This series reports on changes in media engagement and purchasing behavior among Generation Z, the future customers, based on research (a joint study by Dentsu Inc., The Goal Inc., and Condé Nast Japan) (*) examining the impact of the COVID-19 pandemic on luxury brand business.

※ The survey targeted fashion-conscious women, segmented into three generations: Generation Z (24 and under), Millennials (25-39), and General (existing buyers, 35 and over).

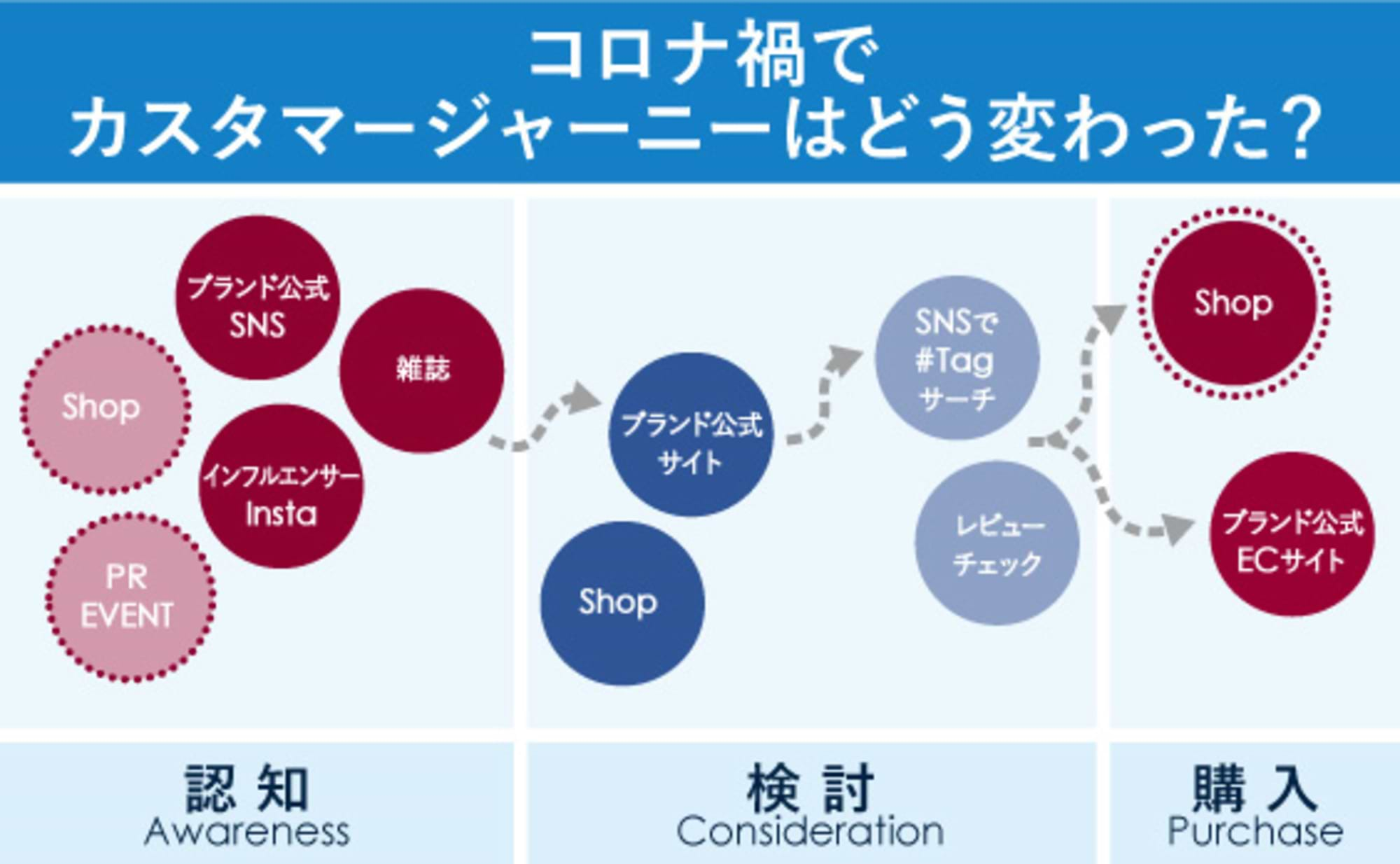

Previously, we analyzed contact points to clarify the customer journey in the luxury industry during the pandemic.

This time, we shift our focus to the brand side, discussing how brands are perceived and what is expected of them.

Luxury items are shifting toward being "higher quality and longer-lasting"

First, we introduce notable shifts in consumer attitudes toward luxury items during the pandemic.

Increased Awareness Due to the Pandemic

-

Rather than buying many affordable items, consumers now desire fewer, higher-priced items that last longer

-

People are willing to spend generously to create a comfortable living environment

Attitudes that decreased due to the pandemic

One major trend of recent years, "easy-to-recognize logo items," has seen a slight decline, particularly among Millennials, alongside reduced opportunities to go out. Additionally, interest in sharing services appears to have decreased, perhaps due to concerns about items being used by large numbers of people.

As people go out less, the importance of accumulating items seems to have decreased. On the other hand, a very distinctive point is the rising support across all generations for "high-quality, long-lasting items that represent the brand," reflecting a broader societal trend of returning to fundamentals.

Interest in "home luxury" – making time spent at home more comfortable, a keyword currently promoted by many brands – was also evident.

Whether or not brands invest in Gen Z will create a significant gap between them in the future

Next, regarding the results of the brand-specific funnel analysis. This survey presented over 50 specific well-known brands and individually surveyed respondents' "awareness," "favorability," and "purchase intent" for each.

This revealed "differences in funnel structure across generations." Below is a comparison of scores from "Awareness" to "Repurchase Intention" by generation. (Calculated from the average of the top 10 most recognized brands)

While there is no significant difference in "Awareness" itself across generations, Generation Z shows a large gap compared to older generations starting from "Favorability" onwards. Of course, due to the high-priced nature of these products, purchasing power presents a hurdle. However, it is possible that for Generation Z, these brands are perceived as "known, but not necessarily desired."

Analyzing individual brands reveals even more pronounced trends. Brands actively communicating with Gen Z achieve higher "Favorability" scores, while those that don't remain merely "known" without fostering genuine favorability.

Some brands express the view: "We understand Gen Z is an important target, but realistically, it's still hard to grasp their actual business impact." While this is certainly true, brands that continue investing actively in Gen Z are successfully building steady goodwill in the minds of their target audience compared to competitors who don't. This survey shows that gap is gradually widening beneath the surface.

Although not yet visible on the surface, the competition that will create a significant gap in the future has already begun. This is why brands continue to focus on and invest in Generation Z.

What Do Consumers Seek from Luxury Brands?

Finally, we will unravel what luxury brands should communicate to consumers going forward, based on survey results regarding "key considerations when purchasing" and "expectations for brands" gathered by brand category.

Regarding these findings, there were almost no generational differences; instead, clear distinctions emerged based on category. As shown below, for the fashion category, consumers expect future brand activities to include "information dissemination via official brand SNS" and "social contribution (environmental protection/acceptance of diversity like LGBTQ)." This tendency appears particularly strong among Generation Z, often called SDGs natives.

This likely correlates with the top factor consumers prioritize when purchasing fashion: "satisfying personal preferences only I understand." Since "self-satisfaction" is the starting point, consumers presumably seek brands with a "philosophy they can relate to."

Conversely, the top purchasing priority for the Watch & Jewelry category was "enabling a more elevated version of oneself." Similar to fashion, top expectations for brands included "social media communication," alongside "expecting meticulous in-store service unique to luxury brands." Since this originates from "status (others' perspective)," it appears brands are expected to provide "special treatment as customers."

Next time, we will invite a guest from Condé Nast Japan to discuss the findings from this two-part report. Considering major trends like the "Great Reset" in the fashion industry and the momentum of SDGs, we aim to clarify the future outlook for luxury brands.

[Survey Overview]

Survey Title: "Post-COVID Luxury Brand Survey"

Conducted: September 2020

Survey Method: Internet survey (quantitative) / Face-to-face interviews (qualitative)

Survey Participants: High-involvement luxury consumers; Total 1,800 SS

Target Categories: Fashion / Watches & Jewelry (W&J) / Cosmetics / Automobiles

Research Company: Dentsu Macromill Insight, Inc.