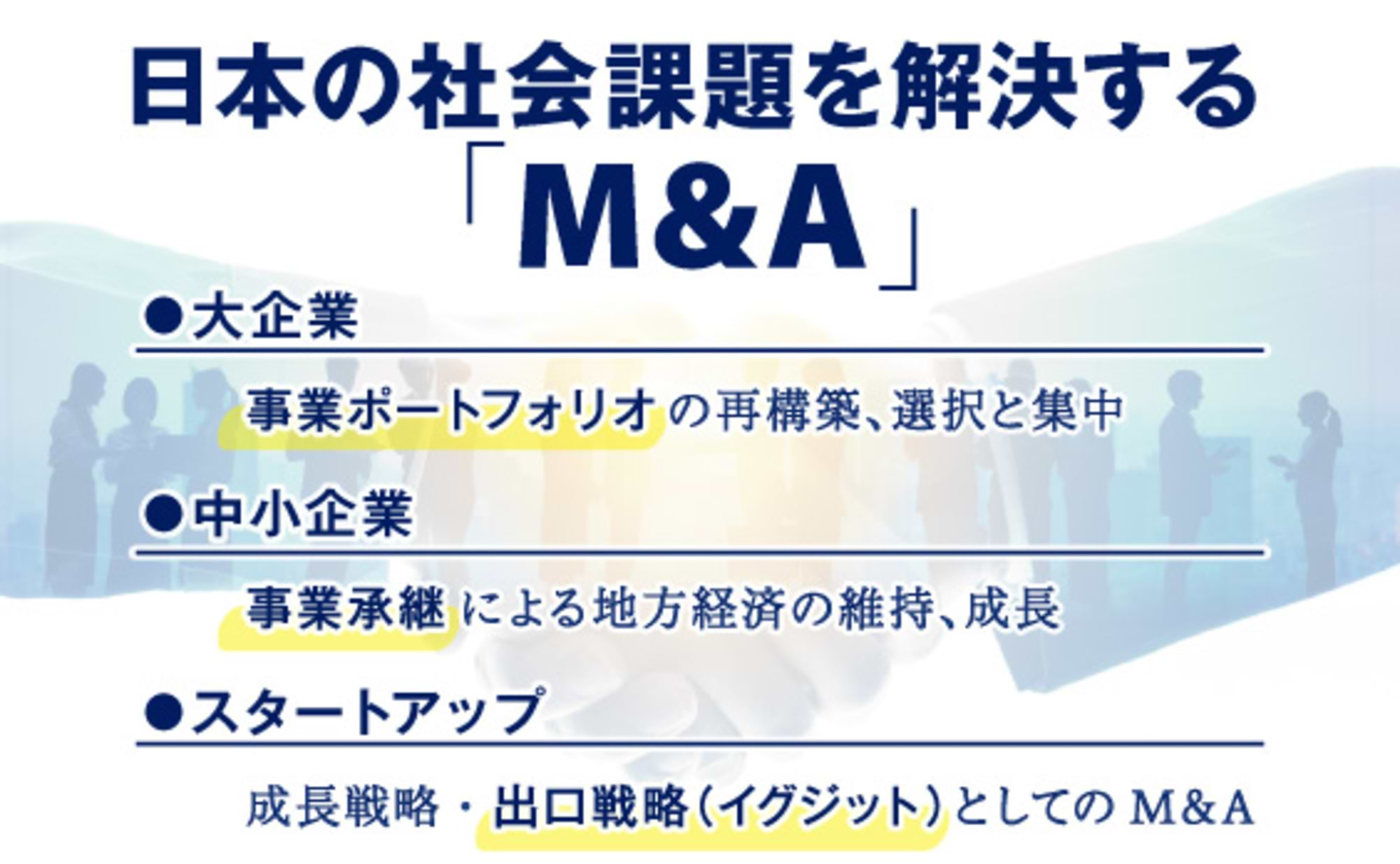

Today, M&A is the ultimate solution for dynamically resolving any corporate management challenge.

This series will clearly unravel the essential value of M&A—what it brings to companies and society in this era.

This installment introduces practical M&A utilization methods directly linked to corporate growth strategies, focusing on specific initiatives by the Japan M&A Center and Dentsu Inc. (*). We welcomed Satoshi Tajima from the Industry Restructuring Department of the Japan M&A Center as our guest, with Dentsu Inc.'s Toshihiro Katayama conducting the interview.

Japan M&A Center and Dentsu Inc. formed a business alliance in 2019. Both companies jointly promote M&A intermediation for businesses.

① Growth Strategy for Small and Medium-Sized Enterprises: "Proactive Sales" to Realize Vision

Katayama: Japan M&A Center and Dentsu Inc. have been collaborating since 2019, having already consulted with dozens of companies. We support M&A across all industries, from large corporations to SMEs and startups. Today, together with Mr. Tajima, we will discuss...

- Growth Strategies for SMEs

- Media Companies' BX/DX Strategy

- Brand Portfolio Restructuring for Large Corporations

- Startup Exit Strategies

I would like to discuss how to leverage M&A for management strategy through these four perspectives.

To begin with, under "Growth Strategies for Small and Medium-Sized Enterprises," I'd like to present a case study of a client who consulted us through Dentsu Inc.'s regional office and transferred their core business to a Tokyo-based company.

Tajima: This client had been in manufacturing since its founding. They approached us saying, "Our recently launched robotics business is starting to gain traction, and we want to focus our investment on this new venture with an eye on its future potential." We proposed raising funds by selling the existing business. Together with Dentsu Inc., we supported the transfer of that business to a Tokyo-based company, and the deal was successfully closed.

Katayama: It's often misunderstood. When people hear "they sold their core business they'd run since founding," some might think, "Were they really in dire straits?" But the reality was the exact opposite. This case was a classic example of using M&A as a strategic move for "proactive management." They achieved BX (Business Transformation) into the robotics business and continue to pursue further growth, with Dentsu Inc. still accompanying them.

Tajima: This client had a clear vision: "We will create the future through our robotics business." Increasingly, executives are choosing M&A not for defensive reasons, but as a means to realize their management aspirations and vision.

Katayama: I agree. By the way, I imagine many companies view the pandemic as an opportunity for growth and are proactively pursuing transformation. But realistically, for companies experiencing declining sales or profits due to the pandemic, is it difficult to pursue M&A at this time?

Tajima: Absolutely not. While recent financial statements are important, they alone don't determine a company's value. There's significant potential to enhance value by examining target companies from multiple perspectives—such as the character of the management, the pace of past sales growth, the number of sales channels, the business area and target market, and the company's social impact and market potential. The key is this: if you anticipate pursuing M&A in the future, prepare well in advance. That way, you won't miss the "optimal timing" when it arrives.

Katayama: So it's crucial to maintain M&A as a "management option" even during normal times.

② Media Companies' BX/DX Strategy: M&A Driving Drastic Transformation

Katayama: Our next theme is "Media Companies' BX/DX Strategy. " Right now, the media sector—including TV, radio, newspapers, magazines, printing companies, and production companies—is undergoing rapid industry consolidation. Digital media, with its fast pace of change, is a given, but even traditional media, the so-called "four major media," faces digital transformation as an urgent, unavoidable challenge.

Amidst this, traditional media hold vast amounts of content like "sports," "entertainment," and "films," and we're seeing an increase in BX/DX strategies that leverage this content, right?

Tajima: One case we supported involved the M&A between Chukyo TV, a television broadcaster, and Aquaring, a company specializing in planning and producing digital content.

Chukyo TV was seeking to "expand its business into the digital domain." Aquaring aspired to "contribute to society through communication design that transcends digital boundaries." These strong, shared visions brought the two companies together. Aquaring joining the Chukyo TV Group enabled further strengthening of the group's digitalization in content production and distribution.

Katayama: This case feels very relatable to Dentsu Inc. as well. Dentsu Inc. has collaborated with media companies in various ways—not only in advertising, but also in content production, event production, and more. Through these long-standing relationships, we often share management-level challenges with media companies.

When such companies require drastic transformation, being able to propose "M&A" as one strategic option contributes to supporting their growth. In today's era, not limited to media companies, I even believe that "drastic transformation cannot be achieved without M&A."

③Rebuilding Large Corporations' Brand Portfolios: M&A for "Choice and Concentration"

Katayama: The third theme is "Rebuilding Large Corporations' Brand Portfolios." In recent years, we've seen more cases where large corporations sell off their businesses and brands as part of shifting business strategies. Could you tell us about cases where M&A is used for this kind of "business portfolio restructuring"?

Tajima: It's a highly effective approach. Companies that have diversified their operations over many years can rebuild their business portfolios by "divesting businesses with low affinity to their current core focus and acquiring businesses with potential synergies." This not only helps restore performance but also has the potential to enhance corporate value.

Indeed, there are corporate examples where companies have steadily improved performance over the past five years by executing numerous acquisitions and divesting non-core businesses, including smaller operations. I believe this type of "selection and concentration" M&A will continue to accelerate going forward.

Katayama: Dentsu Inc. has long had many opportunities to consult on management strategy with clients possessing multiple business portfolios or brand portfolios. Recently, we've also been supporting management strategy in areas like IR and SDGs/ESG investing.

Despite being involved in such deep aspects of business, we lacked the option of M&A, which brings the most drastic transformation. By adding Japan M&A Center as a powerful partner, we expect to achieve more fundamental support for our clients' growth.

Tajima: Thank you. As mentioned earlier, M&A isn't just about financial perspectives; "market valuation" and "brand image from consumers' viewpoints" are also crucial. Partnering with Dentsu Inc., which boasts Japan's top-tier expertise and track record in marketing and branding, excites us about expanding the value of M&A as a tool.

④ Startup Exit Strategies: M&A as an Alternative Goal to IPO

Katayama: Finally, "Startup Exit Strategies." Dentsu Inc. is also dedicated to supporting startup growth. While many Japanese startups have traditionally aimed for an IPO (initial public offering), in the U.S., exiting through M&A is widely accepted as a valid entrepreneurial goal. We're seeing this trend gain momentum in Japan too, right?

Tajima: Yes, that's correct. In the last few years, there's been a significant increase in Japanese large corporations investing in startups. Particularly, when launching new businesses, acquiring startups specialized in that specific field to rapidly bring innovative services to market has become a trend among large corporations.

Katayama: For startups themselves, the hurdles for an IPO are getting higher every year. Even after going public, they face a harsh environment where they must keep running on their own. This has fueled a growing desire to set "goals other than going public." To summarize this situation: large corporations gain "startup talent, technology, and agility," while startups gain "large corporations' supply chains, sales capabilities, and credibility." There are significant benefits for both sides.

Tajima: As Mr. Katayama mentioned, going public isn't the ultimate goal. The crucial question is how to scale the business beyond that point. As IPO scrutiny intensifies, the appeal of M&A—as you highlighted—is gaining attention precisely because it offers advantages not found in an IPO.

Beyond just raising capital, it enables startups to leverage the management resources of large corporations—such as talent acquisition and brand power—and adopt their management methodologies. This major trend is likely to accelerate going forward.

Katayama: I agree. We've discussed how companies across various industries and sizes can effectively utilize M&A. Mr. Tajima, who handles many such deals, is there anything you'd like to convey to Japanese companies?

Tajima: I believe many executives understand the effectiveness of "proactive divestment" and "portfolio restructuring." However, the perception that "business withdrawal/divestment = management failure" remains deeply ingrained in Japan, leading many executives to delay decisions. Yet, we live in an era of rapid change. Unlike Japan's era of steady upward growth, every company must now change to keep growing. If you keep "postponing" or "maintaining the status quo," you'll be left further and further behind in the market.

Katayama: Precisely. I feel that the accumulation of "postponing" reforms and "maintaining the status quo" has made Japan a society where innovation is difficult to achieve. M&A is transformation itself, it's a form of renewal, and it can also lead to maintaining employment. Above all, I want to convey to Japanese companies that it can be a means to drive innovation for creating a better society.

Tajima: M&A exists solely to realize a company's future and vision. I urge companies to think openly about how to evolve their business. If M&A emerges as a viable strategic option in that process, I strongly encourage them to prepare for it proactively.

Katayama: I, too, believe M&A is a key factor for the sustainable development of not only our clients and partner companies, but the entire socio-economic landscape. By joining forces, Japan M&A Center and Dentsu Inc. can help more companies recognize the effectiveness of M&A and work together to build an "Innovative Japan." Thank you for today!