Japanese content such as anime and games is gaining attention and is viewed as a new business opportunity for Japan going forward. Many of you have likely heard about its popularity in ASEAN (Association of Southeast Asian Nations) countries through news reports and other sources.

To explore hints for utilizing Japanese character content, Dentsu Inc. and Dentsu Macromill Insight, Inc. jointly conducted the "Global Content Survey" from late 2020 to early 2021, investigating the awareness and popularity of Japanese anime, characters, and games.

Following the overall trends and trends in China and South Korea introduced in Part 1, this installment examines the results from ASEAN countries. The author, a member of the Strategy Unit at Dentsu Inc.'s Global Business Center, provides insights based on his three-year assignment in Vietnam.

Doraemon enjoys high recognition even in ASEAN. Following it are Detective Conan and Pokémon.

[Figure 1] Anime and Manga Content Awareness in ASEAN Countries

Across all ASEAN countries, Doraemon enjoys the highest recognition as an anime/manga content. This recognition is likely due to Doraemon having been broadcast as an anime and published as manga in ASEAN countries for a long time.

In Vietnam, manga has been published since 1992, and anime has also been broadcast for a long time, making it beloved by a wide range of generations. Furthermore, the creator, Fujiko F. Fujio, during his lifetime, declined royalties and established the "Doraemon Education Support Fund," a scholarship program for children in the region who wish to study but face difficulties due to circumstances.

Furthermore, Doraemon characters dressed in costumes visit elementary schools as road safety mascots, generating excitement, and many Japanese companies operating locally utilize the characters in collaborative campaigns and product lines. As a result of becoming everyday Japanese content encountered frequently in convenience stores and supermarkets, Doraemon has achieved high recognition.

Following Doraemon in recognition are "Detective Conan" and "Pokémon." These works also feature nationwide broadcasts of TV anime series. Their recognition is likely driven by multifaceted expansion, including manga distribution, theatrical film releases, and games like "Pokémon GO."

Detective Conan manju sold at Vietnamese convenience stores. Filled with custard!

One characteristic of ASEAN is that "NARUTO," ranked 11th in Japan, is number one in Indonesia and number two in Malaysia. When I asked anime-loving staff members in Vietnam about their favorite works during my posting there, the top answer was "BORUTO," part of the NARUTO series.

[Chart 2] NARUTO "Image" by Country

Looking at the image attributes for NARUTO, the two particularly highly rated are "cool" and "original." Another characteristic, especially in Indonesia and Malaysia, is that it is valued as "traditional" content.

When I asked the aforementioned local staff why they liked "BORUTO," they cited the flashy action scenes like battles and the fact that it's set in a world of "ninjas," which is quintessentially Japanese.

Incidentally, Vietnamese people tend to be very pro-Japanese. They are serious and their work ethic is similar to that of Japanese people. Japanese products like Honda motorcycles and Acecook instant ramen are deeply integrated into their daily lives.

However, even though they like Japan, what they actually know tends to be very "Japanese" things like "sushi" and "tempura." Similarly, many Japanese restaurants popular in Vietnam seem to emphasize creating a distinctly Japanese atmosphere.

Similarly, research suggests that across ASEAN countries, easily recognizable "typical" Japanese culture and content expressing it generally attract popularity.

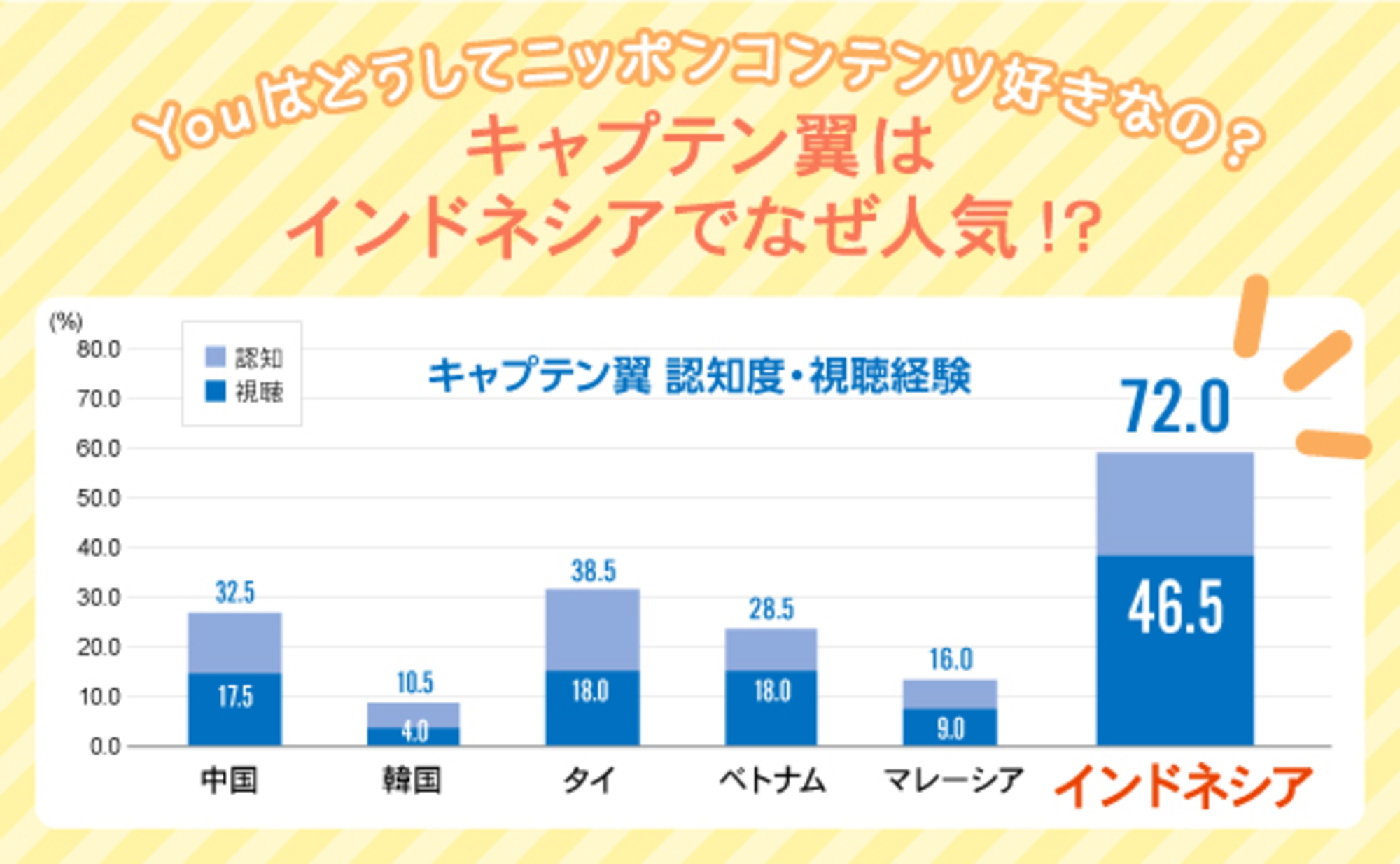

Captain Tsubasa: High Awareness and Viewing Experience in Indonesia

Particularly notable in the ASEAN scores was the high awareness and viewing experience of "Captain Tsubasa" in Indonesia. While awareness hovered around 30% and viewing experience around 15% in other countries, Indonesia's overall awareness was 72% and viewing experience was 46.5%. Furthermore, looking at Indonesia by generation, viewing experience was high across all age groups: 33.3% for teens, 58.7% for those in their 20s, and 48.0% for those in their 30s and 40s.

[Figure 3] Captain Tsubasa Awareness and Viewing Experience by Country

[Chart 4] Captain Tsubasa Awareness and Viewing Experience by Generation in Indonesia

Football enjoys immense popularity across ASEAN. Even in Vietnam, where I was stationed, national team matches took precedence over work, with fans cheering passionately and celebrating victories into the night.

Within ASEAN, Indonesia's domestic league is often called the most passionate league, reflecting its intense soccer fervor. This likely explains the strong compatibility with soccer-themed "Captain Tsubasa."

Furthermore, with the majority of the population being Muslim, anime broadcasts face strict censorship, limiting the number of shows available. Captain Tsubasa has been regularly aired since the 2002 Japan-Korea World Cup, which likely contributes to its recognition and viewership across all age groups.

The Significant Gap in Lifestyle Between Urban and Rural Areas

Japanese anime, characters, and other content are permeating ASEAN. Opportunities to encounter them daily are increasing: manga translated into local languages are sold in bookstores, anime airs on streaming services, and corporate use of the content is thriving. However, this situation is still confined to urban areas and has not yet expanded to the masses.

During my assignment in Vietnam until 2019, I visited various cities for events. However, once you step outside Ho Chi Minh City, you rarely see Japanese anime, characters, or related content.

Lifestyle differs significantly between urban and rural areas. For instance, while shopping at supermarkets is becoming mainstream in cities, rural shopping primarily involves street vendors. This means little exposure to promotional materials like POP displays or PR videos.

Furthermore, while smartphone ownership is high even in rural areas, financial constraints mean that when using smartphones, connecting via cafe Wi-Fi is the norm. Vietnamese TV stations and production companies upload their programs to YouTube, so watching Vietnamese TV shows on smartphones in cafes is commonplace. Not just Vietnam, but rural areas across ASEAN represent largely untapped territory for Japanese content.

ASEAN as a whole is experiencing rapid growth and is brimming with potential for new content businesses aligned with its future development. However, rather than simply rolling out Japanese content, it may be crucial to understand popular sports and cultures to find common ground, or to consider how easily recognizable aspects of Japanese tradition, like ninjas, might be perceived differently than in Japan.

In Vietnam, street vendors still form a vital part of daily life for many residents.

<Survey Overview>

Title: Global Content Survey

Survey Method: Internet survey

Survey Period: [Japan] December 17-24, 2020

[United States] [China] January 4–13, 2021

[South Korea] [Thailand]: January 5–14, 2021

[Vietnam] [Indonesia] January 6–16, 2021

[Malaysia] [UK] January 8–18, 2021

Participants: Men and women aged 10s to 40s in each country

Content Daily Users (Target Content: Manga, Anime, Various Games)

Survey Content: Understanding the power of Japan-centered content (manga/anime), games, and characters.

Expectations toward Japan and Japanese companies, consumer values in each country, etc.

Research Organizations: Dentsu Macromill Insight, Inc., Dentsu

*In addition to popular Japanese content, some popular overseas content is also included as options. Surveys are conducted and analyzed by categorizing items such as recognition and image.