Note: This website was automatically translated, so some terms or nuances may not be completely accurate.

Is it true that "too much wasteful spending on non-targets" is happening? Rethinking the value of TV commercials.

This series explores how to effectively utilize TV commercials, considering advertisers' KPIs and challenges, in light of the increasingly sophisticated TV media landscape.

"TV commercials can reach many people at once, but they waste a lot of impressions on non-targets." If you work in media planning, you've probably heard this sentiment. It might be a side effect of digital media's high-precision targeting becoming the norm.

However, markets are fluid. Television can also deliver ads to "potential targets who may become customers in the future."

This time, Dentsu Inc. media planner Wataru Kuboya will explain how to leverage TV commercials considering "market fluidity," supported by data.

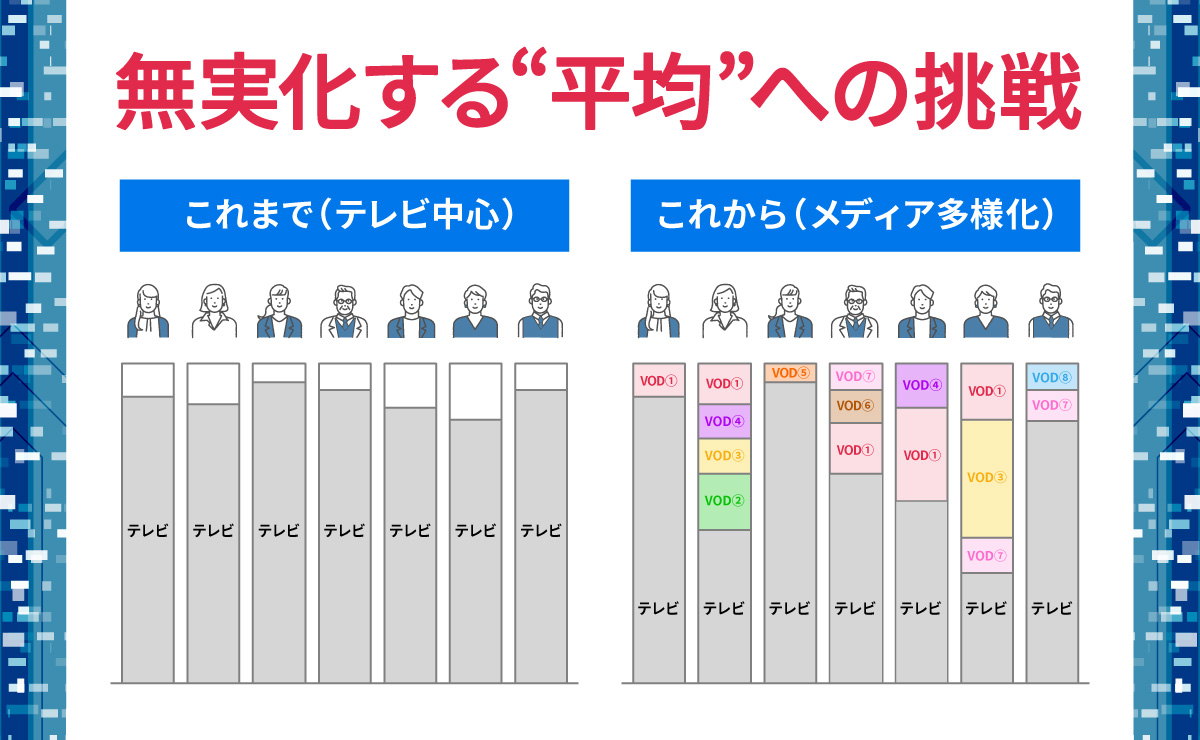

Traditional advertising planning typically focused on the "average" of multiple sample data points regarding media exposure to understand the broader audience. In the past, many people shared a lifestyle where the whole family gathered in the living room to watch TV together. With limited alternatives to television, the average media viewing data functioned as a "typical viewing pattern" in media planning. This is precisely why analyses and effectiveness predictions using averages accurately captured societal realities and were persuasive. However, today consumers' media exposure has diversified. This has eliminated the concept of a "typical viewing style." Because each individual's media exposure differs, we are moving toward an environment where "the average represents no one." Consequently, media planning and effectiveness prediction/analysis have become more challenging than before. Even focusing solely on television reveals a trend of "de-individualizing averages." The chart below, using Dentsu Inc.'s "DCANVAS" database, calculates the awareness gained from TV commercial placements. The horizontal axis represents total individual ad exposure (TRP), while the vertical axis shows the awareness rate. We interpret this fading reality of the average in media consumption data as a "challenge to the 'average' that is becoming meaningless," and consider it a major theme for the future of media planning. Amidst the ongoing diversification of media consumption, television's standout strength lies in its unparalleled "simultaneous reach" among all media. Let's examine the reach characteristics of television versus digital. The chart below, created using Dentsu Inc.'s planning tools, shows the projected reach when investing ¥100 million in both a TV spot and a digital video (both targeting ages 20-34). While digital video has a higher reach rate for the 20-34 age group, considering the simultaneous reach across other demographics, you can see the breadth of reach television covers. The chart below shows the two-year trend for people who have a certain service category as a hobby. While the percentage of hobbyists remained roughly flat at 10.1% in 2022 and 9.4% in 2023, the breakdown reveals that about 40% of them changed over the year. This indicates that the active segment within the market is not fixed but fluid. Beyond the examples cited here, it is by no means uncommon for people who previously had no intention of using a service or product to suddenly develop that intention one day, shifting from the latent to the active segment. This occurs frequently in the real world. Occasionally, one hears judgments like, "We already have sufficient awareness, so we don't need TV commercials." However, TV commercials possess the function of "most efficiently delivering advertising to people who are not yet active in the market but have significant potential to become active in the future, thereby building mindshare." This is considered one of the crucial roles TV commercials, with their strong reach power, play in marketing. Digital advertising, which excels at targeting, improves cost-effectiveness by trimming advertising costs for latent and non-explicit audiences. Considering that many brands and services already cover explicit audiences through digital's high-precision targeting, TV commercials—which can communicate to a broad demographic including latent and non-explicit audiences—are an effective means to increase category share. The importance of mindshare among non-active consumers relates to brand recall capacity. The figure below illustrates one example: across any product category, the number of brands recalled spontaneously is typically just one or two. This means the number of brands we can instantly recall is far fewer than we might imagine. Naturally, brands recalled earlier hold an advantage in terms of choice and consideration time. Therefore, becoming a service that comes to mind the moment a consumer's latent desire surfaces, leading to action, is undoubtedly valuable. So far, we've discussed market fluidity and the role TV commercials play within it. Let's now introduce an example of TV investment strategy grounded in this market perspective. Here, we use a company (Company A) with multiple service lines and brands as an example.Using Dentsu Inc.'s integrated marketing platform "STADIA360" (*), which leverages actual TV viewing data, we analyzed Company A's "TV commercial contact category count" every three months. The contact category count visualizes the number of the company's brand or service categories that one person was exposed to via TV commercials during a set period. ※STADIA360 (STADIA 360) = Japan's largest marketing platform provided by Dentsu Inc., based on actual TV viewing data obtained with user consent. By linking actual TV viewing data with digital behavioral data, it enables integrated on-off analysis. When aiming for the previously mentioned goal of 5-category exposure to boost purchase intent, we found that achieving approximately 33 TV commercial frequency impressions enables exposure to nearly 5 categories. Therefore, running TV commercials to achieve 33 or more frequency impressions over three months can enhance Company A's purchase intent throughout the year. Of course, the frequency required to boost purchase intent varies by industry and market maturity. Dentsu Inc. possesses data on consumers' past media exposure experiences, timing, and awareness, enabling us to link and analyze these factors with precision. In today's world, where media consumption styles have diversified and capturing the true state of society has become difficult, media planning based solely on assumptions or targeting core audiences alone is increasingly unlikely to deliver sufficient advertising effectiveness. To become the brand consumers remember first when they think "I want this," it is essential to plan advertising by considering the characteristics of all media, including television discussed here, alongside the "market fluidity." Was this article helpful? Newsletter registration is here We select and publish important news every day For inquiries about this article Dentsu Inc. Second Integrated Solutions Bureau Planner Engaged in developing media and business strategies based on quantitative and qualitative data analysis. Responsible for end-to-end execution—from building data environments that drive business growth across diverse sectors (consumer goods, durable goods, B2B, apps, IT, etc.) and formulating media strategies, to implementing PDCA cycles. Proficient in both internal and external tools and solutions across television and digital domains.

▼The "Average" That Becomes Irrelevant: The Increasing Difficulty of Media Planning

▼Media Planning That Captures "Market Fluidity" Is Essential

▼Media Planning Isn't Just About Reducing Frequency to Boost Efficiency

"The 'Average' That Becomes Meaningless": Increasing Difficulty in Media Planning

Looking at this, the shape of the graph (curve) representing the average awareness gained relative to ad spend remains largely unchanged for both "2019" and "April 2021–2024". However, the individual campaign data points (plots) show significantly greater upward and downward variation for the "2021–2024" period.This suggests that the approximation curve is drifting away from reality, perhaps due to differences in viewing habits—some people love TV and watch daily, while others only tune in occasionally. This figure also illustrates how media planning is becoming increasingly challenging.

Media Planning That Captures "Market Fluidity" Is Necessary

When communicating TV's strength of "simultaneous reach," I sense some advertisers think, "Isn't TV advertising an inefficient investment?" This stems from viewing the broad reach across age groups as "advertising reach beyond the target audience = wasted investment." In such cases, I often explain the concept of "market fluidity."

This phenomenon is common across many markets. The chart below shows awareness rates and awareness retention rates for a certain beverage category. The horizontal axis represents "2024 awareness rate," while the vertical axis shows "2025 awareness retention rate relative to 2024 awareness rate (set at 100%)." This data reveals that

・Higher awareness levels correlate with higher retention rates, making brands harder to forget

・Awareness retention rates fall within the 65% to 90% range, with strong brands maintaining high awareness levels

can be observed.

Next, let's examine the primary drinking brands and their retention rates within the aforementioned beverage category market. The horizontal axis shows the "Percentage of brands primarily consumed in 2024," while the vertical axis shows the "2025 retention rate, i.e., the percentage still primarily consumed." Even for the most consumed brand, its retention rate is only 66.8%, indicating that approximately one-third stopped making it their primary choice within a year.

These two data points reveal that the speed of change in the funnel between "awareness" and "usage" is not constant. In this case, the bottom funnel metric (the retention rate of the primary brand) shows a higher turnover rate.

Media planning isn't solely about reducing frequency to boost efficiency

We found that as the number of contact categories increased, the overall service usage intent rate for Company A rose. While it's intuitive that more contacts lead to higher usage intent, the key point to note here is the significant surge in usage intent when individuals were exposed to five categories. This proves that creating a situation where individuals are continuously exposed to multiple categories throughout the year effectively boosts overall service usage intent.

The survey also analyzed the correlation between the proportion of contact categories and TV commercial frequency (number of exposures) using "STADIA360". Individuals exposed to Company A's TV commercials 1-3 times naturally had contact with only 1-2 categories. However, as frequency increased, the number of contact categories also grew.

When discussing optimal frequency in integrated TV and digital analysis, the conversation often centers on "how to minimize frequency while maximizing efficiency." However, this example demonstrates a completely different conclusion when viewed from the perspective of "the necessary exposure volume to boost brand or overall company purchase intent."Back Numbers

Author

Kō Kuboya

Also read