"Kawaii" and Originality: Penetrating the UK and US Markets!? ~Global Content Survey: UK and US Edition~

To explore hints for new business opportunities by leveraging Japanese character content, Dentsu Inc. and Dentsu Macromill Insight, Inc. jointly conducted the "Global Content Survey" from late 2020 to early 2021.

This series has introduced the survey results while also incorporating insights from Dentsu Group employees based on their overseas assignments worldwide. We have delved into cultural differences across countries and the background behind the popularity of Japanese character content.

Part 1 covered the overall survey and results from China and South Korea, while Part 2 examined ASEAN findings and trends. This final installment focuses on the UK and US, incorporating the author's experience living in London and residing in the US.

How does Japanese content make its presence felt in the UK and US, countries that have long led global entertainment in film, fashion, music, and more?

*Survey overview available here.

"Pokémon" and "Mario" maintain top-tier presence, rivaling American content

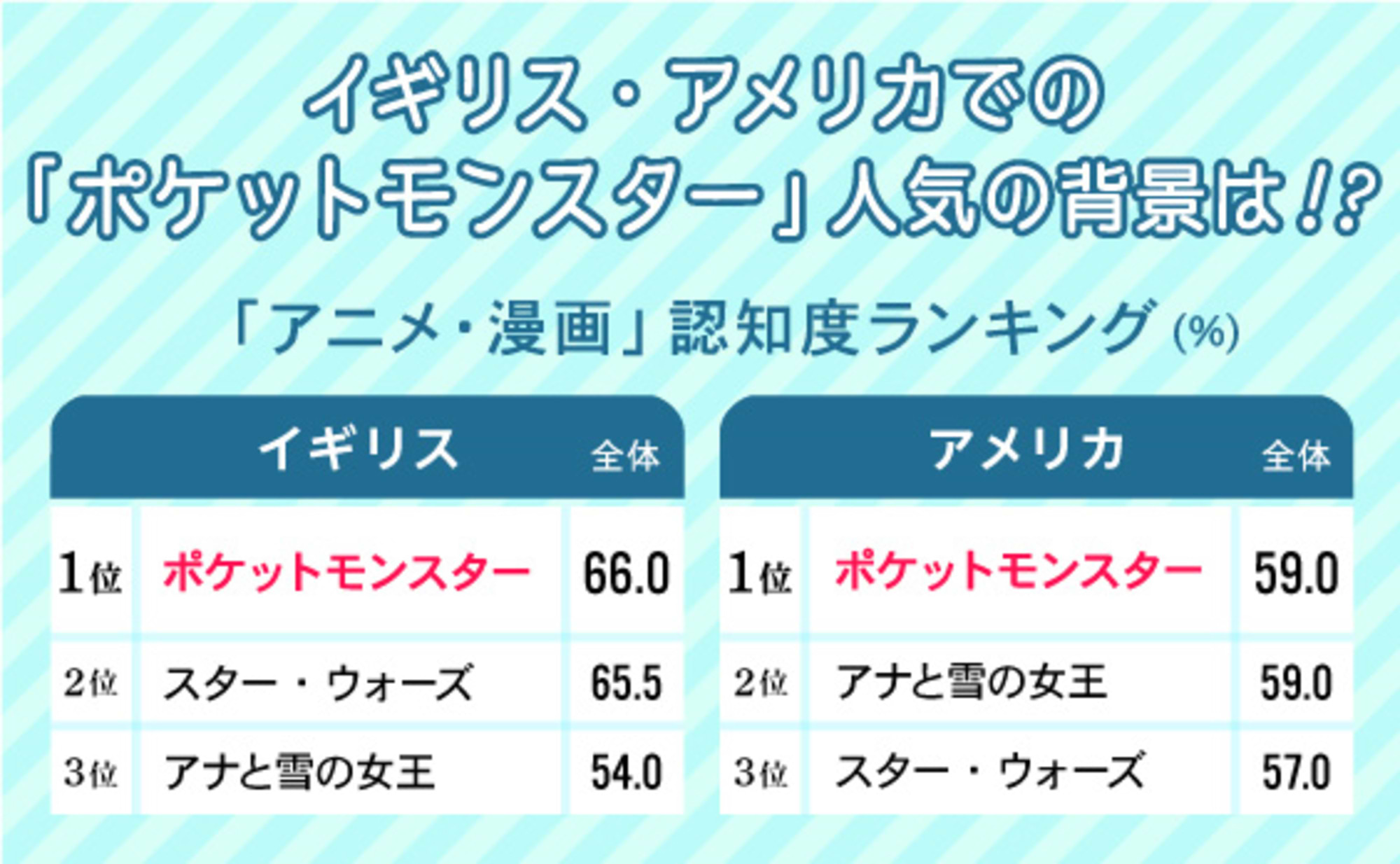

[Figure 1] "Anime/Manga" Recognition Ranking

This survey included both popular Japanese and international content as options. Within the "Anime/Manga" category, "Pokémon" ranked first in recognition in both the UK and the US, surpassing major American franchises like "Star Wars" and "Frozen." "Dragon Ball" also achieved high recognition, ranking 5th in the UK and 4th in the US.

Since the release of the first game in 1996, "Pokémon" has enjoyed popularity through its TV anime and movies, beginning its global expansion, starting with the US, in 1998. Since 2009, the "Pokémon World Championships," a global tournament to determine the world's top player, has been held. Furthermore, the worldwide hit "Pokémon GO," which became a sudden craze in 2016 as a location-based game for smartphones, is still fresh in our memories. It is thought that through this multi-dimensional and global expansion, it has become a familiar content worldwide, including in the UK and the US.

[Figure 2] "Character" Recognition Ranking

In the "Character" category, Japanese content also demonstrates significant presence. "Mario" ranked first in the US and third in the UK (second among those in their teens and twenties), surpassing characters like "Spider-Man" and "Mickey Mouse." Looking further down the list, characters like Hello Kitty achieved high recognition in both the UK and US, standing alongside major content like Winnie the Pooh and Snoopy.

While the top-ranked characters in each category in the UK and US have recognition rates around 60-70%, in Asian countries, content like "Doraemon" and "NARUTO" achieve first place with recognition rates exceeding 80-90%, indicating a difference in penetration.

One possible reason is that in Asian countries, anime and characters have become "mass content" widely loved by everyone from children to adults. In contrast, in the UK and US, they are generally still often perceived as "for children" or aimed at niche, specific groups.

In Asia, frequent exposure to Japanese anime and characters from childhood through TV broadcasts and other channels has led to their gradual "mass-marketization" over time, gaining recognition and support across broad age groups. In contrast, opportunities to encounter Japanese content remain relatively limited in the UK and US, likely contributing to its perception as more "niche."

Furthermore, compared to Asia, the UK and US often perceive character-based content like anime and manga as inherently "for children," which may be another reason for its lower penetration. For example, among major content, Disney's animated works are predominantly aimed at children.

Mario and Hello Kitty are already global majors. The "originality" and "stylishness" of Japanese content are also valued.

Next, using the "character" category as an example, we analyze the image positioning of Japanese content. In both the UK and US, "Mario" and "Hello Kitty" show a high correlation with the image of being "popular and famous worldwide." They are already perceived as global major characters, transcending the framework of Japanese content.

[Figure 3] Content Positioning (Characters): UK

[Figure 4] Content Positioning (Characters): United States

As you all know, "Mario" leveraged its global major presence to generate buzz with its performance at the Rio Olympics closing ceremony. In March 2021, a new area inspired by Mario's world was opened at Universal Studios Japan, with expectations for post-pandemic inbound tourism effects.

Regarding "Hello Kitty," it has gained popularity within the fashion context, with many celebrities—including Lady Gaga—publicly declaring their fandom, and through collaborations with apparel and cosmetics brands worldwide.

Furthermore, Hello Kitty's licensing strategy overseas, which grants significant creative freedom to local partners regarding design elements, may have contributed to its global reach. Successfully riding the wave of celebrity popularity and fashion trends, while being seen as a representative of Japan's "kawaii" culture, likely contributes to its perception as a global major.

Furthermore, while not yet widely recognized, "Gudetama" and the "Animal Crossing" series seem to be perceived as "stylish" in the UK and "original" in the US. A London-based friend of mine (a Japan culture enthusiast) is a huge fan of Gudetama. He passionately shared his love for it, saying, "When it comes to characters, 'kawaii' is usually the norm, but Gudetama is unique and cool because it embraces being lazy, complaining, and even has a dark side."

The ongoing popularity of Japanese culture also contributes to this trend.

As the survey results presented so far indicate, Japanese content is gaining significant popularity in both the UK and the US. Behind this trend, it seems the enduring popularity of Japanese culture plays a strong role.

In Europe, there was a wave of Japonism sparked by Japan's participation in the 1867 Paris Exposition. Perhaps inheriting this legacy, even today, especially in urban areas, Japan continues to be perceived as representing refined culture and style. Furthermore, while we previously noted that Japanese content is relatively "niche" in the UK and US, this can also be interpreted as being perceived, much like Japonism, as "somehow exotic" or "unique and cool!"

One example of this is a popular Japanese restaurant and bar in London that a local friend took me to during my time stationed there. The interior and overall atmosphere were themed around manga and anime.

Also, while I was stationed there, I attended the opening event for Wes Anderson's film "Isle of Dogs," and the Japan-themed event was very lively. As a Japanese person, I felt a little happy that Wes Anderson, known for his stylish films, chose a fictional near-future Japan as the setting for his film, and that many Londoners gathered at an event that resonated with that worldview to enjoy sake and other Japanese drinks.

Even if it hasn't become mainstream culture, Japanese culture is accepted as "cool" by trend-sensitive groups and certain individuals, and this is a major trend in the UK and the US. I think this is partly the basis for the popularity of Japanese content such as anime and characters.

Considering this, while Hello Kitty—which ranked highly in the survey—spread through pop culture and fashion contexts, I believe other Japanese content also holds potential for diverse expansion depending on how it's presented.

Looking at it from a different angle, I feel that Japanese content that is accepted in the UK and the US, where cultural differences are significant, tends to be simple and low-context.

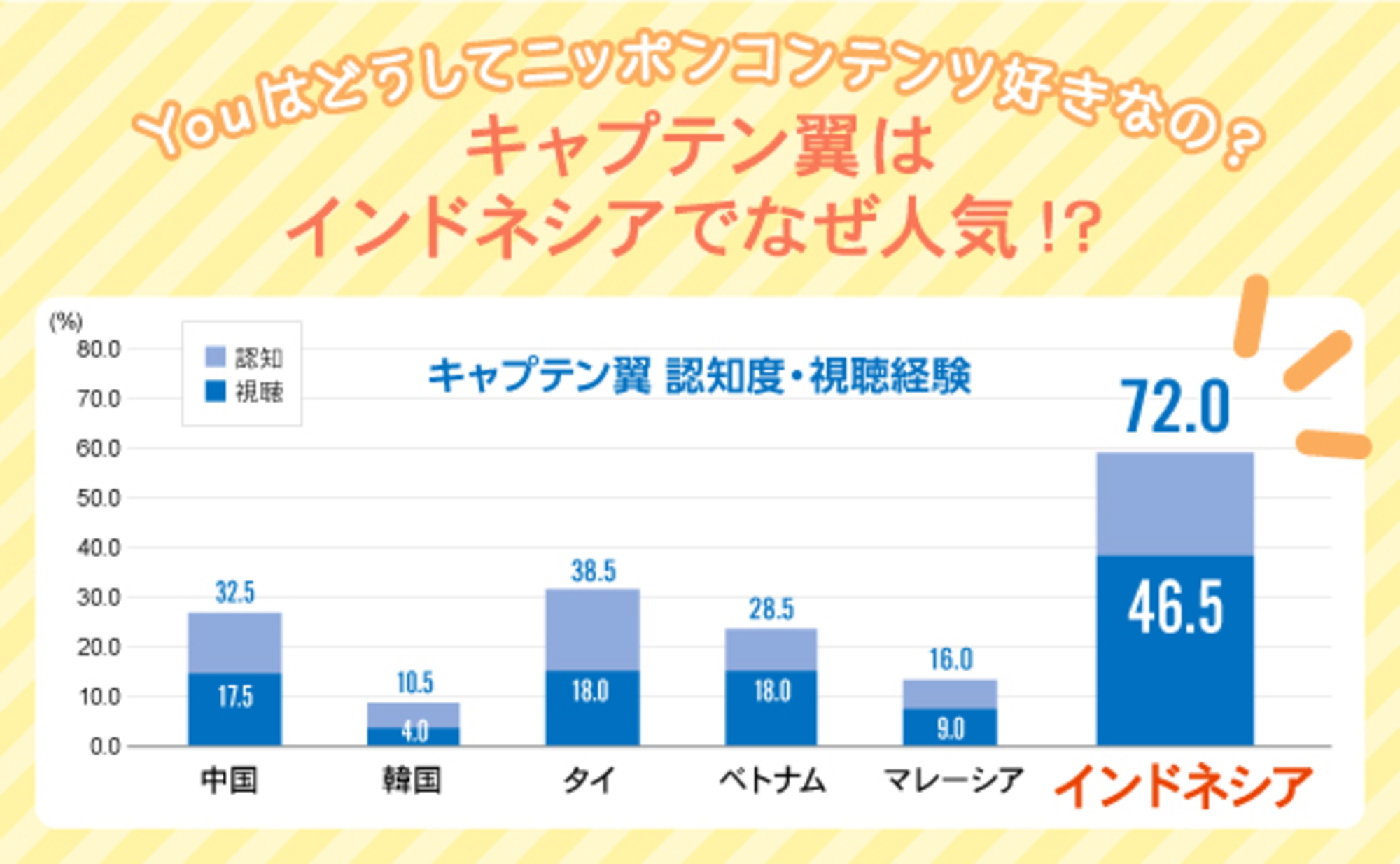

For example, high-context content with stories closely tied to Japanese lifestyle and daily life, such as Doraemon and Captain Tsubasa, is popular in Asia, but does not rank highly in the UK and the US. The top-ranked content in the UK and the US, such as Pokémon, Mario, and Hello Kitty, is set in (mostly) fictional worlds and features relatively low-context, simple characters.

While this differs from the deep and widespread penetration seen in Asia, I had intuitively sensed Japan's popularity in the UK and US. This survey provided a valuable discovery: quantitatively, Japanese content is achieving top-tier presence. I believe there remains significant potential to leverage unique characteristics like "kawaii" to expand business opportunities globally.

<Survey Overview>

Title: Global Content Survey

Survey Method: Internet survey

Survey Period: [Japan] December 17-24, 2020

[US] [China] January 4–13, 2021

[South Korea] [Thailand]: January 5–14, 2021

[Vietnam] [Indonesia] January 6–16, 2021

[Malaysia] [UK] January 8–18, 2021

Participants: Men and women aged 10s to 40s in each country

Content daily consumers (Target content: Manga, anime, various games)

Survey Content: Understanding the power of Japan-centered content (manga/anime), games, and characters.

Expectations toward Japan and Japanese companies, consumer values in each country, etc.

Research Organization: Dentsu Macromill Insight, Inc., Dentsu

*In addition to popular Japanese content, some popular overseas content is also included as options. Surveys are conducted and analyzed by categorizing items such as recognition and image.

Was this article helpful?

Newsletter registration is here

We select and publish important news every day

For inquiries about this article

Back Numbers

2021/06/23

Is there actually a demand for content that is distinctly Japanese and easy to understand? ~Global Content Survey: ASEAN Edition~

2021/06/15

Is "Strong Curiosity" and "Pursuit of Knowledge" the Key to Japanese Content's Global Reach? ~Global Content Survey: China & Korea Edition~

Author

Naoko Azusawa

Dentsu Inc.

Born and raised in Japan, I moved to the United States in my mid-teens and spent my high school and graduate school years there. After returning to Japan, he worked at the Tokyo office of a foreign strategic consulting firm before joining Dentsu Inc. He handled strategy, marketing, and communication planning for a wide range of industries, including domestic and international consumer goods manufacturers, apparel, digital, and B2B companies. He was stationed in Shanghai from 2011 to 2012 and in London from 2017 to 2019.