countries, it falls outside the top 5 in India, Germany, and Brazil.

While Japan's global popularity is growing, there appears to be room for further growth in some countries.

<Japan Brand Survey 2017 Overview>

● Purpose: To understand overseas consumers' perceptions and actual behavior regarding the overall "Japan Brand," including Japanese food, tourism, and Japanese products, thereby supporting corporate marketing activities.

●Target Areas: 20 countries and regions

China (Group A = Beijing, Shanghai, Guangzhou; Group B = Shenzhen, Tianjin, Chongqing, Suzhou, Wuhan, Chengdu, Hangzhou, Dalian, Xi'an, Qingdao), Hong Kong, Taiwan, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Vietnam, Philippines, Australia, USA, Canada, Brazil, UK, France, Germany, Italy, Russia

※East Asia (China, Hong Kong, Taiwan, South Korea)

※ASEAN (Singapore, Thailand, Indonesia, Malaysia, Vietnam, Philippines)

●Survey Method: Internet survey

● Target Population: Men and women aged 20–59 in the middle-income bracket and above

※Definition of "middle-income": Conditions set per country based on national average income (OECD statistics) and social class classification (SEC)

●Sample size: China: 200 respondents each for A and B groups, total 400 respondents; USA: 400 respondents; Other regions: 200 respondents each, total 4,400 respondents

●Survey Period: February 13 to March 10, 2017

Dentsu Inc. Team Cool Japan

A cross-functional project team established by Dentsu Inc. to promote 'Cool Japan-related initiatives'—expanding products and services leveraging Japanese culture and strengths into overseas markets. Dentsu Inc. also invests in the Ministry of Economy, Trade and Industry's Cool Japan Organization (fund). The team brings together client company representatives for overseas expansion, media and content specialists, overseas subsidiary network managers, producers, and planners to work on initiatives promoting Japan's appeal globally.