What does the future hold for retail in an era where digital swallows the real world?

"The Four: GAFA and the World They Created" (Toyo Keizai Inc.), which has become a prophetic text for an era where giant platformers dominate the world with data. Its author, Scott Galloway, stated the following in a recent interview:

"Disruptive innovation now lies in the physical (physical experience). (...) We will witness a massive reallocation of brand investment from traditional advertising to channels. Just as Apple has done." ( From an interview with C Scape's "Outside in." Translated by Keisuke Konishi)

The reason for this environmental shift is linked to the rise of DTC (Direct to Consumer) brands in the US, discussed previously, but it's also because the role of physical stores for brands is fundamentally changing right now. Underlying this are the following factors concerning the "experiential value" of brands in the digital age (Figure 1).

First, the value of digital information and communication, such as smartphones, has become commoditized as it has become part of daily life. At the same time, people are increasingly valuing real brand experiences where they can participate, immerse themselves, and share experiences, as well as direct human connections. This is evident in the popularity of live events like music and sports.

Furthermore, as seen in the rise of the sharing economy, consumer values are shifting, placing greater value on "experiences" over "things" (consumption of experiences versus ownership of goods). This shift from ownership to usage and experiential consumption, exemplified by the expansion of subscription markets, also applies to shopping behavior.

Furthermore, the rise of platform players like Amazon has increased their influence over brands by monopolizing customer touchpoints and data. For brands to survive in this environment, it is crucial to create "direct customer touchpoints," differentiate experiences for each individual customer, and enhance engagement.

Additionally, technologies related to purchasing, such as mobile ID payments, are evolving. In recent years, the convergence of online and physical stores is enabling smart, seamless sales and purchasing experiences, further evolving the "experiential value" of brands originating from physical stores.

Apple, mentioned earlier, has achieved a unique brand experience unmatched by others through its global strategy of expanding its directly operated "Apple Stores." This effectively communicates its design philosophy and worldview. Simultaneously, Apple Stores have become spaces for direct customer connection, transcending traditional retail outlets.

The company accelerated its business model transformation starting in 2014 by appointing Angela Ahrendts, former CEO of Burberry, to lead its retail division. Through customer-facing creative sessions like "Today At Apple," Apple positions its stores not merely as product sales points but as hubs for creative education. This builds user communities and strengthens engagement. In essence, Apple's stores cultivate not just customers who buy products, but true co-creators and evangelists of the brand.

The New Value in Retail Discovered by DTC Brands

Looking at today's retail environment, particularly in the US, the rapid growth of e-commerce markets like Amazon continues to threaten sales and drive closures of traditional retail formats such as department stores, specialty shops, and shopping malls. Swiss financial institution UBS predicts 75,000 stores will close by 2026 (*).

Conversely, DTC brands, as mentioned in the previous article, are accelerating their physical store expansion strategies, particularly in major cities. Here, stores serve as media to enhance brand awareness and expand customer touchpoints, effectively lowering the total cost of customer acquisition, including online channels. The formats of these new stores are also drawing attention. Rather than traditional brick-and-mortar shops, they include "smart stores" that integrate online and in-store ordering/payment experiences, as well as temporary, experiential pop-up stores.

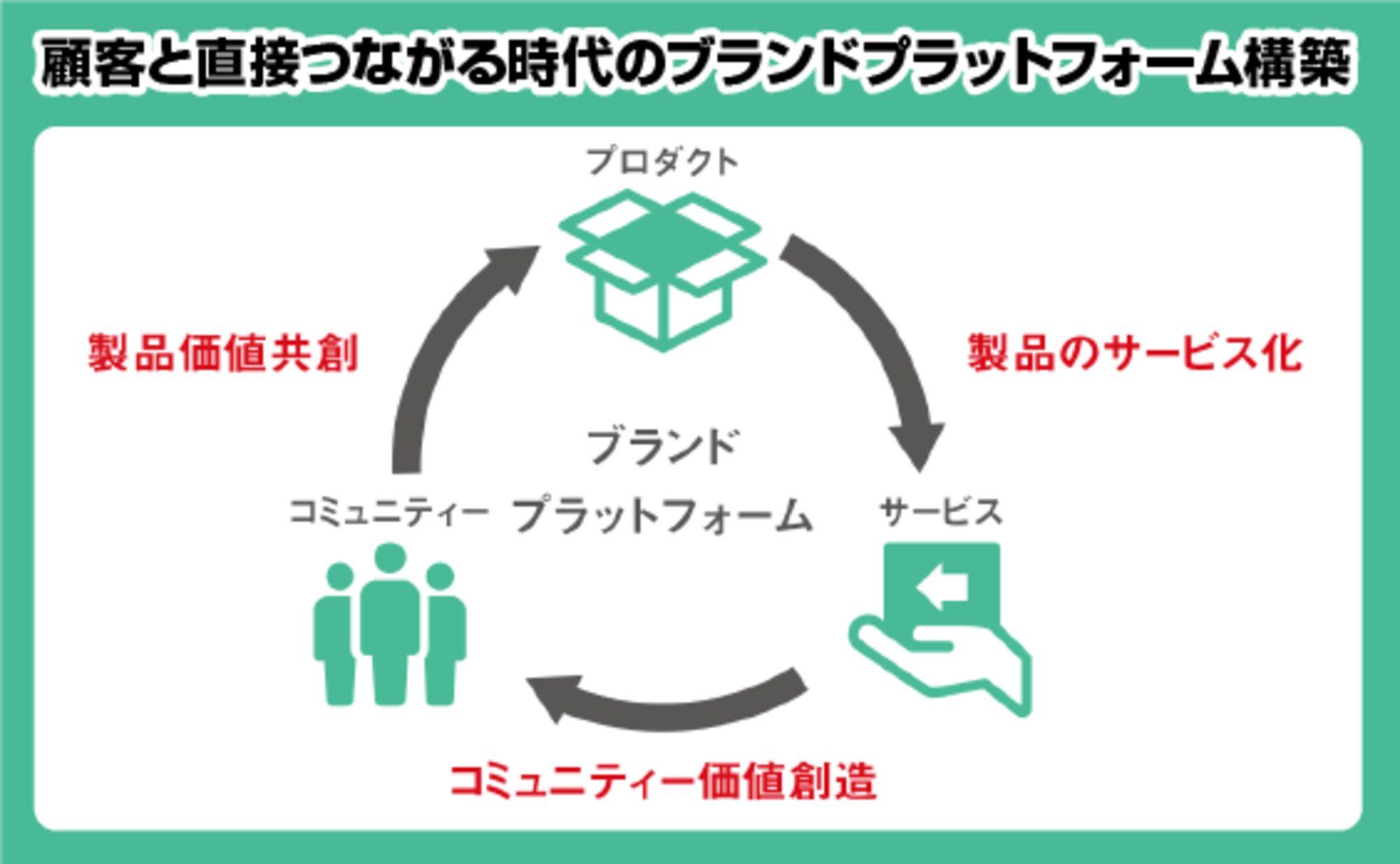

The purpose of these physical store openings is to create new brand experience platforms (Figure 2). Digitalization has commoditized consumer purchase data itself. Furthermore, physical stores are being positioned as the starting point for value creation through direct experience. This aims to foster brand storytelling, product personalization, community participation, product/service education, and co-creation. Simultaneously, it seeks to obtain richer customer feedback through the process leading to in-store purchases, reactions to value propositions, interactions, and service experiences.

For example, Nike announced its Triple Double strategy in 2017 (a management strategy to double three core values: innovation, speed, and direct). While significantly reducing the number of existing retail stores, Nike has strengthened flagship store development centered around Nike ID to deliver a deeper retail experience. The flagship store " House of Innovation," a prime example of this, allows customers to experience the future of retail as a new brand platform that embodies the company's digital strategy.

Shopping at this store requires membership in the Nike ID app. Scanning a product's barcode with your smartphone displays product descriptions, variations, and in-store availability on your screen. Paying via smartphone allows you to take your purchase home immediately, bypassing the checkout line.

Particularly striking is the product customization feature. Customers can freely select from various parts and colors to create their own one-of-a-kind shoes, then order them on the spot for immediate production. The store truly functions as a "space for co-creation of experiences and products," embodying the experiential values of innovation, speed, and directness.

*From a report by S&P Global, a major U.S. financial and information services company.

The Four Roles of Next-Generation Retail as a Platform

In an era where brands connect directly with customers online, the role of retail as an owned channel extends beyond simply reducing purchasing process stress and enhancing flexibility and convenience. As a physical brand platform enabling customer-driven brand value creation through new co-creation experiences, it is increasingly expected to fulfill the following four roles (Figure 3).

Namely:

① Media and brand experience function as a physical brand touchpoint

② Relationship-building (connection) function through personalized service experiences

③ Function to form connections between people and communities starting from physical spaces

④ Function to co-create the value of products and services themselves with customers, including mass customization

For next-generation brands, physical stores are not merely places to sell

For next-generation brands, physical stores are not merely places to sell goods. In fact, the transformation of brand stores into showrooms and the expansion into "lifestyle formats" like hotels and entertainment are increasingly common.

For example, lifestyle brands like MUJI and Bulgari are expanding into hotels that offer unique experiences. Mercedes-Benz is transforming dealerships into lifestyle stores and acquiring naming rights for stadiums and arenas worldwide, aiming to connect with customers through real live entertainment experiences. Such new experiential branding initiatives are also expanding.

Leveraging technological advancements, brands maximize the "value of experiences" as real customer touchpoints, achieving feedback and value co-creation cycles that online channels alone cannot fulfill. This requires new roles and key performance indicators (KPIs) for staff. Rather than focusing solely on sales figures as performance metrics, they must build lasting relationships with customers through online and offline channels, foster community bonds, and cultivate brand evangelists. Next-generation retail as a brand platform undoubtedly requires this kind of business model innovation.