「定年女子」のキャリア自己採点と、お金のモンダイ

電通シニアプロジェクトが実施した「定年女子調査」(広報リリース)を基に、定年前後の女性たちのインサイトに迫る本連載。

第1回では「定年女子」のプロフィールや、仕事と共に歩んできたライフ&ワーキングスタイルについてレビューしました。第2回では、定年を迎えるに当たっての意外なホンネ、そして気になる「お金」のモンダイにフォーカスします。

(※)定年女子調査: 60歳を定年と規定し、

●「プレ定年女子」:6~10年以内に定年予定の50~54歳女性

●「定年女子」:5年以内に定年予定の55~59歳女性

●「ポスト定年女子」:既に定年を経験した60~64歳女性と定義。

またポスト定年女子のうち仕事をしている人を「ポスト定年女子(仕事継続組)」、仕事をしていない人を「ポスト定年女子(仕事リタイア組)」とした。

詳細は巻末をご覧ください。

①自分にGood Job! 「定年女子」が付けた自分のキャリア人生の点数は、平均63点。

定年女子たち(調査対象者のうち55~59歳)に、これまでのキャリア人生を100点満点で採点してもらったところ、平均点数は63点でした。分布としては50~80点台がボリュームゾーンとなっています。

見方によって高いとも低いとも取れる、この平均63点という点数。個々のフリーアンサーを見ていくと、平均点からは見えてこない、それぞれのキャリア人生を積み重ねてきた「定年女子」の思いがそこにはありました。

自分自身のキャリア人生に90点以上の得点を付ける人、逆に30点台以下の低得点を付ける人は、共に全体の1割以下です。ボリュームゾーンは50~80点台に集中しており、この範囲だけで全体の8割を占めます。

50~80点台のボリュームゾーンでも、仕事に注力するのが難しかった、子供と向き合う時間がとりづらかったなど、仕事も育児も納得するまでやりきれないジレンマや苦労が、一つ一つの回答に表れていました。

ポジティブな自己評価は2パターンに分類できます。一つは、精いっぱい自分のやれることをやってきた「夢中で走り続けてきた私」を評価するパターン。振り返ってみると自分がやってきたことが線のようにつながり、やってきたことに無駄なことはなかったという自己評価につながるケースです。そしてもう一つ、仕事と子育ての両立など「つらいことを乗り越えてきた自分の頑張り」を評価するパターンも多く見られました。

一方、自己評価が低いパターンでは、楽な方に流れたことや、もっとやれたのにやれなかったことへの後悔など、「自身の後ろ向きな姿勢」に対するフリーアンサーが目立ちました。「仕事から逃げ腰だった」「自分でなければできない仕事に従事できなかった」「いやいや仕事をしていた」などが挙げられています。

ちなみに、上の図には入っていませんが、すでに定年を迎えた「ポスト定年女子」のフリーアンサーでは、「勤め上げたことへの満足感・自分への賞賛」「資格や専門性を生かした活躍」「リーダーとして貢献した経験」など、いろいろな苦労がありながらも頑張ってきた自分に対する誇りが感じられる回答が多数挙げられていました。

まだ女性が働くことに対して社会的環境が整わない時代から、夢中で働き続けてきた「定年女子」たち。結婚、出産、子育て、夫の転勤、引っ越しなどのライフステージの変化を受け止め、仕事の成果への納得感や、あきらめなくてはならないこととの折り合いをつけながら、仕事に向き合ってきたそれぞれの思いが、「63点」という平均点の裏側には隠されていたのです。

②定年は「通過点」、定年後もまだまだ働き続けたいセルフドリブンな「定年女子」。

たくましくも健気にキャリアを積み重ねてきた「定年女子」は、この先いつまで働く意欲を持っているのでしょうか?これから定年を迎える55~59歳の「定年女子」に、今後定年まで働き続けたいかを尋ねてみました。

結果は、「定年後も働くことが決まっている」人が18.1%で、「決まっていないが、定年後も働きたい」人49.3%も合わせると、約70%が仕事を続ける意欲を持っていました。

これに対して「働き続けるかまだ分からない/まだ決めていない」人は24.6%、「定年後は働かない(リタイアする)」と決めている人はわずか8%にとどまっています。

「定年女子」は、定年までしっかり働き続けることはもちろん、定年後も仕事を続けたい人が多数派だということが分かります。

「定年女子」はなぜ働き続けたいのか?その理由には、やはり将来の経済的な不安や生活維持を挙げる人が多く見られました。

「お金がないと不安(55.9%)」「生計を維持(52.7%)」「お小遣いのため(48.4%)」などが上位に挙がっています。

企業の正規雇用である「定年女子」の平均個人年収は、400万円以下が約5割。単身・離婚・死別含め、現在「おひとり様」の方が約半数であることからも、生活を支えるために働き続ける必要があります。

一方で自分自身のお小遣いが欲しいから働き続けるという人も5割程度おり、自分で稼いで自分で使えるお金がある生活スタイルを崩したくない気持ちがうかがえます。

経済面以外での働き続ける(続けたい)理由としては、「仕事をしていないと生活のリズムが保てない(47.3%)」「社会と関わっていたい(45.2%)」「時間を持て余してしまう(38.7%)」などが挙げられています。定年後の生活リズムや社会性の維持も大事なファクターとなっています。

「定年女子」にとっていまや定年はゴールではなく、ひとつの「通過点」。定年までしっかり働き、その先も仕事を続けたい裏側には、定年後のまだ先の長い人生、経済的に自立し、生活レベルや生活のハリを維持しながら、自分自身の楽しみに使えるように稼ぎたいという考えがあります。セルフドリブン志向でたくましい「定年女子」の生き方が表れています。

③退職金の使いみち。手堅く貯金しつつも、自分へのご褒美も忘れない。

この項では、退職金をはじめとする「定年女子」の気になるお金の問題を見ていきましょう。

定年女子が「自分がもらえると想定している退職金の想定額」は平均594万円。実際に定年を迎えたポスト定年女子がもらった額が1107万円で、金額にはギャップがありました。「わからない、無回答」が3割いることからも、実際の退職金額を把握できている人はまだ少ないようです。

また、退職金以外の老後資金を考える上で「貯蓄額」と「負債額」を計算に入れる必要があります。

総務省統計局による家計調査(2019年)で、「二人以上の世帯」の1世帯当たり貯蓄現在高を年代別に見ると、50代で平均1704万円です。そのうち住宅ローンなどの負債を抱えている割合は55.3%で、負債額平均が652万円となっています。

これが60代になると、貯蓄現在高が2330万円、負債を抱えている世帯の比率は26.9%と、50代の約半分程度まで減り、負債平均額は250万円となっています。

50代はまだローンなど負債がある人が約半数程度いることもあり、貯蓄と退職金を合わせても、人生100年の備えとしては心もとなく、お金の不安が尽きないのが現実です。

このような定年後の経済面での漠然とした不安は、「まずはしっかり預貯金に回す」という定年後の手堅いお金の使いみち意向につながっているようです。

今回の調査で「定年に向けて準備していること」を聞いたところ、「貯蓄する」との回答がおよそ4割でトップでしたが、定年退職金の使いみちもやはり「預貯金(82.1%)」が高くなっています。

それに続いて「旅行費用(22.6%)」「自分へのご褒美(22.6%)」「趣味(15.1%)」「自分自身の介護や医療のための費用(14.2%)」などが挙げられています。

定年前からの貯蓄と退職金をベースに、自分を支える基盤をきちんと準備しながら、そのお金で定年後は旅行や自分自身へのご褒美、外食や自身のウェルネスライフに投資して豊かに過ごしたい「定年女子」。消費の華やかな時代も知る世代らしく、これからの自分を楽しむことへの意欲も忘れてはいません。

④夫は二の次?定年後は時間もお金も自分のために使って楽しい毎日を過ごしたい既婚定年女子

「定年女子」に定年後にどんな希望を抱いているのか尋ねました。「定年後にやりたいことがたくさんある」と回答した人が60.5%、「寂しさはない(59.5%)」「楽しみだ(52.5%)」など、ポジティブな気持ちを持っている人が半数を超え、上位を占めています。

定年後に人生で大事にしたいこととしては、まずは健康でいること。そして貯めたお金を大切に使いながら、「趣味」を楽しむことが挙げられています。

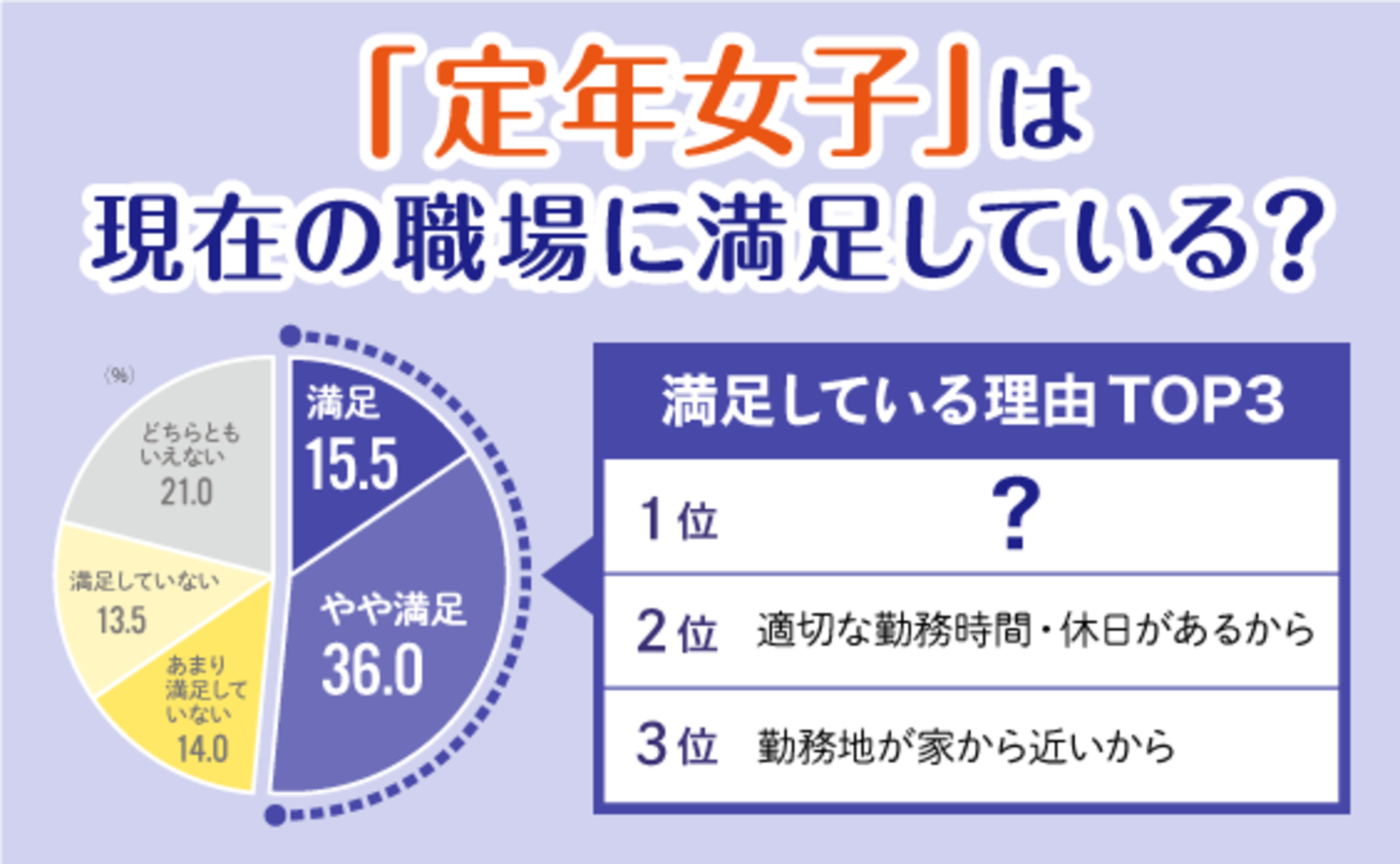

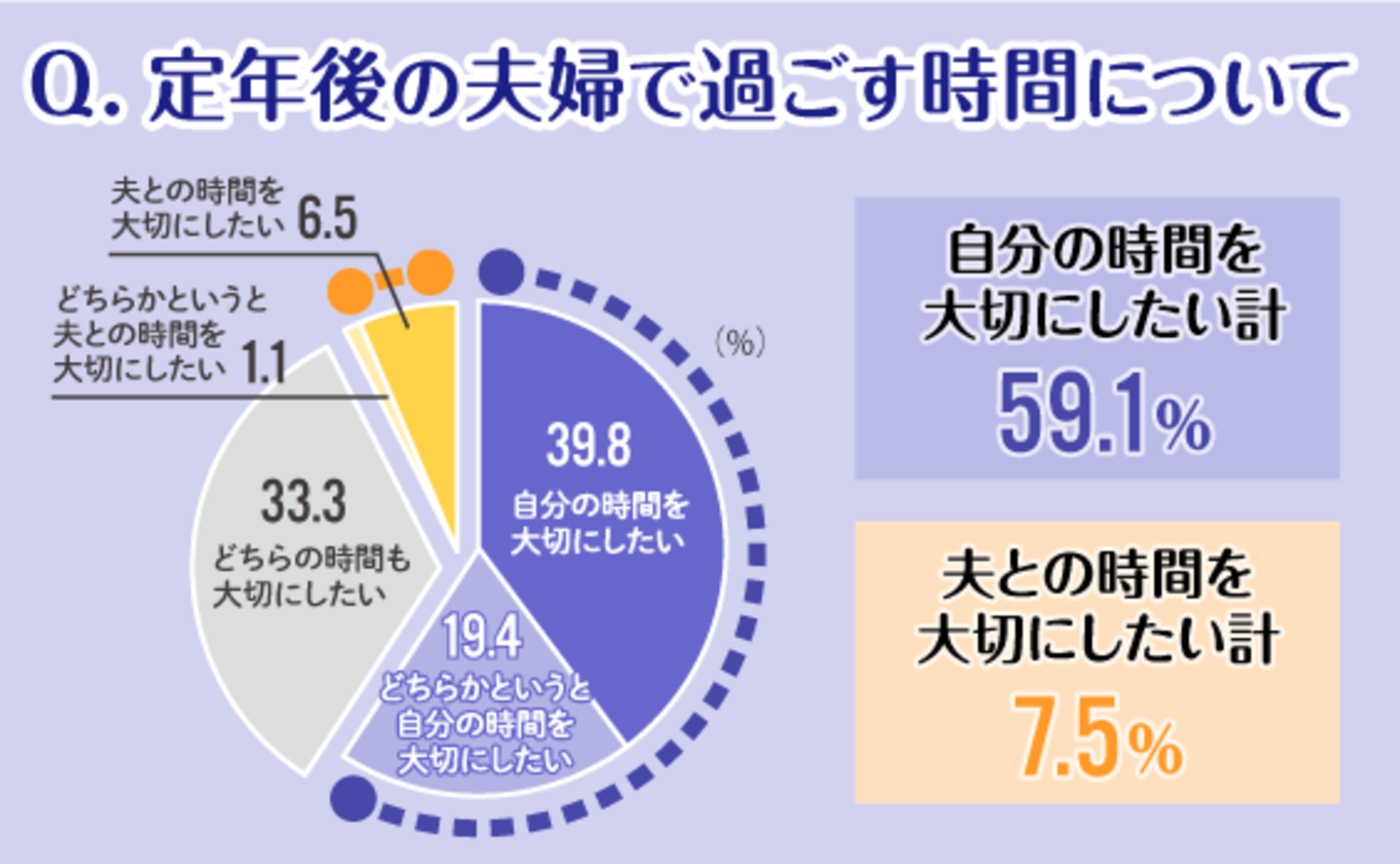

そして、現在既婚者のみを対象とした質問に対しては、「夫と過ごすより自分の時間を大切したい」と考えている人が約6割と多数を占め、夫との生活を楽しみたい人は7.5%にとどまりました。

夫婦で過ごすよりも、自分時間を豊かに楽しみたい、定年後は誰かのためより「自分」を大切に、仕事を続けながら、健康でいきいきと人生を楽しみたいのが「定年女子」のホンネのようです。

このたびのコロナ自粛により、定年を迎える前にすでに、疑似定年ライフのような生活を体験したことが、「定年女子」にどんなインパクトを与えたのかも今後注視していきたいところです。

⑤最終回は「オトナ女子消費を狙え!定年女子へのアプローチのヒント」

ライフステージ変化を越えて、仕事を続け、成果と満足度との折り合いをつけながら、道なき道を走り続けてきた「定年女子」。先の長い人生を俯瞰する彼女たちにとって「定年」は「通過点」であり、働き続けながら自分時間をどう楽しむかを大切にしたいと考えています。

さて、自分で自分を支えるセルフドリブンなたくましさや未来志向のポジティブさを持った「定年女子」たちの、オトナの「女子力」は、定年後の消費意欲にどう反映されていくのでしょうか?

次回は「オトナ女子消費を狙え!定年女子へのアプローチのヒント」と題して、実際の定年を迎えた「ポスト定年女子」の実際や、定年を意識しはじめる「プレ定年女子」との比較もまじえながら、ビジネスにおける定年女子へのアプローチのヒントについてまとめていきます。お楽しみに!

【「定年女子調査」実施概要】

・対象エリア:全国

・調査手法:インターネット調査

・対象者条件およびサンプル数:

A. 定年のある企業に正社員として働く50代女性 400ss

※プレ定年女子=50~54歳 200ss

定年女子=55~59歳 200ss

B. 定年のある企業に正社員として働き、定年を体験した60~64歳女性 200ss(※)

※ポスト定年女子

「定年後も働いている」人=仕事継続組 100ss

「定年後は仕事をしていない」人=リタイア組 100ss

・サンプル総数:600ss

・調査期間:2019年12月

・調査機関:電通マクロミルインサイト

※記事中の図表については、平成27年度国勢調査を元にした年代別の人口構成比率と対象者出現率に合わせたウェイトバック(重みづけ)をした上で集計を実施しています。

この記事は参考になりましたか?

著者

小松 祐子

株式会社 電通

第1統合ソリューション局

ソリューション・ディレクター

一貫して戦略プランニングに従事。 ブランディング、コンサルティング、商品開発や事業・マーケティング・コミュニケーション戦略策定、インナー施策開発、リサーチ、ファシリテーションなどホリスティックなソリューションを提供。 電通シニアプロジェクトメンバー、電通ママラボ主幹研究員