The rapid rise in cashless payment ratios is thought to be influenced by the rise of e-commerce (EC) and its payment methods. If the total EC payment methods are considered 100%, credit card payments account for 73.3%, point payments for 7.7%, and debit card payments for 7.3%, making up the top positions.

When shopping online, the most important factor beyond the shopping experience itself is "high point accrual rate" (73.8%), followed by "smooth cashless payments via credit cards, etc." (70.6%), "wide range of point usage" (36.2%), and "robust point economy" (31.2%).

Thus, the "expansion of the points ecosystem," where points can be used as digital cash in the e-commerce market, is expected to be a major trigger for the penetration of cashless payments.

Regarding future usage intentions for "mobile wallets (mobile payments)", potential interest reached 75.5%, with 17.8% stating "I want to use it", 19.7% "I would somewhat like to use it", and 38.0% "I might use it depending on the situation".

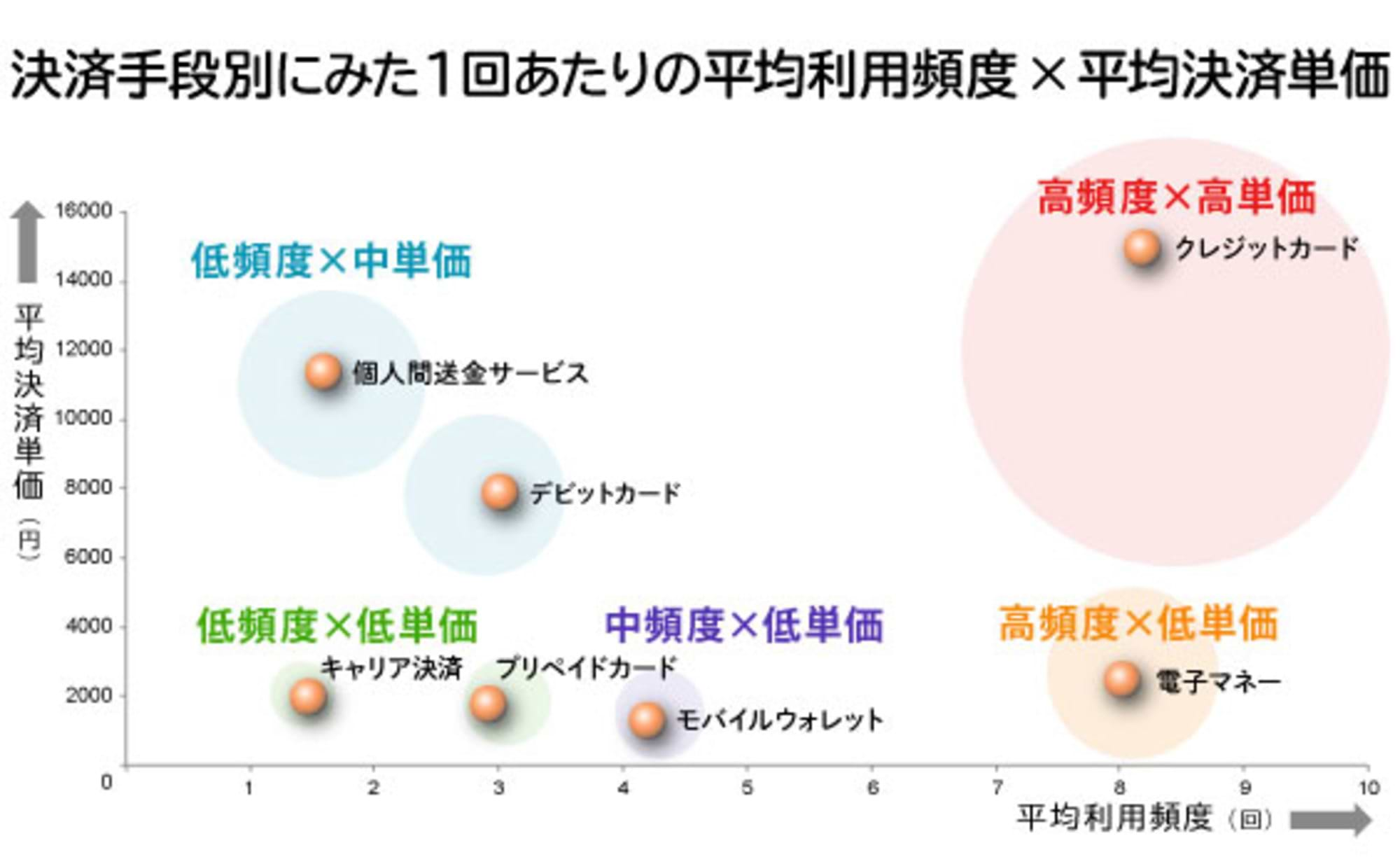

Furthermore, regarding the future increase in the "cashless payment ratio," the results suggest potential for promoting the use of new payment methods and services such as "mobile wallets (mobile payments)" and "peer-to-peer money transfer services."

Regarding future usage intentions for "peer-to-peer money transfer services Note 1," potential usage intent reached 59.8%, with 7.1% stating "I want to use it," 12.5% "I somewhat want to use it," and 40.2% "I might use it depending on the situation."

Note 1: Services enabling person-to-person money transfers for occasions like splitting meal costs, repaying money borrowed from others, or paying membership fees.

Thus, the results of this survey indicate that consumers' demand for cashless payments is steadily increasing.

However, Japan's current "cashless payment ratio" stands at around 19%, less than half the levels seen in South Korea or China, both exceeding 50%. This clearly positions Japan as a "cashless laggard." Against this backdrop, the government has set a target of "40% cashless payment ratio within 10 years," signaling a major national shift towards cashless adoption.

Going forward, competition in the cashless market will intensify as new payment methods and services emerge, and the economic sphere expands. This will be driven not only by traditional players like financial institutions and card companies but also by the entry of players from different industries, such as telecommunications and IT, as well as distribution and retail.