"Broadcast," "Streaming," "Package"... Diverse Choices for Paid Video Content

The variety of video streaming services accessible via the internet has increased. When it comes to paid video content, traditional options like pay-TV services and renting DVDs for playback were common. However, with the advent of online streaming, watching videos on computers became established, and in recent years, viewing on smartphones and tablets has become particularly active, especially among younger demographics.

Currently, excluding theatrical movie viewing, the generally available means of accessing paid video content can be broadly categorized into three forms: "broadcast," renting or purchasing "packaged" media like DVDs or Blu-ray Discs (BD), and "streaming" via the internet. As internet usage continues to expand, discussions from a marketing perspective focus on whether the future paid video market will shift significantly toward internet-based "streaming."

Therefore, to explore future directions, the Media Innovation Research Department at DENTSU SOKEN INC. has decided to first understand the current state of users by grouping those who pay to watch video content—combining users of "broadcast," "packaged media," and "streaming"—under the category of "people who pay to watch video content."

One in four people use paid video services at least once every three months

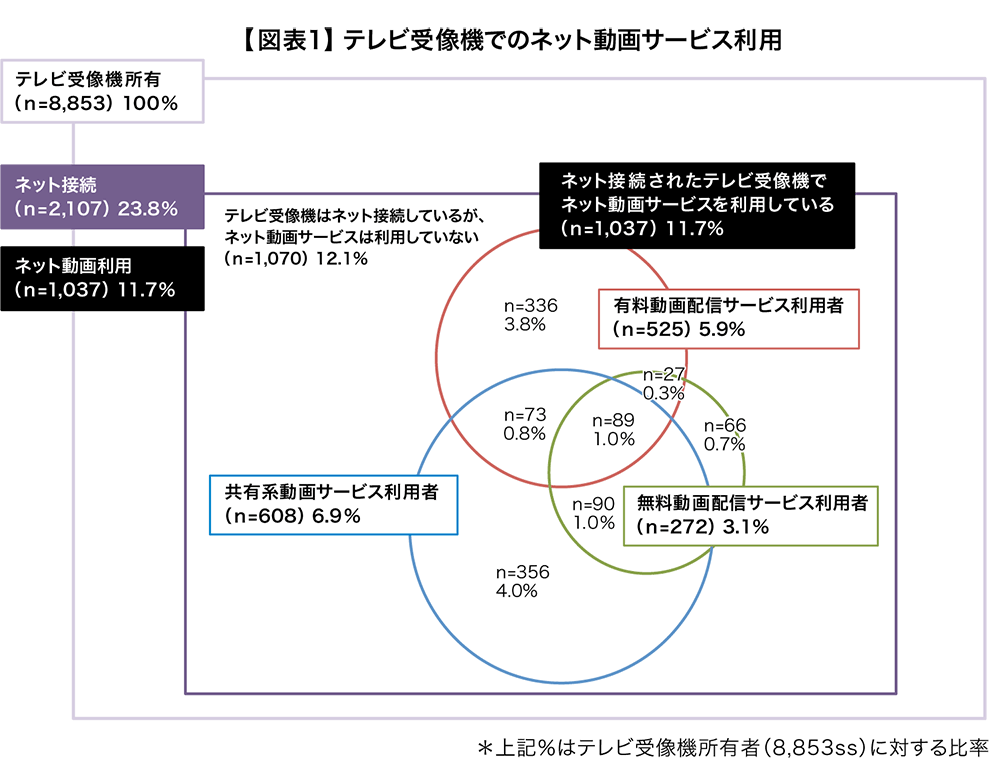

First, in a survey conducted at the end of August 2015, we asked 10,000 men and women aged 15 to 69 to list the paid video services they had used in the past three months (Figure 1). Note that NHK reception contracts (terrestrial and BS) were excluded from the definition of "paid video services" in this survey.

One in four respondents (25.3%) reported using a paid video service at least once in the past three months. Usage was higher among men, particularly among men in their 20s, where one in three (33.4%) reported usage.

So, how do users watch paid video content? We asked service users about their methods (Figure 2, multiple answers allowed).The most common method was "Paid TV Subscription (Monthly Flat Rate)" (58.4%), followed by "Package (DVD/BD) Rental (Pay-Per-Content)" (39.0%), and then "Paid Internet Streaming (Monthly Flat Rate)" (26.5%). Although this was an online survey, it shows that paid internet streaming, despite its relatively short history, already has a significant presence.

Segmentation Among Paid Markets

The three services with the highest usage rates were "Pay TV (monthly flat rate)" (58.4%), "Package (DVD/BD) Rental (pay-per-content)" (39.0%), and "Paid Internet Streaming (monthly flat rate)" (26.5%). Are these services competing with each other? Or are they coexisting? Let's examine their relationship.

Among users of "Paid TV (Monthly Subscription)", 11.1% also used "Paid Internet Streaming (Monthly Subscription)", while 15.6% used "Package (DVD/BD) Rental (Pay-Per-Content)". The overlap between Paid TV users and users of the other two services is not large, suggesting they coexist with some "segmentation" in terms of user acquisition.

Let's also compare the overlap with other service users. For example, the overlap between "paid internet streaming (monthly subscription)" (26.5%) and "paid internet streaming (pay-per-view)" (16.3%) is 8.4% of the total. This means over half of those paying per content also use a monthly subscription streaming service. This suggests these services are complementary rather than distinct.

Incidentally, concerns are often voiced that as users of "paid internet streaming (monthly flat rate)" increase, rather than achieving "segmentation," users of traditional "package (DVD/BD) rentals (pay-per-content)" might drastically decline, as seen in the US. Comparing this using the same method as above, it was confirmed that at the time of the survey, the relationship was more one of gentle mutual complementarity.

Segmentation by Generation and Gender

Let's examine differences in service usage by generation and gender in more detail (Figure 3, multiple responses).

Paid broadcasting (monthly flat rate) is more common among older adults in their 50s and 60s, while package (DVD/BD) rentals and purchases are more prevalent among younger users in their teens to 30s.Paid internet streaming (monthly flat rate) also shows a tendency to be more popular among younger users in their teens to 30s. This suggests that the differing weight of services used across age groups contributes to the segmentation observed earlier between "paid broadcasting (monthly flat rate)" and other services.

Furthermore, there is a gender difference in the usage rate of paid internet streaming. Whether it's monthly subscription plans or pay-per-view content, the usage rate among men tends to be about 10% higher.

Segmentation by Genre Preferences

Another key point explaining the division between "paid broadcasting (monthly flat-rate)" and other services is the difference in the video genres being watched.

The following graph classifies all paid video service users based on the "genre of paid video they watch most often" (Figure 4, multiple responses).According to this, "movie lovers" show significantly higher usage of physical rental stores (50.4%), "sports fans" favor paid broadcasting (86.0%), "music/live event enthusiasts" prefer purchasing physical packages (26.5%), and "variety show fans" show notably higher usage of broadcasters' internet (video-on-demand) streaming services (15.0%).Thus, it was confirmed that even within paid video services, the viewing methods used differ slightly depending on the type of content preferred.

The most notable example is the high pay-TV usage rate among "Sports Fans." A recent memory is the surge in subscribers to the pay-TV service WOWOW when it broadcast tennis player Kei Nishikori's historic first-ever Japanese appearance in the US Open final in 2014.

Thus, the segmentation of paid video usage can also be explained by differences in the content genres offered by service providers.

Signs of New Trends

So, what content genres are preferred on paid video services? Looking at all individuals, the genres most frequently watched by users are movies (31.3%), dramas (20.2%), sports (14.6%), and anime (12.3%) (Figure 5, multiple responses).

However, trends vary slightly when broken down by gender and age. Among women aged 30 and above, dramas are nearly as popular as movies. Sports are particularly popular among men in their 30s and 40s, while anime tends to be especially popular among both men and women in their teens and 20s.

Furthermore, while paid internet video streaming services have traditionally focused on providing access to past movies and TV programs, multiple providers have recently begun including live sports broadcasts, such as baseball, within their monthly subscription packages. This trend is noteworthy as it offers a new option for people in their 30s and 40s—who grew up familiar with the internet and are now the core demographic—to enjoy their favorite sports content.

These new moves by streaming providers may conversely stimulate existing pay-TV broadcasters, potentially accelerating the online distribution of sports programming beyond traditional broadcasting methods.

What lies ahead for paid video viewing?

In the US, the rise of video streaming services over recent years has had a significant impact, leading to industry-wide restructuring that has affected traditional cable TV, satellite broadcasting, and even DVD rental chains. In Japan, as explained under the keyword "segmentation," it does not appear to have led to intense competition across industry boundaries. This is partly because each service has developed its own unique characteristics, matching specific demographics or content niches to retain users.

However, looking long-term, internet usage will likely become even more deeply integrated into daily life, expanding the use of online video streaming. While we previously cited live sports streaming as an example, it's also crucial to note the accelerating trend where streaming providers themselves produce content or secure exclusive content rights for internet distribution.Technologically, content incorporating new forms of expression, such as 360-degree virtual reality, is beginning to be offered to general users.

These new possibilities are not limited to online streaming providers alone; they represent opportunities for all businesses involved in video production and distribution. It is expected that businesses entering the online streaming domain will not only provide convenient access to past content but will also pursue new possibilities in video viewing and undertake initiatives to further enhance its appeal.

[Survey on Paid Video Service Usage Overview]

● Survey Period: August 14–31, 2015

● Survey Participants: Men and women aged 15 (excluding junior high school students) to 69 nationwide

● Scope of Paid Video Services

・Paid broadcasting (monthly flat rate) ※Excluding NHK and NHK-BS subscription fees / Paid internet streaming (monthly flat rate or pay-per-view) / Package (DVD/BD) rental (pay-per-view or monthly flat rate) / Package (DVD/BD) purchase

・Excludes any free trial periods or other free usage for all services

●Survey Implementation Support: Dentsu Macromill Insight, Inc.

1) Screening Survey (Web-based)

10,000 samples were proportionally collected according to the national population distribution by gender and age group to confirm the occurrence rates of "people who used paid video services in the past 3 months" and "the most frequently viewed video genre on paid video services"

2) Main Survey (Web Survey)

For the "most frequently watched genre," 2,752 samples were collected from individuals corresponding to one of six genres: movies, dramas, sports, anime, music/live events/theater, and variety shows.

Double weighting applied based on the composition ratio of "most frequently watched video genres" extracted from the screening survey and the composition ratio of "gender and age groups".