Note: This website was automatically translated, so some terms or nuances may not be completely accurate.

Ask Top KOL Lin Ping! China Influencer Marketing

Limping Zayleben

Sakuraba Maki

Dentsu Inc.

In China, influencers known as KOLs (Key Opinion Leaders) and KOCs (Key Opinion Consumers) significantly influence purchasing behavior, particularly in social media-based e-commerce.

Our guest is Lin Ping in Japan (hereafter Lin Ping), who shares Japanese culture, products, and services with China. On the Chinese social media platform Weibo, she boasts a total following of approximately 5.66 million as of April 2022, making her a top-tier Chinese KOL based in Japan.

Maki Sakuraba from Dentsu Inc .'s China business specialist team, CXC (China Xover Center), spoke with Lin Ping about the realities of influencer marketing in China and the keys to successful cross-border e-commerce.

<Table of Contents>

▼KOLs Foster Aspiration, KOCs Share Tangible Experiences

▼Kyoto Plum Wine Goes Viral! The Authentic "Discovery" and "Warmth" Followers Crave

▼Aim for "Branding" Over "Explosive Sales" in Live Commerce

▼The Key to Conquering China's Fast-Changing Market: Balancing "Speed" and "Prudence"

KOLs cultivate aspiration, while KOCs provide concrete usage insights.

Sakuraba: As a Chinese KOL based in Japan, you've gained significant influence, amassing around 5.66 million followers on China's largest SNS, Weibo. What made you start sharing about Japan?

Lin Ping: I absolutely love Japanese movies. That's why I started learning Japanese, thinking, "I want to be able to watch Japanese films that don't have Chinese versions!" Eventually, my interest expanded beyond movies to Japanese culture and daily life.

After coming to Japan, I started sharing everyday life and travel information about Japan with my Chinese followers. With the boom in visits to Japan after 2010, my followers surged, and I was able to build a career as a KOL. Thanks to that, I'm now so busy I barely have time to watch Japanese movies anymore (laughs).

Sakuraba: Could you briefly explain the difference between KOLs and KOCs, which is essential when discussing the Chinese market?

Lin Ping: KOLs are characterized by the need to create high-quality content as a profession, having a large number of followers, and wielding significant influence. On the other hand, anyone who enjoys shopping and can share on social media can become a KOC.

It might be easier to understand if we think of KOLs as playing the role of "cultivating brand awareness, trust, and aspiration," while KOCs play the role of "delivering more relatable usage tips and personal impressions."

Sakuraba: I see, so their roles differ from a business perspective too. Why do Chinese consumers place such importance on information from KOLs and KOCs?

Linping: First, as background, social media rose to prominence among Chinese people in the late 2000s. Simultaneously, e-commerce platforms like Taobao became established, rapidly spreading the practice of gathering information online.

Additionally, compared to Japanese people, many Chinese are more proactive about sharing their private lives. This led to a massive increase in consumer-generated content, and from this, influencer-like figures emerged who gathered followers.

Sakuraba: It's true; compared to Japanese net users, they seem less resistant to sharing their private lives.

Lin Ping: And the fact that internet information itself can be accessed fairly by everyone, regardless of wealth, is a major difference from before. KOLs can now appeal to the "aspirations" of demographics that were previously unreachable.

The KOL business is growing rapidly. In China, it has established itself as an industry, with specialized KOL training schools and even publicly listed KOL-related companies.

Kyoto Plum Wine Goes Viral! The Authentic "Discovery" and "Warmth" Followers Crave

Sakuraba: Among them, Lin Ping is active as a top-tier Chinese KOL based in Japan. What kind of content creation do you focus on?

Linping: For example, when introducing Japanese products through tie-ups, I first try the product for two weeks before deciding whether to feature it.

Sakuraba: Really? So you sometimes turn offers down?

Linping: Yes. In fact, I might turn down more offers than I accept. I want to feature products with a compelling story or strong characteristics. Even if the product itself isn't particularly unique, if I find something about it truly impressive, I'll definitely share it. But I won't promote anything that seems a bit sketchy or has a poor user experience.

Sakuraba: I see. It's precisely because you're so selective that your followers trust you so deeply.

Limpin: If you make even one "false post," fans will leave immediately. The lifespan of a KOL is generally said to be around 3 to 4 years. Amidst a constant stream of new KOLs emerging, it's incredibly difficult to keep fans engaged, maintain their trust, and consistently produce high-quality content.

That's why I'm very careful about which products I feature. That said, Japanese products often have truly compelling stories and a refined user experience, which makes them easier for me to introduce.

Sakuraba: Are there any categories or genres you find particularly easy to feature, Linpin?

Lingping: First, regardless of category, items with a compelling story or unique characteristics. Also, since I genuinely love traveling and have a strong motivation to support cosmetics and foods from all over Japan, I actually find it easier to feature products from small and medium-sized enterprises (SMEs) than from large corporations in urban areas. Additionally, products utilizing cutting-edge technology that embodies Japan's spirit are always very welcome.

Sakuraba: That makes sense—many of your followers seem to be travel enthusiasts.

Limpin: Exactly! That's why I value the "discovery feeling" and "human touch" that travel enthusiasts seek. For example, I recently came across a plum wine made by a Kyoto sake brewery. I thought it was the best plum wine I'd ever tasted and featured it.

When I first visited that brewery, the staff were polite but kept a bit of distance. But after I made an effort to share its merits with my followers and visited again, they invited me to their home and we enjoyed tasting the sake together. That's the kind of authentic warmth of Kyoto I aim to convey. Shipping costs and customs duties from Kyoto to China add up to quite a bit, but a mini plum wine craze is happening among my followers! (laughs).

Sakuraba: I felt the value lies in information based on real experiences, rather than typical official promotions. Thinking about it, Chinese KOLs in Japan are crucial for Japanese companies, especially regional SMEs. How many are there?

Linping: I'd say there are about 100 Chinese KOLs in Japan right now. Many started by sharing travel-related content on social media after the pandemic, gained followers, and evolved into KOLs.

The goal of live commerce should be "branding" rather than "explosive sales"

Sakuraba: Live commerce by KOLs and KOCs is incredibly popular in China. From your perspective, Linping, are there product categories particularly suited for live commerce?

Linping: For live commerce, "visual appeal" works better than taste or tactile feel, so products with distinctive textures or packaging are easier to showcase. Specifically, I feel it pairs well with clothing, bags, and accessories. Cosmetics are another good fit.

Sakuraba: You also introduce alcoholic beverages, right? Would you say alcohol falls into the difficult category?

Limpin: Live commerce for alcohol is indeed challenging. The approach mainly focuses on the appeal of the brewery's story or suggesting ways to enjoy the drink. However, it's not essential for products to sell during the live stream. The key is to view live commerce not primarily as a "sales platform," but rather as part of your "branding activities."

Sakuraba: I thought live commerce was a space specifically focused on "selling," like running limited-time sales. But actually, it's being used for branding.

Lingping: Yes. Even in China, I don't think many manufacturers can generate significant profits solely through live commerce. More often than not, it's used as a platform to create opportunities for the target audience to recognize the product and try it once, rather than selling large quantities on the spot.

Sakuraba: So it's not just about discounting. That means it's crucial for both companies and KOLs to approach it from the start with the mindset that it's a branding opportunity.

Linping: Exactly. That said, consumers naturally seek "good deals" in live commerce, so limited-time discounts and campaigns are essential. Beyond that, the key is to focus on showcasing your product's strengths rather than chasing massive sales. It's okay if sales per stream are low; the goal is to cultivate customers who become repeat buyers.

Sakuraba: Live commerce hasn't really taken root in Japan yet, but if you're considering e-commerce targeting Chinese consumers, it's definitely something you'd want to utilize. Do you have any advice for Japanese companies looking to launch live commerce?

Linping: Consulting with Japanese companies, I often notice many confuse live commerce with TV shopping. It's actually closer to a pop-up store in a department store. In other words, it's not about one-way information delivery like TV shopping; the key is "interaction" with customers who happen to pass by.

KOLs actively engage with viewer comments and even have conversations unrelated to the products. Since customers seek enjoyment from live commerce, the key is "whether you can entertain those who tune in."

Also, if you're doing live commerce, you should study presentation techniques like lighting, image quality, and camera angles. Customers won't buy if they can't clearly see a product's texture or color. There are even tons of live commerce manuals in China (laughs).

Sakuraba: I'm surprised there are so many live commerce manuals being sold. KOLs really do their homework, don't they?

The key to conquering China's fast-changing market is balancing "speed" and "caution"

Sakuraba: I imagine many of your followers are Gen Z. Are there any characteristics unique to China's Gen Z?

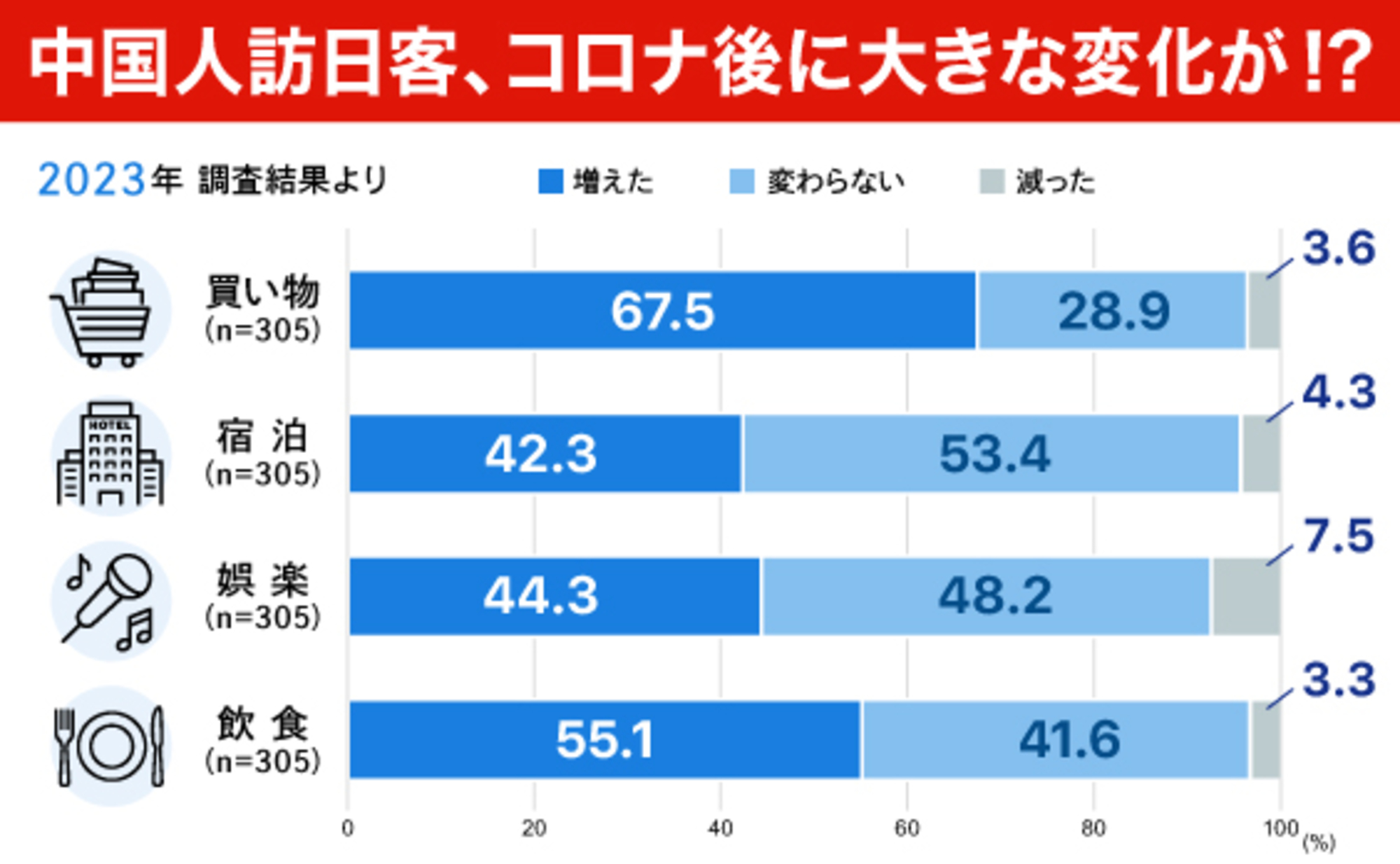

Linping: Their information gathering skills are exceptional, needless to say. But I don't think they share the sense of "we used to be poor" that my generation or our parents' generation feels. Gen Z readily wears high-end international brands, but they also have no qualms about buying Chinese products if the quality and design are good.

Take home appliances: our generation valued Japanese products for their durability and longevity. But young people today live at a pace where they replace even their phones every year or two. This lifestyle doesn't quite align with the "long-lasting" and "sturdy" characteristics often associated with Japanese goods.

Sakuraba: That's a significant shift. Would it be difficult for China's Gen Z to develop an affinity for Japanese brands that evoke a sense of story or history?

Lin Ping: Not necessarily. It's just a general trend. China is a populous country (approximately 1.4485 billion people according to the 2022 World Population Report, ranking first globally), so there are still many people who appreciate Japan's traditional meticulousness.

Moreover, the aesthetic sensibility Japan has cultivated over centuries isn't easily replicated. So, I believe apparel and art-related fields with high design appeal still have potential to resonate with China's Gen Z.

Sakuraba: So it's no longer enough to compete solely on quality like in the past. Products that convey Japan's strengths through design and other elements seem to hold potential.

Lin Ping: Even when making high-quality products, "speed" is crucial in China. Things change so rapidly that products might become outdated while you're carefully testing and developing them. Balancing quality and speed is key.

On the other hand, "caution" cannot be ignored in cross-border e-commerce. If Japanese companies enter this market, they need to find truly reliable partners in China. It's best to carefully scrutinize where to allocate funds, while receiving appropriate advice from staff or external partners who are well-versed in the realities of doing business in China.

Sakuraba: Having KOLs like Linping involved as advisors for product development and marketing would be a huge asset for brands.

Linping: Actually, there are cases where I'm involved from the product development stage, exchanging opinions and offering advice. However, without specific projects, there aren't many opportunities to interact with manufacturers. I think it would be great to have a more open "platform" for information exchange.

Sakuraba: Dentsu Inc. also aims to meet client needs for authentic Chinese insights by collaborating with KOLs. Finally, is there anything you'd like to convey to Japanese companies considering cross-border e-commerce into China?

Linping: Chinese consumers are becoming increasingly discerning. Even so, I believe Japanese products remain highly competitive. In all my experience introducing Japanese goods, I've never received complaints from fans about their quality. That's truly remarkable. It shows how much pride you all take in creating such exceptional products.

That's precisely why it's essential to devise ways to "make people aware" of your products' appeal. Please leverage KOLs and KOCs effectively to create opportunities to gain Chinese fans and word-of-mouth.

Sakuraba: It was very educational to learn about China's real-world trends—from influencer marketing and live commerce to Gen Z behavior—which we're increasingly proposing to clients at Dentsu Group. We look forward to continuing our collaboration.

For planning and executing influencer marketing campaigns utilizing KOLs and KOCs, please consult Dentsu CXC or the Business Transformation Division.

Dentsu Inc. China Xover Center

< dentsucxc@dentsu.co.jp>

Was this article helpful?

Newsletter registration is here

We select and publish important news every day

For inquiries about this article

Back Numbers

Author

Limping Zayleben

KOL

Lin Ping in Japan (林萍在日本), a Chinese KOL based in Japan who shares information about the country. Her Weibo account has over 5.66 million followers. "Lin Ping in Japan" means "Lin Ping residing in Japan" in Japanese.

Sakuraba Maki

Dentsu Inc.

Business Transformation Division

Senior Marketing Director

With over twenty years of experience in marketing planning, I have supported clients across diverse industries in areas such as product development, marketing strategy, and communication strategy formulation. Stationed at Dentsu Inc. Shanghai since 2014, I oversaw the planning division. Returning to Japan in December 2019, I joined CXC. Possessing deep expertise in the Chinese market and Chinese consumer insights, I support Japanese companies entering the Chinese market and Chinese companies entering the Japanese market.