Previously, the "Chinese Tourist Shopping List & Vehicle Survey" revealed that over 95% of Chinese visitors to Japan create shopping lists before their trip, with more than 70% of those items actually purchased. This time, we spoke with Mr. Atsushi Nemoto of Dentsu Inc.'s Global Business Center, who is at the forefront of inbound-related solutions, about specific approaches and case studies.

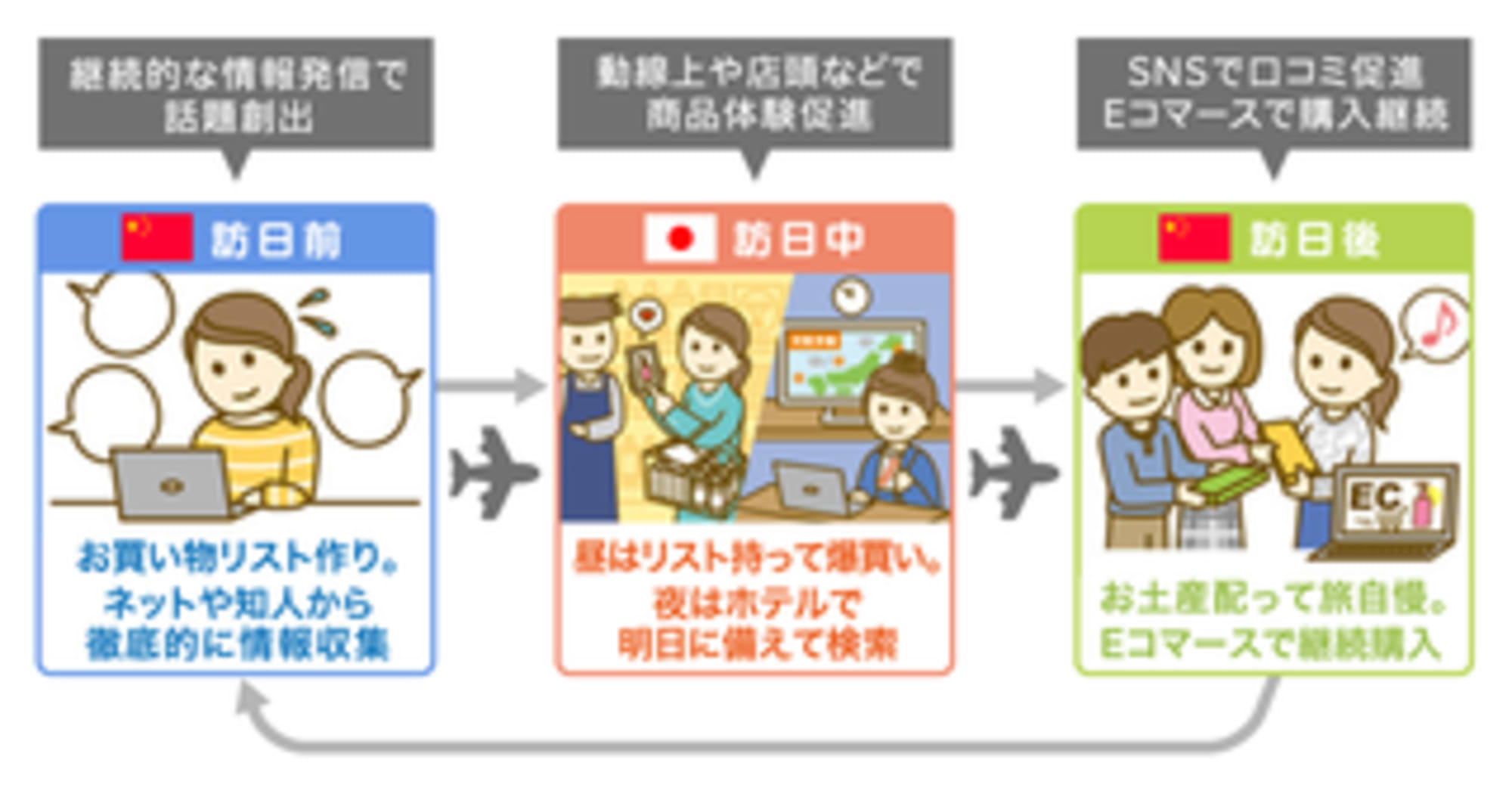

With the 2016 Spring Festival holiday (February 7-13) approaching, the peak timing for implementing strategies is this year-end and New Year period. First and foremost, getting on the shopping list is the most critical task . However , starting from the list, the goal is to build a "spiral" through seamless, integrated strategies before, during, and after the visit. The marketing perspective is crucial: using the visit as an opportunity for product experience and connecting it to continued purchases after returning home.

Pre-Visit: Secure Key Information Channels to Get on the List!

Spread information through online buzz, including search engine listing ads (like Baidu) and social media. Additionally, final approaches like handing materials directly when visas are collected are effective for reaching "100% of inbound travelers."

Point !

Create buzz that "reaches" people, primarily online

Use SNS like WeChat and Weibo to actively share information—including user experiences, pricing, and store details—leveraging videos. Maintaining a consistent volume of content to sustain ongoing buzz is vital.

Travel websites, whose presence grows alongside the surge in independent travelers, should be actively utilized—for example, by publishing firsthand experience blogs. Other options include TV program tie-ins and inbound-focused magazines or free papers, offering a rich menu of tools to foster pre-visit buzz.

Point !

E-commerce promotion is also essential

Many people check major e-commerce sites to verify sales records, see if a product is selling well or popular, and of course, compare prices. Promoting your products here is also essential.

WeChat collaboration example: "10 Medicines Every Japanese Household Should Keep in Their Medicine Cabinet This Winter"

During Japan visits: The peak of "spending sprees." Promoting product experiences is key.

Finally arriving in Japan. Using Narita Airport as the gateway, moving via tour buses or limousines. Recently, subway use is also increasing. While product sampling and OOH are standard, the real challenge lies in how effectively you secure the route to the hotel and execute a coordinated approach.

Furthermore, with the rise in repeat visitors and independent travelers, more tourists are directly viewing and purchasing products not on their lists at stores. Promoting product experiences after arrival, especially in-store initiatives, has become increasingly crucial.

Point !

Active information gathering continues during their stay

In fact, information gathering continues throughout their stay. They use mobile devices to search while shopping and stay in contact with family and friends. Looking at peak times, searches peak around 10 PM. After returning to their hotel room at night, they use their computer to thoroughly gather information for the next day. It's also known that they watch Japanese TV quite a bit.

Point !

Aiming for Viral Sharing on SNS

By creating opportunities for product and brand experiences to spread—like street events where they can take photos to brag about on SNS after returning home—it leads to future consumption.

Post-visit: Target repeat visits through travel bragging rights. E-commerce presents opportunities for continued and expanded purchases.

Sharing souvenirs while bragging about the trip. Word-of-mouth through SNS posts encourages their next visit.

Furthermore, cross-border e-commerce is gaining attention as a mechanism for driving continued purchases triggered by product experiences during the visit. While attention often focuses on the "spending sprees" during visits, the cross-border e-commerce market—including parallel imports and proxy purchases—is rapidly expanding. It has already surpassed spending during visits, reaching a scale of 600 billion yen. Projected to grow to 1.4 trillion yen by 2018, it is actually expected to outpace the growth speed of the spending spree market.

Point !

Leveraging Cross-Border E-Commerce for Repeat Purchases

Dentsu Inc. utilizes e-commerce systems to offer menus where customers can order and complete payment in their home country before visiting Japan, then pick up their tax-free goods upon arrival. We also provide support for opening stores on platforms like Tmall and JD.com, which don't require establishing a legal entity in China.

While shopping lists form the core of consumer behavior, as previously mentioned, 87% of purchases are made for items not on the list—a significant and unignorable proportion. This is particularly high for fashion and daily necessities. Interestingly, these unplanned purchases align with the top-ranked items bought by tourists from Hong Kong and Taiwan, regions with higher FIT (individual overseas travel) rates compared to mainland China ( "Shopping Trends of Inbound Tourists"). As FIT travel grows in China, more products will be selected in-store. Recognizing this new trend and leveraging it for in-store strategies is crucial.

While a further increase in foreign visitors to Japan is anticipated ahead of the 2020 Tokyo Olympics, barriers to cross-border shopping will decrease due to initiatives like the TPP. Utilizing cross-border e-commerce to connect the product experience gained during a visit to Japan with continued purchases or brand switching will become increasingly effective.

Dentsu Inc. possesses diverse teams and solutions within the inbound domain. The Dentsu Inc. Inbound Business Unit flexibly combines these varied resources to provide optimal solutions tailored to each client's challenges. kanko-unit@dentsu.co.jpまでお問い合わせください.