Today, "M&A" is the most essential solution in the management strategy of any company. This series will clearly unravel the fundamental value of M&A, exploring what it brings to companies and society in the current era.

The Dentsu Group has also formed a business agreement with Japan M&A Center, the industry leader, and is conducting "M&A brokerage" as a major weapon for solving corporate management challenges ( see previous article ).

This time, we invited Mr. Tsuneo Watanabe, Director of Japan M&A Center, and Dentsu Inc.'s Shunichi Katayama interviewed him. What value can M&A provide to Japanese society, as explained by this leading expert in "industry restructuring M&A"?

In fact, many companies choosing M&A are "successful companies" on both the seller and buyer sides.

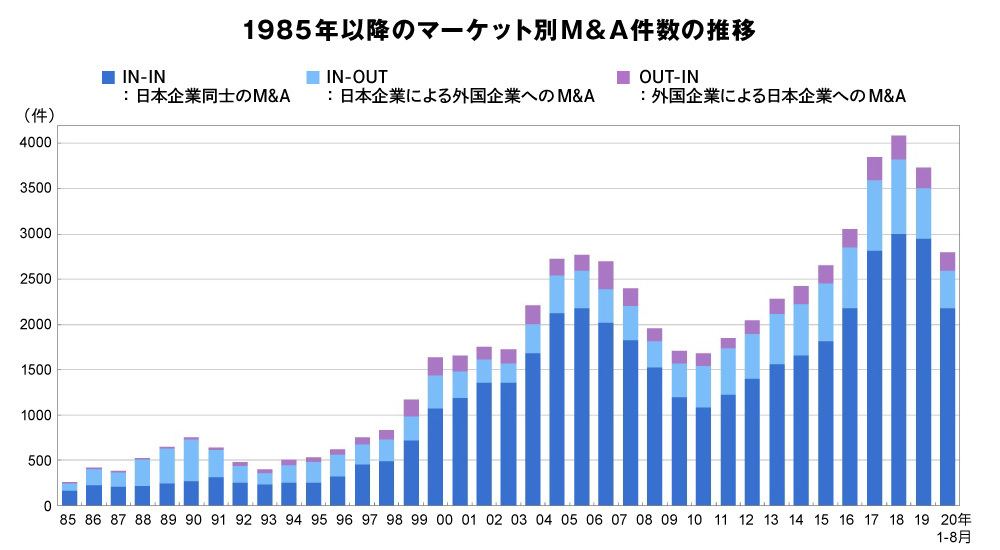

Katayama: Japan M&A Center is the industry leader with an unmatched track record. Within that firm, Mr. Watanabe stands as the top M&A dealmaker, having handled numerous transactions and truly been one of the driving forces behind Japan's industry consolidation. In recent years, the M&A market seems to be expanding rapidly. From a professional perspective, what is your actual assessment?

Watanabe: You're absolutely right; the number of M&A deals is currently increasing significantly. Most selling companies have annual sales of around 200 million to 10 billion yen, and about half of the buying companies are listed firms. While many people associate M&A with "acquiring loss-making companies on the verge of bankruptcy," the reality is that most sellers who go through M&A are profitable, high-quality companies.

Katayama: So, in reality, successful companies often choose M&A as one of their strategic options. Now, there are as many approaches to M&A as there are deals—100 different methods for 100 different cases. While the logic and knowledge taught in business school are important, "experience" is absolutely crucial in this field. Watanabe-san, what specific industries have you been involved in for M&A?

Watanabe: I've worked across a wide range of industries, including manufacturing, IT, food, and construction. My experience spans the entire country, from Hokkaido to Okinawa, and I've also handled companies with overseas bases. Particularly around 2012, I foresaw that "reorganization within the dispensing pharmacy industry" – something no one believed in at the time – was inevitable. I pioneered and focused on M&A within the dispensing pharmacy sector.

Other notable deals include the capital alliance between major IT players Toshiba Information Systems and Denso, as well as the M&A between the IT startup Rist and Kyocera Communication Systems.

Katayama: Thank you. Mr. Watanabe, who has handled the most deals in Japan, has truly accomplished something remarkable in a very straightforward way. Moreover, the companies he has worked with—pharmaceutical firms, manufacturers, IT companies—are highly aligned with the clients we support through advertising communications.

In recent years, Dentsu Inc. has also been increasingly asked by clients to handle "upstream" business strategy. M&A is precisely a means to solve these upstream corporate challenges. Therefore, we find it extremely reassuring to be able to team up with Japan M&A Center, which boasts an overwhelming track record in this field, and Mr. Watanabe.

M&A, which is established through a "continuum of communication," is a marriage between companies.

Katayama: Dentsu Inc. has adopted "Integrated Growth Partner" (IGP) as its mid-term vision, aiming to be a partner committed to the sustainable growth of client companies and society. I feel this aligns closely with the management philosophy of Japan M&A Center: "Contributing to the survival and development of companies through M&A operations." Could you explain again what value M&A brings to companies?

Watanabe: I view M&A as a means to realize the "vision" of both the seller and the buyer. The selling company passes on the baton imbued with the founding aspiration of "this is what we want to achieve." The buying company receives this baton to reach its own stated vision faster and in a better state. Connecting the visions of both companies is one of the key values M&A brings to businesses.

Katayama: And as these successive baton passes of vision occur, they culminate in contributing to the sustainable development of the entire Japanese economy, right?

Watanabe: Yes, I believe so. Currently, around 50,000 companies go out of business annually, and it's said that over half of these are profitable small and medium-sized enterprises. Being profitable means these companies contribute value to the Japanese economy and serve society. The fact that so many companies supporting the Japanese economy are closing down every year is itself a major challenge.

Katayama: When a company closes, everything disappears—including the assets and talent accumulated over time. One reason companies still choose closure over M&A is the negative perception surrounding M&A. I believe it's crucial for the Japanese economy's sustainable growth that we accurately convey the "essential value of M&A" to society—that it can create mutual happiness for both buyers and sellers and enable significant growth.

Watanabe: I expect Dentsu Inc. to excel in this area, as it aligns well with their strengths. I see a high affinity between Dentsu Inc. and M&A. Dentsu Inc. is fundamentally a communications company, and the entire M&A process is essentially a continuous series of communications.

Katayama: That's exactly it. What surprised me most when I started working with the Japan M&A Center was the communication aspect. Many people might have a dry image of M&A, but it's actually so rich in drama and emotional communication that calling it a "marriage between companies" isn't an exaggeration.

Companies are driven by people, and human feelings are often moved by emotions, not just money. I've come to understand that Japan M&A Center is a company that truly values communication. I see a connection with what Dentsu Inc. has always valued.

Watanabe: I agree. Beyond communication, I believe we can jointly advance M&A in areas where Dentsu Inc. possesses expertise and networks—such as restructuring the business portfolios of large corporations, transforming and updating the businesses of media companies, and facilitating exit strategies for startups. While we primarily handle M&A for mid-sized and small companies, partnering with Dentsu Inc. makes me feel our possibilities have expanded significantly.

Katayama: Thank you. Especially for B2C products, brand strategy is essentially the same as business strategy. If you consider the brand portfolio as the business portfolio, M&A becomes an unavoidable strategic option. Furthermore, by being able to propose M&A as an exit strategy alternative to IPOs for the startups we work with daily, we believe that Dentsu Inc. will also be able to expand its scope of support. We recognize that M&A has already become an indispensable option for Dentsu Inc.'s clients and partners, ranging from large corporations to startups.

Today, game-changing shifts are occurring across every industry, including advertising, with even influential companies collapsing overnight. Conversely, we've seen numerous cases where rearranging companies or portfolios like puzzle pieces leads to sudden, dramatic success. Japan M&A Center creates such added value—directly solving management challenges through matching—which I personally feel parallels Dentsu Inc.'s agency work and management solutions (laughs).

Japan M&A Center and Dentsu Inc.: Tackling Companies' "Upstream Challenges" Through M&A

Katayama: Now, while there are numerous upstream management strategy challenges, I believe M&A is overwhelmingly important and critical among them. It also possesses the influence to drive industry consolidation and has a significant impact on society as a whole. We at the Dentsu Group are deeply honored to be able to take on such dynamic projects alongside the Japan M&A Center. What are your thoughts, Watanabe-san? Please share your honest opinion.

Watanabe: Traditionally, general trading companies have been responsible for the commercial flow within Japan's value chain. We believe that "reorganizing Japan's entire value chain through M&A" is a crucial role for us. Conversely, however, the challenge has been that we could only handle the "reorganization of the value chain" itself.

Partnering with Dentsu Inc. will enable us to accelerate the growth of companies post-M&A more swiftly. In other words, we believe we can now advance the realization of the "vision" for both the selling and acquiring companies faster and in a better state. That is the new challenge, and it's incredibly exciting.

Katayama: Thank you! For Dentsu Inc., partnering with Japan's strongest M&A team is truly significant. As Dentsu Inc. champions IGP, M&A brokerage is an indispensable weapon as the ultimate solution for resolving companies' upstream challenges.

We should increasingly leverage M&A as a means to solve the challenges we routinely face: supporting the growth of clients and partner companies, industry restructuring, and fundamentally resolving societal issues. Let's continue to jointly drive the sustainable growth of Japanese companies and Japanese society!