Cross Media Planner Transforms Planning

――First, please tell us the background behind developing "Cross Media Planner."

Nakayama: Recent years have seen structural changes in how younger demographics engage with media. As individuals now interact with more diverse media types, cross-device strategies have become essential. Consequently, clients increasingly express a need to reach audiences less accessible via TV through web channels.

Furthermore, we started receiving allocation-related questions like, "When running a TV commercial at 1500 GRP, what is the optimal volume for online video ad placements?" This highlighted the need for more efficient and effective planning than ever before.

Manabe: Regarding digital media, we previously simulated the reach of reserved advertising like Yahoo!'s Brand Panel. However, we couldn't simulate programmatic advertising using traditional methods. The "Cross Media Planner" solved this. It now enables simulations that include TV commercials alongside online video and display ads, encompassing programmatic advertising.

――What exactly is "Cross Media Planner"?

Manabe: It utilizes Dentsu Inc.'s "d-holistics" database, which analyzes media exposure and purchasing behavior using single-source data. It instantly simulates metrics such as reach, campaign awareness, and brand awareness. For example, it can calculate daily advertising costs and reach, as well as integrated figures for each advertising menu, and even the degree of overlap between TV and digital.

――So planning can now be based on precise simulation results. How have clients responded?

Nakayama: Among clients who previously prioritized TV, some have started showing interest in digital media thanks to the "Cross Media Planner." There's also a growing trend of conducting surveys for each campaign to establish unique baseline values for each client.

In another client case, during a competitive pitch focused solely on online video ads with "maximizing campaign awareness" as the KPI, we included integrated mass and digital planning combining TV commercials and online video ads based on "Cross Media Planner" simulations. This approach earned high praise and secured the win.

Manabe: Digital media is often judged purely on clicks, but with online video ads, the video format itself contributes to brand building. The ability to simulate not just reach, but everything from campaign awareness to purchase intent for planning using Cross Media Planner is incredibly significant.

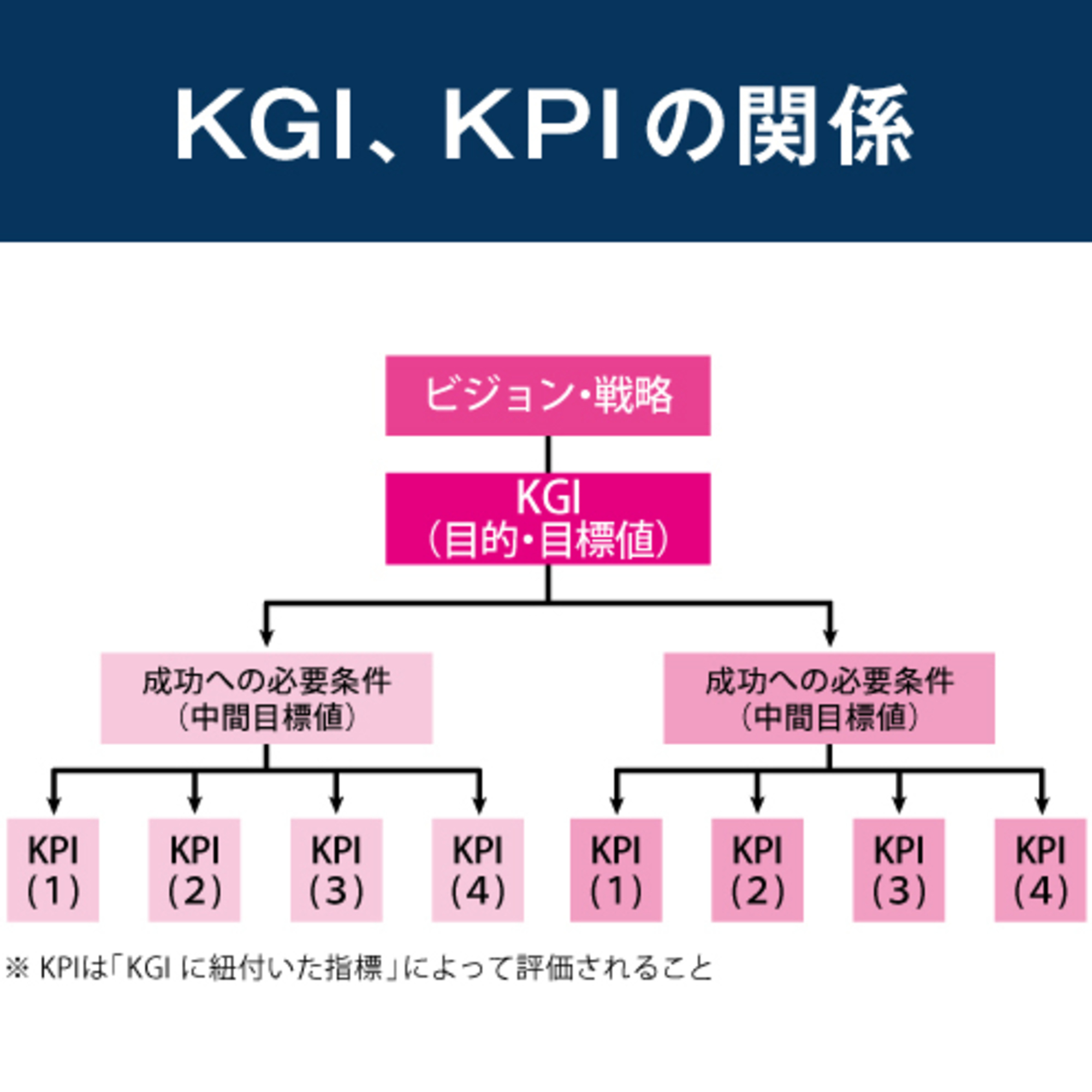

Nakayama: Planners can now use Cross Media Planner to allocate budgets and media, then leverage insights from KPI performance to optimize allocations for subsequent campaigns. This makes it much easier to implement the PDCA cycle for advertising initiatives throughout the year.

Key Considerations for Maximizing Online Video Ad Effectiveness

――What factors are truly important when planning and executing "TV Commercials × Online Video Advertising"?

Matsuno: For planning and managing online video ads, maximizing advertising effectiveness critically depends on running the PDCA cycle from four perspectives: target reach, frequency, recency, and creative.

Optimizing TV Commercials × Online Video Advertising

Regarding planning and operation across these four perspectives, combining TV commercials with online video ads allows for a more fundamental and multi-layered deep dive compared to focusing solely on online video ads.

The Dentsu Group tackles these challenges through "Dentsu Data Driver" (D3), a cross-group organization.

For example, with online video ads alone, KPIs are often set based on the reach of precedent ads. However, when combined with TV commercials, the KPIs to pursue change. We must consider the total combined reach and frequency across TV and online, and further, when cross-referenced with single-source panel data, how the advertising exposure level varied by target audience.

We also encounter questions like, "For audiences who watch TV, we can pursue these KPIs for online video ads, but shouldn't we change the KPIs for audiences who don't watch much TV?" In actual cases, we're seeing instances where KPIs are set specifically for each target audience.

――Are there other innovative approaches to KPI setting?

Matsuno: Yes. Particularly interesting is the phenomenon where combining TV and online to expose audiences to multiple types of creative ultimately increases target recall and awareness rates. In such cases, we address this by setting KPIs focused on maximizing exposure to different creatives and designing the delivery strategy to achieve that.

Regarding creative, we've also become able to respond to client questions like "Should online video ads use the same content as TV commercials, or different content?" with case-by-case analysis backed by various examples and numerical evidence.

Providing solutions that align with the times and client needs

――What are the current challenges and future outlook?

Nakayama: The digital industry and digital media are a world of constant change, where new things emerge and are quickly replaced, making it a highly dynamic environment. Our challenges include staying abreast of the latest trends in the overall market, media, and online video menus, maintaining up-to-date knowledge, and constantly updating our planning tools to respond to these changes.

Furthermore, with the recent mobile shift and increased smartphone usage time, measuring reach for smartphone advertising—including apps—has become an urgent priority. Moving forward, we aim to build measurement systems that work even on smartphone apps and accumulate case studies.

Matsuno: Operationally, digital media has often been focused on CPC and low unit costs. Moving forward, we need to consider its use for branding. One media company is introducing new added value, such as conducting brand lift surveys for campaigns exceeding a certain spend threshold.

Rather than simply selling ads that seem to have high reach, we must calmly assess and propose to clients how much to allocate to which media to maximize KPIs related to branding. Collaboration with each media company is also necessary for leveraging online video ads for branding, so we intend to work on this as well.

Manabe: "Cross Media Planner" offers the advantage of simulating across multiple media options. Expanding these options in the future will require cooperation from media companies, so we need to advance that collaboration.

Furthermore, we must consider developing tools compatible with media measurement methods and utilization data, so I feel there are many challenges ahead.

However, with the establishment of D3 as a cross-functional organization, we now have a framework centered on data to provide one-stop solutions. This positions us to advance more swiftly toward the next stage.

Dentsu Data Driver (D3)

D3 is a next-generation digital marketing specialist team spanning the Dentsu Group, formed by Dentsu Inc., Nextedge Dentsu, and Dentsu e-marketing one. http://www.dentsu-data-driver.jp

Contact: D3 Secretariat d3-info@dentsu.co.jp