In Part 6, we covered how the COVID-19 pandemic has changed the behavior of China's youth. This time, we introduce trends in content tie-ups targeting China's youth and the services we provide to solve challenges for Chinese clients in the post-COVID era.

Can Anime Reach 400 Million People? Content Collaboration Trends in China

Hello, I'm Yasuhiro Yamauchi from dentsu X, currently on assignment in Shanghai. In China, cultural content like anime, comics, and games is collectively referred to as "ACG" (taking the English initials) or "2D" (二次元). According to research by iiMedia Research, China's 2D user base is projected to reach 400 million by 2021. (Source: https://www.iimedia.cn/c400/69592.html )

In Japan, it's often said that "among younger generations, anime is not a subculture but a mainstream culture." China is now in precisely the same situation.

(Reference: Anime is the Ultimate Marketing Solution )

Even during the COVID-19 pandemic, the ACG sphere showed no signs of weakening consumer spending power; rather, it demonstrated a strengthening trend. This was evident in reports of increased user numbers on content platforms centered around anime and games, as well as higher revenues for game companies.

Given that e-commerce marketing is central in China, and with short product lifecycles, content tie-ins are frequently used to capture new consumer attention. ACG-related content tie-ins are a frequently considered option when targeting young people. It's also not uncommon for them to be considered as an alternative to celebrity endorsements.

Beyond "Singles' Day" (November 11th, also known as Double Eleven, China's largest shopping event), which has gained increasing attention in Japan, various content tie-ins emerge targeting major sales periods like "618". Many of these tie-ins involve Japanese anime works. Naturally, these are tie-ins based on legitimate licensing agreements.

Strengthened copyright enforcement, coupled with major e-commerce platforms actively supporting content matching initiatives, is another factor accelerating content tie-ups in China.

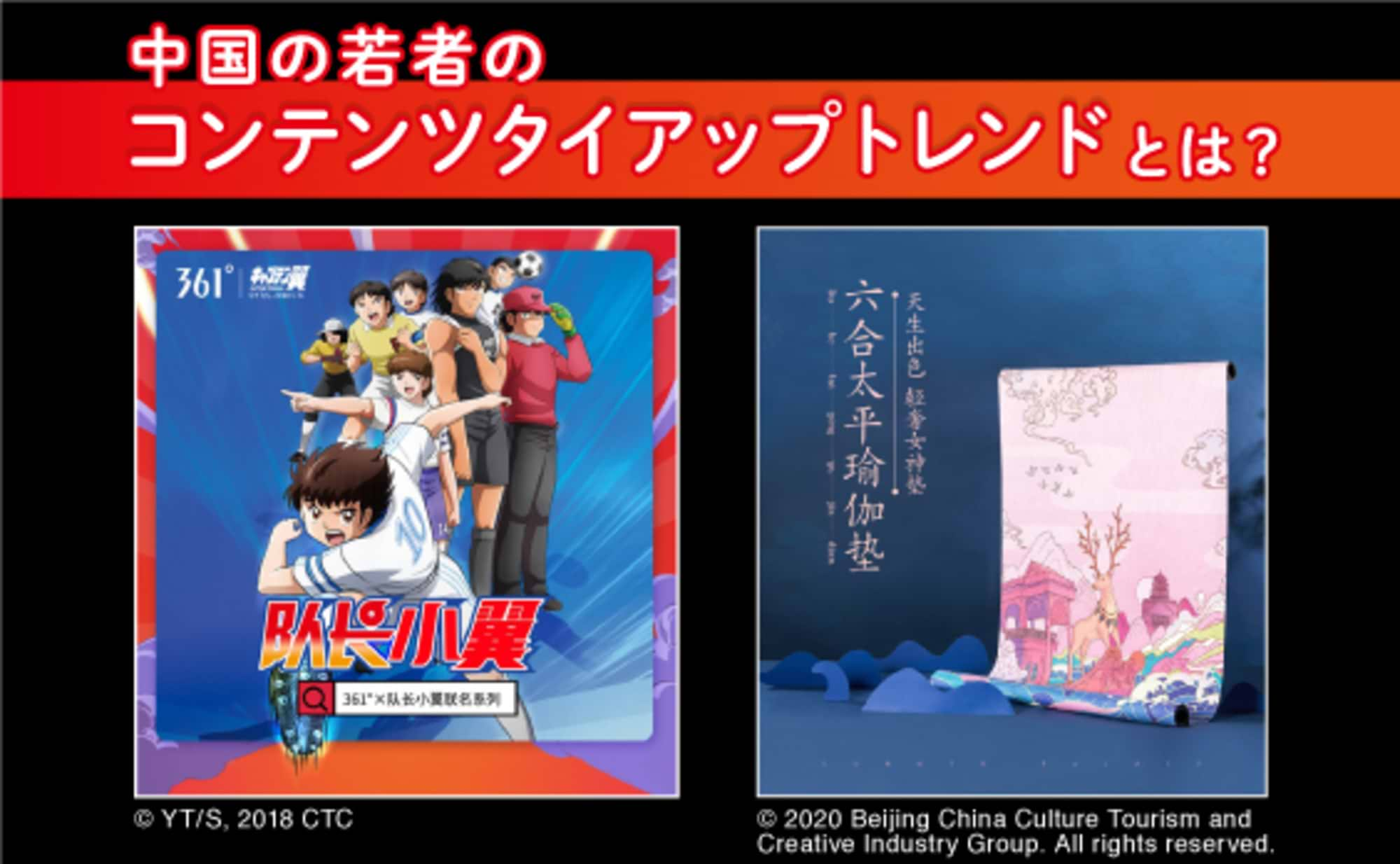

Example of the Chinese sports brand "361°" utilizing "Captain Tsubasa"

Beyond ACG-related content, trends for tie-in collaborations include virtual characters and "Guochao" (national trend), which refers to traditional cultural assets.

Virtual characters are familiar in Japan too, but a distinctive feature of their marketing use in China is their appearance in "live commerce." Live commerce combines live streaming with e-commerce and has seen rapid growth in China recently.

While KOLs (Key Opinion Leaders, often referred to as KOLs in China) promote products, ordinary employees and company executives also appear. Virtual characters can "co-star" with them, making live commerce a key arena for their activities.

"Guochao" content includes traditional cultural assets like museums and gardens, which offer unique motifs and design patterns for collaboration business. The fusion of tradition and cutting-edge design is embraced by modern youth as cool, leading to tie-ups with a wide range of brands including fashion, cosmetics, and food.

Examples of "Guochao" content managed by Zhongchuang Culture & Tourism

In China, content tie-ins are actively pursued to spark interest.

Post-COVID Era: Approaches to China's Youth

Next, Yoichi Hasegawa of Dentsu Inc. Aegis Network China will introduce some of the solutions Dentsu Group provides in China to approach young people in the post-COVID era.

Here,

① We want to tailor our approach to the lifestyle behaviors and trends of young people

② Secure solid sales through e-commerce

③ Enhance the brand value of products and services

Solutions for these three challenges are introduced below.

① We want to tailor our approach to the lifestyle behaviors and trends of young people

Solution: Partner with media popular among young people!

Dentsu Group has formed strategic partnerships with BAT—Baidu, Alibaba, and Tencent—over the past few years. Then, in June of this year, as the COVID-19 pandemic began to subside, it announced partnerships with four media platforms strong among young people, often called the "Four Little Kings" following BAT: Bilibili (an entertainment content company focused on video), Xiaohongshu (a social and e-commerce platform), Zhihu (a Q&A site), and Kuaishou (a short video platform like TikTok).

The Four Platforms Strong with Young People: "The Little Four Heavenly Kings"

② Secure solid sales in e-commerce

Solution: Implement live commerce with KOLs (Chinese influencers) who have strong sales power!

Live streams featuring KOLs with strong sales capabilities are highly effective. We also managed numerous KOL-led live streams during the "618" shopping festival, the major sales event following Singles' Day. During this year's "618," the clients we supported achieved sales significantly exceeding their previous year's average.

③ Want to enhance the brand value of products or services?

Solution: Support campaigns by featuring talent to elevate brand image!

Live streams sometimes prioritize securing sales through discounts over enhancing brand value. However, we have supported numerous campaigns both on and off e-commerce platforms that leverage the strengths of products and brands.

Specifically, for planning support for Tmall events (like Super Brand Day) where Alibaba selects participating brands based on concept, we simultaneously achieved brand value enhancement through talent endorsements and sales growth through KOL livestreams.

Through our partnership with Laqi, a leading Taobao Certified Partner (T CP) announced last December, we continue to support clients in strengthening their brands and achieving sustained sales growth.

Moving forward, we plan to expand our support for solving client challenges in line with changes in Chinese consumers' behavior. If you are considering approaches to reach young Chinese consumers, please feel free to contact us.