The number of international tourists visiting Japan has been increasing year by year, reaching a record high in 2017.

Furthermore, 2019 brought the Rugby World Cup, 2020 the Tokyo Olympics and Paralympics, and 2021 the World Masters Games Kansai, marking the "Golden Sports Years."

These major sporting events are expected to further increase the number of foreign visitors to Japan and stimulate more active initiatives by government, local authorities, and companies. Amidst this, how is Japan perceived globally?

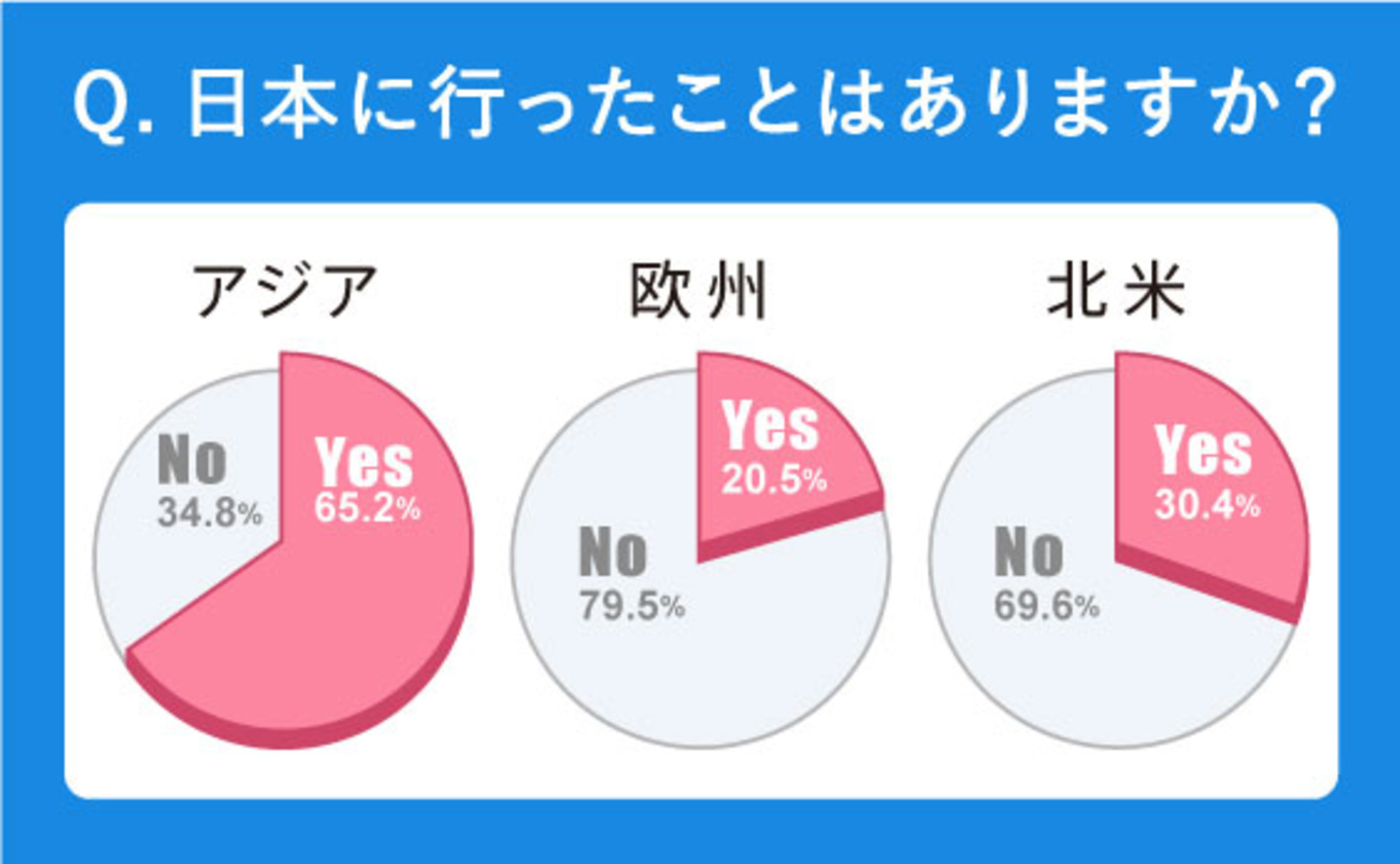

In which countries and regions is the intention to visit Japan growing, and for what reasons? Furthermore, how is "Made in Japan" currently perceived? Dentsu Inc.'s "Team Cool Japan" conducted the "Japan Brand Survey 2018" in 20 countries and regions worldwide from January to February 2018.

This series introduces survey results that will be key points for future businesses targeting visitors to Japan. Part 4 focuses on "Visitors' Interest in Private Lodgings." We examine everything from preferred accommodation types to the information sources they consult when planning trips to Japan.

Q: What type of accommodation would you like to use in Japan?

A: Airbnb ranks third in Asia. Since Asian visitors also show strong interest in visiting regional areas, could Airbnb/private lodging be key to revitalizing regional cities?

The most popular types of accommodation in Japan were ranked as follows: "Economy Hotels," "Ryokan (Traditional Inns)," "First-Class Hotels," "Airbnb," and "Capsule Hotels."

Looking at responses by region, "Economy Hotels" were most popular in Asia, "Ryokan" in Europe, and "First-Class Hotels" in North America. The globally popular "Airbnb/Private Lodging" showed particularly strong interest in Asia.

Airbnb, the representative platform for private lodging, has seen its user base grow annually since entering Japan in 2014, with domestic listings reaching 51,000 (Airbnb Japan, 2017). While ranking fourth overall, over 30% of respondents expressed interest in using it in Japan. This figure exceeds 40% in ASEAN countries, particularly Thailand and Malaysia, where inbound tourism is expected to grow significantly.

According to this survey, many respondents from Asia expressed interest in visiting regional areas of Japan. Given the high level of interest in "Airbnb/private lodging," it is highly likely to hold the key to revitalizing regional cities in the future.

So, where do these inbound tourists get their information and plan their trips? Let's take a look next.

Q: What are your sources of information for traveling to Japan?

A: The Japan National Tourism Organization website is popular!

China uses "Ctrip," Hong Kong and North America use "Expedia," while South Korea, Taiwan, and Vietnam rely on "personal blogs."

Across all countries, "travel agency websites," "Japan National Tourism Organization website," and "TripAdvisor" appear to be commonly referenced. Surprisingly, the "Japan National Tourism Organization website" is popular, with over 50% of respondents in the ASEAN-focused survey indicating contact!

Additionally, in Europe, "TripAdvisor," "Expedia," and "Booking.com" are highly referenced; in North America, besides "Expedia," "Hotels.com" is popular; and in Asia, "personal blogs" have high engagement. The sites referenced differ by region. By considering these points when disseminating information, you can likely attract inbound travelers more efficiently.

Taking North America as an example, as introduced in the third installment "Which Japanese Prefectures Do You Want to Visit?", "Castles/Castle Sites" and "Cherry Blossoms" are popular. Therefore, creating a feature on "Castles Where Cherry Blossoms Look Spectacular" on "Expedia," a site frequently referenced by North Americans, is predicted to be an effective way to attract visitors.

Thus, to efficiently approach inbound tourists, one key point is to combine frequently visited websites with themes they wish to experience when publishing advertisements or articles. Furthermore, incorporating articles introducing the region's history and local specialties could heighten interest and potentially lead to attracting visitors.

Overview of the 2018 Japan Brand Survey

● Purpose: To understand overseas consumers' perceptions and actual behavior regarding "Japan Brand" products, including Japanese food, tourism, and Japanese goods, thereby supporting corporate marketing activities.

●Target Areas: 20 countries and regions

China (Group A = Beijing, Shanghai, Guangzhou; Group B = Shenzhen, Tianjin, Chongqing, Suzhou, Wuhan, Chengdu, Hangzhou, Dalian, Xi'an, Qingdao), Hong Kong, Taiwan, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Vietnam, Philippines, Australia, USA (Northeast, Midwest, South, West), Canada, Brazil, UK, France, Germany, Italy, Russia

※East Asia (China, Hong Kong, Taiwan, South Korea)

※ASEAN (Singapore, Thailand, Indonesia, Malaysia, Vietnam, Philippines)

●Survey Method: Internet survey

●Respondent criteria: Men and women aged 20-59 in the middle-income bracket and above

※Definition of "middle-income": Conditions set per country based on national average income (OECD statistics, etc.) and social class classification (SEC)

●Sample size: China: 300 each for A and B groups, total 600; USA: 600; Other regions: 300 each, total 6,600

●Survey Period: January 12 to February 16, 2018

Dentsu Inc. Team Cool Japan

A cross-functional project team established by Dentsu Inc. to promote 'Cool Japan-related initiatives'—expanding products and services leveraging Japanese culture and strengths into overseas markets. It brings together client company representatives handling overseas expansion, media and content specialists, overseas subsidiary network managers, producers, and planners to work on initiatives that project Japan's appeal to the world.