Highly skilled IT professionals with exceptional algorithm development capabilities are now indispensable to corporate growth, regardless of whether the company is IT-focused or not. In this series, we've explored the cultivation and recruitment of such talent alongside Naohiro Takahashi, President of AtCoder and a key figure in the competitive programming world.

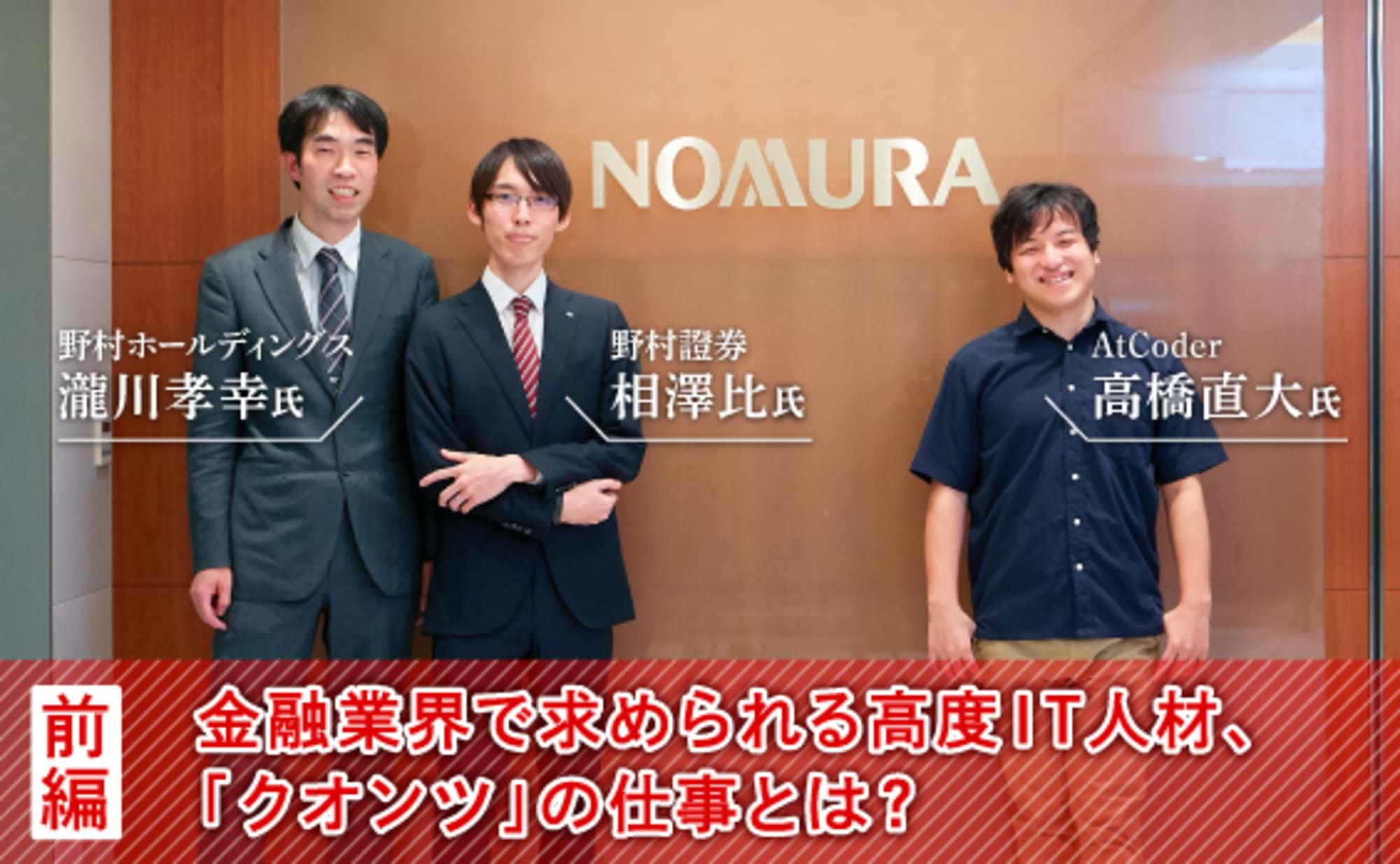

This time, we focus on the role of highly skilled IT professionals in the "financial industry." We visited Takayuki Takigawa of Nomura Holdings and Hitoshi Aizawa of Nomura Securities to hear about the role of IT technology in financial business and its relationship with business growth.

Part 1: What is the role of "quants," the highly skilled IT professionals sought after in the financial industry?

*Quant

A specialized role that uses mathematical methods to analyze market trends and develop financial products

From left: Takayuki Takigawa, Nomura Holdings; Hitoshi Aizawa, Nomura Securities; Naohiro Takahashi, AtCoder

What Kind of Highly Skilled IT Professionals Does the Financial Business Require?

Takahashi: What qualities does the financial industry, particularly Nomura Holdings, seek in IT professionals?

Takigawa: Regarding quants, individuals with a mathematical and statistical background excel. Those with mathematical aptitude are fundamentally welcome. From that perspective, individuals familiar with competitive programming like AtCoder, which strongly emphasizes mathematical aptitude, are highly welcomed.

While many companies have recently begun actively hiring data scientists, we have been recruiting and developing quants—specialists in mathematical and data analysis—for over 30 years. We have a large team of members not only in Japan but also across various locations like London, Singapore, and India.

Takahashi: Does participating in competitive programming have a positive impact on quant work?

Takigawa: Yes, it does. The experience of systematically thinking about things mathematically itself has a positive impact. This tendency is particularly strong in the securities industry within financial institutions.

Financial institutions include not only securities firms but also banks, insurance companies, and various other sectors. The core business of a bank is fundamentally "lending." They analyze companies by examining the financial information disclosed quarterly and other information obtained through communication with the loan officers handling the accounts. They assess whether the company is sound when looking at the entire lending period, whether it's one year or three years. For life insurance, the analysis period extends even further. For death insurance policies, for instance, we analyze ultra-long-term demographic trends spanning 30 or 50 years until the policyholder's death, using population statistics and similar data. On the other hand, at securities firms like ours, the market moves constantly, moment by moment. What happened in the past often never repeats itself. Therefore, we must mathematically explain "what is happening in the market right now," translate that into algorithms, and then verify for ourselves whether it is truly correct.

Continuously analyzing and verifying daily events mathematically can feel grueling for those without experience in thoroughly thinking things through mathematically. But people who consistently participate in competitive programming contests like AtCoder are hungry for mathematical thinking, right? (laughs) Such individuals likely have aptitude for being a quant.

Aizawa: Competitive programming doesn't directly cultivate a quant's analytical skills, but it definitely builds foundational abilities like mathematical thinking and coding skills.

Organizing what processing you want to do and how to achieve it, then bringing the tools in your mind and applying them effectively. Implementing systems accurately. These are like strength training to build foundational stamina. Understanding algorithms and thinking, "Could this algorithm be applied to this situation?" feels like training how you use your mind.

Takahashi: Earlier, you mentioned recruiting and training quants from overseas. Which countries are most represented?

Takigawa: There's no particular bias favoring any specific country. If someone speaks English and possesses strong mathematical skills, nationality doesn't matter. We prioritize individual capability. We recruit diverse talent globally while fostering collaboration.

Takahashi: In the competitive programming world, Russia and China are strong. Russia has a thriving domestic contest scene. China's characteristic is having a large pool of young talent, thanks to national policy. That's because the top 50 finishers in contests held in China can choose any university they want. There are even competitive programming academies accepting students as young as 10; when I visited one in Nanjing, there were 1,000 students. The entire country is promoting IT talent development and offering preferential treatment to those who excel. Other strong regions are Eastern Europe, Japan, South Korea, and Taiwan.

Aizawa: That's fascinating.

Takahashi: The top ranks on AtCoder's rating list are dominated by Russians. Even though they have plenty of exciting contests within Russia, they still challenge themselves on Japan's AtCoder—they're all competitive programming enthusiasts hungry for more (laughs). Incidentally, India, often perceived as strong in IT, doesn't actually perform very well in these contests. However, they do have a very large number of registered participants.

Also, perhaps due to the time difference, the US seems more focused on domestic activities. To participate in AtCoder from the US, you'd have to start at 4 AM.

Aizawa: It's true, late start times make participation tough. I used to compete in overseas contests too, but the late nights were grueling. In that sense, having AtCoder in Japan is incredibly valuable.

The appeal of financial business for competitive programming enthusiasts

Takahashi: Could you tell us about the impact having quants like Aizawa brings to the securities business?

Takigawa: In finance, which places heavy emphasis on data analysis, generating ideas no one else has considered requires mathematical thinking. To validate whether those ideas are sound, you need to translate them into algorithms, making programming skills crucial. Quants possessing both mathematical thinking and programming skills will likely remain a key source of competitive advantage for financial institutions going forward.

Aizawa: Financial business is highly competitive and heavily reliant on data and mathematical models. Precisely because of these characteristics, mathematical ability is required even outside specialized roles like quants. For example, salespeople selling derivatives might discuss mathematical models with me, saying, "Given the current market conditions, the model behaves this way, so the price should be this." Traders themselves also conduct market analysis, risk analysis, and write code.

The emphasis varies by position, but everyone uses mathematical skills—and sometimes coding skills—in their work. At our company, it's fair to say that mathematical talent, not just quants, drives the business.

Takigawa: I've heard that at some companies, specialists in data analysis and model development are pushed to the margins and work in a limited capacity. However, our company has a long history of quants playing active roles. We have numerous quants holding the highest position of Managing Director within the company. From this perspective, I believe you can see that quants, who leverage mathematical thinking to create various financial services and solutions, are positioned as the core of our company.

Takahashi: Beyond mathematical thinking, would the ability to understand algorithms and programming skills also be beneficial to your business?

Aizawa: They are extremely beneficial. When actually applying mathematical models, implementation into systems is essential. Algorithmic processing and coding are indispensable.

Takigawa: Unlike manufacturing, where you can physically inspect products, the financial industry might seem vague. But it's actually a black-and-white world defined by numbers. Precisely because the subject of analysis is inherently ambiguous, we seek individuals with the skills to make it tangible through mathematical thinking and programming abilities.

Takahashi: To be honest, I'm a complete outsider to the financial industry and could only think of algorithmic trading. My understanding stopped at "Since algorithmic trading exists, the financial industry must need algorithms, right?"

But from what you've said, it sounds like a company built on algorithms. It struck me as far more focused on developing algorithms than just building systems as an IT engineer. Hearing both of you talk sounded so enjoyable, I even thought I'd like to work as a quant myself (laughs).

Many competitive programming participants aim for IT companies, especially web or game development firms. But I started thinking it wouldn't be strange at all if entering the financial industry became the mainstream path.

I want to convey the appeal of the financial industry to competitive programmers, and I also feel compelled to show people who think, "Math isn't useful for business, right?" that it's actually being put to use in these kinds of situations. Thank you for today.