The importance of corporate DX (Digital Transformation) is increasing not only in Japan but also in China.

Japanese companies entering the Chinese market must adapt to "DX unique to China."

Amidst this, the Dentsu Group is rolling out a Chinese version of its "DX Diagnosis," originally developed for the Japanese market, specifically for Japanese companies.

Read the DX Diagnostic series here

We spoke with Mr. Tanaka Hiromoto of Dentsu Inc. McGarryBowen China's Shanghai office, who supports Japanese companies' DX efforts, about the objectives of the Chinese DX Diagnostic and the local situation.

Challenges Japanese Companies Face in China, a "DX Advanced Nation"

Yamamoto: Please tell us about the services Dentsu Inc. Shanghai provides to its clients.

Tanaka: We primarily provide solutions to solve marketing challenges, focusing on advertising and sales promotion campaigns, for Japanese companies based in Shanghai. As you know, China has seen remarkable growth in its unique digital ecosystem, and marketing methods adapted to this ecosystem have also evolved significantly. In this market environment, and especially now after experiencing the pandemic, we are receiving a great deal of consultation from clients regarding DX.

Yamamoto: Could you share the background behind developing the "China DX Diagnosis"?

What is the DX Diagnosis?

What is the DX Diagnosis?

This diagnostic solution ( release here ) measures DX progress using a deviation score, based on Dentsu Inc.'s proprietary research, focusing on the "Marketing DX" domain related to customer touchpoints.

Research conditions for Japan and China are detailed at the end of the article.

Tanaka: In China, a leading DX nation, we increasingly heard from managers of Japanese companies' Chinese operations saying things like, "We want to tackle DX for survival," or "We want to challenge DX using the Chinese market as a leading example and transform our business model." This stems from DX accelerating dramatically during the pandemic and China's share and importance within sales composition growing significantly.

Traditionally, Japanese companies operating in China tended to prioritize "supply chain management" and "localizing the Japanese headquarters model." However, in recent years, "creating business models from the perspective of local Chinese customers" and "promoting DX" have risen to the top of the agenda.

The Dentsu Group also keenly felt the need to accurately grasp the challenges Japanese companies face in business reform and DX promotion and to clarify the direction they should take. This led us to consider introducing a DX diagnostic tool that had already proven successful in Japan. However, given the significant differences between China and Japan, particularly in the digital sphere, our teams in Tokyo and China conducted extensive discussions and customized the tool specifically for the Chinese market.

The "China DX Diagnostic" Based on the Four Characteristics of the Chinese Market

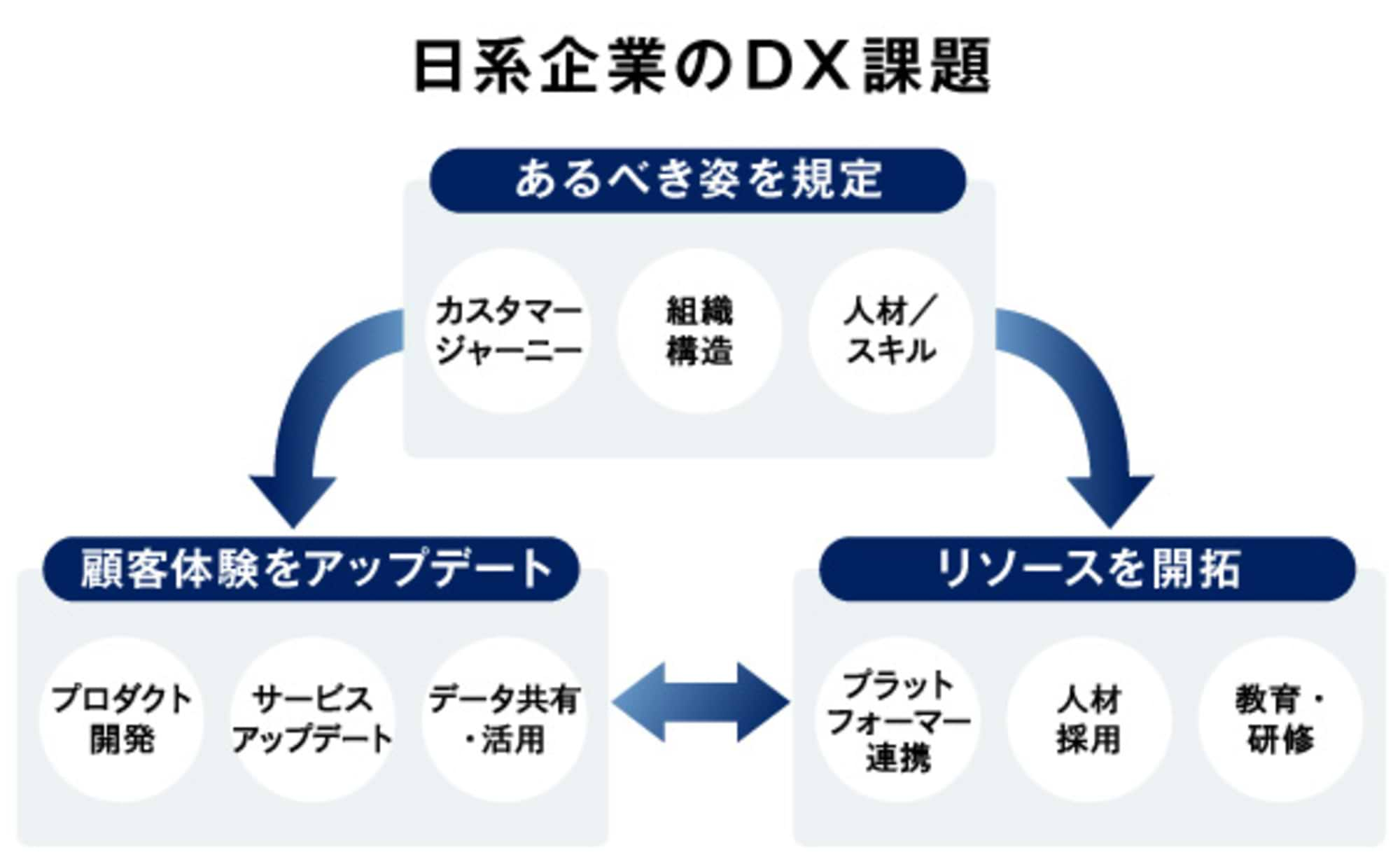

Yamamoto: Typically, DX diagnostics focus on

- Customer Experience

- Systems

- Data & Talent

- Organization/Operations

are examined through interviews.

- Vision

- Customer Focus

- DX Progress

We then extract challenges and propose solutions for marketing DX, grounded in consumer insights. What are the key features of the China DX Diagnostic?

Tanaka: The Chinese market has distinct characteristics compared to the Japanese market. We particularly focused on the following four points and added a fifth diagnostic element, the unique "China Factor."

- Providing CX (Customer Experience) tailored to the Chinese market

- CX transformation to respond to rapid market changes

- Relationships with China's unique platform operators

- Unique post-pandemic actions

Yamamoto: What strengths of Japanese companies emerged from the survey results?

Tanaka: It's the deeply ingrained "customer-first mindset." Providing personalized CX to each individual, gathering data from various touchpoints, and utilizing customer satisfaction evaluations. Putting customers first and actively pursuing new initiatives is a key strength of Japanese companies.

However, we also identified challenges: siloed organizational structures and a lack of clarity on the desired future state. This means their customer-first mindset isn't always translating into tangible results.

That said, I don't view the current lack of results pessimistically. I believe identifying both "strengths" and "challenges" is where we find the starting point for solutions.

Yamamoto: Could you elaborate a bit more on what Japanese companies are lacking?

Tanaka: As mentioned earlier, the vision and definition of the customer journey remain underdeveloped. Precisely because the "organizational structure and business processes necessary to achieve optimal CX" – the end goal – is unclear, the current state of insufficient organizational DX advancement has become apparent.

Leading Chinese and global companies tend to swiftly adopt new CX designs using the latest technologies, then continuously update the customer experience through repeated trial and error.

Yamamoto: Regarding the "China factor" mentioned earlier, how are Japanese companies responding?

Tanaka: Unfortunately, the current reality is that their response remains uniformly low across the board. Crucially, insufficient collaboration with platform operators—an indispensable element when considering the customer journey in the Chinese market—is hindering the promotion of unique actions originating from that point and the delivery of the journey itself.

Yamamoto: There are certainly many challenges.

Tanaka: Indeed, Japanese companies face numerous hurdles they must overcome. However, considering the potential of the Chinese market, I believe it's a challenging market worth tackling, one where significant rewards can be reaped.

Moreover, the strengths and challenges highlighted for these Japanese companies aren't unique to China. While the platform environment and pace of digitalization differ, these are challenges that must be addressed regardless of the global market. In that sense, viewing "China, a leader in DX, as the crucible for conquering global markets" isn't far off the mark.

Yamamoto: I understand you've already started offering the Chinese DX diagnostic to some Japanese companies. How has the response been?

Tanaka: We've received feedback such as: "It allowed us to reassess our current position through benchmarking against other industry players and Chinese companies," and "It prompted us to rethink not only our ongoing ERP(※1) implementation but also new CX and CRM(※2) initiatives we hadn't previously pursued." We sense that companies can utilize this as a support tool to relatively and objectively understand the importance of customer-centric and marketing-focused DX, thereby driving their DX efforts forward.

※1 ERP = Enterprise Resource Planning

※2 CRM = Customer Relationship Management

The Chinese market can serve as a testing ground for BX and DX

Yamamoto: Finally, could you share your thoughts on the significance of Japanese companies pursuing DX in China?

Tanaka: Compared to Japan, China has more advanced digital infrastructure. I believe it can serve as a "DX testing ground" as a leading market. I am convinced that challenging DX while keeping in mind the strengths and challenges of Japanese companies revealed by this DX diagnosis will be key to business transformation for Japanese companies expanding globally.

The pace of change in the Chinese market is truly remarkable. For instance, while traditional Chinese e-commerce primarily involved opening stores on platforms like Alibaba and JD.com, a shift away from this is now occurring. One trend is D2C Inc. (Direct-to-Consumer Inc.). Driven by recent changes in the media/content landscape, heightened cost awareness, and advancements in data technology, this model is gaining attention as a business approach less reliant on platform-based e-commerce. Another is "Private Traffic." This model involves capturing proprietary customer data, nurturing it within communities, and driving conversions. It is currently attracting significant attention in the Chinese market.

The Chinese market is also an attractive place to challenge new marketing approaches like D2C Inc. and private traffic. Dentsu Inc. hopes to support Japanese companies in this space and help create success stories together.

Yamamoto: Thank you.

For inquiries about the China DX Diagnostic results or DX-related consultations, please feel free to contact Dentsu Inc. Global Business Center.

What is the DX Diagnosis?

What is the DX Diagnosis?