Note: This website was automatically translated, so some terms or nuances may not be completely accurate.

Are Japan's Regions Attractive? ~Growing Interest in Japan's Regions~

News stories about foreign tourists gathering in unexpected places in Japan sometimes make headlines and become topics of conversation. I myself have spotted foreign tourists in inconvenient locations with limited transportation options and wondered, "How did they find out about this place, and how did they manage to get here?"

Japan has diverse "regions" each with their own unique cultures, but how well are these known overseas, and what exactly attracts people to them?

This series explores insights for future inbound business from the "Japan Brand Survey 2019," conducted in 20 countries and regions in December 2018. This time, we focus on "regional areas" and delve deeper.

Is it common knowledge that Japan has diverse and charming regions?

First, let's examine whether Japan's regions are recognized overseas. When asked about their image of Japan, 78.7% of respondents across all 20 countries and regions agreed that "Japan has regions with unique cultures."

The score was high at 83.5% in the Asia region, which is understandable. However, it was surprising to find that awareness was also relatively high in Europe (76.5%), North America (67.0%), and even Germany, which had the lowest score at 62.0%.

Furthermore, after providing the additional explanation, "Japan has diverse regions, each with distinctive tourist attractions, cuisine, and local specialties. (etc.)," and asking, "Would you like to visit Japan's regions?", a significant 83.4% expressed interest in going.

Over half specifically stated they "very much want to visit," indicating very high interest. This tendency was particularly strong in the ASEAN region, where over 70% expressed a "very strong desire" to visit.

Furthermore, even among those without prior visitation experience, over 70% expressed a desire to visit regional areas. This raises expectations for the potential of regional Japan, prompting the question: "If awareness and understanding of Japan's regions deepens further, might inbound tourists increase even more?"

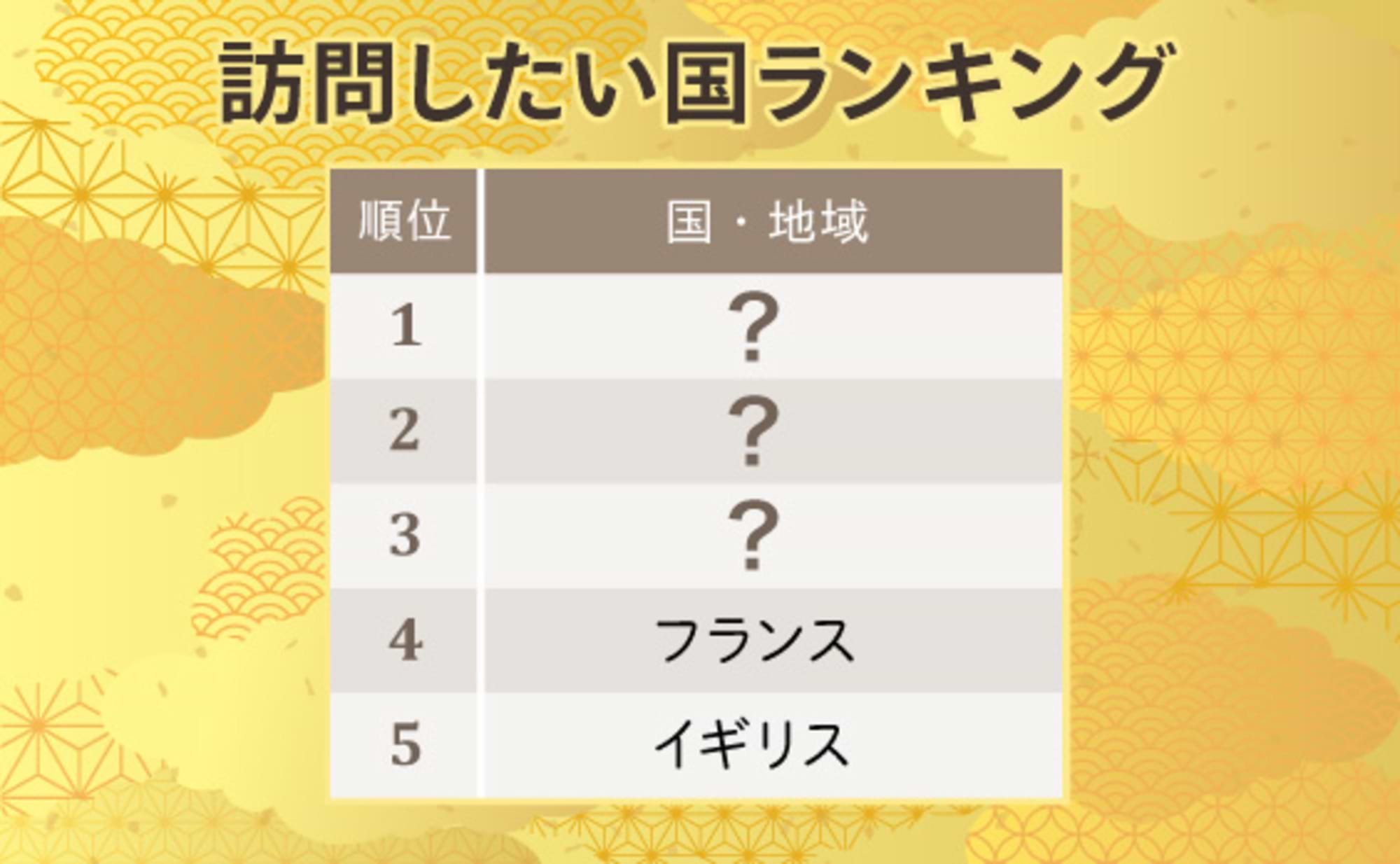

Visitors to Japan are heading not just to "Tokyo," but also to regional areas. "Hokkaido" is rapidly rising in popularity!

Let's look at which specific regions are popular and have high visit intentions. When respondents were presented with prefectures and asked about awareness, visit intentions, and visit experience, Tokyo topped all categories. Its awareness rate exceeds 60%.

Hokkaido ranks second. It scores just behind Tokyo in all categories: awareness, visit intention, and visit experience. In the 2015 survey, Hokkaido ranked fifth in awareness and fourth in visit intention, showing its presence has surged dramatically over these four years.

Other prefectures well-known overseas include Osaka, Kyoto, followed by Hiroshima and Nagasaki, likely due to their historical significance. Two years ago, during group interviews with foreign residents in Japan, it was striking to hear participants from North America say, "In my home country, Hiroshima has become a place people want to visit at least once."

Furthermore, Fukushima Prefecture ranking as Japan's eighth most famous prefecture reflects the high newsworthiness of the Great East Japan Earthquake overseas. Its visit intention score also ranks eighth, proportional to its recognition, with particularly high intentions in ASEAN countries like Indonesia and the Philippines. More people may extend their trips to Tohoku in the future.

Countries and regions in East Asia show high scores overall for awareness, visit intention, and visit experience. For visit experience, Tokyo ranks first, followed by Hokkaido, Osaka/Kyoto, Okinawa, and the Kyushu area (Fukuoka/Kumamoto).

As this trend gradually expands, it will be interesting to see which regions gain popularity next. After Kyushu, could it be Tohoku, Shikoku, or Chugoku?

The top experience people want in regional areas is "hot springs." Unique local cuisine is also drawing major attention!

When asked about "experiences they want to have in regional areas," "hot springs" ranked first. "Hot springs" also placed third in "things they want to do in Japan" and second in "things they are interested in regarding Japan," showing that foreigners, like Japanese people, find hot springs appealing.

Following hot springs were "nature," "cherry blossoms," "Japanese gardens," and "traditional local cuisine." The inclusion of "Japanese sweets" and "local street food" in the top 10 also shows many people want to experience regional food.

Ramen (11th place), which narrowly missed the top 10, was cited by over 50-60% of respondents in the Philippines, Taiwan, Hong Kong, South Korea, and Singapore as something they want to experience, highlighting its potential as a regional tourism resource.

Looking at countries and regions, Turkey, included in the survey for the first time, had a top 10 list of "Nature," "Japanese Gardens," "Hot Springs," "Shrines and Temples," "Interaction with Samurai," "Cherry Blossoms," "Festivals," "Local Museums," "Traditional Crafts," and "Mountain Climbing/Trekking." This suggests a broad interest in regional areas, centered on history and culture.

In contrast, Hong Kong, with many repeat visitors, showed high interest in "hot springs," "nature," "cherry blossoms," "Wagyu beef," "autumn leaves," "ramen," "down-to-earth local food," "Japanese sweets," "snow," and "seafood." This distinctly highlights a strong focus on food and the four seasons.

Hong Kong has a high proportion of repeat visitors (80.7% are repeat private visitors), leading to more specialized travel purposes. In contrast, Turkey, with fewer visitors to Japan (75.7% have never visited), shows a broader range of interests, likely stemming from a desire to first understand Japan's national character and uniqueness.

This survey demonstrated exceptionally high interest in Japan's regional areas. Results confirm that interest among inbound tourists, particularly from East Asian countries and regions with high visitation rates, is gradually expanding to regional destinations.

To further leverage the potential of regional areas, it will be necessary to understand the needs of target countries and regions and match them effectively to attract visitors more efficiently.

[Contact for Inquiries Regarding This Matter]

Dentsu Inc. Japan Brand Project Team

japanbrand@dentsu.co.jp

Japan Brand Survey Hub Page

https://www.dentsu.co.jp/knowledge/japan_brand/

[Purpose of the Dentsu Inc. Japan Brand Survey]

Dentsu Inc.'s proprietary survey initiated in 2011 to understand how the Japan Brand was perceived globally when reputational damage occurred to Japanese agricultural and marine products and inbound tourism following the Great East Japan Earthquake. In 2022, it evolved into a company-wide cross-functional project activity, fundamentally restructuring the survey design, analytical approach, and outputs to enhance expertise.In 2025, it will newly plan and build a public knowledge portfolio, aiming to create social value grounded in consumer insights.

The Japan Brand Survey regularly gauges the awareness and actual attitudes of overseas consumers regarding the Japan Brand as a whole, covering areas such as inbound tourism, regional revitalization, food, Japanese products, content, values, lifestyles, and social trends. It visualizes the changing sentiments of consumers and the challenges and potential of the Japan Brand, contributing to increasingly complex corporate activities while also promoting cross-cultural understanding within Japanese society.

【Dentsu Inc. Japan Brand Survey 2019: Survey Overview】

・Target Areas: 20 countries/regions (Mainland China, Hong Kong, Taiwan, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Vietnam, Philippines, Australia, USA, Canada, UK, France, Germany, Italy, Russia, Turkey)

・Sample Size: 6,600 (Breakdown: United States 600, Mainland China 600, Other Countries/Regions 300 each)

・Survey Period: December 2018

・Respondent criteria: Men and women aged 20–59 (middle-income and above)

・Survey Method: Internet survey

・Research Organizations: Dentsu Inc. (Principal Investigator), Video Research Ltd. (Implementation Support)

[Notes and Disclaimers]

※1: Mainland China coverage primarily limited to Tier 1 cities; Australia limited to the Sydney metropolitan area; Southeast Asia primarily limited to metropolitan areas.

※2: Definition of middle-income level: Criteria set per country based on national average income (e.g., OECD statistics) and social class classification (SEC).

※3: Samples were collected with equal allocation by gender and age group for each country/region, then weighted to match the population composition.

※4: Proportions in this survey are rounded to the second decimal place (or first decimal place for some integer values), so totals may not add up to 100%.

※5: Country and region names used in this survey report and on the website follow the longstanding views of the Japanese government, Japanese social norms, and business practices.

※6: In creating the charts and graphs for this survey, the names of countries and regions analyzed use the international standard ISO Country Code (ISO 3166-1 alpha-2/3), with some exceptions.

United States/US/USA, Canada/CA/CAN, Australia/AU/AUS, United Kingdom/UK/GBR, Germany/DE/DEU, France/FR/FRA, Italy/IT/ITA,Spain/ES/ESP, Finland/FI/FIN, United Arab Emirates/UAE, Saudi Arabia/SA/SAU, India/IN/IND, Indonesia/ID/IDN, Singapore/SG/SGP, Malaysia/MY/MYS, Philippines/PH/PHL, Thailand/TH/THA,Vietnam/VN/VNM, Mainland China/CN/CHN, Hong Kong/HK/HKG, Taiwan/TW/TWN, South Korea/KR/KOR, Turkey/TR

※7: Country and region names used in this survey are for statistical or analytical convenience only and do not indicate any political stance or viewpoint.

※8: The maps used in this survey (world map and Japan map) have been partially modified and cropped to suit the analysis content and page layout. They do not necessarily accurately reflect national borders or territorial boundaries.

Newsletter registration is here

We select and publish important news every day

For inquiries about this article

Back Numbers

Author

Katsura Nakazato

Dentsu Inc.

Fourth Marketing Bureau

Communications Director

Since joining the company, I have been part of the Marketing Section. I have been responsible for communication planning for companies and government agencies across diverse fields including food, beverages, cosmetics, and apparel. I have also worked on numerous overseas public relations projects for government agencies and local governments. Since 2013, I have been in charge of conducting the 'Dentsu Japan Brand Survey.' I am a member of the Dentsu Inc. Team Cool Japan.