The inbound industry suffered a major blow during the COVID-19 pandemic, but it is now recovering with momentum exceeding pre-pandemic levels.

Chinese visitors to Japan, who were overwhelmingly dominant before the pandemic, have not yet fully returned. As of May 2024, their numbers alone remain below those of visitors from South Korea. Nevertheless, Chinese tourists spend more during their trips than visitors from any other country, approximately 1.5 times more than South Koreans, making their potential undeniable.

This article explores insights for future inbound tourism strategies, particularly targeting Chinese visitors, based on the 'Dentsu Inc. Inbound Survey' conducted in 2021, the height of the pandemic, and in 2023, when COVID-19 was reclassified as a Category 5 infectious disease.

The key phrase is:

- "From Quantity to Quality"

- "From inbound to crossbound"

- "From sales promotion to building fans"

Maki Sakuraba and Yao Nong of Dentsu CXC, experts on the Chinese market, discuss these points!

*Survey overview here.

Visitors to Japan: From First-Time Visitors to Hardcore Repeat Visitors!

*Percentage composition (%) is rounded to the second decimal place, so totals may not always add up to 100%.

Sakuraba: Among Chinese visitors to Japan after the downgrade to Category 5, about half are "repeaters" who have visited Japan four or more times, love Japan, and are familiar with Japanese tourism. Furthermore, about 75% of those planning to visit Japan in the future have visited Japan two or more times.

This shows that those eager to visit Japan immediately after the pandemic subsides are repeat visitors who are already familiar with Japan. Why do they keep coming back?

Ma: Currently, most Chinese visitors to Japan are those who can obtain what's known as a "multiple-entry visa." These individuals want to come to Japan whenever they can, and they can. The weak yen is providing an additional tailwind.

For these individuals, Japan is "a country where they can experience high-quality, everyday life that feels close to home." Japan offers abundant pre-trip information and well-developed, accessible infrastructure. Consequently, for those with a strong desire for experience-driven consumption, Japan holds a unique appeal. Many come seeking not extraordinary, out-of-the-ordinary experiences, but rather moderate surprises and stimulation that feel like an extension of their daily lives.

Sakuraba: So, the repeat visitors who make up the majority of Chinese tourists to Japan differ from general tourists in both their behavior and what they value. Let's look at their behavior based on the survey results.

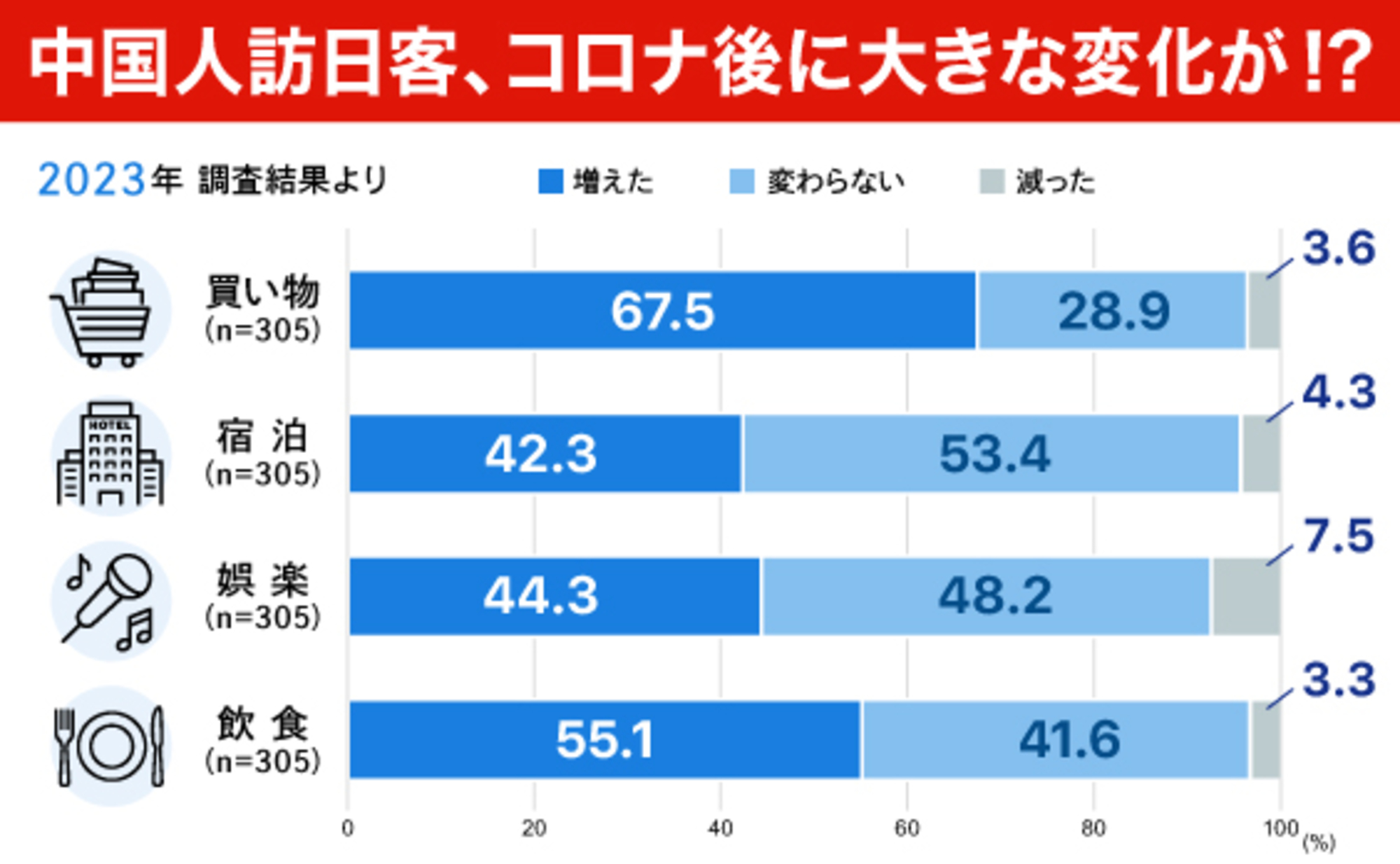

Ma: While there is a trend in Japan toward shifting spending from goods to experiences, 70% of people increased their shopping expenditure, indicating they still spend significantly on purchases.

For repeat visitors, shopping is no longer just about souvenirs. They are buying "items only available in Japan" or "items that meet their specific preferences and requirements" for themselves. Therefore, the easier it is to find these items through prior research and the clearer the purchasing process, the more likely they are to buy.

Sakuraba: The shift toward experiential consumption is also a trend clearly identified in the survey, right?

Ma: When asked why they chose Japan as their travel destination,

- "I want to enjoy Japanese gourmet food"

- "I want to learn more about Japanese history and culture"

- "I want to walk around neighborhoods beyond the tourist spots"

Interest in Japan is the driving force. Many also desire experiences similar to those of Japanese people—experiences that feel like living in Japan, not just being tourists.

Sakuraba: Speaking of experiences, what about dining?

Ma: Regarding meals during their visit to Japan,

- "I have had/will likely have more opportunities to visit restaurants popular with Japanese people, not just tourist-oriented ones" (51.5%)

- "Opportunities to eat local specialties and regional cuisine have increased/are likely to increase" (45.9%)

- "Opportunities to visit restaurants serving Italian, French, or other non-Japanese cuisine have increased/are likely to increase" (42.6%)

are the top three responses. This indicates an increase in visitors utilizing popular eateries among Japanese people, not limited to Japanese cuisine. Additionally,

- "I have had/will likely have more opportunities to eat seasonal Japanese foods" (40.0%)

shows that opportunities to gain a deeper understanding of Japanese cuisine are increasing.

Sakuraba: So, Chinese tourists who initially ate and shopped at very touristy spots are developing a deeper interest in the "real Japan, not just for tourists" as they return multiple times.

Ma: I agree. A similar trend is seen in the places they visit after their initial trip to Japan, with

- "I chose popular tourist spots that Japanese people often visit" (48.5%)

- "Chose places where they could experience Japanese daily life" (47.5%)

- "Chose places with traditional events or local festivals" (47.2%)

are the top three choices. Since repeat visitors have already experienced the standard spots popular with Chinese tourists, it's clear they prefer more authentically Japanese experiences.

However, they don't go as far as "hidden gems known only to the initiated." It's also clear that while these places may not be known to Chinese tourists yet, they need to be popular among Japanese people and have a sense of being "mainstream in Japan."

Sakuraba: Regarding shopping, what changes have you observed?

Ma: Looking at categories, "cosmetics" remain popular, but "clothing," "food," "daily necessities," and "medicines" are increasing. We also see changes in reasons for selecting products:

- "I started buying products popular among Japanese people or products that became a topic of conversation" (41.6%)

- "I started buying jewelry, accessories, and art pieces with Japanese design or style" (36.7%)

- "I started buying products featured in Japanese fashion or trend magazines" (36.1%)

These are the top three. There's a clear trend toward popularity for items Japanese people are buying or products trending in Japan.

Sakuraba: Compared to before COVID, it feels much more like buying from a connoisseur.

Ma: For repeat customers, it's important that the purchasing experience has a "story" and "adds to their knowledge." I think it's crucial to stimulate a sense of superiority – "I know about good Japanese things" – rather than just consuming goods. To turn high-quality inbound tourists who pursue essence into fans of our own brand, , it's important for them to understand the brand's history and philosophy.

Is the strength of Japanese entertainment content overwhelming!?

Sakuraba: Another point particularly noteworthy when comparing to pre-COVID times is the diversification of tourism elements, especially the heightened interest in Japanese subculture and entertainment.

Sakuraba: In the survey, when asked , "What would you like to do if you went to Japan? Please tell us up to five things you are particularly interested in," the largest increases were as follows:

- "Want to visit theme parks" (17.8% → 36.1% )

- "Experience new fashion and lifestyle trends" (20.5% → 29.8% )

- "Experience subculture like movies, anime, games, andcharacters" (25. 3% → 33.1% )

- "Enjoy entertainment like shows, live performances, and concerts" (19. 3% → 26.9% )

Another survey also revealed the strong influence of Japanese anime and characters. This affection isn't limited to young people; even those born in the 80s, now in their 40s, show strong attachment to their favorite Japanese anime and characters.

Ma: It seems they have particularly fond memories of the anime they watched as children. For Gen Z, Japanese subculture is a trend to enjoy, while for Chinese people born in the 70s and 80s, it represents "nostalgic consumption of their youth." I believe leveraging Japanese IP will be crucial when considering future inbound tourism.

Sakuraba: While Chinese visitors to Japan have a high repeat rate, we also surveyed how their satisfaction with Japan travel has changed compared to pre-COVID times. The results showed that 47.5% felt "more satisfied than before COVID," while 43.0% felt "just as satisfied as before COVID," indicating that 90% are satisfied with their Japan trips.

However, we also observed a slight tendency for satisfaction to be lower among those visiting Japan frequently and those with higher incomes. We must not forget to make efforts to further enhance satisfaction.

Ma: That's right. The more times people visit Japan, the higher their expectations become. It's crucial to constantly provide repeat visitors with surprises and new discoveries. Especially for Chinese visitors who love Japan, there's a strong tendency to want to experience and enjoy the "real" Japan, the authentic Japan, through their travels. If we can continuously create compelling experiential content aimed at this, it will lead to higher satisfaction and increased goodwill.

Inbound tourism is an opportunity to increase your company's fan base overseas.

Sakuraba: So far, we've seen that current Chinese visitors to Japan are mostly repeat customers who love Japan and want to understand and experience it more deeply.

However, when researching inbound demand, we felt it was insufficient to only ask about "purchasing behavior during tourism in Japan." Therefore, in this survey, we also asked about how these individuals interact with Japanese company brands in China before and after their trips.

Ma: Yes. The primary channel for purchasing Japanese products in China remains e-commerce. Compared to before the pandemic, we found that for "cosmetics," "food," "clothing," and "daily necessities," opportunities to purchase from "cross-border e-commerce flagship stores from Japan" have increased compared to "domestic Chinese e-commerce flagship stores. "

Even without a base or sales agent in China, the growing "opportunities to sell directly to Chinese consumers from Japan" represent a chance for Japanese companies. This is because customers encountered during inbound travel are not just "first-time visitors"; it becomes possible to maintain them as ongoing customers afterward.

In Chinese e-commerce, a "flagship store" refers to an official store selling only the company's own brand products. Here, "domestic flagship store" means Japanese brands selling products from mainland China, even if they have no local bases or distributors there. On the other hand, a "cross-border e-commerce flagship store" refers to an official store within a "cross-border e-commerce platform" like Tmall Global or JD Worldwide, selling products directly from Japan.

Sakuraba: When we talk about inbound tourism, there's a tendency to focus too much on "promotional strategies for tourists," thinking about how to get them to consume products and services during their trip to Japan. However, people who spend money on inbound tourism also tend to have a high purchasing intent for cross-border e-commerce.

Therefore, rather than just "tourists," I believe it's crucial to turn them into "brand fans." This allows us to maintain a lasting connection with them as "crossbound" customers—neither purely inbound nor purely outbound.

Ma: At Dentsu CXC, we advise Japanese companies to view inbound not merely as domestic promotions for overseas travelers, but as an opportunity to acquire overseas consumers. We propose integrating inbound and cross-border e-commerce into a unified strategy. In some cases, while developing an inbound strategy, companies conclude they should also re-examine their domestic strategy.

When the number of Chinese visitors to Japan recovers to pre-pandemic levels, inbound consumption will become a market Japanese companies cannot afford to ignore. It is vital to start strategically considering inbound as a business now, rather than scrambling later.

[Survey Overview]

・Survey Name: Dentsu Inc. Inbound Survey 2023

・Method: Online survey

・Respondent Criteria

Region: Beijing, Shanghai, Guangzhou

Age & Gender: Men and women aged 20–39

Monthly Household Income: ¥10,000 or more

Criteria: Individuals with prior Japan visit experience, those who traveled to Japan after January 2023, and those planning to travel to Japan within the next year

・Sample Size: 400 respondents (equally divided between men and women in their 20s and 30s)

・Survey Period: Friday, December 8, 2023 – Monday, December 18, 2023

[Survey Overview]

・Survey Name: Dentsu Inc. Inbound Survey (Japan Brand Survey) 2021

・Survey Method: Online survey

・Respondent Criteria

Region: Beijing, Shanghai, Guangzhou

Age/Gender: Men and women aged 20–39

Monthly Household Income: ¥10,000 or more

Criteria: Traveled to Japan within the past 3 years (excluding business trips or inspections) and considering future travel to Japan

・Sample Size: 400 respondents

・Survey Period: Friday, September 17, 2021 to Wednesday, September 22, 2021

If you are interested in cross-border e-commerce targeting China, please feel free to contact Dentsu Inc. CXC!

Business Transformation Division, Dentsu Inc. China Xover Center

< dentsucxc@dentsu.co.jp>