Note: This website was automatically translated, so some terms or nuances may not be completely accurate.

Goodbye, Mid-Term Plan Dilemma! Introducing the "Accumulation" × "Backward Calculation" Approach

Now, major corporations are beginning to discontinue the publication of their mid-term business plans (hereinafter referred to as MTBP).

Against a backdrop of heightened uncertainty in the business environment, rigid numerical targets are becoming a risk in themselves, leading more companies to opt for flexible and agile management disclosure.

"Thinking in terms of 'accumulation' prevents us from reaching our true goals."

"If you think in terms of 'working backwards' from the future, it becomes nothing but a pipe dream."

For business unit heads at companies continuing to formulate mid-term plans in such times, the dilemma lies in reconciling "ambition" with "reality."

This article discusses deriving growth scenarios using a multiplication approach—combining "bottom-up" and "backward calculation"—as the first step toward resolving this "mid-term plan dilemma."

Why Are Revisions Increasing? The Evolving Mid-Term Plan

Some large corporations that abolished their mid-term plans had fallen into what is known as "mid-term plan fatigue." They became exhausted by the process of meticulously building targets by stacking up three years of carefully crafted revenue forecasts, often resulting in frequent failure to meet those targets.

To break this vicious cycle, some companies have scrapped mid-term plans altogether, instead establishing management policies with a 30-year horizon. They define their desired future state not in absolute figures like revenue, but in ratio-based metrics like profit margins. This allows for a truly big-picture perspective, working backward from the ideal future vision to annually reassess the growth path.

The result, they say, is the ability to dynamically implement strategies that contribute to growth and capital efficiency, rather than being constrained by targets set several years in advance. For some companies, the abolition of mid-term plans has led to robust performance and expectations for capital reforms, driving their stock prices to new all-time highs.

Five main factors underlie the trend toward abolishing mid-term plans, ceasing their publication, or their increasing formality:

Factor 1: Increased Uncertainty in the Business Environment

First, it has become increasingly difficult to make concrete projections several years ahead due to geopolitical risks, rapid technological change, pandemics, and other factors.

Even if numerical targets are set, the underlying assumptions can quickly collapse, making "promises" to investors and employees a risk in themselves.

Factor 2: Enhanced Quarterly Information Disclosure

Companies already explain progress and strategy through quarterly earnings reports, diminishing the significance of additionally publishing mid-term plans.

Institutional investors also tend to value "flexible progress and directional explanations" over "rigid three-year plans."

Factor 3: Reflection on Overemphasis on Numerical Targets

Another factor is that numerically driven mid-term plans, such as "X trillion yen in sales" or "X% operating profit margin," often prove unattainable and tend to become "window dressing to meet targets."

The judgment is that if such plans become mere formalities that erode trust, it is better not to publish them at all.

Factor 4: Emphasis on Agility and Agile Management

There is a growing shift toward a management style that prioritizes annual or semi-annual reviews and course corrections, rather than setting everything for 3-5 years in advance like a mid-term plan.

A "strategy roadmap updated as needed" aligns better with the needs of both the front lines and investors than a "mid-term plan."

Factor 5: Changes in Responding to Foreign Investors

In global capital markets, publishing a mid-term plan is not mandatory. Instead, the prevailing view is that enhancing corporate value hinges on capital efficiency metrics (ROE, ROIC) and shareholder return policies.

Against this backdrop, Japan's unique "faith in mid-term plans" is fading, accelerating the move toward global standards.

The "Mid-Term Plan Dilemma" Often Faced by Business Unit Heads

However, the reality is that not all companies can immediately abolish mid-term plans. Amid increasing external uncertainty, most companies still continue formulating them.

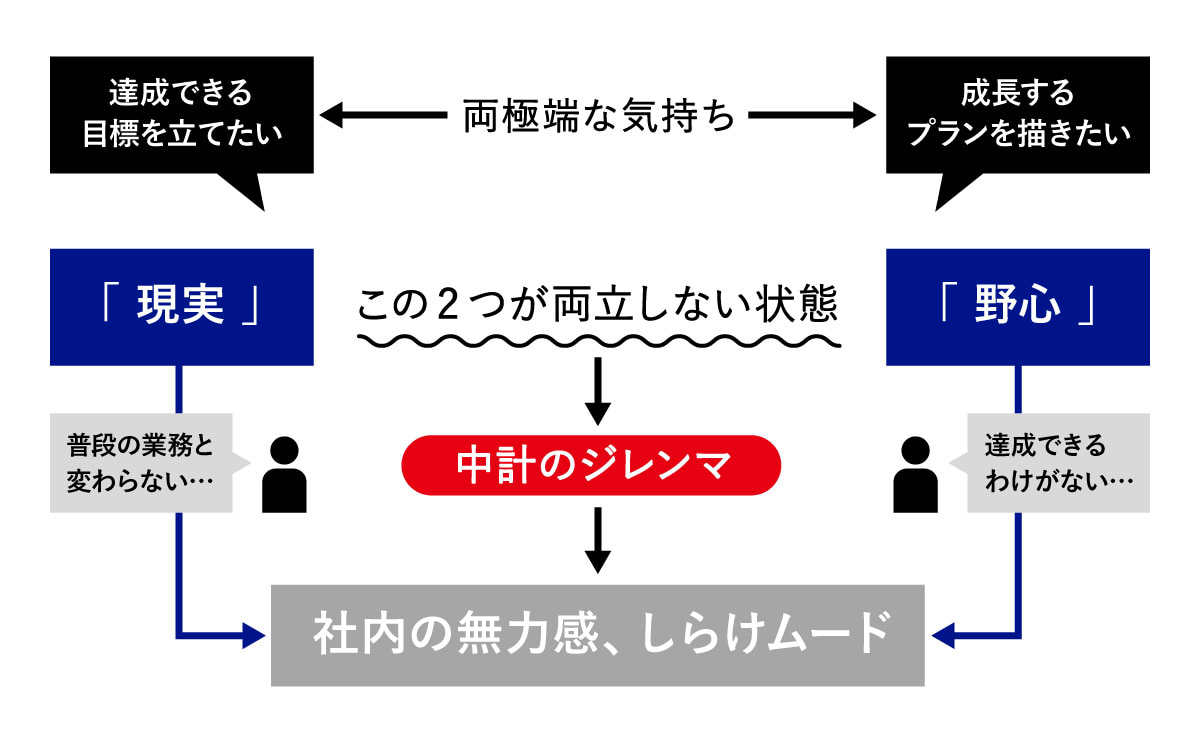

In this environment, a common concern heard among division heads during mid-term planning is the difficulty of balancing "ambition" and "reality" – the "mid-term plan dilemma."

- "If we think in terms of 'accumulation,' we can't reach goals that can be called growth."

- "But if we think in terms of 'working backwards' from the future, it becomes nothing but a pipe dream."

Amid unprecedented circumstances, ambitious goals are set to create new value. However, the more abstract and challenging the goal, the greater the disconnect from reality.

When such goals are suddenly presented, employees may perceive them as unrealistic, potentially sparking negative reactions like: "Is everything suddenly DX?" "What exactly are we supposed to do?" "Don't they understand the reality on the ground?"

The result is that employees perceive these goals as not worth serious effort, treating the mid-term plan and their daily work as separate entities.

Conversely, if you prioritize strict numerical planning, the goals become mere accumulations of realistic figures, creating a dilemma where they fail to reach targets that represent true growth.

Alternatively, due to uncertainty about the future, estimates might be piled up based on rough calculations, resulting in unrealistic numerical targets.

In this case too, the front-line staff will think, "No way, that's impossible," and won't take it seriously.

So, how can a business unit head resolve the "mid-term plan dilemma" and derive a growth scenario for their department that balances impact and feasibility?

The "Top-Down" × "Backward Calculation" Approach

To resolve the 'mid-term plan dilemma,' we introduce how Dentsu Group companies, particularly Dentsu Consulting Inc., provide support.

In many cases, we propose projects using the following "Top-Down" × "Bottom-Up" approach. (Case study: Supporting a food company)

While this example uses a food company case, the actual process is customized to incorporate scenarios solving each company's unique challenges.

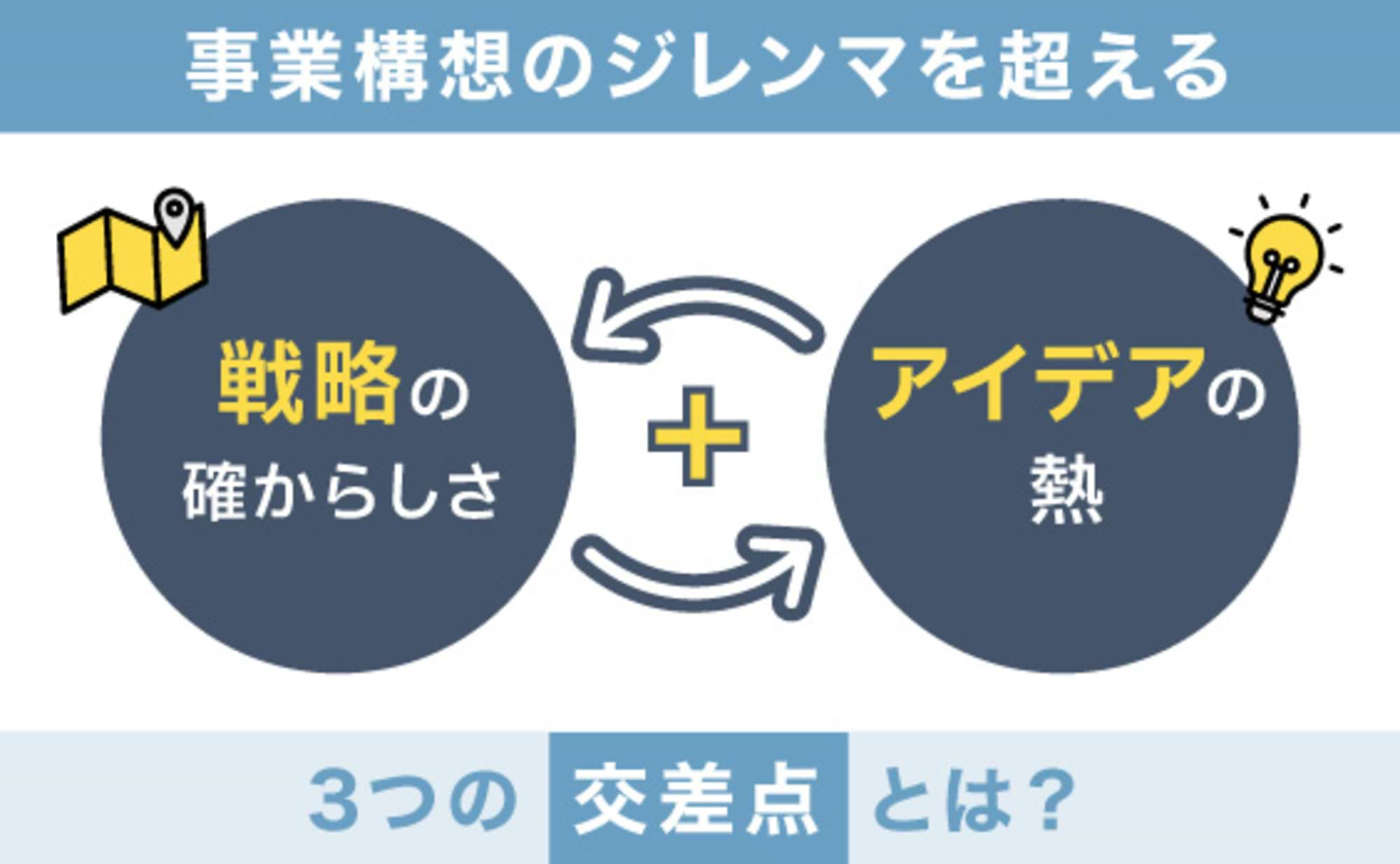

Relying solely on a "bottom-up" perspective limits significant growth potential, while focusing exclusively on a "backcasting" perspective from the future risks becoming unrealistic.

To break through this situation, an effective approach is to "categorize the potential areas within the target market." This achieves both future-oriented thinking and grounded planning by leveraging the overlap between the "bottom-up" and "back-to-future" perspectives.

The project primarily follows these three steps:

Step 1: Bottom-Up Future Forecasting

Starting with trends in consumer health awareness, we define the underlying assumptions for the 2030 market using a bottom-up approach based on 5W1H analysis, grounded in market trend research across six segments influenced by these trends.

Step 2: "Backward-Calculated" Future Forecasting

Based on the interconnectedness of high-impact wellness trends identified across domains (how each trend connects to shape the future), we derive insight typologies (megatrends) for 2035.

Step 3: Categorizing Potential Areas

We categorize potential domains for 2030 by combining the 5W1H elements of the updated "premises surrounding the 2030 market" (derived by multiplying the outputs of Step 1 and Step 2).

Although not shown in the diagram above, it is also common to derive strategic themes leveraging the company's strengths for each potential area typology identified in Step 3.

Balancing Impact and Feasibility

- Against a backdrop of heightened uncertainty in the business environment, the increasing formalization of mid-term planning has led more companies to discontinue formulating or publishing such plans.

- Amid this trend, business unit heads at companies that continue mid-term planning often face the "mid-term planning dilemma"—the difficulty of balancing "ambition" and "reality."

- To resolve this "mid-term plan dilemma" and derive a growth scenario for their division that balances impact and feasibility, the "Top-Down × Bottom-Up" approach is effective.

The key to the "Top-Down" × "Back-Calculation" approach lies in balancing feasibility and creativity to identify "potential areas."

Companies supported by Dentsu Consulting Inc. using this approach have praised it, stating: "We can expect support in deriving and realizing growth scenarios that balance feasibility and creativity."

If you are a division head, section manager, or other responsible party grappling with the "mid-term plan dilemma" as you prepare your next mid-term plan, or if you are in the corporate planning department, please contact Dentsu Consulting Inc.

Dentsu Consulting Inc.

https://www.dentsuconsulting.com/

Was this article helpful?

Newsletter registration is here

We select and publish important news every day

For inquiries about this article

Back Numbers

Author

Hiroyuki Kubo

Dentsu Consulting Inc.

Manager

Primarily serving industries like consumer goods, retail/distribution, automotive, and healthcare, we provide support in vision and mid-to-long-term strategy formulation based on megatrends, business strategy and planning development, new business development, and market research.