Lately, I've been hearing the term "retail media" more often. This concept, gaining attention through successful examples like Walmart in the U.S., is now poised to arrive in Japan. But what exactly is retail media? How will its emergence change marketing? Mr. Hamaguchi and Mr. Yamazaki from Dentsu Inc.'s Data & Technology Center, who are involved in launching clients' retail media initiatives, explain.

What Exactly Is Retail Media?

While definitions vary, broadly speaking, retail media refers to advertising channels provided by retailers as media companies. Examples include various online ads on retailer-operated e-commerce sites and digital signage ads installed in physical stores. A key feature is its ability to leverage first-party data—unique data collected and owned by retailers, such as consumer purchase history and behavioral data from retailer app usage logs—to enable precise targeting and deliver ads or coupons (discount vouchers for promotions). Furthermore, in-store digital signage and billboards are seen by customers immediately before purchase, making them highly effective touchpoints with strong recency effects. Retail media with these characteristics is anticipated to be a "purchase-driving" medium.

In the US, Walmart's retail media is rapidly expanding alongside Amazon's, especially given Walmart's physical store presence. According to Walmart's earnings report, Walmart's retail media sales in 2021 reached $1.55 billion (approximately ¥224.8 billion at an exchange rate of ¥145 per $1). In Japan too, CARTA HOLDINGS, INC recently announced its forecast for the retail media advertising market size, predicting it will exceed ¥80 billion by 2026.

Source: September 2022, CARTA HOLDINGS, INC.

Why is Retail Media Gaining Attention Now?

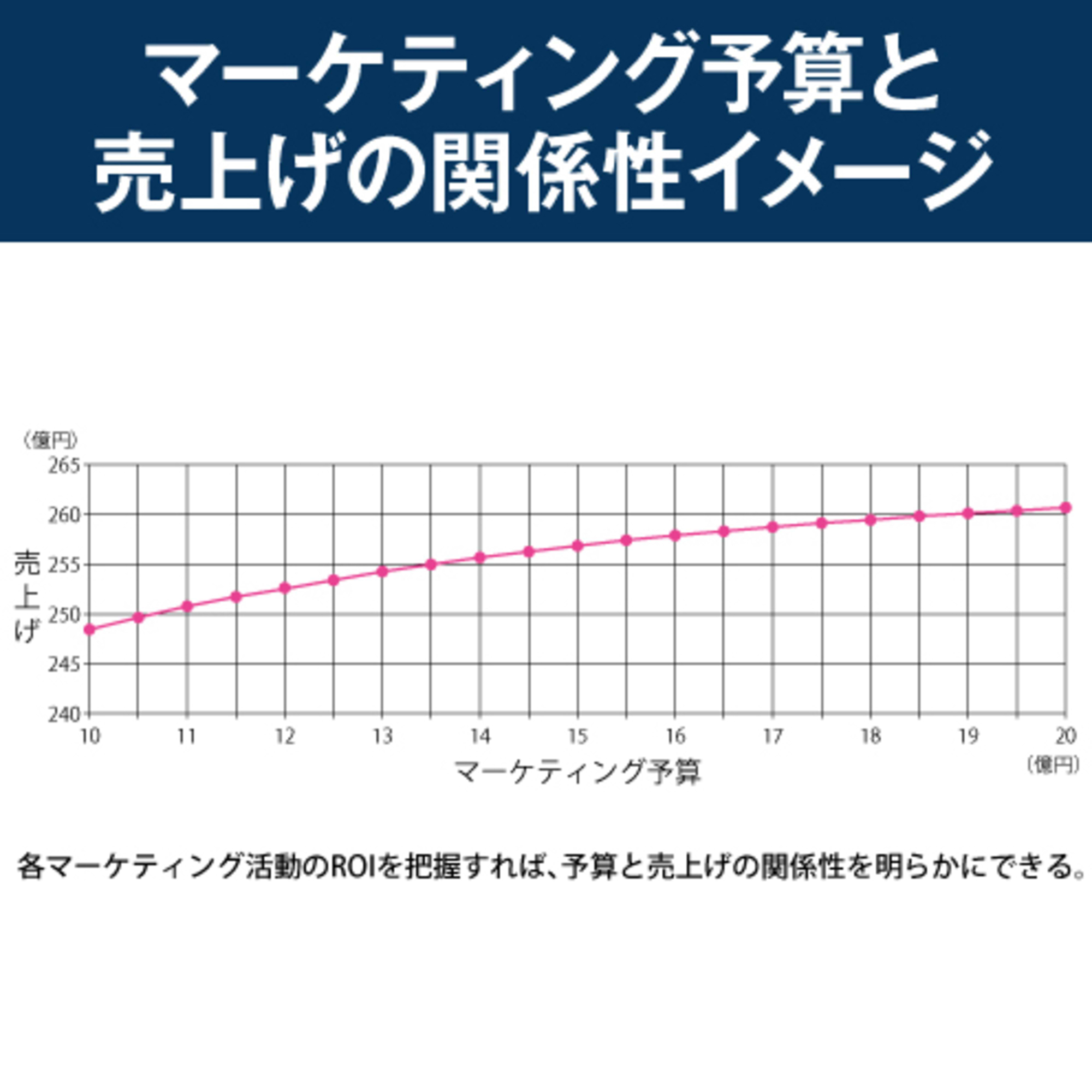

With the advancement of digital advertising, the visualization of advertising effectiveness has made tremendous strides. Companies that can capture conversions (CV) occurring specifically online have made it standard practice to implement PDCA while measuring final outcomes and improving ROI.

On the other hand, considering the consumer goods sector, many manufacturers lack access to CV data—specifically, purchase data indicating whether their products were bought by consumers. While advancements in DX have led many consumer goods manufacturers to adopt D2C Inc. strategies, the vast majority of sales still occur in retail stores. Consequently, the purchase data essential for manufacturers' PDCA cycles remains accumulated by retailers.

Furthermore, even if purchase data is held, PDCA cannot be implemented unless actions can actually be taken toward consumers. Recently, many retailers have built direct touchpoints with consumers—not only in-store but also through their own apps, LINE, email, and more—enabling the provision of appropriate customer experiences based on each individual consumer's purchasing behavior.

This means that by partnering with retailers, consumer goods manufacturers are gaining access to an environment where they can realize new forms of marketing unlike anything before. These new initiatives offered by retailers are called Retail Media, and various retailers are beginning to enter this space.

Retail Media Elevates Marketing

Of course, consumer goods manufacturers and retailers have collaborated on marketing initiatives before. However, there has been limited coordination between two key groups: - Regional sales teams and retail merchandisers (buyers) at consumer goods companies, who primarily focus on sales promotions centered around "how to increase sales within specific distribution channels." - Marketing/advertising departments at consumer goods companies and advertising agencies, who focus on advertising and consider "how to maximize overall sales from a long-term perspective, not just short-term gains."

The emergence of retail media is enabling the integration of these sales promotion and advertising functions. This creates a framework where all stakeholders can partner to advance marketing sophistication.

Seven-Eleven Japan × Dentsu Group's Challenge

Retail media is thriving in the United States, but retail conditions differ significantly between America and Japan. Compared to the U.S., where bulk shopping is common, many people in Japan shop several times a week. A retail media solution localized for Japan, carefully considering these differences in lifestyle habits, is needed.

As the wave of retail media reaches Japan, Seven-Eleven Japan launched its Retail Media Promotion Department in September to actively advance its retail media business. Even before this department's establishment, Dentsu Group has supported Seven-Eleven Japan's unique retail media initiatives, including developing business concepts and conducting advertising PoCs within the Seven-Eleven app.

The goal is to "understand each customer's preferences, achieve a 1-to-1 approach, create an environment that encourages continued purchases through better customer experiences, and jointly cultivate high-value customers for consumer goods manufacturers alongside the retailer."

In this series, we explore the new marketing possibilities enabled by Japan's unique retail media, featuring discussions with Katsuki Sugiura and Kenji Oishi from Seven-Eleven Japan, Katsumasa Yagi, President of Dentsu Consulting Inc., and Shun Iba, President of IBA Company. Stay tuned.