On February 28, "2018 Japan Advertising Expenditures" was announced. Toshiyuki Kitahara of Dentsu Inc. Media Innovation Lab explains changes in the advertising markets for the four mass media outlets, the internet, and promotional media.

Overview of Japan's Advertising Expenditures in 2018

Japan's total advertising expenditure for 2018 (January to December) reached ¥6.53 trillion, a 2.2% increase year-on-year. This marks the seventh consecutive year of growth since 2012.

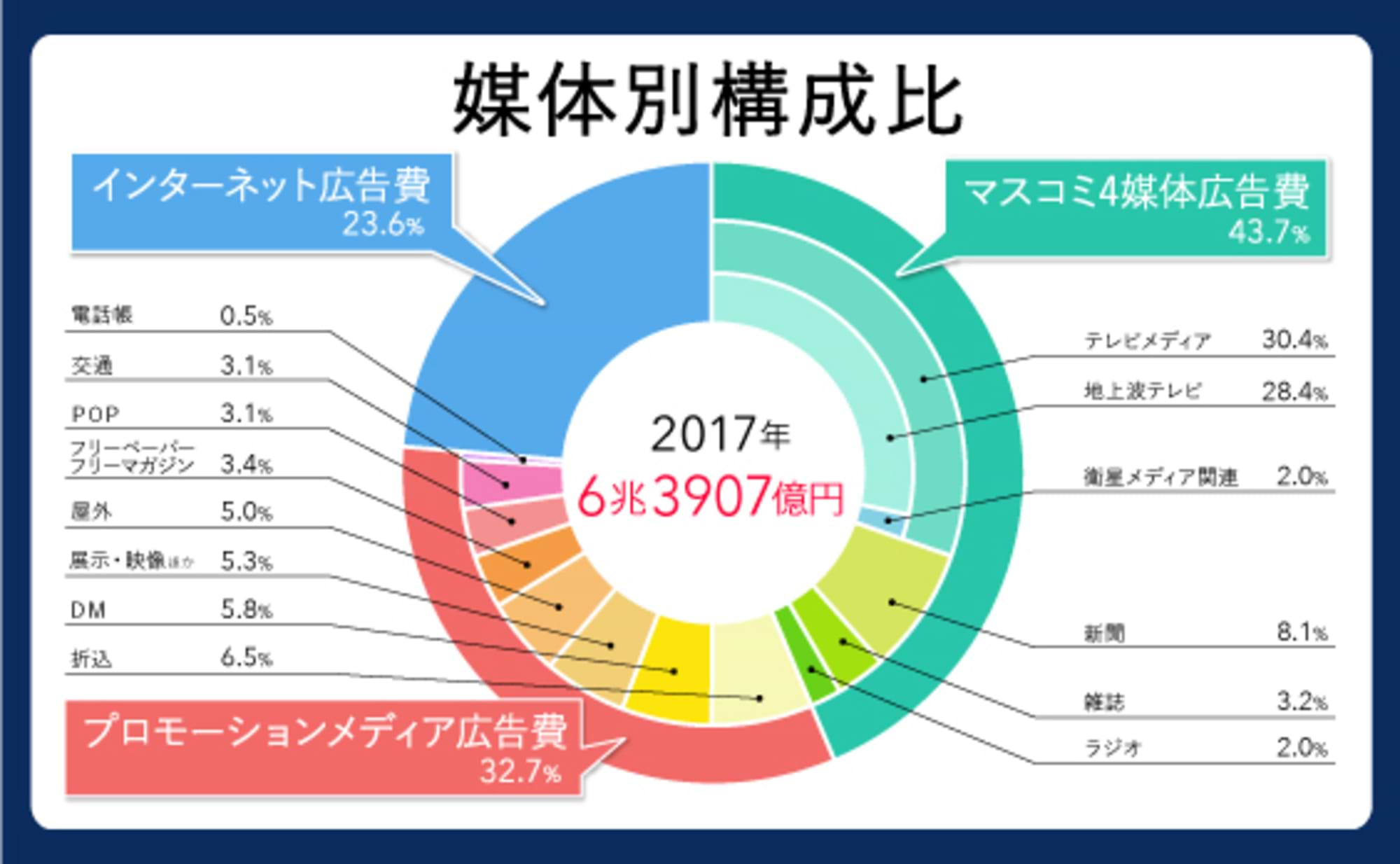

Japan's advertising expenditure can be broadly categorized into advertising expenditure for the four mass media, internet advertising expenditure, and promotional media advertising expenditure. Their respective shares of total advertising expenditure were: four mass media 41.4%, internet 26.9%, and promotional media 31.7%.

In recent years, while the share of the four mass media and promotional media has gradually decreased, the share of internet advertising, which has maintained double-digit growth since 2014, has increased annually. By 2018, it exceeded one-quarter of total advertising expenditure.

Advertising expenditure for the four mass media outlets—newspapers, magazines, television, and radio—totaled ¥2,702.6 billion, representing 96.7% of the previous year's level. The breakdown shows newspapers at 92.9% of the previous year, magazines at 91.0%, radio at 99.1%, and television (combining terrestrial and satellite media) at 98.2%.

Promotional media advertising expenditure was ¥2.0685 trillion, 99.1% of the previous year's level, with "transportation advertising," "POP," and "exhibitions/video, etc." showing positive growth.

Internet advertising expenditure (media fees + production costs), achieving double-digit growth for the fifth consecutive year, reached ¥1.7589 trillion, up 116.5% year-on-year, approaching the scale of terrestrial TV advertising expenditure at ¥1.7848 trillion. Looking at the breakdown, media fees continued to perform well, reaching ¥1.4480 trillion, up 118.6% year-on-year. Production costs also increased to ¥310.9 billion, a 107.7% increase year-on-year. Within media costs, programmatic advertising, particularly on large-scale platforms, showed remarkable growth, reaching ¥1.1518 trillion, a 122.5% increase year-on-year.

Looking at 2018 as a whole, despite numerous concerns such as repeated natural disasters, weak personal consumption, and stagnant real income growth, robust corporate earnings and a favorable employment environment supported the continued strength of internet advertising, which led overall advertising expenditure. Furthermore, the year-on-year growth rate of nominal gross domestic product (GDP) in 2018 was 0.6%, and the ratio of total advertising expenditure to GDP was 1.19% (an increase of 0.02% from the previous year).

First Estimation of "Digital Advertising Expenditures Originating from the Four Mass Media"

The advertising market is currently undergoing significant structural change. Traditionally, advertising strategy centered on allocating budgets based on fixed media roles: placing ads exclusively on a specific medium, or assigning branding to TV commercials and conversions to digital.

However, the current approach is shifting away from media-centric thinking. Instead, advertisers are meticulously examining how their target consumers—the general public—engage with information. They are then strategizing how to place ads at the contact points identified through this analysis.

While some consumers rely heavily on the internet, others remain attached to the traditional mass media. Given that most people now use multiple media platforms across channels, the demand is shifting away from fixed media choices toward efficiently combining multiple online and offline media, aligning with target behaviors.

Therefore, it's not simply a shift of the advertising market from mass media to the internet; the very method of ad placement is changing. For challenges that internet advertising alone cannot solve, "integrated solutions" are deepening. These solutions leverage data and technology to synergize with the strengths of traditional media.

To reflect these structural changes in the advertising market and the trend toward integrated solutions, starting in 2018, a new category called "Digital Advertising Expenditures Originating from the Four Mass Media" (advertising expenditures on internet services provided independently by the four mass media operators) was added to internet advertising expenditure figures. This category estimates the digital advertising expenditures for newspapers, magazines, radio, and television, respectively. A brief explanation follows.

In 2018, the total digital advertising expenditure originating from the four mass media outlets reached 58.2 billion yen, with particularly notable growth in areas beyond programmatic advertising, such as so-called reserved advertising.

Newspaper digital advertising reached ¥13.2 billion. Amid a strengthening trend toward brand safety (avoiding brand damage) in digital advertising, newspapers' brand power, rooted in high reliability, is being reevaluated.

Magazine digital: ¥33.7 billion. Publishers are expanding their digital operations, with some media achieving rapid growth by emphasizing the value of their published content. Digital-native media not based on print magazines are also increasing. The shift to digital media is accelerating, with some publishers seeing digital advertising account for nearly half of their ad revenue.

Radio digital: ¥800 million. Sales grew, backed by the popularity of broadcasters' original internet content. Market expansion is anticipated through audio ads, including those on radiko.jp.

TV Media Digital: ¥10.5 billion. Video advertising leveraging TV content strength leads the market. Services like TVer, which provides catch-up streaming of terrestrial TV programs, warrant close attention for further growth.

Three Advertising-Related Markets Gaining Attention Due to Integrated Solution Evolution

We have conducted new research on three markets gaining attention in relation to integrated solutions. While these figures are not included in "2018 Japan Advertising Expenditures," we aim to incorporate them into total advertising expenditure in the future.

First, with events significantly increasing ahead of 2020, we estimated 2018 event-related advertising expenditure at ¥314.8 billion. Particularly in Tokyo, urban regeneration projects are advancing for 2020, and events like art installations utilizing digital technology and e-sports are thriving. Furthermore, SNS-linked campaigns, where participants take photos at events and share them, have become commonplace. This trend reflects a growing appreciation for the "value of real-life experiences" that cannot be obtained solely through the internet.

Next, due to the decline in newspaper insert advertisements, direct mail delivery to individual mailboxes is being reevaluated as an alternative for area marketing. We estimated the market size for this in 2018 to be ¥112.9 billion.

The DM advertising production-related market is 121.4 billion yen. While DM advertising costs are estimated to include only postage and delivery fees, production-related costs were also estimated for reference, given the recent increase in rich DMs targeting loyal customers. Integration between web and print is advancing, such as sending direct mail to customers who abandon their shopping carts on e-commerce sites. This expansion of "integrated solutions" that go beyond internet-only approaches to include direct print appeals is growing.

Additionally, although not included in the figures presented this time, the significant increase in in-site advertising on e-commerce media is a notable trend, suggesting a market of considerable scale has formed. Future developments in this area warrant attention.

Finally, while the internet advertising market continued to expand in 2018, issues like brand safety, ad fraud, and viewability (ad visibility) have become more apparent, and urgent countermeasures are currently being implemented.

When I joined Dentsu Inc., a senior colleague told me, "Advertising isn't fundamentally something people see. Our job is to figure out how to get them to see it." "How to create messages that make people turn their heads" remains a universal challenge even in today's digital age.

While the sheer volume of data has increased dramatically, making targeting easier than in the past, truly delivering genuinely effective messages to each individual remains a step further. For the healthy growth of the advertising market, I believe sincere efforts toward advertising itself, and the people and society surrounding it, are increasingly essential.

Details on "2018 Japan Advertising Expenditures" can be found here (Dentsu Inc. News Release).