Note: This website was automatically translated, so some terms or nuances may not be completely accurate.

Viewing TV as a "device." What is Lifenet Life's advertising strategy?

Yasuhiro Hida

Lifenet Insurance Company

Shinichi Kanemoto

Septeni Japan Co., Ltd.

Kō Kuboya

Dentsu Inc.

Hama Daiki

Dentsu Digital Inc.

~Evaluating the advertising effectiveness of "Terrestrial TV" and "Connected TV" using the same metrics!~

Currently, over 50% of TV devices in Japanese households are connected to the internet, and this connectivity rate is increasing year by year. This is what we call "Connected TV."

Related Series:"Connected TV" Changing Advertising Communication Strategy

Connected TV refers to internet-connected TV devices that allow easy viewing of online video content like YouTube and TVer. You could say it's like watching online videos with the same ease as changing terrestrial TV channels.

This time, we invited Yasuhiro Hida from Lifenet Insurance Company, who has initiated efforts to cross-utilize terrestrial TV commercials and Connected TV advertising, as our guest. We discussed approaches to Connected TV and cross-media planning.

This discussion features a roundtable format with: Shinichi Kanemoto from Septeni Japan, who manages digital advertising operations at Lifenet focusing on connected TV ad strategies; and Dentsu Inc. planners Wataru Kuboya and Daiki Hama, who support the company's media buying using analysis from "Response Connector Dashboard Pro" (hereafter "ResCon Pro") (※1).

※1 = Response Connector Dashboard Pro

A dashboard for measuring advertising effectiveness provided by the Dentsu Group. It measures the impact of both terrestrial broadcast and connected TV ads on viewers. It enables analysis and evaluation of both formats using the same metrics—something traditionally difficult to compare—and provides insights that can lead to new strategic initiatives.

Press Release: Cross-Platform Analysis of Conversion Effects for Connected TV Ads and Terrestrial TV Commercials

Visualizing Connected TV Advertising Effectiveness Using "The Same Metrics as Terrestrial TV"

──What exactly is " Connected TV advertising"?

Hama: It refers to ads displayed when viewing online video content on a TV screen. More specifically, we term "connected TV ads" those digital ads accessed via TV among all digital ads viewed on platforms like YouTube, TVer, or AbemaTV. The ad creatives themselves are identical to those displayed on smartphones or PC browsers.

Kanemoto: However, even though they're digital ads, connected TV ads share characteristics similar to terrestrial TV commercials. For instance, they often involve co-viewing, and consumers' receptiveness to these ads differs from that seen on smartphones or PC browsers. Additionally, unlike on smartphones or PCs, viewers cannot tap or click the ad to navigate to a landing page. Consequently, tracking direct actions during ad viewing is challenging, which is unique for digital advertising.

──Let's discuss the implementation of "Terrestrial TV Commercials × Connected TV Advertising" at Lifenet Insurance. Could you explain the background for introducing Dentsu Inc.'s ResコネPro this time?

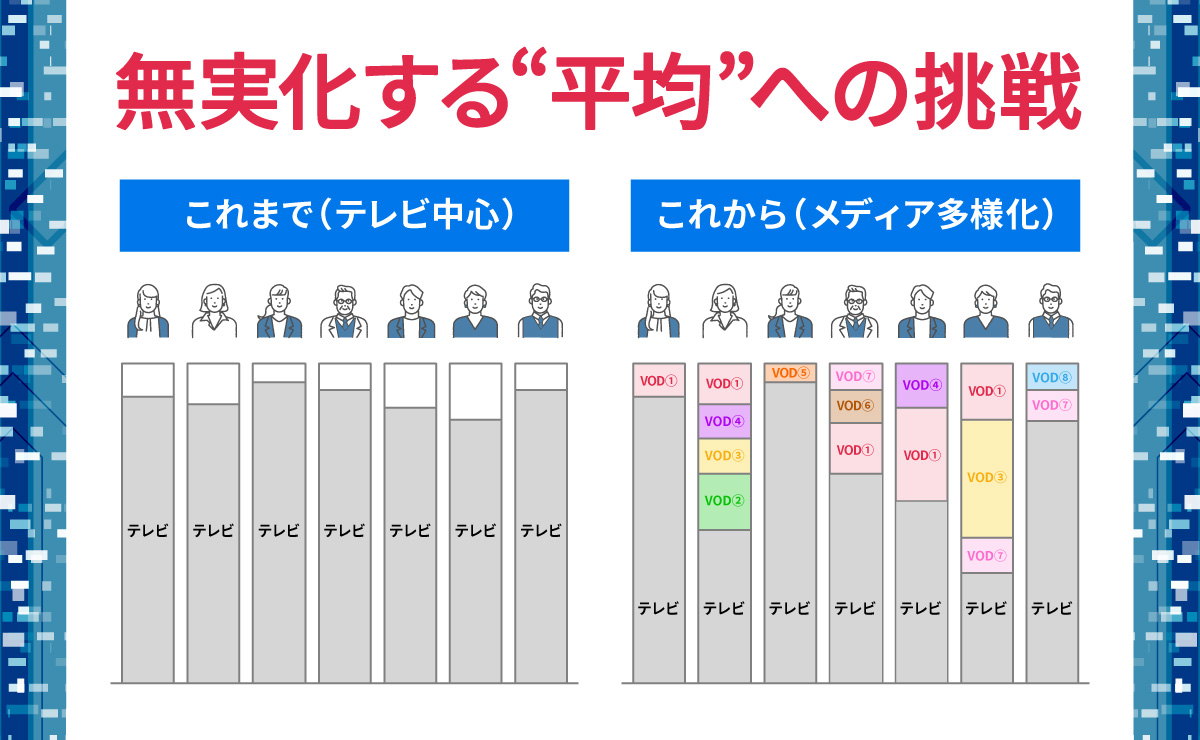

Hida: Lifenet Life delivers life insurance online. We don't engage in traditional face-to-face sales. Therefore, advertising is crucial for building awareness. Internally, we've long been asked, "Is terrestrial TV advertising really sufficient?" Each time, we've explained by showing results from effectiveness verification. However, in recent years, we started getting asked, "Why aren't you doing connected TV advertising?" Of course, we hadn't decided against it, but visualizing its effectiveness compared to terrestrial TV commercials was difficult. That's the background: we wanted to enable data-driven discussions, like "Terrestrial TV commercials have this much effect, and connected TV advertising has this much effect."

Kuboya: Actually, even before the release of ResコネPro, as a planner, I was proposing cross-media effectiveness verification for terrestrial TV commercials and digital ads, centered around Dentsu Inc.'s STADIA(※2). ResコネPro was released around that time, and since it enabled comparing the effectiveness of terrestrial TV and Connected TV, I also had Hama, the ResコネPro manager, participate as a planner.

※2=STADIA

A marketing platform based on Dentsu Inc.'s domestic-leading TV viewing log database. By matching TV viewing log data with digital behavioral data, it enables integrated on-off analysis.

──Let's cover the basics of Response Connector. While immediate measurement of terrestrial TV commercial effectiveness is often considered difficult, the Dentsu Group has been able to provide data acquisition similar to digital advertising through its "Response Connector Dashboard," correct?

Related Series:Startup-Style TV Commercial Utilization Techniques

Hama: Yes, we named it Response Connector because it measures and analyzes all responses from commercials and links them to subsequent actions. The previous Response Connector was called "Response Connector Basic," which provided immediate visualization of terrestrial TV commercial effectiveness. Specifically, it allowed analysis of advertising effectiveness toward conversions (CV) set as business KPIs, broken down by creative, time slot, day of the week, etc., after commercial airing.

The "Response Connector Pro" you are now utilizing features the addition of connected TV advertising to the analysis scope. On a single dashboard, you can compare and evaluate the effectiveness of both terrestrial TV commercials and connected TV ads using the "same metrics." You can analyze in detail website visitor counts, app download numbers, inquiry counts, and more.

<Response Connector Dashboard Pro Screen Image>

Hida: When I saw the press release for Response Connector Pro, I thought, "This is it!" Our company could already verify the effectiveness of terrestrial TV commercials alone, even before implementing Response Connector. However, we simply couldn't evaluate terrestrial TV commercials and connected TV ads using the same metrics. We couldn't see how much ad volume our commercials were getting on YouTube or TVer by the hour or minute, and we couldn't see the immediate response. Response Connector Pro lets us get that kind of information and evaluate terrestrial TV commercials and connected TV ads using the same metrics on a single tool. That's why I knew this was the only option.

Kanemoto: Rescone Pro essentially converts between different units of ad volume: "GRP (Gross Rating Points) for terrestrial TV commercials" and "imp (impressions) for digital ads." This allows us to compare the effectiveness of terrestrial TV commercials and connected TV ads on conversions side-by-side using the same scale.

By converting GRP to impressions and vice versa, you can compare terrestrial TV with YouTube and TVer side-by-side!

──So Rescone converted the connected TV ad effectiveness Lifenet Life Insurance sought into GRP equivalents, enabling comparison with terrestrial TV commercials.

Kanemoto: Yes. As a digital advertising strategist at SEPTENI CO.,LTD, I manage and analyze Lifenet Insurance's mid-funnel campaigns. This past March, we ran ads on terrestrial TV, YouTube, and TVer, then analyzed their respective effects. Previously, we could only evaluate offline and online separately using different metrics (GRP and impressions). Comparing them using the same metric allowed us to identify specific areas for improvement: "Maybe we should do this more."

Hida: From the advertiser's perspective, there was a challenge in whether we could treat ads deemed "effective" based on GRP and those deemed "effective" based on impressions equally. We wanted to move beyond evaluating individual campaigns' merits and instead lay everything out on the same table for a bird's-eye view, aiming to explain "how things are shaping up overall." This time, comparing them using the same metric revealed that terrestrial TV commercials contribute more significantly to our defined conversion points. This doesn't mean "digital is no good," but rather that "we can now discuss based on analysis results using the same metric" is a huge step forward. Without understanding the differences, we can't discuss the next steps.

Kuboya: The strength of digital, not just Connected TV, is its targeting capability—pinpointing specific genders, age groups, or attributes like "not yet insured." But rather than just saying "they each have different roles, so both are good" and leaving it at that, ResConne Pro addresses the need to compare how much each ultimately contributes to business KPIs.

Hida: What was great about this initiative is that previously, we managed and operated budgets by splitting them into "offline advertising costs" and "online advertising costs." Now, instead, we've created a "TV device budget" framework. This allows us to discuss how to allocate the proportion between terrestrial TV commercials and connected TV advertising within that budget.

However, this "TV device budget" concept can be challenging to implement in an integrated way with agencies that only sell terrestrial TV commercials or those that only sell digital advertising, as they inevitably lean heavily toward one side. If you rely on a company that only does one, they'll inevitably push you towards "digital is the way to go now." In that sense, it's a real advantage and a blessing that Dentsu Inc., strong in terrestrial TV, and SEPTENI CO.,LTD, strong in digital, can work together in an "on-off integrated" system.

Should online and offline teams operate separately?

──What is the actual flow and structure for analyzing advertising effectiveness?

Kuboya: Mr. Kanemoto from SEPTENI CO.,LTD handles the effectiveness measurement, encompassing both terrestrial broadcast and connected TV, and provides us with detailed reports.

Hida: It's truly groundbreaking that a digital company like SEPTENI CO.,LTD would offer insights like, "This month, terrestrial TV commercials showed this particular advantage." Normally, wouldn't they be inclined to push digital options? But they maintain a stance of looking strictly at the numbers and seeking effectiveness and efficiency impartially. That makes me think, "With SEPTENI CO.,LTD, we can really explore the potential of connected TV."

Kanemoto: Thank you. At SEPTENI CO.,LTD, we are truly grateful to Lifenet Insurance for providing us with this opportunity.

For a digital-only agency like SEPTENI CO.,LTD, terrestrial TV commercial data is completely invisible. GRP is practically a foreign language, making it impossible to judge effectiveness or confidently propose, "Then let's handle this part online."

This time, however, Lifenet Life has been closely collaborating with us, sharing insights like "This is how we manage terrestrial broadcasts" and "These are the current challenges with web," making it much easier for us to propose solutions.

Hida: Lifenet Life has a system where both their offline and online managers feed information directly to Mr. Kanemoto. He takes all that in and conducts analyses and insights unique to integrated on/off strategies. I bet you never imagined, while working at SEPTENI CO.,LTD, you'd be invited to the client's offline regular meetings every week.

Kanemoto: Thanks to that, I learned how to interpret the Rescone Pro metrics. I'm truly grateful to receive insights and opinions from so many different angles. Certainly, for SEPTENI CO.,LTD, the core role is managing, operating, and reporting on connected TV ad delivery. But connected TV combines elements of both terrestrial broadcast and digital advertising, so analysis really needs to incorporate perspectives from both sides. In that regard, I think the proactive approach of everyone at Lifenet Life makes the process much smoother.

──What is Dentsu Inc.'s role in this process?

Kuboya: Since ResConne is a dashboard, our job extends to developing it to a state where "anyone, including the client, can view it." Beyond that, the "interpretation" can be done by the client themselves, sometimes by Dentsu Inc., and in this case, it's being handled by Mr. Kanemoto at SEPTENI CO.,LTD. Regardless of who performs the analysis, it's crucial that "everyone can see it using the same yardstick." This time too, after the ad delivery, we held a "review meeting" based on Mr. Kanemoto's report and clearly defined the next actions. I believe the three companies worked together effectively to get to this point.

Hama: Typically, both the client side and the advertising agency side have "online specialists" and "offline specialists," clearly separated by department or budget considerations, with meetings conducted one-on-one. This time, however, all the online and offline specialists from both companies are present together, and we're able to discuss things jointly with SEPTENI CO.,LTD as well. Since each person in charge can take ownership of both terrestrial TV and connected TV, I'm really impressed by Lifenet Insurance's integrated approach that avoids fragmentation.

──So you hold review meetings to discuss placements on terrestrial TV and connected TV, and plan next steps based on the results.

Kuboya: With typical commercials, we take about a month after a campaign ends to analyze and draw conclusions. But with Rescone, once terrestrial TV commercials start, we see initial results as quickly as the very next day. Plus, since connected TV ads are digital, we can adjust operations quickly, including adding more placements. This means we can optimize the overall campaign by increasing digital placements based on the analysis of terrestrial TV results.

Hida: This was perfect timing for us, as we were already considering that terrestrial TV commercials and connected TV ads shouldn't be treated as separate offline and online channels, but rather used together within the broader "TV device" category. We thought we could first gauge the initial response to the terrestrial TV commercial and, if the volume seemed insufficient, follow up later with connected TV ads.

Kanemoto: Exactly. We can see "last week's terrestrial TV commercials were at this level, and connected TV ads were at this level," then quickly adjust our strategy. In this case, after reviewing March's terrestrial TV commercials, connected TV ads, and overall GRPs, we can supplement the "shortfall" with connected TV ads. Rather than dividing it into TV and online, we can now formulate strategies for the entire "TV device" ecosystem. This expands options for future media planning, which is a positive development.

Isn't the goal "getting viewers to watch video ads all the way through"?

──For the initiative implemented in March, did you run the same creative assets on YouTube and TVer as you did for terrestrial TV commercials?

Hida: Yes, we did. To measure each medium's pure contribution to conversions under identical conditions, we defined "site visits" as the conversion and set the target conversion count as the KPI. We wanted to see how much each medium's ads contributed to site visits. The conclusion was that terrestrial TV commercials overwhelmingly contributed the most to site visits immediately after airing.

Hama: The key discovery this time was that the "winning assets" for terrestrial TV and YouTube are different. Analyzing the data clearly showed this.

Hida: Comparing YouTube and terrestrial TV, the timing of commercial airing differs, right? Viewing attitudes also vary. Seeing such stark differences made us realize anew that identical creative simply won't work.

Optimizing content like this is common practice when considering web videos. However, using Rescone allowed us to visualize this common sense as actual numbers and "confirm and compare it within the framework of TV devices," which was significant.

── What specifically makes YouTube different from terrestrial TV, and what kind of differences did you actually see?

Kanemoto: We saw a difference in results when we changed the position of the sound logo. For terrestrial TV and TVer, we delivered ad materials with the sound logo at the end. For YouTube, we also tried delivering materials where the sound logo played at the beginning of the ad. The result was that on YouTube, placing it at the beginning yielded better performance.

On YouTube, the skip button appears around the 5-second mark, causing massive drop-offs. However, if we could make an impression with the sound logo "Lifenet Life♪" within those first 5 seconds, even if viewers skipped partway through, "Lifenet Life" would stick in their memory. We were able to verify this kind of "common sense" using Rescone.

Kuboya: With typical connected TV ads, since viewers can't directly click or tap to go to a site like they can on smartphones or PCs, evaluation often relies on "complete view" – whether the video was watched all the way through. But getting people to watch the whole video isn't the only goal, right? Getting them to visit the site is crucial. So we designed it to be evaluated using deeper metrics: "How many people who saw the ad actually visited Lifenet Life's site?"

──I understand that efforts to measure cross-platform effectiveness across terrestrial TV and connected TV within TV devices accelerated after the March implementation. What is the current status?

Kanemoto: We're still at the stage of recognizing results and planning next steps. To translate insights from ResConne Pro into action, we'll need to identify winning patterns through ongoing PDCA cycles. Since ResConne evaluates metrics invisible in traditional operations, improving from here is where connected TV truly shines.

Hida: We discovered that even the same ad can have vastly different effects on conversions. Bridging that gap requires operational skill or creative strength. However, we've first achieved the milestone of "visualization." This allows me to report, "This is the level of difference we found," and "We plan to bridge it this way going forward." It also makes it easier to present the next steps.

──Based on these analysis results, what do you think are the respective values of terrestrial TV commercials and connected TV ads?

Hida: I believe the value of terrestrial TV commercials lies in their massive "reach" and the "response" that this reach generates. Comparing GRPs and impressions makes it immediately clear: the reach efficiency of terrestrial TV commercials as mass advertising is overwhelming. Furthermore, when a commercial airs seamlessly integrated into program content, the explosive power of the instantaneous response generated through social media and other channels is something only terrestrial TV can deliver. In terms of "getting noticed" and "getting known," nothing beats terrestrial TV commercials.

Kanemoto: Conversely, the value of connected TV advertising lies in its controllability—the ability to target precisely and deliver exactly what you want to the people you want to reach. It also offers the agility to pivot quickly and change direction within short timeframes. While everyone recognizes the strengths of each medium, the ability to compare them on the same playing field through connected TV has really energized discussions like, "Okay, let's aim for these numbers!"

Hama: Connected TV ads are digital delivery, so they run constantly, say 50 impressions per minute. But 50 impressions can't create the buzz and conversation that terrestrial TV does. Conversely, converting TV GRPs to impressions is staggering (laughs). You suddenly see numbers like 2 million impressions. I think connected TV will become a really strong medium if we analyze terrestrial TV's strengths and find ways to unleash even more explosive reach. In fact, AbemaTV's FIFA World Cup coverage and Prime Video's boxing broadcasts are already explosive content slots, right?

Kuboya: While it depends on the digital platform, for services like TVer that offer simultaneous broadcasts with terrestrial TV or exclusive live content, I imagine they'll prioritize viewing patterns similar to terrestrial TV. However, platforms like YouTube and social media don't seem focused on increasing the number of viewers per impression. Rather than explosive reach, they likely leverage traditional digital advertising strengths: data aggregation and targeting capabilities.

──How has the ability to gather cross-platform data been evaluated within Lifenet Life Insurance, including by management?

Hida: Based on these results, we've decided on one significant change. We're standardizing what we previously called the "offline budget" to the "TV device budget." We want to think in terms of how much we're allocating this month to that large-screen TV device. On top of that, we want to focus on optimizing the content we run on that device. This approach also addresses the question, "Is terrestrial TV alone sufficient?" and represents a major step forward in terms of budget optimization.

Hama: The term "TV device budget" really clicks. Fundamentally, users watching TV devices don't consciously think about whether it's terrestrial or digital, or which budget the ad they're seeing is coming from, right?

Hida: Exactly. From the viewer's perspective, it's not a major issue. Whether it's terrestrial or connected TV, it's still television.

Hama: Since users aren't conscious of it, I think the term "connected TV" itself might fade into obsolescence. And I hope the concept you mentioned, "TV device budget," becomes more widely adopted.

──Finally, could you share your outlook on Lifenet Life Insurance's future media planning?

Hama: Programmatic digital advertising inherently seeks "efficiency" and "ROI," which often leads to some form of budget shrinkage. While opinions may vary, to avoid shrinkage, we're exploring ways to quantitatively visualize and break down the explosive impact that terrestrial TV possesses. Regarding connected TV advertising, since its contribution to conversions is currently lower compared to terrestrial TV commercials, expanding the pie alongside efficiency is essential.

Hida: I'd like to share here that while we do aim for efficiency, we don't want to shrink. Of course, we'll pursue optimal budget allocation within TV devices, but we'd be thrilled if Dentsu Group shares our commitment to sustained upward growth and stays engaged with the same passion as us until the very end!

Kuboya: Thank you for your support! We believe we're just at the starting point for leveraging the explosive reach of terrestrial TV on connected TV. Thank you for today.

Was this article helpful?

Newsletter registration is here

We select and publish important news every day

For inquiries about this article

Author

Yasuhiro Hida

Lifenet Insurance Company

Sales Headquarters Marketing Department

Department Manager

After working at an advertising agency, an event planning and management company, and a PR firm, joined Lifenet Insurance in 2012. Served as Marketing Department Manager from 2018, overseeing advertising, public relations, and website operations. During the COVID-19 pandemic, led budget management, operational performance oversight, and performance reporting as Sales Planning Department Manager. Assumed current role as CMO in May 2023.

Shinichi Kanemoto

Septeni Japan Co., Ltd.

First Sales Division Second Sales Department

Performance Lead

As a sales representative at SEPTENI CO.,LTD, I primarily handled financial advertisers. I possess advertising operation experience in both direct response and branding domains, and have engaged in integrated online-offline marketing practices, including the utilization of connected TV. In this initiative, I am primarily responsible for media planning on the connected TV front.

Articles by this person

Kō Kuboya

Dentsu Inc.

Second Integrated Solutions Bureau

Planner

Engaged in developing media and business strategies based on quantitative and qualitative data analysis. Responsible for end-to-end execution—from building data environments that drive business growth across diverse sectors (consumer goods, durable goods, B2B, apps, IT, etc.) and formulating media strategies, to implementing PDCA cycles. Proficient in both internal and external tools and solutions across television and digital domains.

Hama Daiki

Dentsu Digital Inc.

Corporate Division, Corporate Planning Department, Strategic Planning Lead

While engaged in media planning operations, I also develop solutions addressing various challenges and needs arising in the field. This includes creating the "Response Connector Dashboard Pro" to visualize the effectiveness of TV commercials and connected TV. My focus extends beyond individual optimization in media planning to broadly achieve marketing efficiency and maximize impact, centered on overall business growth. Master of Engineering (Human Engineering/UX).