Note: This website was automatically translated, so some terms or nuances may not be completely accurate.

What is the role of "quants," the highly skilled IT professionals sought after in the financial industry?

Takayuki Takigawa

Nomura Holdings, Inc. Future Co-Creation Promotion Department Planning and Research Division

Aizawa Hi

Nomura Securities Co., Ltd. Global Markets Digital Strategy Division and Macro Trading Department Quant Development Section

Naohiro Takahashi

AtCoder Inc.

Highly skilled IT professionals, possessing excellent programming skills and algorithm development capabilities, are now indispensable to corporate growth, regardless of whether the company is IT-focused or not. In this series, we have explored the cultivation and recruitment of such highly skilled IT professionals alongside Naohiro Takahashi, President of AtCoder, a key figure in the competitive programming world.

This installment focuses on the contributions of highly skilled IT professionals within the "financial industry." We visited Takayuki Takigawa of Nomura Holdings and Hitoshi Aizawa of Nomura Securities to discuss the role of IT technology in financial business and its relationship to business growth.

Financial business is data business

Takahashi: Mr. Aizawa, I understand you are a quantitative analyst in the Quant Development Department at Nomura Securities. First, what exactly is a "quant"?

Aizawa: "Quant" is derived from "Quantitative." It refers to the use of mathematical methods to analyze market trends, develop financial products, and formulate investment strategies, or to the people who do this work. While it may not be a familiar term to the general public, it's an indispensable profession in the financial industry.

Takigawa: Our company has a specialized team that develops mathematical models (※1) and analyzes data using statistical, mathematical, and information science techniques. We refer to the members of this team as quants. Some companies, like ours, assign quants to each major business line, while other financial institutions consolidate their quants into a single research institute. In terms of numbers, I believe our company employs the largest number of quants in Japan.

※1 = Mathematical model

Models that mathematically formalize various phenomena—such as weather forecasting, biological processes, economic activity, traffic congestion, and population projections—using methods from mathematics, statistics, and information science. By deriving equations mathematically or simulating scenarios on computers, these models enable predictions of potential events.

Takahashi: Mr. Aizawa, did you originally study mathematics?

Aizawa: I didn't major in mathematics, but I studied physics in the Graduate School of Science throughout university and graduate school. I conducted theoretical research in particle theory and numerical calculations based on that theory. I joined Nomura Securities right after graduation and have been working in my current department for five years.

Takahashi: Isn't it an unusual path to move from particle physics to the financial industry?

Aizawa: It's not uncommon for physics researchers to become quants in the financial industry. I considered it a top career choice because it allows me to utilize my physics research and mathematical skill set.

Takahashi: I thought most people in finance studied economics or information systems.

Takigawa: It might be surprising, but globally, many mathematical experts venture into financial business. For instance, the two famous mathematicians behind the Black-Scholes model are well-known. In the 1970s, they devised a single equation that created an entirely new financial market. Its scale is said to reach approximately $600 trillion. Incidentally, Scholes, who devised this equation, later won the Nobel Prize in Economics and even started his own asset management business. It's not just about creating the formula and stopping there; it's about how the formula you create changes the world. I think that's where the real thrill of finance lies.

Takahashi: That's fascinating.

Takigawa: Beyond that, diverse individuals are entering the financial business—star researchers whose names grace mathematical theorems, renowned university professors in machine learning, and others with varied backgrounds.

Takahashi: I understand you're involved in developing new businesses at Nomura Holdings' Future Co-Creation Promotion Department. What has your career path been like?

Takigawa: At university, I majored in "Financial Engineering," researching methods to mathematically derive techniques for estimating future prices of financial products and new asset management approaches based on probability theory and other mathematical methods. In graduate school, I studied "Artificial Markets," creating virtual financial markets on computers to conduct various simulations. After graduating, I joined Nomura Research Institute as a new graduate and was assigned to the R&D department. From there, I worked at the Bank of Japan and IBM Japan before joining Nomura Holdings in 2014. Currently, I'm involved in planning and promoting projects that integrate machine learning, quantum computing, and other technologies into existing operations.

Takahashi: How is IT utilized within the financial industry?

Takigawa: IT and data analysis—quantitative analysis—are involved in a wide range of operations, from asset management, trading, product development, research, and risk management to digital marketing. The essence of the financial business is a data business, so its relationship with IT is deep.

Takigawa: Take stocks, for example. There's electronic data recording "when and at what price shares issued by a certain company were purchased," and this data causes their value to fluctuate daily. The factors driving these fluctuations could be news about the company, a recent trade, or perhaps entirely unrelated information. Utilizing all this diverse data to mathematically model the mechanisms behind these fluctuations is the very essence of data science.

Takahashi: That's certainly true.

Takigawa: Data also plays a major role in the "asset management" business, where firms manage investments on behalf of pension funds and similar entities. While there are vast investment targets like stocks and mutual funds, since we're entrusted with our clients' hard-earned money, we must clearly define the criteria for selecting investments. To achieve this, we build mathematical models to calculate where and how much to invest, based on diverse information: corporate financial data, financial market intelligence, or even seemingly unrelated data.

Furthermore, in the field of short-term stock trading, we provide services where computers automatically execute trades while predicting, for example, stock prices five minutes into the future. Developing these models is also the role of quants.

Quants are also involved in risk management. Following the Lehman Shock, financial regulations require institutions to calculate potential maximum losses across the entire company. While many simply use simplified models specified by regulators, our company employs proprietary models approved by authorities to more accurately reflect our business characteristics.

Additionally, our research department uses quantitative models to visualize processes graphically, such as how stock price changes propagate within corporate groups we have trading relationships with. There's also the global initiative to evaluate companies based on the three perspectives of "ESG" (environmental initiatives, social engagement, and corporate governance) to achieve a sustainable society. We provide data-driven consulting, including developing specific methodologies to incorporate such perspectives into corporate evaluations.

Takahashi: So you're leveraging every conceivable type of data to drive your business. The perspective that "financial business is data business" was new to me—a real revelation.

You don't need to possess all capabilities from the start

Takahashi: Mr. Aizawa, what kind of work do you handle as a quant?

Aizawa: I analyze valuation models for financial derivatives and implement them into valuation systems.

Takahashi: Could you explain derivatives in simpler terms?

Aizawa: Financial products include stocks, foreign exchange, bonds, and so on. Their prices have liquidity; they are bought and sold, determining prices like "today's dollar-yen rate" or "the Nikkei average stock price."

Since these financial products constantly fluctuate in value, they carry price volatility risk. Derivatives, or financial derivatives, transform the form of that risk. The key feature of derivatives is that the amount paid in the future changes conditionally based on the price movements of the underlying financial product.

Specifically, there are transaction types like "futures contracts," where parties agree now on a future transaction price; "options trading," where the right to trade at a future price is bought or sold; or "swap transactions," where parties exchange cash flows of different natures but equal present value based on future cash flows, such as exchanging fixed-rate interest income for variable-rate interest payments.

Takigawa: To put it bluntly, derivatives might be easier to understand if you think of them as a kind of insurance product. No one knows what a stock price will be in the future, right? So, you trade the right to say, "I'll buy this stock at this price in three months." Without mathematical assumptions, you can't price how much to buy or sell that right for. That's where quants use statistical and mathematical techniques to calculate the price.

Aizawa: My primary role is developing numerical computation libraries (※2) for derivative valuation systems. We calculate price movement models based on mathematical frameworks and financial engineering to derive fair values.

When designing mathematical models, I sometimes write code myself as prototyping to verify functionality. Even during actual numerical computation, I employ various numerical algorithms to ensure efficient calculations at the operational level. I also collaborate with the IT department to implement these into systems used by our internal traders and salespeople.

※2 = Library

A collection of files containing standardized programs with specific functions, organized so they can be referenced by other programs.

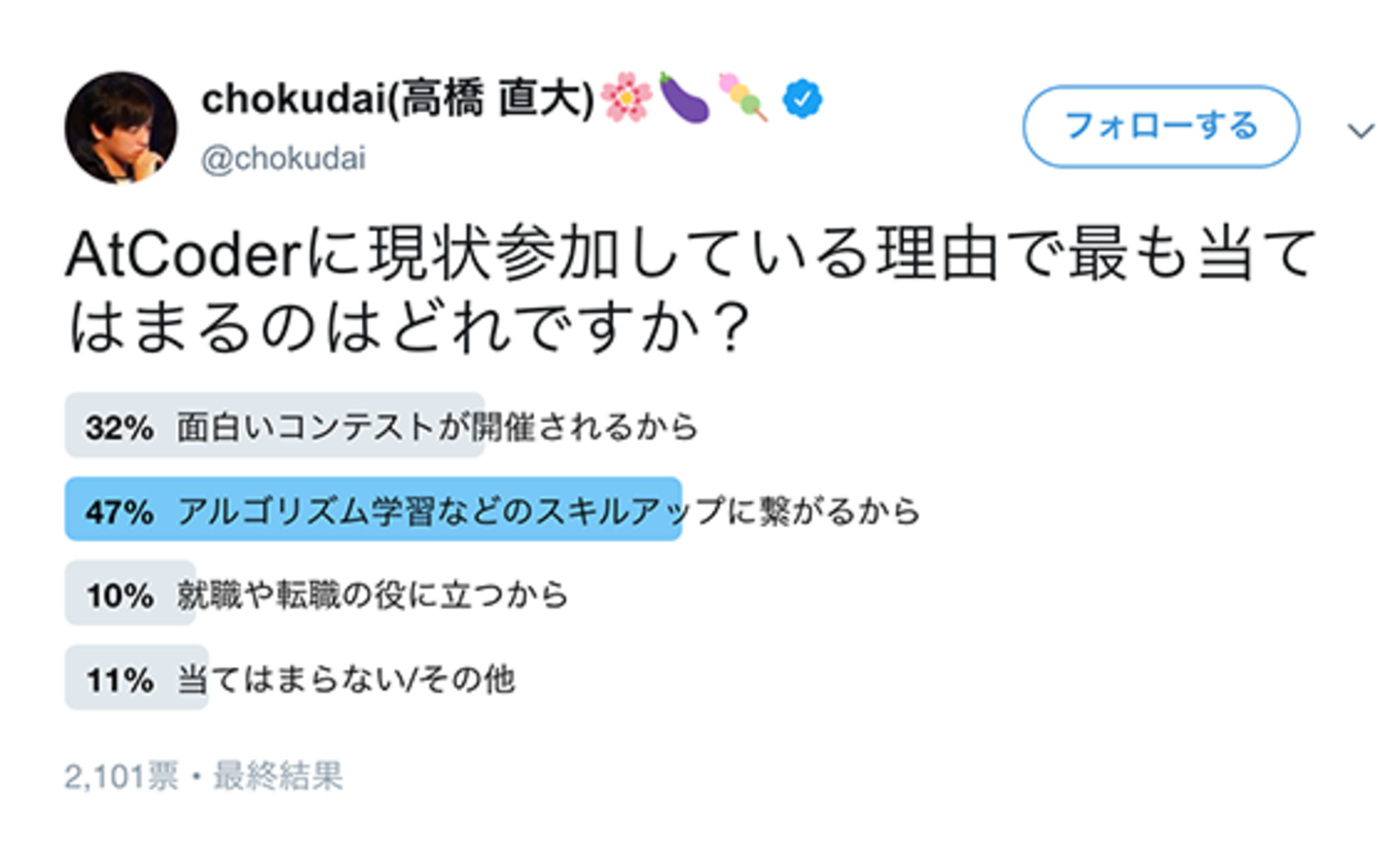

Takahashi: It's impressive that you not only create mathematical models but also handle the programming for verification and system implementation. The AtCoder competitive programming contests attract participants not only from information science backgrounds but also many who studied physics or mathematics. They seem to participate with the goal of joining information technology companies. Did you learn programming during your student days, Mr. Aizawa?

Aizawa: During my student days, I only wrote simple code for lectures and research. I encountered AtCoder after becoming a working professional. Being a quant requires understanding mathematical models, grasping the mathematical tools to build them, and the ability to write them as code. No one possesses all these skills from the start. While I have a physics background, I studied algorithm construction and programming intensively after starting this job.

The Approach to Algorithms Used in Financial Business

Takahashi: What kinds of algorithms are used in derivative valuation systems?

Aizawa: The computational methods for derivative valuation can be broadly categorized into two types. One is the analytical algorithm, which directly calculates the solution for what the fair price of a derivative should be using mathematical formulas. The other is the approximate algorithm, which seeks "candidate" solutions while minimizing error.

In both cases, the price fluctuations of the underlying financial instrument (the underlying asset) are first modeled mathematically, but the way this is expressed and solved differs.

Regarding analytical algorithms, it is known that the Black-Scholes model, mentioned earlier, and its derivatives can be used to directly calculate derivative prices using stochastic differential equations. However, they are not applicable to all products and cannot be applied to certain complex derivatives.

For example, consider a derivative that grants the right to trade a financial instrument at a predetermined price, exercisable anytime within a one-year period. In this case, the calculation becomes complex because it requires simultaneously considering numerous scenarios: whether the right will be exercised after one month, after three months, and so on. In such cases where direct calculation of the derivative's price is difficult, approximate algorithms are used to compute candidate solutions.

Approximation algorithms can be further categorized into several types.

Three representative methods can be cited.

One is the Monte Carlo method (※3), which simulates various possible future scenarios on a computer according to a mathematical model (stochastic differential equation) to find candidate solutions that statistically fit well.

The second method assumes that the price fluctuations of the underlying asset can be expressed using the same mathematical model. However, by adding several constraints, it transforms the problem into a partial differential equation (boundary value problem) and converts it into a computable form (finite difference method※4) to derive the derivative price.

The third method involves dividing the trading period into several segments. For each segment, a simplified mathematical model is established based on two scenarios for the future price movement of the underlying asset: "rise" or "fall" (or two or more scenarios further subdividing the price rise/fall pattern). After establishing a mathematical model simplifying these patterns, all possible patterns are examined. Based on the profit ultimately obtained in each pattern and its probability of occurrence, the expected value of future profits is calculated using a technique called dynamic programming (※5).

※3 = Monte Carlo Method

A type of numerical calculation algorithm. A method that finds approximate solutions by repeatedly performing simulations using random numbers.

※4 = Finite Difference Method

A type of numerical calculation algorithm. A method that converts differential equations into difference equations and solves the difference equations to obtain approximate solutions for the original differential equations.

※5=Dynamic Programming

One of the representative algorithms. A method that divides the problem to be solved into multiple subproblems (smaller problems) and finds the answer to the original problem by solving the subproblems sequentially.

Takahashi: So it's like breaking down something mathematically unsolvable into smaller parts that a computer can compute, then finding an approximate value.

Aizawa: Exactly. For complex financial derivatives with intricate patterns, exact valuation is difficult. We use the computational power of computers to find approximate solutions through numerical calculations like simulations.

Takahashi: And you're incorporating mathematical innovations like improving computational speed, right? That's fascinating.

To summarize what we've discussed so far: to calculate the fair value of derivatives and potential future risks, we develop mathematical models using stochastic differential equations and partial differential equations. To actually derive prices from these models, numerical computation is necessary. For this purpose, we write programs and build high-speed, high-precision algorithms. Since machine specifications have limitations, we develop highly efficient algorithms or use approximate algorithms to extract the desired data as effectively as possible. That's what we do in our daily work.

Aizawa: That's exactly right.

Takahashi: In that case, it might be a slightly different world from competitive programming, which focuses on deriving precise answers. It might be a bit closer to contests like marathon matches, where you improve accuracy over a long period.

Aizawa: Translating mental concepts into algorithms and implementing them appropriately and swiftly—that process feels similar to competitive programming.

Takahashi: Where do the differences in quantitative skills manifest? Is it prediction accuracy?

Aizawa: It depends on the quant's role. For a quant using mathematical models in portfolio management, performance is key. For a researcher analyzing market information to make future forecasts, it's whether the analysis results align with reality and are trustworthy. For a derivatives quant like myself, it's whether price valuation and risk assessment are accurate, and whether traders can buy and sell to generate profits. In any case, if the calculations are wrong, it leads to losses, so caution is essential.

Takahashi: That's scary. There's no guarantee the prices you derive are correct. How do you avoid mistakes?

Aizawa: We conduct thorough testing and perform code reviews within the team. Additionally, we have a Risk Management Department that validates mathematical models. While there are multiple layers of checks, the responsibility of the quants who design these mathematical models remains significant.

Takigawa: In system development companies, requirements definition is often the focus, and programming strictly according to those requirements is considered crucial. But securities firms don't primarily focus on system development. They have goals as securities firms, like pricing derivatives, and algorithms are a means to achieve those goals. There's no one defining requirements for us, but the quality of the algorithm is clearly reflected in the numerical results. To meet the objectives, we must relentlessly innovate and refine the algorithms ourselves. Because of that, I think the bar set for us is higher.

Bringing in technologies and examples from outside the financial industry could make you a pioneer

Takahashi: Lately, we've been hearing the term "algorithmic trading" more often, haven't we? I imagine that when people who learned algorithms through competitive programming venture into financial trading, algorithmic trading is often their first challenge.

Aizawa: While we use the term "algorithmic trading," it covers a broad range of meanings, so let's clarify it first. In the financial industry, when we talk about algorithmic trading, we're referring to something different from what you mentioned, Takahashi. For example, when handling large stock orders, selling everything at once could cause the price to plummet and result in losses. Therefore, it's necessary to sell gradually while minimizing market impact. However, selling too slowly leaves you vulnerable to market fluctuations. So, while predicting market prices, orders are split appropriately and placed to minimize transaction costs. This type of automated, computer-driven trade execution is called algorithmic trading.

On the other hand, algorithmic trading can also refer to rapidly buying and selling stocks based on signals from minute market movements, such as "the stock price might spike briefly right after this." This is what Mr. Takahashi is referring to, correct?

Takigawa: In the financial industry, we call that type of trading "high-frequency trading." Often, it's less about mathematical models and more about infrastructure—the equipment, communication lines, and such.

Takahashi: I see, I understand. In derivatives, mathematical models are used to provide credibility for valuation models and risk prediction, right? Is such justification unnecessary for predicting stock prices five minutes ahead when trading stocks short-term via algorithmic trading?

Takigawa: In algorithmic trading, we often present various trading strategies to clients and let them decide which to adopt. Therefore, explaining what each strategy entails is necessary. That said, explaining minute- or even second-level trading mechanisms intuitively without using information science or statistical terminology is inherently difficult. Moreover, I don't think clients typically demand detailed explanations of the algorithms themselves, as these are the source of a firm's competitive advantage.

When managing assets entrusted by entities like pension funds, we also use intuitively understandable indicators, including corporate financial information disclosed quarterly. We are also frequently asked to explain the mathematical models we employ and how they differ from several industry-standard mathematical models. For example, when using deep learning, we must be able to provide a mathematical explanation for why certain results were achieved. Simply stating "we tried using a machine learning library" fails to fulfill the duty of explanation. To justify why a particular price was reached or why a specific decision was made, one must interpret the machine learning formulas and algorithms, demanding a higher level of mathematical proficiency.

Takahashi: In the financial business, I feel that continuously pursuing cutting-edge technology drives business growth. How do you keep up with the latest technologies?

Takigawa: We catch up not only within the industry but also in academic fields. We sponsor conferences like the Japanese Society for Artificial Intelligence and the Japanese Society for Natural Language Processing. Sometimes we bring back cutting-edge themes from these and collaborate with quants to explore how they can be applied in finance. For instance, we research areas like reinforcement learning and transfer learning (※6) – technologies gaining traction in other industries but still emerging in finance. Furthermore, we present some of our findings at top global conferences like the AAAI. There are still many areas within finance that haven't been fully leveraged, so someone entering the field from a completely different background could potentially become a leading expert in financial IT within a few years.

※6 = Transfer Learning

A technique that applies a model trained in one domain to adapt it to another domain. It is attracting attention in the AI field because it can achieve high-accuracy results with less data than usual.

Given finance's interdisciplinary nature, we actively pursue collaborations with other industries. For example, through a partnership with a venture company that won the world championship in computer shogi, we developed an algorithm that reads the market's next move like reading shogi game records. This algorithm has been implemented in our stock trading operations.

In the world of mathematics, new theorems are discovered by combining various axioms (※7). The financial industry shares this approach in the importance of hypothesis setting and translating it into models. We have cultivated models and techniques over many years, and combining these with new techniques can sometimes give birth to entirely new methods. It is a highly logical and mathematical world.

※7=Axiom

The most fundamental assumptions introduced as premises for deriving other propositions.

Takahashi: That gut feeling of "This technology might be applicable" is a kind of intuition, not necessarily mathematical aptitude. It felt similar to the mindset in competitive programming: "Couldn't we apply this algorithm to this problem?"

※Continued in Part 2

Was this article helpful?

Newsletter registration is here

We select and publish important news every day

For inquiries about this article

Back Numbers

Author

Takayuki Takigawa

Nomura Holdings, Inc. Future Co-Creation Promotion Department Planning and Research Division

Nomura Holdings, Inc. Human Resources Strategy Department Recruitment Group

Vice President, Recruitment Group, Human Resources Strategy Department Nomura Securities Co., Ltd.

Master of Information Science. Joined Nomura Research Institute upon graduation and participated in company-wide R&D initiatives. Subsequently, engaged in research and examinations concerning the advancement of financial institutions' risk management frameworks at the Bank of Japan, as well as formulating examination and operational policies. Later, worked in consulting for financial institutions at IBM. Joined Nomura Holdings in 2014. Currently engaged in new business development and related planning and research (Future Co-creation Promotion Department).

Aizawa Hi

Nomura Securities Co., Ltd. Global Markets Digital Strategy Division and Macro Trading Department Quant Development Section

Senior Associate

Master's degree in Physics from the Graduate School of Science. Joined Nomura Securities as a new graduate and was assigned to the Quant Development Section of the Macro Trading Department. For the subsequent five years, I was responsible for analyzing valuation models for financial derivatives related to interest rates and foreign exchange, and implementing them into valuation systems.

Naohiro Takahashi

AtCoder Inc.

President and CEO

Placed third globally in the Imagine Cup programming contest hosted by Microsoft. Subsequently achieved numerous top results in programming contests, including four wins at the ICFP Contest and two runner-up finishes at TopCoder Open. In 2012, founded the service "AtCoder" to host programming contests in Japan. It has since grown into a contest attracting over 7,000 participants weekly.