Note: This website was automatically translated, so some terms or nuances may not be completely accurate.

The appeal demanded varies by industry! What should companies communicate now?

The Appeal Brand Survey is conducted to analyze what corporate activities and facts consumers find appealing and how these are communicated. This survey is designed based on the "Appeal Branding Model" developed by the Corporate Communications Strategy Institute (within PR Consulting Dentsu Inc.) and is conducted annually around June, targeting 10,000 consumers nationwide.

Revised in 2025 for the first time in seven years, the "Attractiveness Branding Model Ver.3" has evolved into a new framework to align with changing times.

This series introduces findings from the Appeal Brand Survey. We explain the appeal perceived by corporate stakeholders and the key points to focus on for enhancing brand value, broken down by industry.

Read the first article here: What are the facts about companies consumers find attractive, as revealed by new metrics?

<Table of Contents>

▼Looking at 200 Companies Across 24 Attractiveness Domains ...

▼Different "Desirable Attractiveness" by Industry

▼"Domestic Automobiles & Motorcycles," "Steel & Heavy Machinery," and "Electrical Equipment" Industries: Focus on "Technology"!

▼"Aviation & Logistics," "Food Service," and "Content Business & Platform Services" industries: Differentiate through "Customer Service"!

▼Communication Key Points Revealed Through Cluster Analysis

▼Streamline through industry-specific information channels!

▼Clearly define "Who to communicate with and what to convey." Then, understand your target audience.

Looking at 200 companies across 24 areas of appeal...

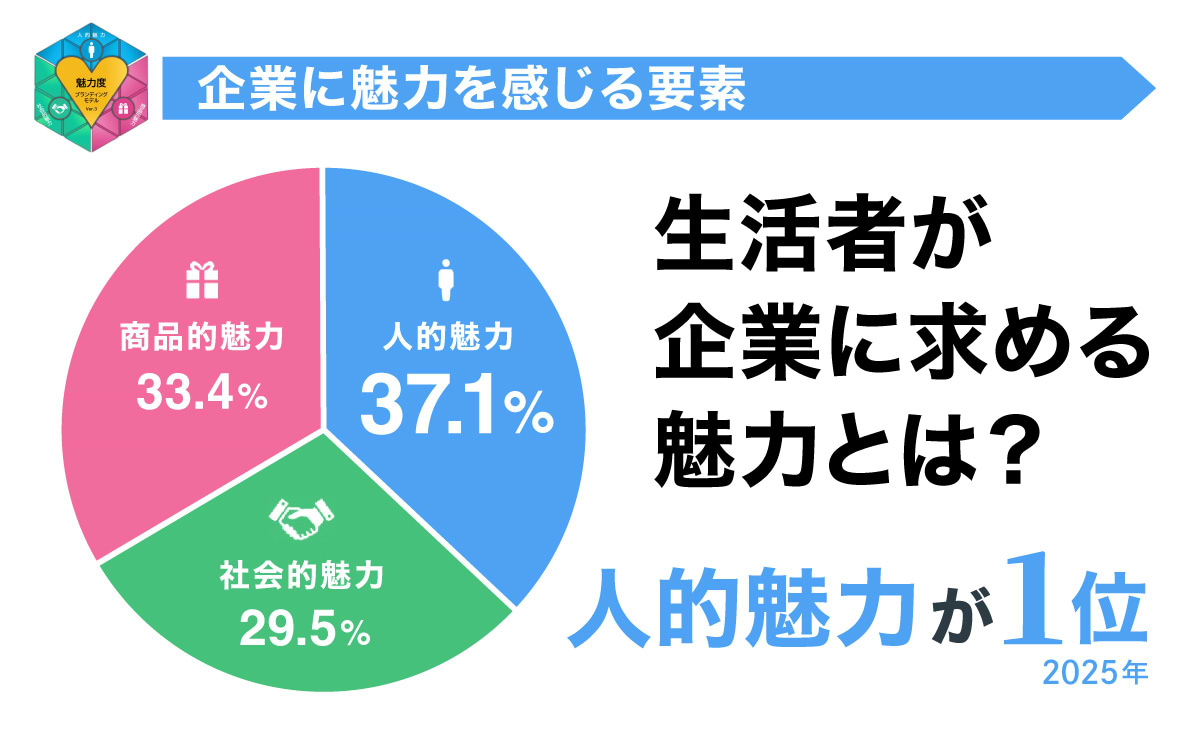

The "Attractiveness Branding Model Ver.3" divides a company's "attractiveness" into three elements: "Human Appeal," "Social Appeal," and "Product Appeal," further categorizing them into 8 domains (24 domains total).

Based on this concept, we surveyed 10,000 consumers nationwide about the "appeal" of 200 companies across 20 industries. As mentioned in the previous article, the following order showed the highest percentages of appeal being selected.

Looking at all 20 industries combined, the results were: 1st place "Addressing Issues" (tackling essential challenges in daily life), 2nd place "Stability and Transparency" (reliability and stability of management), and 3rd place "Technology" (high technical capabilities and know-how).

Divergent "Desirable Attributes" by Industry

However, when grouping industries with similar top three appeal areas by sector, the following trends emerged.

- Industries exist where "Human Appeal," "Social Appeal," and "Product Appeal" each rank first

- While some industries have "Human Appeal" and "Product Appeal" occupying all top 3 spots, no industry has "Social Appeal" occupying all top 3 spots

- The most frequently occurring appeal element is "Human Appeal" at 28 domains, followed by "Social Appeal" and "Product Appeal" both at 17 domains (out of 62 total domains [20 industries × top 3, with 2 industries tied for 3rd place]).

- The most frequently occurring appeal category within the top 3 is "Issue Response" (Social Appeal), appearing in 14 out of 20 industries. Next is "Stability/Transparency" (Human Appeal) in 13 industries.

- The most frequently ranked top appeal area was "Technology" (Human Appeal) in 6 industries. Next was "Issue Response" (Social Appeal) in 5 industries.

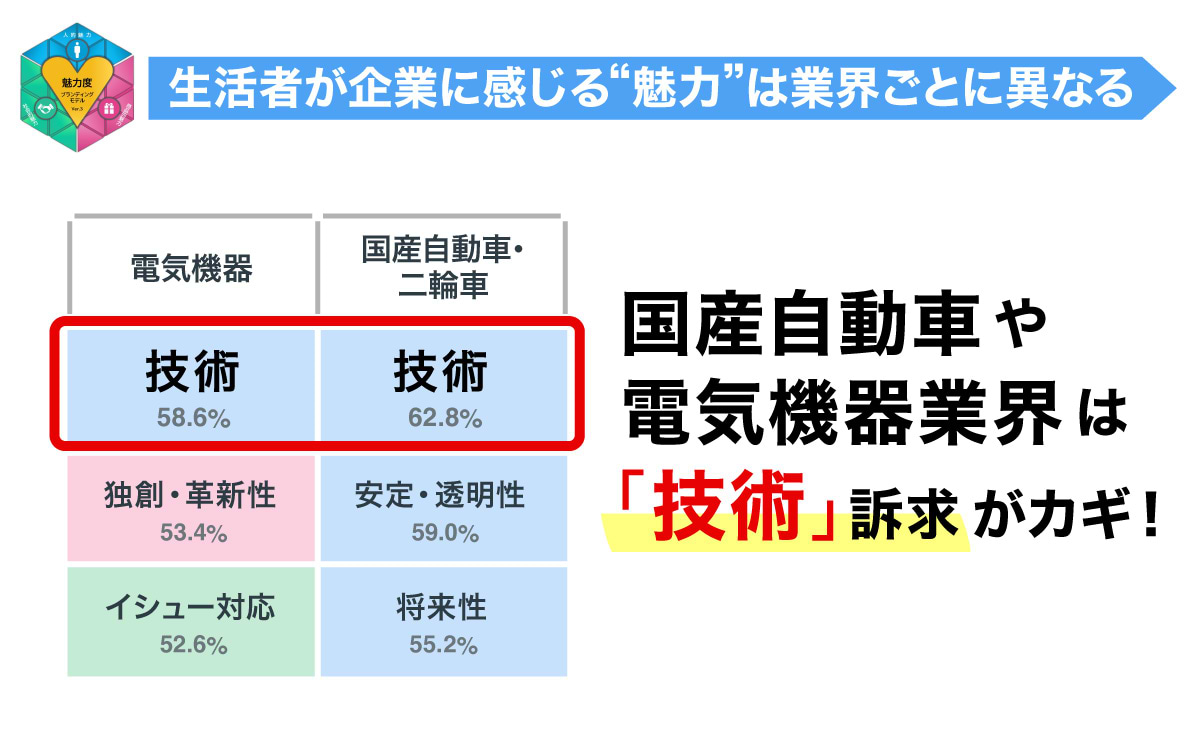

The "Domestic Automobiles & Motorcycles," "Steel & Heavy Machinery," and "Electrical Equipment" industries should emphasize "Technology"!

Of the 24 appeal areas, the industries that placed "Technology" at the top were: "Semiconductors & Electronics," "Electrical Equipment," "Imported EVs & Automotive Parts," "Steel & Heavy Machinery," "Real Estate & Construction," and "Domestic Automobiles & Motorcycles" – totaling 6 industries.

Even among those prioritizing "Technology," "Domestic Automobiles & Motorcycles" and "Steel & Heavy Machinery" had all three top appeal areas dominated by "Human Appeal." This indicates these industries should particularly emphasize approaches centered on "Human Appeal. "

Furthermore, in the "Semiconductors & Electronic Devices," "Steel & Heavy Machinery," and "Imported EVs & Automotive Parts" industries, the "Frontier Spirit" aspect of human appeal is included, indicating that pioneering efforts like market expansion and global promotion are perceived as attractive.Furthermore, in the "Imported EV Automobiles & Automotive Parts" and "Electrical Equipment" industries, the product appeal factor "Originality & Innovation" is included, indicating that the originality of the products and services themselves is perceived as attractive.

Industries where "Technology," "Frontier Spirit," and "Originality/Innovation" resonate strongly tend to attract attention for information showcasing advanced technology and innovation, including skills and know-how. This can be a key competitive advantage. However, information that was once cutting-edge can quickly become outdated, necessitating constant updates. It's also important to be mindful of methods like releasing information in small increments or presenting the same content from various angles.

Aviation/Logistics, Food Service, and Content Business & Platform Services Industries: Differentiate Through Customer Service!

The "Aviation & Logistics," "Distribution & Retail," "Food Service," and "Content Business & Platform Services" industries prioritize product appeal. Specifically, strengths like "needs development," "customer service," and "cost performance" are highly valued.

Since "needs development" and "customer service" appear in the top 3 for these 4 industries, the key seems to be communicating about "solving customer-related challenges" and "efforts directed at stakeholders," rather than promoting the company's know-how or system technology, or announcing new products.

Communication Points Revealed by Cluster Analysis

Beyond the top three strengths discussed earlier, applying cluster analysis to the 24 areas of strength across all industries yielded the following classifications.

Five distinct clusters emerged, named as follows: "Foundation Industry Type," "Durable Goods & Stability Type," "Innovation Industry Type," "Consumer & Lifestyle Integration Type," and "Unique Type." The key communication points for each cluster are outlined below.

"Foundation Industry Type"……Essentiality to daily life and reliability of technology

"Durable Goods & Stability"……Strong focus on management stability

Innovative Industry Type: Emphasis on creating new value

"Consumer/Lifestyle-Focused" & "Unique"……Emphasis on customer touchpoints; corporate technology and know-how are important elsewhere

Optimize efficiency through industry-specific information channels!

In the previous article, we reported that for attractive information channels, "Real-world" ranked 1st (40.6%). "Media advertising" ranked 2nd (33.5%). "Media programs/articles" ranked 3rd (31.4%).

Differences by industry are also evident in these attractive information channels, as shown below.

In the attractive information channels for each industry, "Media Advertising" stands out in the "Energy" industry, "Real-world" and "Media Advertising" in the "Beverage" industry, and "Media Programs/Articles" in the "Steel & Heavy Machinery" industry. The "Content Business & Platform Services" industry showed an overwhelmingly higher use of "Social Media" compared to other industries.

This result suggests that the information channels through which consumers perceive a company's appeal vary significantly by industry. Naturally, some channels may be less effective at reaching targets, or certain industries may be less frequently covered. However, it is essential to develop strategies based on the understanding that consumers recognize "the appeal (facts) of this industry is obtained through this information channel."

Clearly define "who to communicate with and what to convey." And understand your target audience.

At the Corporate Communications Strategy Institute, we interpret industry-specific "attractiveness trends" as "fact priority levels." While we analyzed corporate appeal by classifying it into 3 elements and 24 domains, all are essential and valuable aspects of appeal, albeit with varying degrees of perceived importance. However, we also recognize the reality that communicating "facts consumers find less appealing" or "facts too commonplace within the industry" often fails to resonate as expected.

For instance, the required communication methods and content differ significantly between B2C companies dealing with everyday consumer goods and services, and B2B companies whose business primarily revolves around clients. This is precisely why, in corporate communications, clearly defining "who to communicate with and what to communicate" and establishing priorities is fundamental and critically important.

While the philosophy or ideal of "wanting to make everyone happy" is appropriate as a KGI (Key Goal Indicator), it is ambiguous as a KPI (Key Performance Indicator). To efficiently convey a company's appeal within limited budgets, it is essential to steadily achieve KPIs that demonstrate the path to accumulating results.

This is where focusing on "understanding" the target audience becomes crucial. To advance toward its ideal goal and future vision, a company must understand:

- What does the target audience currently understand?

- What do they not yet understand?

- What should they understand going forward?

- What facts will spark their interest to foster this understanding?

No matter how many facts you pile up that hold little interest, the company's appeal will be hard to convey.

By honing your "vision" to gauge the target's level of understanding, your "hearing" to listen to their voice, and your "voice volume" to ensure your message reaches them, corporate communication will become stronger and more effective.

In our next installment, we will introduce survey data on "economic value, social value, and brand value of companies."

[Survey Overview]

Survey Name: Attractiveness Brand Survey

Survey Period: June 20 to July 8, 2025

Survey Method: Online survey

Survey Area: Nationwide

Survey Participants/Sample: 10,000 men and women aged 20–69 nationwide (equal male-female distribution across segments below)

(Breakdown) 20s: 2,000 respondents / 30s: 2,000 respondents / 40s: 2,000 respondents / 50s: 2,000 respondents / 60s: 2,000 respondents

*To extract the above sample, a screening survey was conducted targeting general men and women aged 20–69 (high school age and above, regardless of marital status or occupation). In addition to age criteria, respondents were allocated to 20 industries (companies) deemed attractive, with 500 respondents per industry.

Survey Release:

https://www.dentsuprc.co.jp/releasestopics/news_releases/20251020.html

Was this article helpful?

Newsletter registration is here

We select and publish important news every day

For inquiries about this article

Author

Shohei Suetsugu

PR Consulting Dentsu Inc.

Corporate Public Relations Strategy Research Institute

Deputy Director

After working at an advertising agency and a planning company, joined PR Consulting Dentsu Inc. in 2007. Handled communication planning for clients in beverages, electronics, telecommunications, and universities. Currently engaged in research, analysis, and consulting at the Corporate Public Relations Strategy Institute, focusing on reputation analysis, PR effectiveness measurement, IR communication capability surveys, issue analysis, and social risk.