With less than four years remaining until the Tokyo 2020 Olympic and Paralympic Games, and with international visitors to Japan surpassing 20 million in 2015, the world's attention on Japan continues to grow.

How does the world currently perceive Japan? How is the "Japan brand" – encompassing tourism, landscapes, cuisine, and products – evaluated overseas?

Illustration: Mai Beppu

In April 2016, Dentsu Inc.'s "Team Cool Japan" and DENTSU SOKEN INC.'s "Japanology" project conducted the "Japan Brand Survey 2016" across 20 countries and regions worldwide, revealing overseas consumer perceptions and realities through 10 questions. Here, we present five questions that generated particularly strong responses in a quiz format.

Q. Which country likes Japan the most?

A. Thailand ranked 1st. ASEAN countries dominate the top 5

Thailand, which also ranked first in visit intent, topped the list for Japan favorability (combining "very favorable" and "somewhat favorable"). ASEAN countries dominated the top five.

The top rankings were close across all regions, with Asia exclusively holding countries/regions showing over 90% favorability, indicating exceptionally high positive sentiment.

Compared to the previous year, the United States led the increase with a 15-point rise, followed by Canada and the United Kingdom, indicating growing favorability toward Japan even in Europe and North America.

Q. What do you want to do in Japan?

A. The top activity is "eating Japanese food." Shopping's popularity continues to rise, even in Europe and America

Overall, "Eating Japanese food" ranked first, followed by "Visiting natural and scenic spots" and "Shopping." "Eating Japanese food" ranked first in all regions except India, Indonesia, and Brazil, indicating that the popularity of Japanese cuisine, recognized as a UNESCO Intangible Cultural Heritage, appears to be firmly established.

Looking at the second and subsequent choices in Western countries, interest in cultural experiences like "visiting historical sites and buildings" and "traditional cultural experiences" such as tea ceremonies and flower arranging is evident. Shopping is also popular in countries like Germany, the US, and France.

Furthermore, in many Asian areas like South Korea, Singapore, and Thailand, "hot springs" ranked highly, while "shopping" ranked high in India, Hong Kong, and South Korea.

Regarding "shopping," which has gained points since last year, we hear voices from Westerners wanting to buy items that embody traditional culture. It seems an increasing number of people are looking forward to a wide range of ways to enjoy Japan, not limited to traditional cultural experiences.

Q. Which Japanese regions do you want to visit?

A. Hokkaido's popularity is rising in East Asia and Thailand

The top regional destination remains "Tokyo," followed by "Osaka." Overall, "Hokkaido" ranked 4th and "Okinawa" 5th, indicating an accelerating regional boom.

When focusing on East Asia (China: Beijing, Shanghai; Hong Kong; South Korea; Taiwan) and Thailand, Hokkaido tops the list of desired Japanese regions to visit. Okinawa also ranks second in Hong Kong and fifth in other areas.

The author personally noticed more foreign visitors when traveling to regional areas. In East Asia and Southeast Asia, more people have visited Japan multiple times. It seems an increasing number want to explore places beyond Tokyo, Osaka, and Kyoto to experience the unique charm of Japan's regions.

Q. What do you want to experience in Japan's regional areas?

A. The top experience people want in regional areas is "hot springs." Seasonal and area-specific, insider-style experiences like "nature" and "cherry blossoms" are popular.

Japan's regional areas each possess distinct charms, from food culture and tourist attractions to seasonal landscapes. When asked what they want to experience locally, overall preferences leaned toward unique regional experiences like "hot springs" and "nature," along with seasonal experiences like "cherry blossoms" that are limited to specific times of the year.

Additionally, experiences reflecting Japanese culture, like "Japanese gardens" and "down-to-earth local cuisine," ranked in the top five. This result may reflect a deepening understanding of Japan.

Furthermore, when looking at specific countries and regions for activities people want to do in the regions, the results showed differing interests: "Wagyu beef" is popular in Hong Kong, local "ramen" in Taiwan and the Philippines, "castles/castle ruins" and "waterfalls" in Russia, and "festivals" in the United States. This indicates growing interest in various Japanese tourism resources even outside Asia.

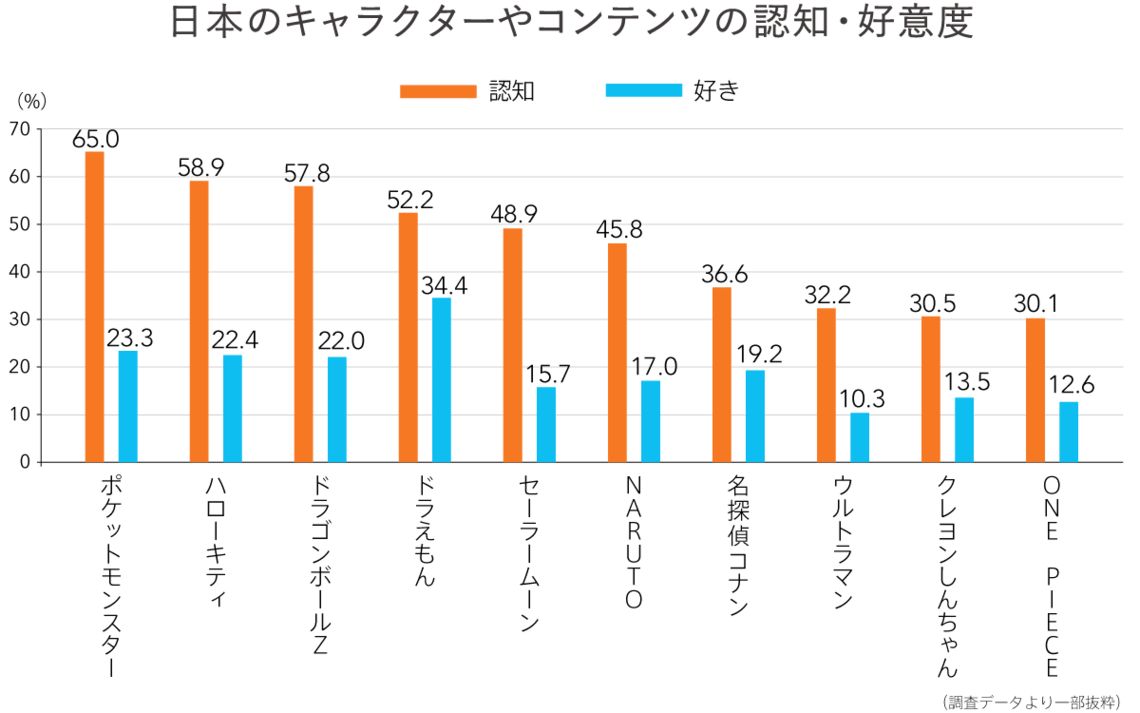

Q. What is the awareness and favorability of Japanese characters and content?

A. "Pokémon" ranked highest in awareness, while "Doraemon" ranked highest in favorability

Overall, "Pokémon" ranked highest in recognition, while "Doraemon" topped the list for favorability. This survey was conducted before the global phenomenon "Pokémon GO" launched, showing that "Pokémon" recognition was already extremely high even before the game's popularity.

By region, top-ranked "Pokémon," "Hello Kitty," and "Dragon Ball Z" enjoyed high recognition not only in Asia but also in Europe and North America, indicating popularity across all regions.

On the other hand, while Doraemon, Detective Conan, Ultraman, and Crayon Shin-chan had relatively high recognition in Asia, their awareness was low in Europe and North America, showing regional differences.

Japanese companies increasingly utilize characters when expanding overseas. Japanese characters accepted in each region appear to possess universal appeal.

What do you think? Were there results that surprised you, perhaps differing from your expectations?

The government's 2020 inbound tourism target is 40 million visitors. Overseas consumers are becoming an increasingly important target. We hope you will utilize the "Japan Brand Survey 2016" to understand the awareness and realities of overseas consumers and apply this knowledge to your marketing activities.

Q&A! Japan Brand Survey 2016 Explained in 1 Minute

Q1 Which countries show the highest intent to visit Japan?

Q2 : What do they want to do in Japan?

Q3: Which Japanese regions do they want to visit?

Q4 : What do they want to experience in regional Japan?

Q5 Which World Heritage site is most recognized?

Q6 Which countries like Japan?

Q7 How is "Made in Japan" perceived?

Q8 What are the information sources for visitors to Japan?

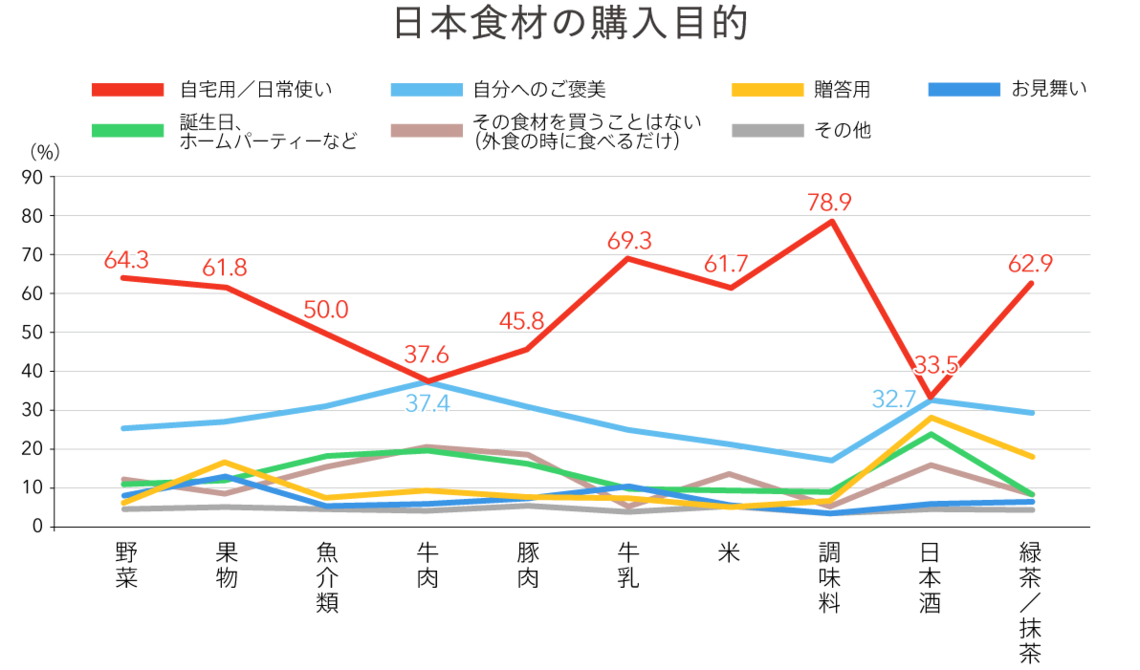

Q9 What is the purpose of buying Japanese ingredients?

Q10 What is the awareness and favorability of Japanese characters and content?

<Overview of the 2016 Japan Brand Survey>

● Purpose: To understand overseas consumers' perceptions and actual behavior regarding the overall "Japan Brand" encompassing Japanese food, tourism, products, etc., and to support corporate marketing activities.

●Target Areas: 20 countries/regions

China (Beijing, Shanghai), Hong Kong, South Korea, Taiwan, India, Singapore, Thailand, Indonesia, Malaysia, Vietnam, Philippines, Australia, USA, Canada, Brazil, UK, France, Germany, Italy, Russia

●Survey Method: Online survey

●Respondent Criteria: Men and women aged 20-59 from middle-income households and above

●Sample Size: 200 respondents per region, 4,000 respondents total

●Survey Period: April 25 to May 18, 2016

Dentsu Inc. Team Cool Japan

A company-wide cross-functional project team established to promote 'Cool Japan-related initiatives'—expanding products and services leveraging Japanese culture and strengths into overseas markets. Dentsu Inc. also invests in the Ministry of Economy, Trade and Industry's Cool Japan Organization (fund). The team brings together client company representatives handling overseas expansion, media and content specialists, overseas subsidiary network managers, producers, and planners to work on initiatives promoting Japan's appeal globally.

DENTSU SOKEN INC. "Japanology" Project

DENTSU SOKEN INC. is advancing initiatives focused on culture as a management issue for 2020 and beyond. We provide workshops and training on cross-cultural management and organizational culture diagnostics for Japanese companies advancing globalization and foreign companies aiming to penetrate the Japanese market.