Risk is "Uncertainty"

The image evoked by the word "risk" likely varies considerably from person to person. In Japan, it is generally understood to mean "danger."

Risks are things that cause harm to those involved—natural disasters, incidents, accidents, crime victims—things we want to avoid. Ideally, we'd steer clear of them. If avoidance isn't possible, we prepare for the situation. Based on this premise, risk management becomes a cost, an activity that doesn't generate profit.

However, the original meaning of risk is different. In Western countries, risk is understood as "uncertainty." That is, the outcomes resulting from an action are uncertain. Results may align with expectations, but they could also swing in a negative direction or a positive one. Preparing for this uncertainty in outcomes, managing that uncertainty, is risk management.

The expression "taking a risk" refers to committing resources toward achieving a favorable outcome in an uncertain future. When launching a new business or building a new factory, success is not guaranteed. Despite the uncertain outcome, the decision to invest is made for growth and profit. In business, this is what it means to take a risk.

Corporate Management and Risk

Of course, companies cannot take risks indiscriminately. Making investments beyond their means, where things do not go as planned, can threaten the company's survival. Thus, keeping risks below a certain level is also part of risk management.

The elements subject to risk management are diverse. It must encompass every aspect of business: judging opportunities, planning and developing products, managing personnel and finances. In this sense, risk management is management itself.

However, this concept of risk management does not seem deeply ingrained in many Japanese companies. In the era when the "convoy system" persisted across many industries, and companies could grow by simply keeping pace with their peers, the idea that "risk management means avoiding danger" might have been effective. But today, keeping pace is a path to decline. Many executives now believe that to succeed, companies must challenge what others won't do and create innovation.

To generate innovation, trial and error is indispensable. True innovation blossoms from repeated failures. However, not all failures are acceptable. Without effective risk management, failures exceeding acceptable limits may be overlooked. The importance of risk management in its true sense is undoubtedly increasing.

Risks are becoming more complex

Another reason risk management has gained prominence is the increasing complexity and diversity of risks. This stems from various environmental changes, including increased international transactions, advancing digitalization in business, and evolving legal regulations.

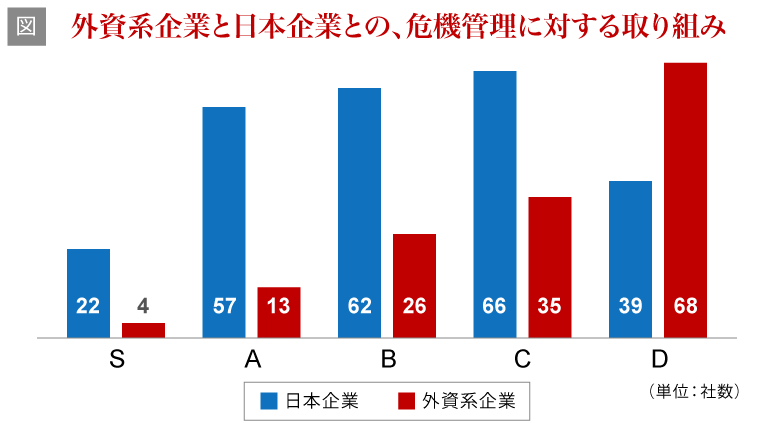

Addressing simple and obvious risks is relatively straightforward. Since each department is well aware of "where and what risks exist," risk management by department heads can be effective to a certain extent. Many Japanese companies have traditionally managed risks using this approach.

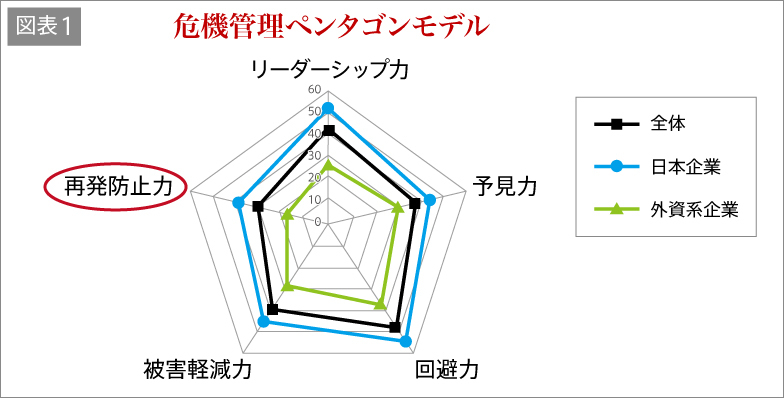

However, risks that have become complex and diverse cannot be adequately addressed by a single department alone. Risks that fall into the "blind spots" between departments' areas of responsibility, or risks that span multiple departments, may eventually lead to major crises. Companies now require cross-departmental initiatives or risk management that involves group companies. Top-level involvement and leadership are indispensable.

However, no matter how much risk management is strengthened, materialized risks can sometimes cause damage exceeding expectations. This could develop into a corporate crisis. Risk management cannot reduce the probability of occurrence to zero. Companies must engage in risk management with this understanding.

Risk management is integral to management decision-making itself

Using a car as an analogy, risk management is like the steering wheel and brakes. They are indispensable for arriving safely at your destination. It is precisely because you have reliable steering and brakes that you can step on the accelerator when necessary.

Preparing before a drive is also part of risk management. The day before a family trip, you'll likely check the weather forecast. You'll research the route and potential rest stops, and pay attention to your own physical condition. All this preparation is to ensure you have a good time with your family. Through these preparations, you are managing the uncertainty of the outcome.

Corporate management is similar. You consider the expected level of return, the risks necessary to achieve that return, and evaluate whether those risks are within your company's capacity to bear. This is a fundamental process for advancing management and business strategies.

If a deterioration in market conditions is anticipated, you might need to postpone taking the risk altogether. It's like canceling a drive when the weather forecast predicts heavy rain. You read the market environment, assess whether there are obstacles in your path, and check if you have the resources to reach your destination. Solid risk management is essential for executing business strategy.