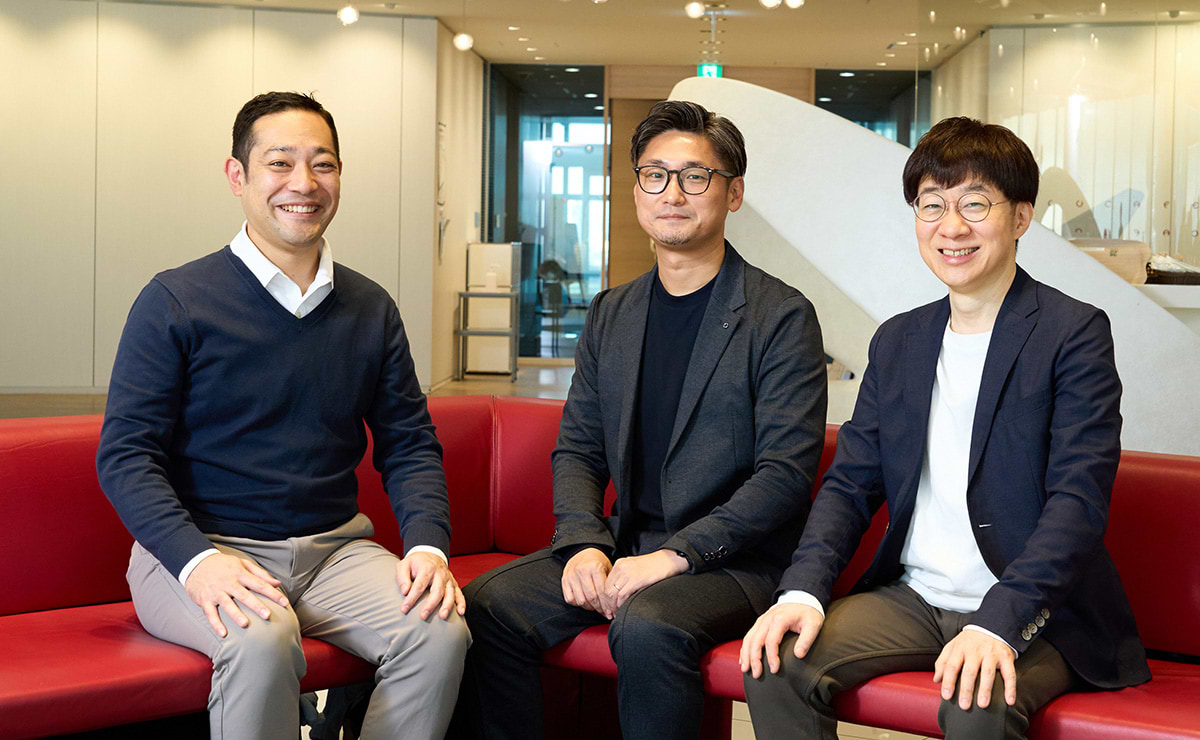

From left: Takashi Chiba (Dentsu Inc.), Hiroaki Sato (Nikkei BP), Naofumi Sato (Dentsu Inc.)

Unraveling 2024 consumption through the lens of desire and previewing 2025 desire trends!

This time, we change the format from our regular series to bring you a New Year's special roundtable discussion featuring guest Mr. Hiroaki Sato, former editor-in-chief of Nikkei Trendy.

On December 25, 2024, the webinar

"Nikkei BP × dentsu desire design: Analyzing 2024 Consumption and Predicting 2025 Desire Trends from a Desire Perspective"

was held.

However, some themes couldn't be fully covered in the limited time of the webinar. Therefore, this roundtable serves as a sequel to the webinar, where Mr. Naofumi Sato of DDD introduces three desire trends that weren't fully explored. Sharp opinions also flew from Mr. Hiroaki Sato and Mr. Takashi Chiba of DDD, sparking a heated discussion.

What are Japanese people seeking in these turbulent times? What are companies and brands trying to deliver? In this first part, we analyze and predict the desire trend "Trend Detox"!

Confronting Negative Moods! Six "Desire Trends" for 2025.

Takashi Chiba, Dentsu Inc.

Chiba: For this New Year's roundtable, we welcome former Nikkei Trendy Editor-in-Chief Hiroaki Sato as our guest. We'd like to focus on three "desire trends" we couldn't fully cover in our recent webinar. Since both of you are named Sato, we'll refer to you as Hiroaki-san and Naofumi-san from here on.

Sato (Hisaaki), Sato (Naoki): Nice to meet you!

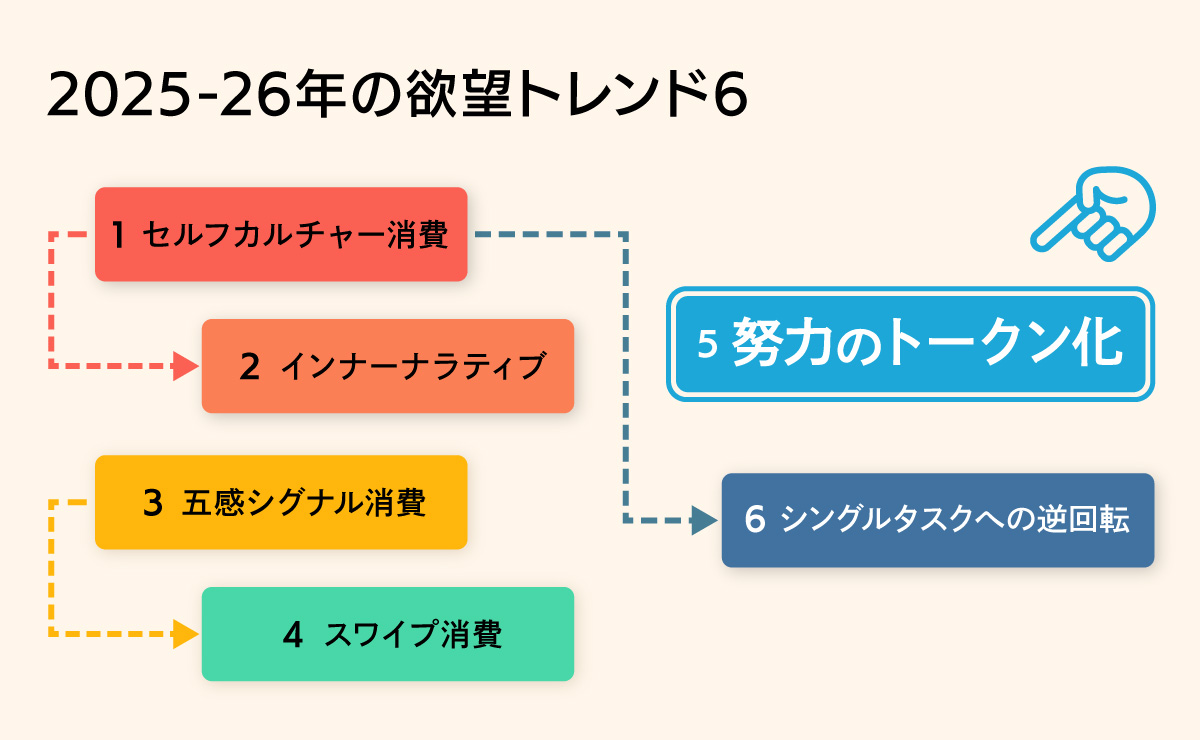

Sato (Naoki): Before we dive in, I'd like to share an overview of the "Six Desire Trends 2025" for Web Dentsu Inc. News readers. This is an analysis and proposal unique to DDD, predicting that the following six trends will define consumption in 2025.

- Desire Trend 01: Positive Boost

- Desire Trend 02: Journalistic Economy

- Desire Trend 03: Shin "Bamboo" from Pine, Bamboo, Plum

- Desire Trend 04: Trend Detox

- Desire Trend 05: Korea as a POP Filter

- Desire Trend 06 Seeking the Price of the Dangerous

Chiba: By the way, regarding these six desire trends, we received various insights from Nikkei Trendy and Mr. Omei during the webinar, and we also made new discoveries within DDD. The content we're showing today has been updated based on those elements.

Sato (Yo): My apologies. All six desire trends really hit the core, and I was genuinely impressed. That goes for trends 01-03 introduced by Naoshi-san in the webinar, and also trends 04-06 this time. They clearly derive consumer insights from 2024 hit products, and it all makes perfect sense.

Sato (Nao): Thank you! While our discussion today focuses on desire trends 04, 05, and 06, I'll briefly outline 01, 02, and 03 since they interconnect conceptually. For details on Positive Boost and Shin "Bamboo," please refer to the Do! Solutions report article.

Desire Trend 01: "Positive Boost"

"Positive Boost" refers to the consumer psychology of wanting to choose overwhelmingly bright, kind, and joyful things—or things that evoke such feelings—for oneself and the world, especially in daily life affected by negative circumstances like rising prices and economic stagnation. We consider this the main trend for 2025, and Dentsu Inc. has also issued a press release on it.

Furthermore, we predict detailed sub-trends under "Positive Boost," including: * "The Blessings of a 'Positive' God" * "The Kindness Filter Bubble" * "Psychological Safety Living Through 'Communities'" * "Self-Affirmation Alternatives" We plan to introduce these in a Do! Solutions report article.

Desire Trend 02: "Journalistic Economy"

"Journalistic Economy" is the concept succeeding "Ethical Consumption." It represents an experiential approach, rather than a persuasive one, allowing people to enjoyably connect with social issues in their daily lives. Consumers aren't indifferent to social problems; they want to understand them if they exist and wish to help change the world for the better.

Therefore, we believe we will see an increase in cases where marketing enables people to feel social issues through various forms of consumption as part of their ordinary lives, and where consumption itself contributes to solving those problems.

Desire Trend 03: "New 'Bamboo' from Pine, Bamboo, and Plum"

This trend describes the sudden resurgence of the "mid-price range," which had been struggling against the polarization of all services and products into expensive "Pine" and cheap "Plum" options. In a word, this trend is about reframing the mid-price range.

The mid-range "Bamboo" offers greater freedom for products and services compared to the status-bound "Pine" or cost-performance-driven "Plum." Consequently, it is introducing new personalities and perspectives into each category, forming a position as the "New Bamboo."

Desire Trend: "Trend Detox." Is chasing trends a thing of the past!?

Sato (Nao): Now, let's finally explain the remaining three desire trends. First is "Trend Detox." It's a bit awkward to say this in front of Mr. Omei, who publishes a magazine called Nikkei Trendy, but honestly, I think the era of chasing trends is over. This is half-joking, half-serious, but it's a trend that even our team at Dentsu Inc. Desire Design feels a momentary sense of despair about (laughs).

Product and service differentiation has already reached its limits, and we're now competing over minute differences. Furthermore, the cycle where various booms emerge only to vanish quickly is accelerating year by year in the social media era. Being exposed to social media means we're constantly bombarded with new information. Trying to keep up with it all and stay perpetually up-to-date would completely overwhelm us physically, financially, and mentally. Plus, consumers are increasingly seeing through the fact that someone is orchestrating these booms.

Amid this landscape, the "retro-flat" trend has converged. Highlighted as a 2022 desire trend, it describes the phenomenon where past hit products are compared on the same level as current new hits. In an era where Spotify recommends 80s city pop after you listen to a new artist, consumers are learning to accept both old and new things on a level playing field. Consequently, whether something is new or old becomes less important than whether it suits them personally. People are no longer necessarily placing value on "the latest trends."

For example, Y2K fashion—a modern reinterpretation of 2000s women's trends—has now firmly established itself as its own genre. Even if something isn't currently trendy, if it has a "context"—like an old artist you admire wore that style—it easily becomes an option.

In summary, even products whose boom has passed are now valued based on the principle that "what I like is good." This marks the beginning of what could be called "self-centered staple hunting."

I'll show examples in a list. "My staple" refers to cases where something an individual liked gained enough support to become what we could call "our staple." A prime example is the digital camera. Smartphone cameras are now so advanced they exceed what users need. In this era, older digital cameras that can capture retro-style photos without needing editing have, conversely, gained value.

Dentsu Inc., Mr. Naofumi Sato

2025: The Opportunity Year for "New Classics"

Sato (Naoki): Moving forward, here is a supplementary list of hit products related to "trend detox," added based on the characteristics of 2024 hit products introduced by Mr. Omei in the webinar.

First, supplement 1: "Pressure on Established Standards." This trend sees new products and content "aligning with existing staple brands." In the webinar, Mr. Omei cited "fan culture & retro" as one characteristic of 2024's hit products. Observing the popularity of legendary content like "Godzilla," which appeals to both Showa and Reiwa generations, I feel the value of established staples is steadily increasing.

The list serving as Supplement 2 for "Trend Detox" is "Opportunities for New Classics." I selected these based on the "serious classic brands" Mr. Omei highlighted as a hit product characteristic in the webinar. This keyword "new classics" might become quite significant in 2025.

One standout example is Kirin Beer's "Harefuu." Unlike products previously considered the core of beer like "Ichiban Shibori," "Super Dry," or "Black Label," Harefuu broke conventions with its blue packaging and unique naming. Yet Kirin confidently positioned it as a new staple, and the market embraced it as such. Traditionally, categories like food and beverages were called "senmitsu" (meaning "one in a thousand"), implying that out of 1,000 new products, only three would become established staples. But now, I believe there's a real opportunity to create new staples if manufacturers confidently present what they consider the right answer.

We introduced this movement within the context of "trend detox" based on the hypothesis that consumers aren't chasing trends but seeking "core staples" that truly suit them. Mr. Omi, how do you now view the concept of staples?

Sato (Hiroaki): Back in 2021, four years ago, the top-selling products were "Kirin Ichiban Shibori Zero Sugar" and "Asahi Super Dry Draft Can." Both were extensions of existing staple brands. Yet, these could have easily been launched as completely new brands. Anchoring them to existing brands was, in a sense, a defensive strategy.

In contrast, last year's "Harefū" and "Mirai no Lemon Sour" aimed to become "new staples" without relying on existing brands. What I felt seeing these was that "if you put real effort into creating a valuable product, even if it's not an extension of an existing brand, both retailers and end-users will genuinely accept it as a long-seller." I think the groundwork for that kind of acceptance is already in place in today's market.

Nikkei BP, Mr. Hiroaki Sato

Sato (Nao): Those two products are indeed symbolic. With both, you can feel the manufacturer's determination – the sense that they thoroughly thought through their category and presented what they considered the "right answer." They focused on the "core" of what they could achieve with their technology and spirit, and I also sense a growing trend where such products are becoming established staples. Your point, Hiroaki, is that "products launched as new staples going forward don't necessarily have to align closely with existing brands," correct?

Sato (Hiroaki): Exactly. Consumers pick up on that kind of genuine commitment from manufacturers.

Sato (Nao): They do. I think consumers, tired of chasing the latest trends, are also yearning for definitive products they can use for the long term. It seems manufacturers are responding by launching new staples with a sense of classic authority, declaring, "This is our core offering, the 'right answer' in this category."

Sato (Hiroshi): I agree. Incidentally, "new staple" and "trend" used to be almost synonymous, but now they're a bit different. Back then, a trend meant one company launched a hit product with a new idea, and others followed suit. But recently, for example, when Asahi Beer created a new hit product like the "Fresh Draft Can," other companies aren't trying to follow that. Instead of chasing someone else's hit, they're taking the stance of "Let's compete by launching our own distinct staple product."

Sato (Nao): Indeed, the era of "watching competitors' moves" seems to be fading. I get the impression that every manufacturer is now properly focusing on the end-user. Not just with beer, but across industries, companies are expressing their core values through products and establishing them as staples – that trend has been continuing in recent years. Take the Draft Beer Can: its core idea is "This is how you pop the top open – this is the best way to enjoy beer right now," and they're building a whole new product lineup around that.

Chiba: Listening to both of you now, it struck me that for both manufacturers and consumers, the concept of "standard" doesn't seem confined to just one product anymore. Even within the standard category, it's not just one type; it's more like a standard with choices—meaning there are options within the standard itself.

Sato (Hiroshi): Yes, I think what you just said, Chiba-san, reflects a clear intention on the part of companies. They're deliberately designing it so consumers can choose from several options within the staple category, depending on their mood or situation. For example, with Asahi Beer, they've established "Marufu" as a staple alongside "Super Dry," right?

Sato (Nao): I see. In that sense, I think we can say that "standard" is no longer a title given to a single product; it's becoming a "conceptualized" idea. That is, under one big idea, individual products emerge as "chooseable standards." This era where consumers take the lead in choosing their standards might be the reality of trend detox.

Does pursuing marketing to its extreme lead to trend detox?

Sato (Hiroshi): When I previously had a roundtable discussion with marketers from Kirin and Asahi, it was striking that both companies expressed the same sentiment. In a nutshell, they said they had stubbornly pursued a "customer-centric perspective."

What this means is that P&G's famous "Consumer is Boss" philosophy has increasingly permeated Japanese companies. In the past, within beer companies, the term "customer" meant different things to sales and marketing. For sales, "customers" referred to retailers and distributors, while for marketing, "customers" meant consumers—the end users. They unified this perspective across all departments, adopting a completely "end-user perspective."

As a result of companies focusing solely on end-users, they stopped worrying about competitors in a positive sense, leading to the creation of highly unique "new staples." Products like "Harefū," born from the bold idea that "maybe it doesn't even have to be draft beer," emerged precisely from this mindset of looking at end-users rather than competitors.

Chiba: Your point that marketing from the end-user's perspective has truly taken root in Japanese companies is an important one. During the webinar, Mr. Omei mentioned that while Asahi's development team initially rejected the draft beer can, saying "This much foam overflowing is unacceptable," the marketers insisted "End-users will accept it," leading to its productization. That was quite memorable.

Sato (Hisao): Yes, it's about the fusion of marketing and R&D. The same applies to Asahi Beer's "Future Lemon Sour." Apparently, R&D viewed the variation in lemon size negatively. But marketing saw this variation as "character," introducing a customer-centric perspective with the idea "That's what makes it good." As a result, it became established as a new staple product.

Sato (Nao): Especially for products and services like beer, where selling through marketing power is mainstream, the mindset has shifted to "there's no point looking sideways anymore." More specifically, while keeping end-user insights as the foundation, I think they're deeply considering the connection: "What unique value can we provide?"

Sato (Hiroshi): This series of changes might reflect how marketing has taken root in Japanese companies, altering how consumers engage with brands. For a long time, Japanese companies seemed to call sales promotions or advertising "marketing." But marketing isn't just about creating fleeting trends; it's about turning genuinely valuable things for customers into long-lasting hits.

In other words, as companies pursue marketing to its fullest, new staples emerge, and I think what Naofumi-san was saying might lead to a "trend detox." Here, "trend" refers to fleeting fads.

Chiba: That's fascinating. Next time, we'll explore the remaining two desire trends: "Korea as a POP Filter" and "Demanding a Serious Price!"