There is still a lack of role models for fathers' childcare. Diverse fathers were raising children in their own ways. Furthermore, environmental changes during the pandemic have transformed both how fathers interact with their families and how they work. Understanding fathers' behaviors and feelings—areas that remain largely unknown to companies—is an indispensable point for future marketing.

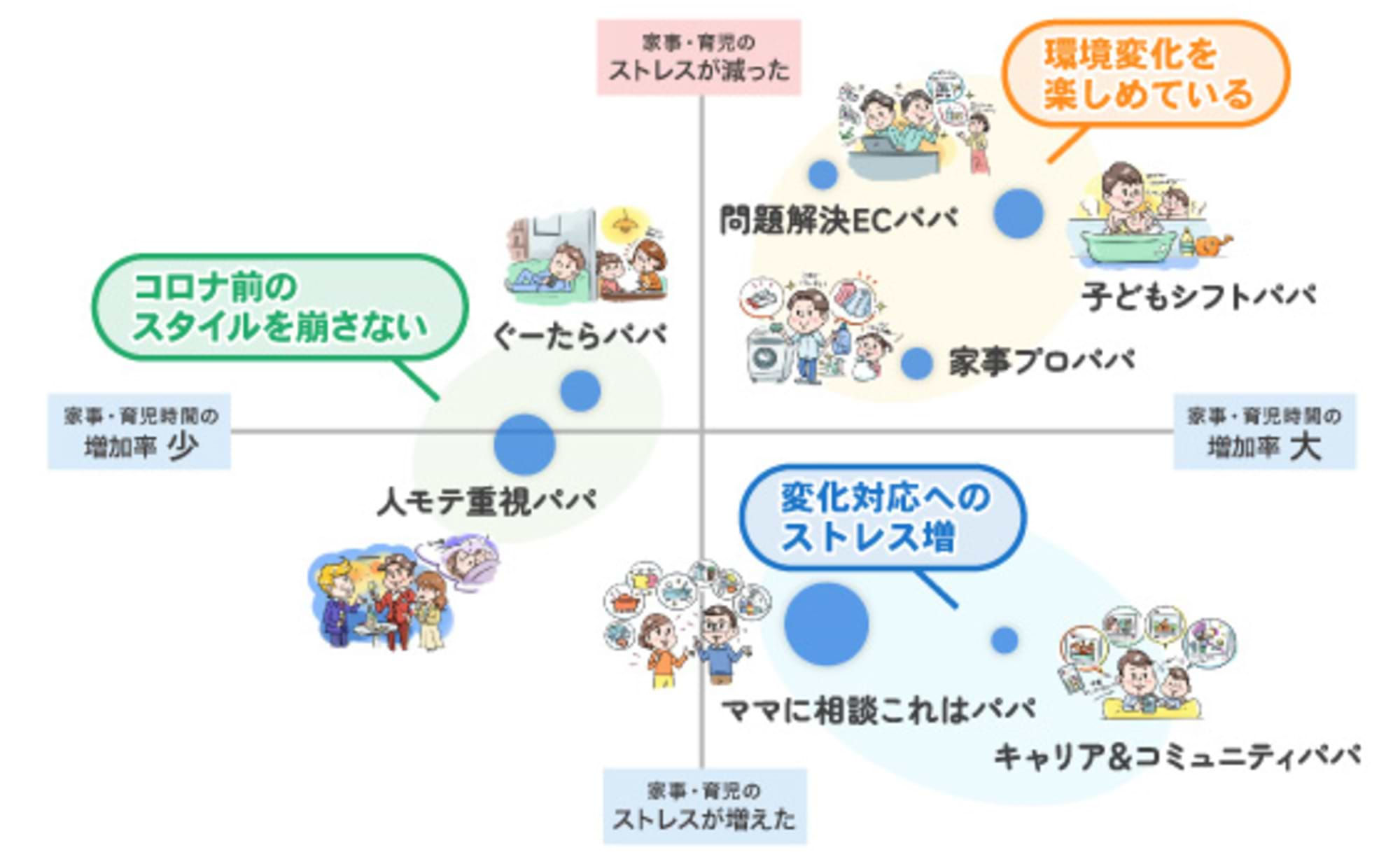

In this series, based on the findings from Papalabo's survey "Changes in Dads' Lives: The Reality of Parenting by Dads and Families After COVID," we introduced in Parts 1 and 2 the changes in dads' awareness and behavior, along with seven distinct clusters and their characteristics. Building on these insights, this third installment explores "Changes in Dads and Future Family Consumption."

【Papa Lab】

"Dads are Japan's potential"

Papa Lab is a mini-agency specializing in dads, where every member is a working father. Professionals from diverse fields—sales, strategy, creative, digital, media, and corporate—come together. Starting with research targeting dads and families, we provide solutions including marketing support, content development, and promoting paternity leave uptake. In 2019, we published "Research on the Diverse Lives of Dads" based on dad interviews.

https://www.projects.dentsu.jp/papalabo/variety/

Family-oriented products and services are seeing increased dad-led purchasing

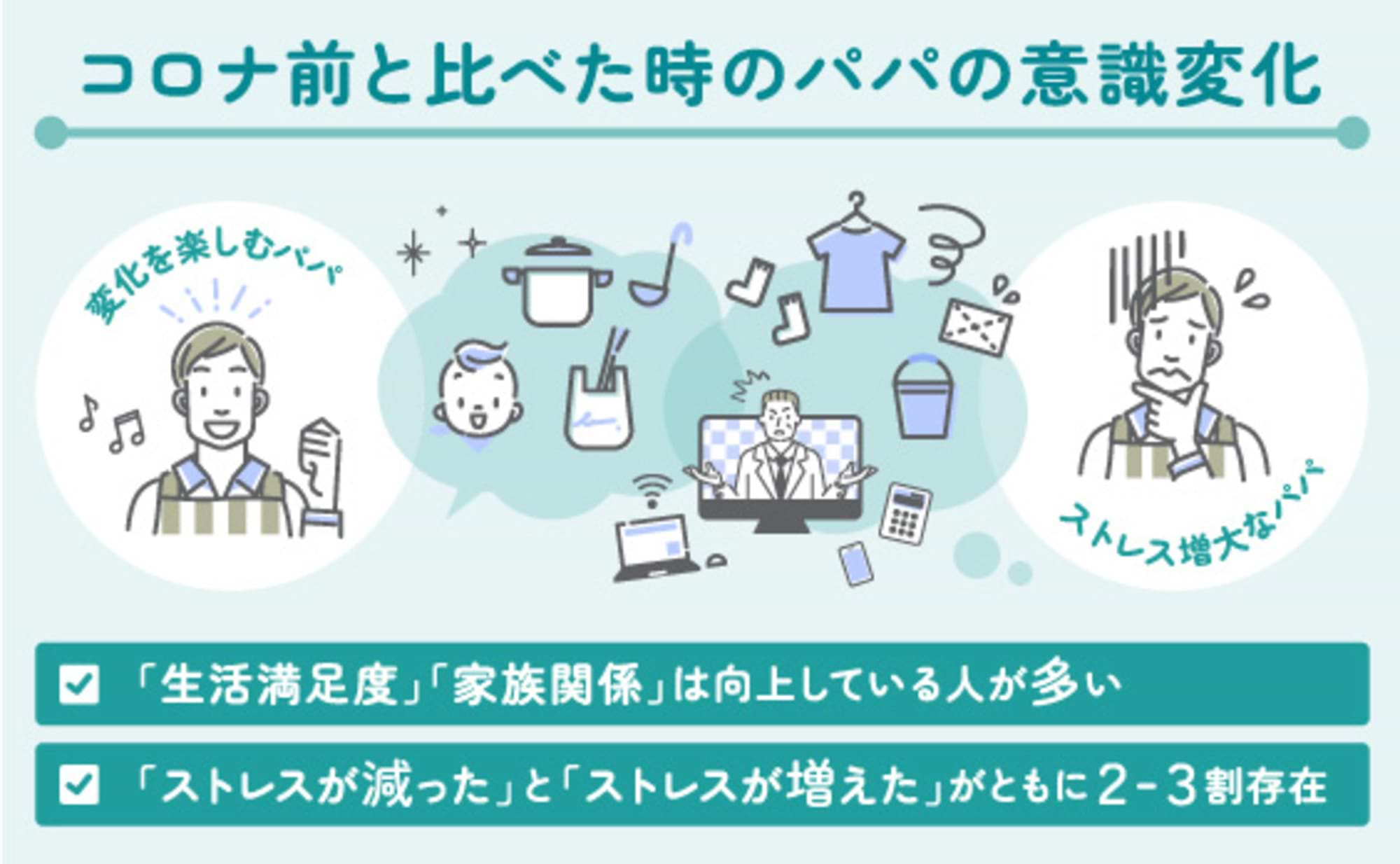

Paparabo research shows that the pandemic has changed work styles, leading many dads to reallocate their daily time. With increased work-from-home and remote options—especially for office workers—and fewer business dinners, dads now spend more time at home. As a result, many report positive changes like increased time with children and improved family relationships.

Behind these changes, it seems time previously spent on work, commuting, and business dinners is now being redirected toward family time. This shift has led to dads spending more time thinking about their families. Consequently, dads' involvement in "family activities" and "purchasing family-oriented products and services" appears to be higher than before.

Paparabo's research shows that even in categories like household goods and appliances, where moms traditionally made most purchasing decisions, more dads are now involved in brand selection and actively deciding which products or services to buy. We believe this shift in dads' behavior is becoming increasingly important to consider when developing future family-oriented products and services.

Responding to the desire to "gain confidence as a dad" and "become a dad who makes his family happy"

What initially caught our attention was the fact that even among dads experiencing improved family relationships and higher life satisfaction, many reported increased stress from household chores, childcare, and work. We hypothesize that this stems from dads' need for validation. Increased family time creates more opportunities to think, "I want to feel more confident as a dad" or "I want to be a dad who makes my family happy," which paradoxically leads to pressure and stress. Survey results show this desire to "feel confident as a dad" is more prevalent in clusters with high validation needs, supporting our hypothesis.

Source: Dentsu Inc. "d-campX Survey" × Video Research Ltd. "ACR/ex" Dads: Parents aged 20-59 with children in junior high school or younger (N=690)

Given this fact, when approaching dads with high approval needs, external motivation—approaching from outside the dad's perspective—is considered effective. This includes highlighting "points that make moms happy" or "points that make kids happy" using actual voices, and presenting them as "third-party recommendations" (products/services introduced by influencers that meet family wants). Exposing them to realistic evaluations from perspectives other than their own lends credibility to the product or service, creating a "sense of security that allows confident purchasing" – a major key to driving purchase decisions.

Responding to values like "taking the lead in enjoying time with family" and "wanting to be the driving force in enhancing everyone's life satisfaction"

On the other hand, it's clear that a significant number of dads are experiencing a positive spiral: changes in lifestyle and work patterns, along with the reallocation of time, are reducing stress from household chores, childcare, and work, while also increasing their overall life satisfaction. Looking at their life values, even in this with-corona lifestyle, they seem to have a positive mindset: "I want to take the lead in enjoying time with my family" and "I want to be the driving force aiming for a better life and increasing the life satisfaction of everyone in the family."

These dads prioritize experiences when selecting family-oriented products and services: "What kind of experiences can we have as a family? Will it be a good experience?" They also value "not being fixated on price, but rather deciding based on functional value, emotional value, and whether the satisfaction lasts." Therefore, approaches that connect to their internal motivation are effective. These include providing "information that inspires them from the perspective of enjoying life" and "stories that build trust in design and quality value," prompting self-reflection and discovery, and stirring a desire to try or experience something new. It's crucial to help them envision how adopting new products or services could become the catalyst for their family to enjoy a better life and quality time together.

What families need going forward is a perspective focused on "solutions for spending better time together" and "proposing experiential value that makes time and space enjoyable and comfortable."

The pandemic has increased work-style options and freed up disposable time, leading to more time spent by dads with their families. This shift likely amplifies the desire to improve "their role as a dad," "family time," and "daily life" more than before. This trend is not temporary but is taking root as a new value system, making it a crucial perspective when considering the post-pandemic society.

Through this survey, we believe the challenges for future family-oriented products and services will converge on two key points: how to become a "solution for families to spend better time together," and how to provide "experiences that make time and space spent together as a family enjoyable and comfortable."

[Survey Overview]

■ Dentsu Inc. "d-campX"

Survey Method: Internet survey using dedicated response tablets

Survey Area: Tokyo 50km radius

Survey Period: March and June 2021

Respondents: Married men aged 20-59 living with children in junior high school or younger

Sample Size: 690 respondents

■Video Research Ltd. " ACR/ex "

Survey Method: Internet survey using dedicated response tablets

Survey Area: Within 50 km of Tokyo

Survey Period: April–June 2021

Target Population: Married men aged 20–59 living with children in junior high school or younger

Sample Size: 690 respondents

For detailed ACR/ex information, click here

■Dentsu Inc. Papalab × Video Research Ltd. "ACR/ex" connect Survey

Survey Method: Internet survey using dedicated response tablets

Survey Area: Tokyo 50km radius

Survey Period: November 2021

Subjects: Married men aged 20-59 living with children in junior high school or younger

Sample Size: 647 respondents