Note: This website was automatically translated, so some terms or nuances may not be completely accurate.

The purpose of corporate advertising has become clear. What does IR mean in the era of individual investors?

With the new NISA gaining traction, investing has become more accessible to consumers. Japan now has over 80 million individual shareholders. The growth of individual investors is expected to accelerate further.

In 2025, Dentsu Inc. developed and launched "IR-Branding 360°." This solution applies Dentsu Inc.'s expertise in "consumer marketing" to IR for individual investors, supporting the development of communication strategies.

This article features interviews with Dentsu Inc. marketing consultant Miho Uenishi and business producer Kojiro Shikagawa, who accompany companies in their IR branding efforts. We asked them about the background behind developing this solution and the future direction of IR.

Over 80 million individual shareholders. A new relationship between companies and consumers

──Please introduce yourselves.

Uenishi: As a marketing consultant, I've primarily focused on consumer-targeted marketing. For this project, I'm applying my years of consumer marketing expertise and Dentsu Inc.'s assets to analyze individual investors and develop communication strategies.

Shikagawa: I am a business producer who works as a partner to client companies, tackling various challenges. My client, the Nisshin Seifun Group, approached me wanting to incorporate an investor perspective into their consumer communications. I then reached out to Uenishi's team, which became the initial catalyst for developing "IR-Branding360°."

──It seems somewhat unexpected that two professionals with backgrounds in marketing and business production would support the IR domain.

Shikagawa: It might seem unusual for Dentsu Inc. to support IR, and some might not immediately grasp why. However, as we'll detail in this series, we believe the "investment" perspective is indispensable for future communication with consumers.

This is because individual investors—that is, "consumers"—now hold significant stakes in companies and increasingly influence management. From my perspective as a business producer, I've started proposing to clients, "Why not transform your IR?" as part of solving their challenges.

Uenishi: And if we view IR as communication with consumers, Dentsu Inc. possesses extensive expertise cultivated over many years. Understanding consumers through diverse data analysis and developing communication that resonates with them are areas where Dentsu Inc. excels. This initiative extends those capabilities into the IR domain.

──First, could you explain the background behind the increasing number of companies focusing on communication with individual investors?

Uenishi: The Japan Exchange Group announced survey results showing the total number of individual investors holding stocks in Japan has exceeded 80 million. The number of individual investors has set a new record for 11 consecutive years, and the base of investors is expanding, partly due to the impact of the new NISA.

While it varies by company, among our clients, individual investors make up roughly 10% of the shareholder base overall. In some cases, they account for as much as 40% or even over half. Individual investors are now a presence no company can afford to overlook.

Furthermore, in recent years, overseas activist shareholders and acquisition plans by foreign companies have shown that shareholder composition can significantly impact corporate management. In contrast, some individual investors are affectionately called "fan shareholders" because they develop a strong attachment to the company. They tend to hold shares long-term and often buy more when the stock price falls.

In other words, companies are beginning to focus on acquiring fan shareholders and implementing measures targeting individual investors to help stabilize stock prices and reduce the risk of takeovers.

──How does the increase in individual investors change corporate IR?

Shikagawa: The information and messages companies need to communicate change. Historically, corporate IR was largely aimed at institutional investors like insurance companies, investment trust firms, and pension funds. When these institutional investors evaluated companies, they primarily focused on so-called "financial information." Consequently, most corporate communications centered on financial data and management strategies.

Individual investors, however, focus on how an investment connects to their own lives. While many still prioritize growing their assets, I believe the expansion of the new NISA will change individual investor behavior going forward. Many start with low-risk, low-return investment trusts, but eventually, they should progress to selecting and buying specific stocks themselves. Dentsu Inc.'s research also shows a clear trend: many people start by purchasing index-based investment trusts and gradually move towards investing in individual stocks.

And when that time comes, rather than suddenly buying shares of companies they know little about, I think they will first look to companies close to them – companies where relatives work, or companies they have professional ties with – companies they want to support. In other words, elements of "supportive investment" in companies will gradually come into play. This is where "non-financial information" becomes crucial. To foster a desire to support a company, financial information alone is insufficient.

Uenishi: Historically, non-financial information has been treated almost as an "add-on" in IR. Non-financial information refers to the value a company creates and the activities it undertakes that aren't reflected in financial figures. This includes things like technological capabilities, human resources, intellectual property, reputation within society, and environmental initiatives.

Non-financial information is sometimes referred to as "pre-financial information," representing indicators of corporate activities before they manifest in financial metrics. While often perceived as less relevant to investment decisions, some of these factors can have significant impact later on.

Shikagawa: Non-financial information can also serve as the "context" for financial information. Financial data is just numbers, but behind those numbers lie the intentions and actions of the company and its people. Telling this story as a narrative fosters empathy among consumers. Going forward, such information will increasingly influence investment decisions.

Uenishi: Among institutional investors, ideas like impact investing—where the focus is on "investing to generate positive social impact alongside financial returns"—are gaining traction. For individual investors too, whether a company "has a positive impact on the society we live in through its activities" should become a factor in investment decisions. Therefore, for both groups, communicating non-financial information clearly and compellingly has become a critical task for companies.

Future IR will involve communicating growth strategies as compelling narratives

──Specifically, what changes are occurring in corporate communications?

Uenishi: There is a growing momentum to integrate the management of teams that were often fragmented—such as the advertising department handling corporate advertising, the PR team handling media relations, and the IR team handling investor relations. This is because communication with individual investors and communication with consumers have significant overlap.

Shikagawa and I sometimes refer to individual investors as "consumer investors," because they are also "ordinary consumers" who invest as an extension of their daily lives. How to communicate corporate value to these consumers is becoming crucial. Setting the objectives for corporate advertising will be particularly important going forward.

Shikagawa: Since corporate advertising and IR might seem somewhat disconnected, let me elaborate. Traditionally, corporate advertising aimed at branding was primarily about "introducing ourselves" – essentially a self-introduction. This was especially true for B2B companies, where corporate advertising served as a "self-introduction" to stakeholders like business partners and job seekers. However, going forward, we must engage with a new stakeholder: individual investors.

Therefore, the message of corporate advertising must expand from a "self-introduction" to a "growth strategy." To win over individual investors, it will be necessary not only to convey "what we have done so far" in a self-introductory manner but also to communicate "what we plan to do next" as a clear and compelling story.

Furthermore, when companies communicate their growth strategies, they must convey not only "how much profit we expect to generate," but also "how society will improve alongside our profits as this company grows." The Dentsu Group promotes "B2B2S" (Business-to-Business-to-Society), which reflects the context of Dentsu Inc. assisting clients in making society better.

──Considering the presence of individual investors as stakeholders, this means the "primary purpose" of corporate advertising will no longer be solely about increasing awareness or improving favorability.

Uenishi: Yes. Going forward, corporate advertising KPIs should include not just "awareness growth," but also "investment intent" and "expectations for the company." Beyond evaluations like "liking" or "knowing" the company, metrics incorporating a future perspective – "this company will improve going forward" – will be necessary. In other words, the performance indicators for corporate communications will likely be updated.

Shikagawa: Until now, companies have been "chosen" by consumers based on their products and services. Going forward, another selection criterion will be added: investment. This isn't just about asset building; it's a scenario where consumers invest because they believe "this company will improve society."

Uenishi: Beyond advertising, companies will need to communicate their growth strategies as a cohesive story through all branding activities. Previously, departments like PR, advertising, and IR disseminated messages separately to different stakeholders—employees, investors, consumers, and business partners. What is the company's core value? What are its future aspirations? Moving forward, these messages must be communicated with greater consistency.

──Could you share an example from the Nisshin Seifun Group, where you support corporate branding and IR?

Shikagawa: The Nisshin Seifun Group holds approximately 40% of the domestic flour market share (by weight). They also develop products like high-fiber flour rich in dietary fiber and possess significant production capacity not only domestically but also overseas in countries like the United States, Canada, and Australia. Although it's a Japanese company, they are actually the number one producer in Australia, where flour is a staple food.

When I took charge of the Nisshin Seifun Group and learned this information, I was personally surprised and excited, thinking, "There's such an amazing company in Japan supporting the world's food supply!" "Enriching food culture and the future of food on the global stage." This, I believe, is the very essence of the Nisshin Seifun Group's "growth strategy."

For example, traditional investor communications focused on disclosing information like "holding a 40% market share in flour." Now, we also convey the story: "A company that has supported Japanese dietary habits for 125 years through stable flour supply." This communication design is something only Dentsu Inc., with its deep involvement in creative and consumer communications, could achieve.

──Conveying non-financial information compellingly leads to investment. That's precisely why we propose enhancing corporate value by incorporating a PR and communication perspective into the IR domain.

Shikagawa: Exactly. If we can clearly convey a company's growth strategy as a compelling story filled with future promise, it makes people want to invest in that company. They'll feel good about supporting it, and their everyday awareness will shift.

Beyond "I like this company and resonate with it, so I buy its products or services," the option to "invest" comes into play. Isn't this the shape of corporate communication in the new era?

How does Dentsu Inc. apply its consumer insights to IR?

──Could you explain in detail what the "IR-Branding360°" service entails?

Shikagawa: In essence, it's a solution that integrates corporate communications and IR management from a comprehensive, multi-stakeholder perspective. To achieve this, we leverage Dentsu Inc.'s consumer marketing insights. The foundation is understanding consumers.

Uenishi: Companies may hold shareholder meetings or seminars for individual investors as part of their IR activities, but only a portion of shareholders participate. Consequently, many companies surprisingly lack visibility into "who the individual investors are who buy their stock or show interest."

IR-Branding360° uses data derived from combining Dentsu Inc.'s consumer big data with results from large-scale surveys of individual investors to identify

We identified distinct types of individual investors based on their investment tendencies.

Personas for each cluster

and the investment journey for each cluster

By leveraging Dentsu's data infrastructure, such as the People Driven DMP, and solutions like STADIA,

By leveraging Dentsu Inc.'s data infrastructure, such as the People Driven DMP, and solutions like STADIA, which visualizes consumer exposure to TV programs and advertising effectiveness, you can understand various aspects about people interested in your company's stock. This includes their gender, age, hobbies, values, investment budget, investor type, and the specific information they encounter across which media channels from the moment they learn about a stock until they make a purchase.

──What exactly do you mean by "investor type"?

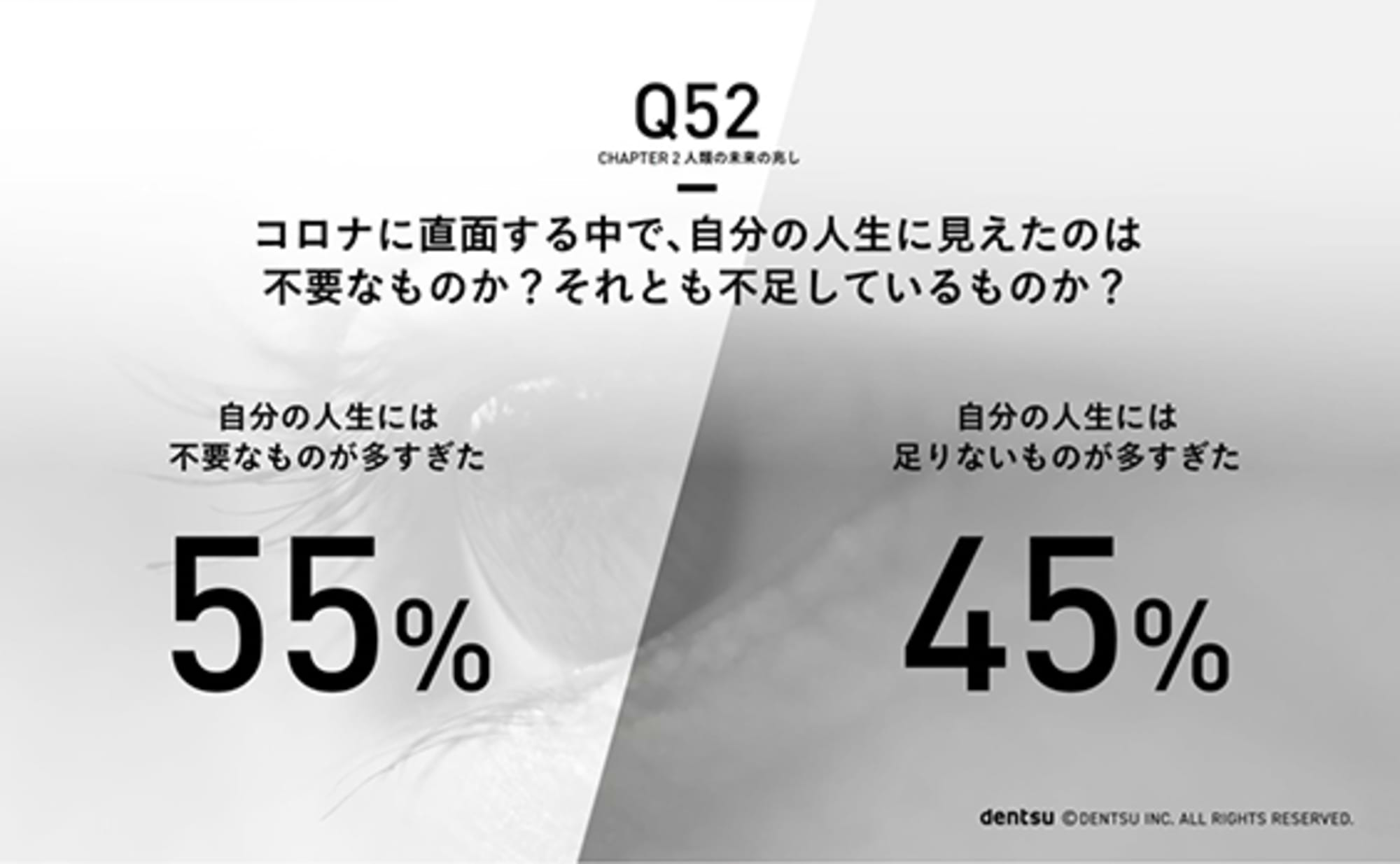

Uenishi: We categorize them into eight clusters, such as the "New NISA Entry Type" who started individual investing due to the new NISA system, or the "Support-Oriented Supporter Type" who buys stocks to support the product or company itself. We can analyze which type is most common among our company's stock buyers. When we researched and analyzed it, I was surprised to see the types were quite distinctly separated. We can understand not only the persona and journey for each type, but also the volume within each segment.

Uenishi: By cross-referencing various data here, we can determine: Which cluster members are buying our company's stock? What hobbies do these cluster members have, and what TV programs do they watch during which time slots? What media do they engage with and what actions do they take from learning about the stock to making a purchase?

──How are the analysis results utilized?

Uenishi: If we can concretely understand things like "This cluster of people is buying this much of our stock" or "From learning about the stock to investing, they engage with these media in this way," we can formulate effective media planning and communication strategies targeted at individual investors.

Furthermore, we can discern which company businesses appeal to individual investors who purchase our stock and what narratives resonate with them, broken down by investor type. This allows us to design more effective methods for communicating growth strategies and disseminating information. This solution provides a one-stop service, covering not only analysis-based information dissemination but also the creation of integrated reports.

Shikagawa: We'll cover the specifics of the analysis and communication design for the Nisshin Seifun Group case in a separate session. To briefly touch on the final output, based on the analysis described above, we were responsible for renewing both the Nisshin Seifun Group's branding site and their IR site. Both were realized through cross-departmental collaboration, breaking down barriers between the PR Department's Advertising Team and the IR/SR Office.

For the branding site, we focused on presenting "growth strategies" rather than a "self-introduction," crafting a narrative that individual investors could relate to. My belief is that "IR alone cannot fully convey the message"; branding uniquely allows for communicating stories and intentions.

For the IR site, we consciously incorporated UI/UX perspectives by utilizing illustrations and infographics. Traditional IR sites are often designed primarily for institutional investors, frequently resembling "link collections." They also tend to focus solely on disseminating accurate financial information, resulting in a somewhat "expressionless" presentation. Our design approach was to introduce a public relations and advertising perspective, making it easier for investors to grasp the "intent" of the company and its management.

>The Base of Life Special Site

https://www.nisshin.com/thebaseoflife/

>To Individual Investors

https://www.nisshin.com/ir/investor/

Uenishi: Communicating the "intent" held by a company's top leadership to investors is extremely important. Yet, it's an aspect that was surprisingly difficult to convey through traditional IR communications. The company's intent to grow in this direction is also crucial information for investors.

──So this is an example of communicating a story that makes consumers want to support corporate activities, while also integrating advertising and PR communications.

Shikagawa: To summarize today's discussion: Moving forward, consumers will choose companies not only for their products and services but also as "investment targets." As investing becomes more accessible and the relationship between consumers and companies fundamentally shifts, both IR and corporate advertising approaches must evolve. We believe that initiatives previously conducted separately for "various stakeholders" will now be executed with consistency, centered around a single cohesive story.

As consumers increasingly invest in companies, Dentsu Inc. aims to leverage our expertise in consumer marketing to support our clients' corporate communications.

The information published at this time is as follows.

Was this article helpful?

Newsletter registration is here

We select and publish important news every day

For inquiries about this article

Author

Miharu Uenishi

Dentsu Inc.

Third Integrated Solutions Bureau

Senior Solutions Planner

After joining Dentsu Inc., I worked in sales roles for major electronics, housing, and food manufacturers, retailers, and startups. Since 2016, I have been active as a Strategic Planner. I develop brand strategies and communication strategies for multiple clients in sectors including food and beverages and cosmetics, and also handle product development and sustainability consulting. Dentsu Inc. Team SDGs Consultant.

Kojiro Kagawa

Dentsu Inc.

Business Producers Division 20

Integrated Marketing Producer

Studied design at an art university, then pursued media art in graduate school. After joining the company, leveraged that experience while gaining exposure to marketing, promotion, campaign planning, and creative work. Currently drives diverse projects across multiple domains in an integrated manner. "Shaping what truly matters" is the motto.