Based on various surveys and research conducted by Dentsu Inc. Public Relations' research organization, the Corporate Communications Strategy Institute, we are serializing a series titled "Hone Your Corporate Communication Skills!" This time, we report on the second "Corporate Attractiveness Survey 2017," conducted in March 2017, from the perspective of gender and age groups.

Point

Consumers prioritize different corporate appeal factors by gender and age group!

・"Human Appeal" is most valued by M1 (men aged 20-34), but other demographics also prioritize it.

・"Product Appeal" tends to be valued more by women.

・"Corporate Appeal" is generally not highly valued by consumers.

・When communicating corporate activities (Facts), it is best to strategically tailor the approach to the target demographic's attributes.

Three Elements of Corporate Appeal Emphasized by Gender and Age Group

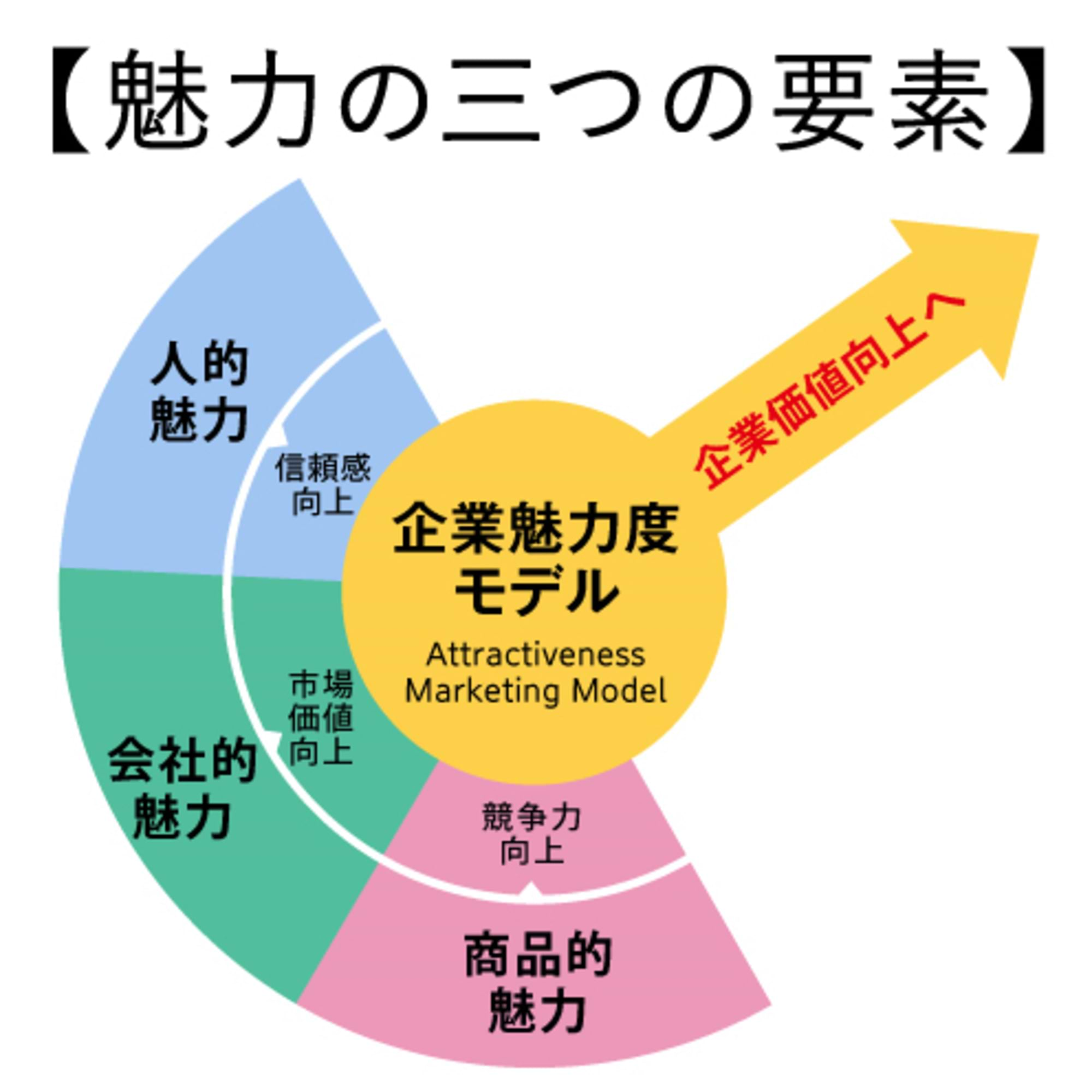

As mentioned in Part 1 of this series, the Corporate Appeal Model classifies and analyzes corporate actions (Fact*) into three elements: "Human Appeal," "Corporate Appeal," and "Product Appeal." The following graph summarizes which of these three elements consumers prioritize, broken down by gender and age group (M1: Men aged 20-34, M2: Men aged 35-49, M3: Men aged 50+; F1: Women aged 20-34, F2: Women aged 35-49, F3: Women aged 50+).

※Corporate actions themselves and the factual corporate components associated with them.

Looking at the breakdown by gender and age group, the first thing that stands out is M1's emphasis on "Human Appeal." At 42.1%, it is the only group exceeding 40%. Furthermore, "Human Appeal" is generally valued by other attributes besides M1.

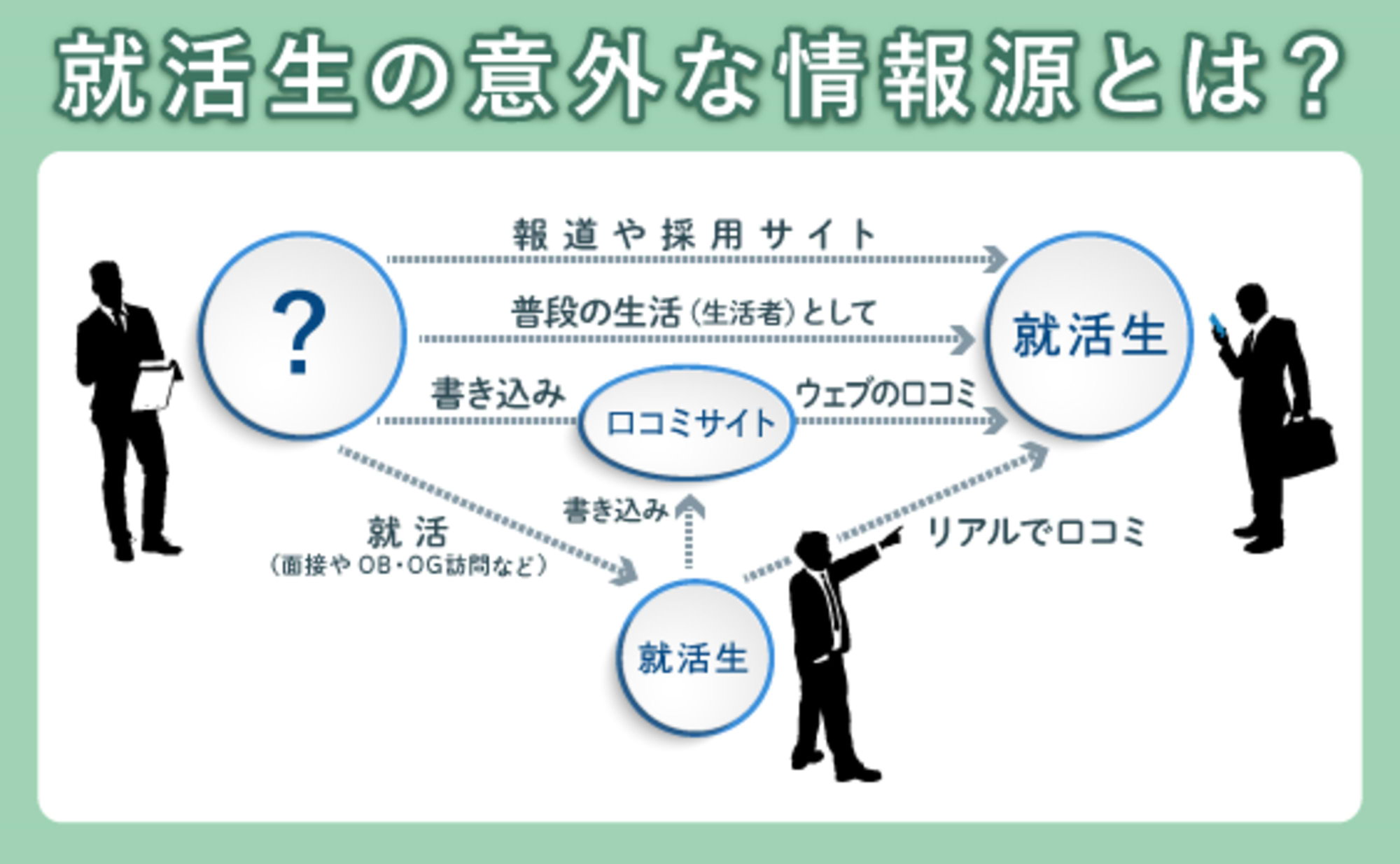

"Human Appeal" refers to the corporate charm conveyed through the individuals and business activities that make up the company, such as leadership and sincerity. Many companies already feature not only their top executives but also well-known employees and young staff as "points of contact" with consumers on their websites, at company information sessions, and other corporate communication venues. This indicates that these approaches are actually viewed favorably by consumers.

Next, looking at women (F1 to F3), the "Product Appeal" score is either higher than or nearly equal to "Human Appeal," indicating they are more sensitive to "Product Appeal" compared to men.

"Product Appeal" refers to the appeal conveyed through products and services, such as their originality, after-sales service capabilities, and cost performance. This indicates that when communicating with women, focusing on products and services is more effective. The popularity of "deals" and "tips for using products" in many women's magazines and women-targeted information apps aligns with this female psychology.

The remaining "corporate appeal" refers to the appeal of a company's growth strategy, profitability, and other aspects of its financial performance, along with the systems and initiatives supporting them. While this is an important metric for groups highly interested in a company's business side, such as investors and business professionals, it does not account for a large proportion in gender and age group analysis.

Focusing on communication that resonates with each attribute

We further break down the three elements—"Human Appeal," "Corporate Appeal," and "Product Appeal"—into six domains (leadership, risk/governance response, solution capabilities, etc.) and examine the data across 18 items ( see Part 1 for details on the 18 items).

Items highlighted in color in the table indicate values more than 3 points higher (red) or lower (blue) than the overall average.

The main characteristics of each attribute are as follows:

M1: High scores in "Leadership" and "Artisan Commitment" under "Human Appeal," while "Product Appeal" is generally low.

M2: Shows high levels of "Artisan Commitment," but no other notable characteristics.

M3: While no items are more than 3 points below the overall average, M3 shows sensitivity overall, with 4 items above the average in "Human Appeal," 3 in "Corporate Appeal," and 2 in "Product Appeal." Notably, "Identity" under "Human Appeal" is 9.2 points higher than the overall average.

F1: Generally shows low scores, but demonstrates high scores in "Product Appeal" solution capability.

F2: Scores 3 points or more below the overall average in all items for "Personal Appeal" and "Company Appeal." Also shows no notable characteristics in "Product Appeal."

F3: Unlike F1 and F2, no items are more than 3 points below the overall average. Scores are more than 3 points above the overall average in two items: "Social Coexistence" under "Corporate Appeal" and "Safety/After-Sales Service/Complaint Handling" under "Product Appeal".

Understanding which appeal resonates most with specific demographics provides insights into which aspects of corporate actions (Fact) should be emphasized in corporate and product brand communications. For example, a company targeting the M2 demographic might focus its messaging on how the dedication of skilled craftsmen is incorporated into product development. Considering the characteristics of your target consumers' demographics could inform your future communication strategies.