Note: This website was automatically translated, so some terms or nuances may not be completely accurate.

Three Key Points Companies Should Prioritize When Engaging in Ethical Consumption

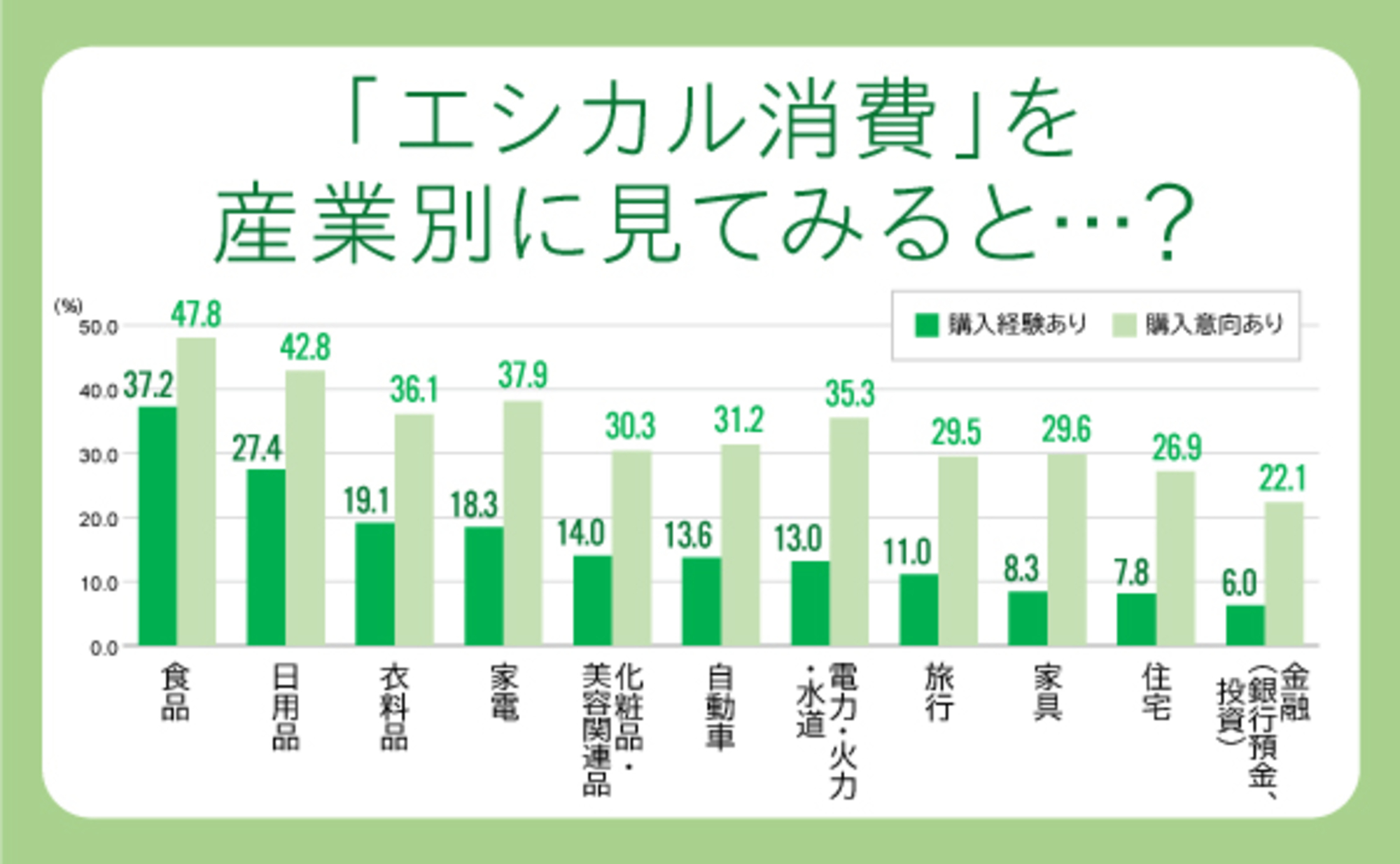

Dentsu Inc. recently announced the results of its "Ethical Consumption Awareness Survey 2020" (hereafter, this survey) ( release here ). Based on these findings, we will explain the significance and methods for companies and society to engage in "ethical consumption" in a series of articles.

What is Ethical Consumption?

Our research team defines ethical consumption as "consumers engaging in consumption activities while considering solutions to social issues or supporting businesses addressing such issues." Incidentally, "ethical" is an adjective meaning "based on ethical principles." Consumption, an indispensable part of our lives, can be considered one of the most accessible ways to engage in ethical behavior.

In the past two articles, we introduced "What is Ethical Consumption?" and "Consumer Awareness of Ethical Consumption." This time, we present the results of cluster analysis based on this survey and three key points companies should prioritize when engaging in ethical consumption.

<Table of Contents>

▼Eight Clusters Revealed Through Awareness and Consumption Behavior

▼Point 1: Know Your Target Audience

▼Point 2: Think Beyond Gen Z—Focus on Parent-Child Households Too

▼Point 3: Beware of "Image Traps"

▼The Future of Ethical Consumption in Japan

Eight Clusters Revealed Through Awareness and Consumption Behavior

Our research team analyzed attitudes and consumption behaviors related to ethical consumption, categorizing consumers into eight distinct clusters.

・

Seni ors with moderately high ethical consumption intentions. They want to choose ethical products when they have the chance.

・Ethical Action Group

The vanguard of ethical consumption, demonstrating high awareness and intent. With high household income, they show strong interest in ethical choices even for durable goods.

・Ethical Potential Group

Not actively engaged, but exhibit the highest ethical consumption intent. They also have high household income and often have children in their teens or millennial generation.

・Ethical Hassle-Averse Segment

This segment still has low ethical consumption intent. They haven't embraced ethical consumption because it requires time to research.

・Ethical Cautious Group

This group wants to practice ethical consumption across a wide range of industries but acts only after carefully verifying benefits, quality, functionality, and suitability for themselves.

・My Way Family Segment

This group has families and high incomes but still shows limited interest in ethical consumption. While their understanding of ethical consumption is not yet advanced, they represent a segment with potential.

・Indifferent Middle Class

A segment passive about ethical consumption. Many are middle-aged singles with low ethical awareness.

・Ethical Followers

A segment where awareness is still developing, but who may become interested in ethical consumption due to the influence of acquaintances . High male ratio.

Point 1: Know Your Target Audience

When companies engage in ethical consumption, the first crucial step is recognizing that consumers involved in ethical consumption come in various types. Since it's essential to generate empathy for the company's ethical activities and help consumers understand the benefits, it's vital to thoroughly understand consumers—specifically, who actually has heightened awareness and who possesses ethical consumption values that align with the company's products or services—and approach them accordingly.

When clustering consumers this time, the first thing that stood out was their level of interest in ethical consumption. Mapping awareness and intent to practice ethical consumption reveals three groups: the "Growth Group," the "Indifferent Group," and the "Untapped Group."

Furthermore, within these groups, the areas of interest for ethical consumption differ. Rather than simply looking at volume or demographics like gender and age, it's crucial to examine each group's ethical consumption awareness from multiple angles: Where are the segments most interested in our products and services? Could there actually be segments within the Indifferent Group that are more receptive?

As mentioned in the previous article, ethical consumption that consumers want to practice is something where they can understand the benefits for themselves and society. In other words, it's necessary to generate empathy for the activity and ensure they understand the benefits.

We must pause to reconsider whether the measures designed to generate empathy will actually be accepted by the target audience ( ), clearly define the target, and gain a deep understanding of them.

Point 2: Expand Your Perspective Beyond Gen Z to Include Parent-Child Households

From here, we'll pick out three clusters belonging to the aforementioned "growth group" and delve into their specific profiles.

First is the "Ethical Action Group," the largest segment with the highest interest in ethical consumption. This group has a slightly higher proportion of women, with those aged 40 and above comprising three-quarters of the group, and they also have higher household incomes. Their ethical consumption awareness ranks first among the clusters across a wide range of industries, from daily necessities to furniture. It's no exaggeration to call them the representative group for ethical consumption.

While showing less interest than the Ethical Action Group, the Ethical Potential Group demonstrates strong implementation intent. Though their market share is 8.5%, lower than the Ethical Action Group, an overwhelming 97.4% express intent to practice ethical consumption. While awareness of "ethical consumption" itself hasn't quite taken hold yet, this group is highly likely to actively practice it as ethical consumption becomes more commonplace.

This group also consists mostly of women aged 40 and above, with a higher proportion having children than the Ethical Action Group—over half. Many of these children are Millennials, suggesting this group has the potential for strong ethical consumption awareness across both parents and children.

However, their primary areas of interest are industries representative of ethical consumption, such as "food" and "clothing." In sectors where ethical consumption has yet to take hold, like "daily necessities" and "appliances," efforts should likely start with raising awareness of ethical products and services.

Finally, there is the "Ethical Seniors" cluster. Comprising a majority of individuals aged 60 and above, this group shows a somewhat higher inclination toward ethical consumption, generally favoring ethical choices. They are particularly receptive to products and services where women's opinions significantly influence purchasing decisions, such as food, automobiles, and home appliances. As they are also concerned about social and environmental issues, their influence on purchasing decisions could grow significantly as awareness of ethical consumption expands.

So far, we've examined the three clusters belonging to the "Growth Group." Their common traits are that none are young demographics and that they all have children.

It's often said that terms like "ethical," "sustainability," and "SDGs" resonate strongly with Millennials and Gen Z, who include many innovators. However, examining each cluster's affinity with ethical values reveals a surprising fact: when companies pursue ethical consumption, it actually aligns well with higher-income seniors, parent-child households, and families. When companies pursue ethical consumption ( ), it seems necessary to also direct their focus toward parent-child households.

Point 3: Beware of the "Image Trap"

Finally, let's look at the profile of the "Ethical Trouble-Makers."

This segment comprises 20% of the total population, with a balanced mix of genders and ages, and demonstrates a certain level of awareness about ethical consumption. However, they do not rank highly in ethical consumption awareness across any specific industry, nor do they exhibit proactive values towards ethical consumption. Even though they recognize ethical products, this segment can be extremely difficult to win over emotionally.

Simply targeting them repeatedly because of their large numbers may not yield the desired level of engagement. Notably, this group cites "needing time to research before purchasing" as a reason for not wanting to practice ethical consumption. Forcing them to understand ethical consumption or aggressively promoting your company's initiatives could instead create a negative impression.

While this group's mindset is just one example, simply knowing about "ethical consumption" doesn't guarantee positive engagement. Furthermore, interest in specific industries varies significantly across different consumer segments. Identifying the right target audience for your company is crucial—not only for businesses but also for consumers practicing ethical consumption.

The Future of Ethical Consumption in Japan

As society moves toward a future where all industries must engage with ethical consumption, what mindset should companies adopt? This survey revealed the need to identify ethical targets with a clear purpose and aligned awareness, and to foster empathy among those already interested. When companies pursue ethical consumption, they must consider "what kind of ethical journey to design for which people."

Next time, we will introduce the outlook for the world of ethical consumption.

【Overview of Ethical Consumption Awareness Survey 2020】

・Target Area: Nationwide, Japan

・Respondent Criteria: Men and women aged 10 to 70

・Sample Size: 125 respondents per gender/age group, totaling 1,000 people, weighted to reflect population demographics

・Survey Method: Internet survey

・Survey Period: November 18–25, 2020

・Research Agency: Dentsu Macromill Insight, Inc.

※Percentage composition is rounded to the second decimal place, so totals may not always add up to 100%.

Was this article helpful?

Newsletter registration is here

We select and publish important news every day

For inquiries about this article

Back Numbers

Author

Tomokazu Seki

Dentsu Inc.

Data Marketing Center

Planner

As a business strategist, I drive business development and marketing planning for various companies. My strength lies in identifying challenges by embedding data utilization not only in promotions but across all service and business development domains. Currently, I handle a wide range of marketing operations, from big data analysis using DMP (Data Management Platform) to business planning and implementing promotional strategies. My hobby is playing games while sipping Japanese black tea with my beloved dog.