The importance of "omnichannel"—used to describe the ability to buy products seamlessly across all touchpoints—has been discussed in Japan for some time, but concrete challenges are now emerging. Continuing from last time, we speak with Mr. Hidehiko Aoki of Merrill Lynch Japan Securities, an expert in domestic and international retail and distribution, alongside Mr. Hiroshi Maruyama, Mr. Takuma Uehara, and Mr. Hiroki Watanabe from Dentsu Inc., who are tackling corporate omnichannel strategies and bring these challenges to the table.

Five Principles for Achieving Omnichannel (Part 2)

3. Digitize and Systematize Know-How

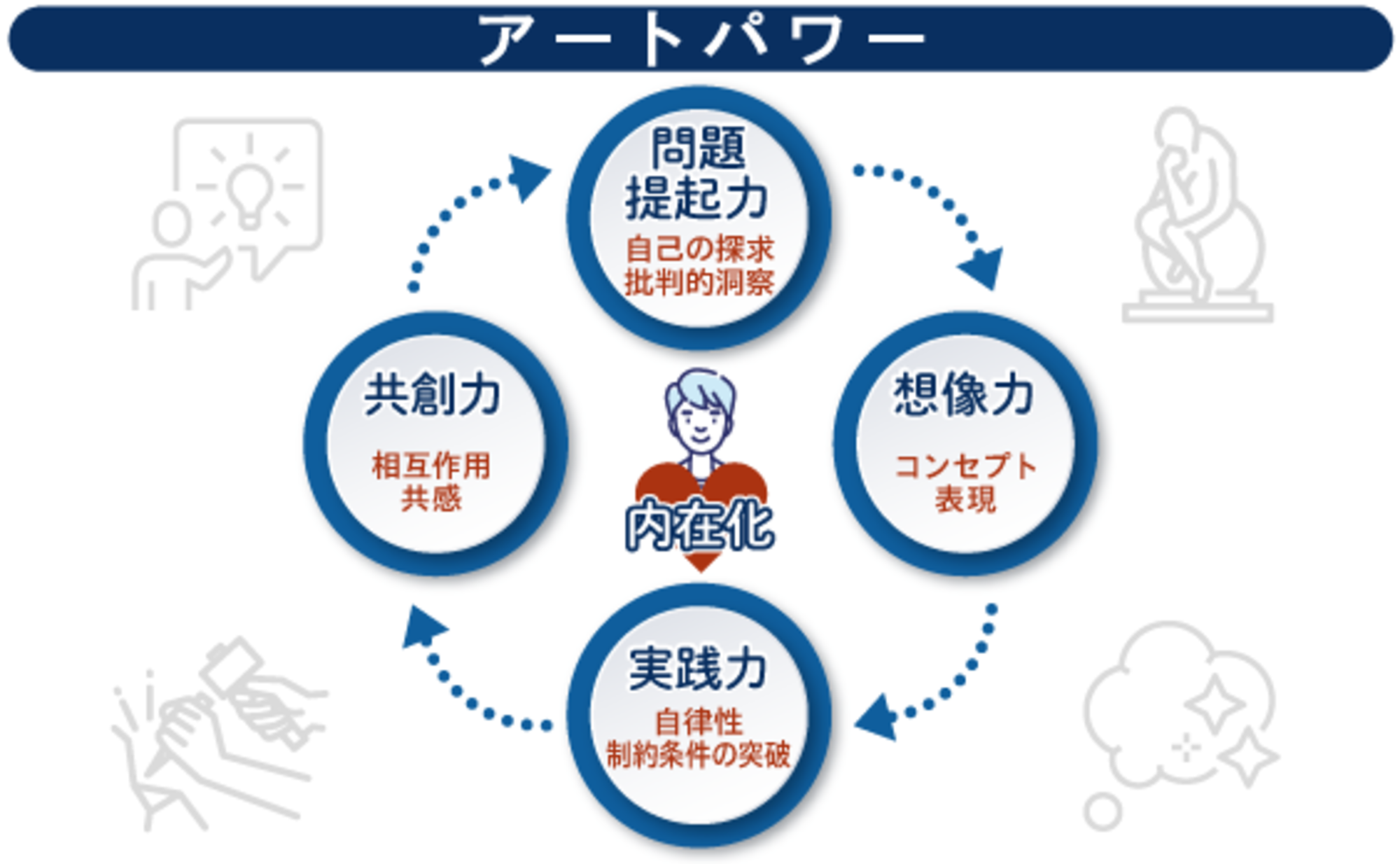

Maruyama: The third challenge is sharing know-how. The more I hear about the current state of distribution and retail, the more I realize how difficult it is because much of the know-how can't be put into words. The "spirit of the merchant" – the dedication and pride of businesspeople – often significantly impacts sales. I think it would be great if we could leverage that in omnichannel too.

Aoki: I too have been struck by how remarkable store creators are. When assisting a newly founded e-commerce startup, I visited supermarkets to learn how brick-and-mortar stores secure profits. Calculating exactly how many units of each individual product needed to sell to cover expenses and secure gross profit was something I couldn't easily figure out on paper. Yet, the physical store had a product lineup perfectly aligned with customer needs and was ultimately profitable. It felt like a miracle, where art and science had found their perfect balance.

Maruyama: There are stores that just make you want to buy things, right? Can we distill that "merchant spirit" into a form everyone can use?

Aoki: It's probably difficult to digitize and systematize all the knowledge of those who handle physical stores. However, I think we can distinguish what's possible from what isn't. If experienced physical store operators and people familiar with modern shopping patterns discuss the limitations of physical stores and how to overcome them through online or omnichannel strategies, I believe many ideas could emerge.

The problem is that the people who built physical stores from the ground up are gradually disappearing due to age. Their insights could be the key to building an omnichannel strategy incorporating online from scratch, so perhaps we should start with thorough interviews.

Uehara: Regarding digitalization, earlier ( in Part 1 ) we discussed Amazon's practice of "poaching significant numbers of top IT talent." Given how crucial on-the-ground operations are, does this also make in-house development within the IT department a key challenge?

Aoki: Yes, that's correct. Omni-channel is fundamental to business operations, so I believe thecoreIT systems need to be developed in-house.

The method of headhunting top talent from specialized firms is extremely common. In Europe and the US, even executives are frequently headhunted as specialists to restructure companies, so moving between companies this way isn't unusual.

Culturally, this can be difficult in Japan. Another approach is to receive support from external companies while teaching the essence of IT to staff deeply familiar with the front lines. Omnichannel requires deep frontline knowledge, so some companies achieve results by bringing in people with retail experience, like those who handled customer interactions in stores, and developing them into IT talent at headquarters.

People coming from outside may have perfect skills, but they lack that "merchant spirit" Mr. Maruyama talks about, right? I also firmly believe that this "merchant spirit" – the kind that can't be translated into development requirements – is absolutely crucial. How to generalize this should be a major point to consider when building IT frameworks.

4. Ending the Customer Scramble

Watanabe: Regarding the channel conflicts mentioned repeatedly earlier, the larger the company or the more group companies it has, the more resistance there tends to be to sharing customer IDs between channels or group companies. It's fine if the target audience or products differ and cross-selling is expected, but it becomes difficult when customers are referred to companies or departments handling lower-priced products, right?

Aoki: Exactly. Beyond balancing company-to-company interests, we alsoneed to considerthe performance evaluation of the people working within these structures. Both product sales and customer ID acquisition require tangible results like "this person made the sale" to contribute to evaluations and drive motivation.

One example: John Lewis, a British department store, recently adopted an omnichannel strategy. Initially, they sold the same products online at lower prices than in physical stores, reasoning that online had lower costs.

Naturally, customers shifted to online shopping. To protect store profits, they then raised online prices. This time, however, overall sales flowed to competitors.

At this point, they returned to their core principle: "Customers who actually visit our stores are what truly matter." They then initiated an effort to let customers who received in-store service and made purchases also enjoy the lower online prices. They started offering a checkout service for in-store customers: if they took the product home as is, they'd pay the store price, but if they ordered via a terminal in the store, they'd get it delivered to their home at the online price. Furthermore, they changed their staff evaluation criteria so that if sales were made online through this channel, it would count towards the performance of the staff member who assisted the customer in-store. As a result, they achieved a high level of service for in-store customers, and both the physical stores and online sales recovered.

Maruyama: I see. This worked because it was executed as a management decision, right?

Aoki: Exactly. Creating a new channel to make things seamless—well, the cost structures are different, so pricing issues arise, and it often becomes unclear who contributed what. You have to make detailed adjustments there.

Conversely, from the late 90s to the 2000s, U.S. bookstore chains like Barnes & Noble and toy retailers like Toys "R" Us all struggled. They failed to recognize the customer touchpoints cultivated by physical stores as assets; the very existence of stores became a liability. The limitations of the store cost structure also became a constraint, so we need to consider how to solve this.

Uehara: So how will retailers position physical stores going forward?

Aoki: I believe we're at a significant turning point. We've shifted from "stores as the main channel, with online as a supplement" to "see in-store, buy online." Now, even food has become "e-commerce standard." Therefore, retailers are being forced to discern precisely which products should be handled in-store. An extreme example: convenience store coffee, which you can buy immediately when you want it, cannot be replaced by e-commerce. Recognizing such advantages is crucial.

The CEO of Macy's, the American department store, stated that their successful omnichannel strategy stems from their physical stores' competitiveness. I think the fundamental question is whether stores have competitive strength in the first place. If not, boosting that is essential.

Uehara: I see. One distribution company announced that instead of a uniform nationwide product lineup, they would enhance local offerings, particularly fresh foods, to boost the competitiveness of physical stores in each area.

Aoki: Especially for physical stores handling food and such, which are deeply integrated into local life, this approach of first honing the strengths of individual stores is a valid strategy.

5. Unify the Mindset Across All Channels

Maruyama: The approach to physical stores and online channels reminded me a bit of newspaper media business models. Print media's overview and discovery aspects resemble physical stores, but digital article distribution has also become commonplace.

Aoki: What matters then is the quality of the articles, the content itself. If it's good, people will want to read it whether it's in print or online. It's the same as product strength being crucial in distribution.

Maruyama: Regarding our final theme, after hearing your insights, Mr. Aoki, I truly feel this is essential to achieving the "seamless" experience we initially defined as the core of omnichannel.

We need to unify the mindset across channels, and also between headquarters and the field. We often hear cases where a new service decided by headquarters doesn't function well in the field, leading to customer complaints...

Aoki: That tends to happen when field operations aren't factored in. Also, with new apps, if there's a gap in IT literacy between headquarters and the field, things don't work out. There are cases where, despite the effort put into development, adoption can't be promoted.

Maruyama: Just the other day, an acquaintance told me they were amazed when using a wearable payment app introduced at an overseas theme park—every staff member they asked knew how to use it. I believe this was achieved because headquarters understood the field's IT literacy and properly trained staff to use it. I felt it's crucial to eliminate discrepancies between channels and between headquarters and the field to consistently deliver a unified experience to customers.

Aoki: That's precisely why the philosophy I mentioned earlier—that shared belief that "this is why omnichannel matters to us"—is essential.

If top management doesn't thoroughly understand field operations, it creates strain on the field and ultimately harms customers. This isn't unique to omnichannel, but decision-making that considers actual operations is indispensable.

Ultimately, whether the PDCA cycle is functioning effectively is key. Since this is a new initiative, there's no right answer from the start. First, formulate hypotheses about the effects of store-online collaboration, test them, identify issues based on the results, and move forward. If this PDCA cycle isn't running effectively across all three layers—the field, the project, and management—it will stall somewhere.

Plan and Do are relatively easy to execute, but Check and the subsequent Action step are often missing.

Watanabe: How can we effectively run PDCA across those three layers?

Aoki: For the operational and project levels, it's crucial that those in higher positions encourage people by saying, "Go ahead and try it." Even if they fail, they can learn from it. Fostering that kind of culture is part of management's job. However, omnichannel transformation is a new initiative that changes the business model, so cultivating an organizational culture that encourages trial and error while accumulating results is vital.

Engaging with omnichannel reveals management challenges

Maruyama: Hearing all this explanation, I realized that driving omnichannel transformation ultimately means rethinking the very nature of business itself. That was a major takeaway. Our work primarily focuses on helping companies with communication and building customer relationships. While it's challenging for us to directly influence a company's core structure regarding omnichannel, I hope we can identify effective tactics to achieve it and apply them to solving corporate challenges.

Aoki: The "operational issues" I mentioned earlier—like inventory and customer IDs—can be resolved by establishing rules. More crucial are the "fundamental issues": whether there's a mindset to create new business models and top management's understanding of operations. Changing these externally is indeed difficult, but isn't one of Dentsu Inc.'s major roles helping executives realize that "omnichannel transformation involves a comprehensive business overhaul"?

Attempting to achieve omnichannel forces fundamental transformation. I believe it requires a broad perspective to see the benefits in these discoveries—that by taking on the challenge, various management issues become visible. For companies tackling this, I hope they can reach a point where, say five years later, they can say, "By pursuing omnichannel, comprehensive management reform progressed steadily."