On March 11, "2019 Japan Advertising Expenditures" was announced. Toshiyuki Kitahara of Dentsu Inc. Media Innovation Lab explains the changes in the advertising markets for the four mass media outlets, the internet, and promotional media.

Overview of Japan's Advertising Expenditures in 2019

Japan's total advertising expenditure for 2019 (January to December) reached ¥6,938.1 billion, a 106.2% increase from the previous year (*), marking the eighth consecutive year since 2012 that it has exceeded the previous year's results.

※Starting this year, "Advertising Expenditures on E-commerce Platforms for Physical Goods" ( ※1 ) and "Events" ( ※2 ) were newly added to the estimation scope for "Japan's Advertising Expenditures." Using the same estimation method as the previous year, the figure would be ¥6,651.4 billion, a 101.9% increase year-on-year.

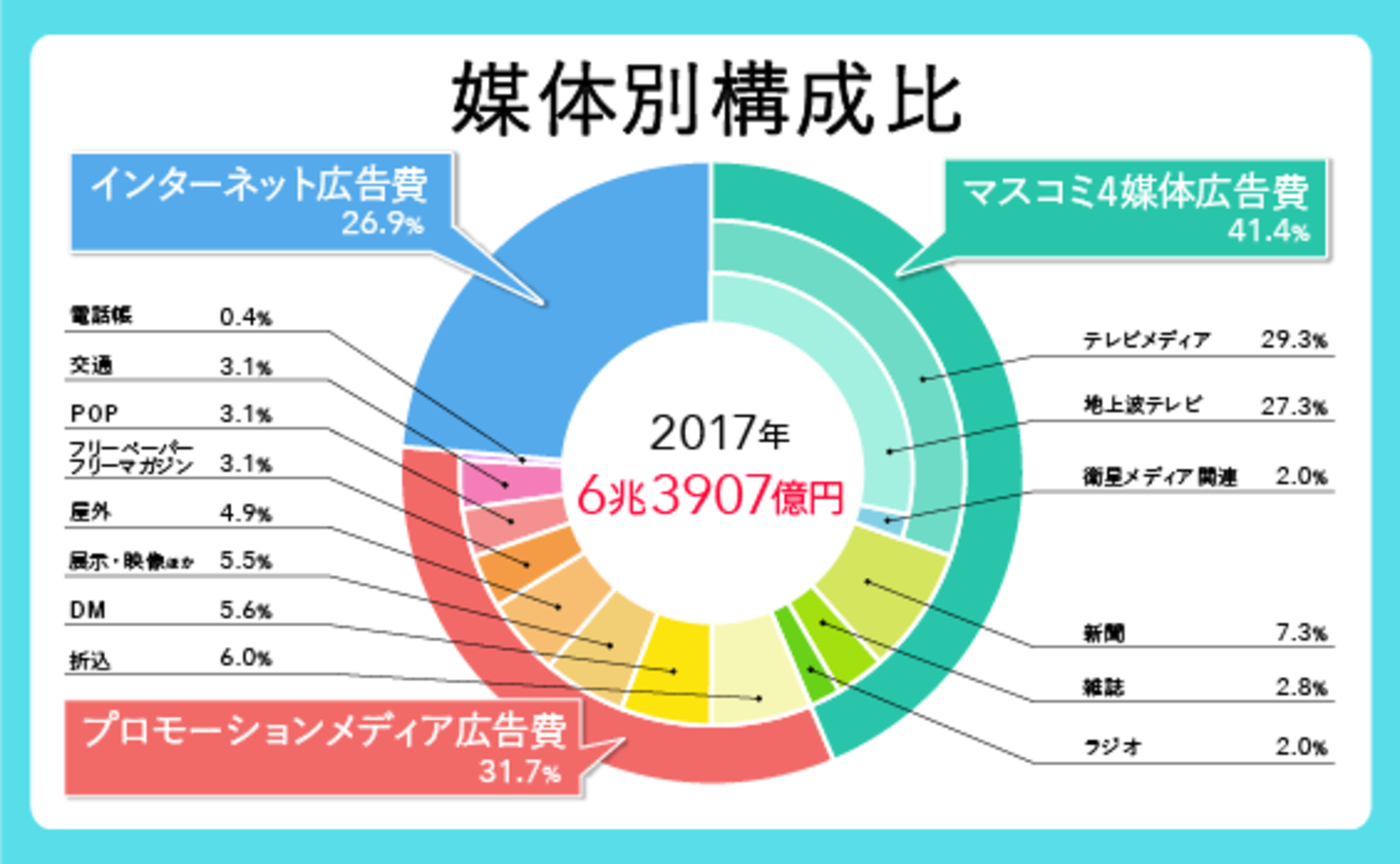

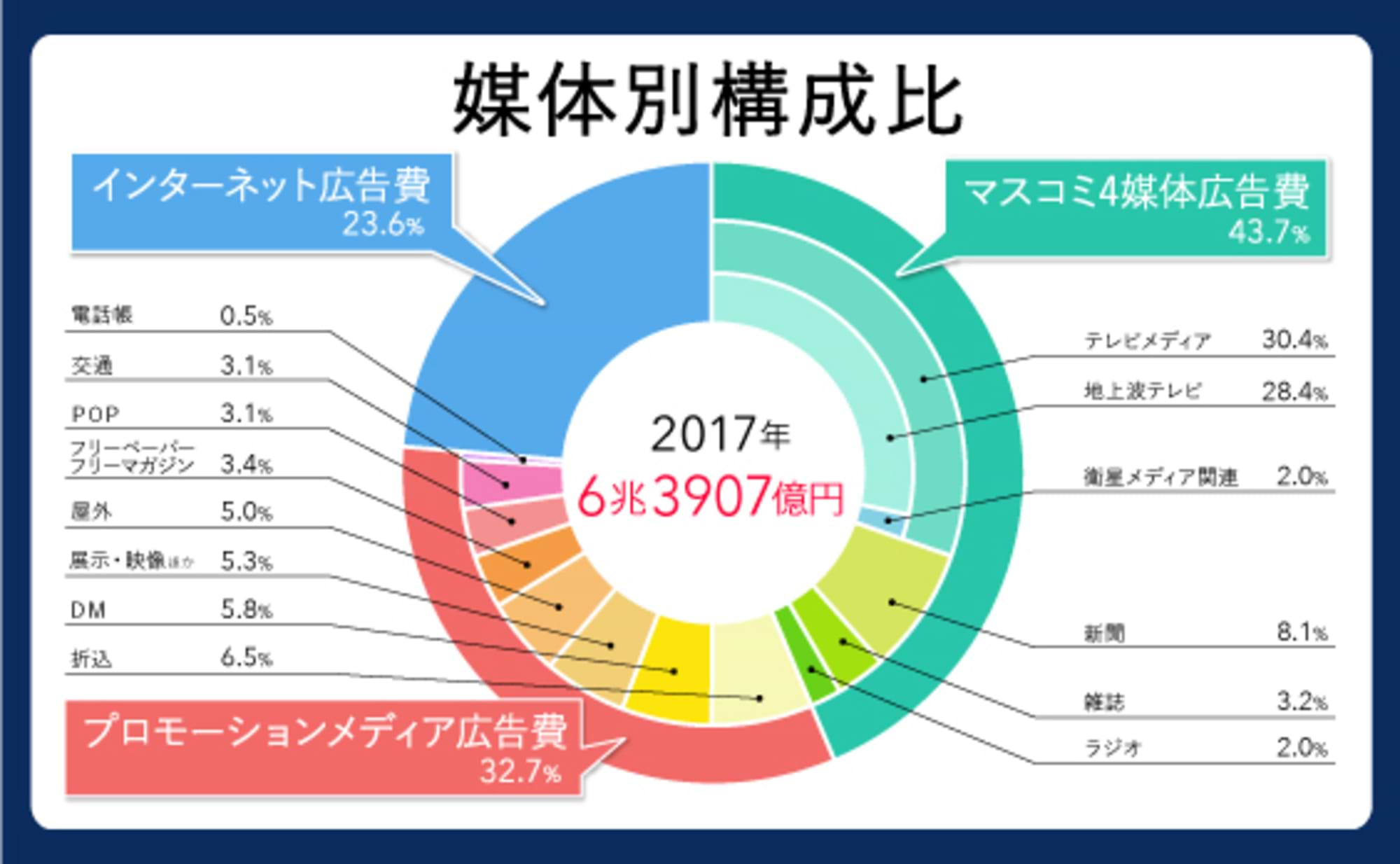

Japan's advertising expenditure is broadly categorized into "Mass Media Advertising Expenditure," "Internet Advertising Expenditure," and "Promotional Media Advertising Expenditure."

Their respective shares of total advertising expenditure are: Mass Media 4: 37.6%, Internet: 30.3%, and Promotional Media: 32.1%. Within Mass Media 4, TV Media accounted for 26.8%. The share of Internet advertising, which has maintained double-digit growth since 2014, surpassed that of TV Media.

●Advertising Expenditures for the Four Major Media

Advertising expenditure for the four mass media outlets—newspapers, magazines, television, and radio—totaled ¥2,609.4 billion, a 96.6% year-on-year figure. The breakdown shows decreases across all categories: newspapers at 95.0% year-on-year, magazines at 91.0%, radio at 98.6%, and television media (combining terrestrial and satellite media) at 97.3%.

●Internet Advertising Expenditures

Internet advertising expenditure (media costs + advertising production costs + "product-selling e-commerce platform advertising costs"), achieving double-digit growth for the sixth consecutive year, reached ¥2.1048 trillion, a 119.7% increase year-on-year, surpassing television media's ¥1.8612 trillion.

Even excluding "product-selling e-commerce platform advertising costs," internet advertising spending, calculated using the same estimation method as last year, still exceeded television at ¥1,998.4 billion, a 113.6% increase year-on-year.

Breaking it down, media fees reached ¥1,663.0 billion, a 114.8% increase year-on-year. Production fees were ¥335.4 billion, a 107.9% increase year-on-year. The newly estimated "product-selling e-commerce platform advertising fees" amounted to ¥106.4 billion. While a reference value, it is estimated to be approximately 129.4% of the previous year's figure.

Media costs, particularly those for major platform operators, continue to show robust growth. Furthermore, the "digital advertising costs originating from the four mass media outlets" discussed later, along with the newly estimated "advertising costs for product-selling e-commerce platforms," have further boosted overall advertising spending.

●Promotional Media Advertising Expenditures

This segment reached ¥2,223.9 billion, a 107.5% year-on-year increase. This figure includes the growth from "Events" within the "Events, Exhibitions, Video, etc." category, for which the estimation scope was expanded starting in 2019. Even excluding this expansion, "Outdoor Advertising," "Transportation Advertising," and "Exhibitions, Video, etc." all showed net increases.

Transportation advertising continues to see digital signage covering the decline in print media. The taxi vision market expanded particularly rapidly in 2019, warranting future attention.

In summary, even as Japan's GDP slowed significantly due to various changing circumstances, internet advertising continued to drive overall advertising spending.

Added Estimation for "Product-Selling E-Commerce Platform Advertising Expenditures" and "Events, Exhibitions, Video, etc."

Starting in 2019, we have newly established the categories "Advertising Expenditures for E-commerce Platforms Selling Physical Goods" within Internet Advertising Expenditures and "Events" within Promotional Media Advertising Expenditures, and have estimated the advertising expenditures for each.

●New Category: "Advertising Expenditures for Product-Selling E-Commerce Platforms"

The e-commerce platform advertising market consists of three segments: "Product Sales," "Services," and "Digital Content." This time, we added estimates specifically for "Product Sales E-commerce Platforms," excluding the harder-to-estimate "Services" and "Digital Content" segments.

For this estimation, we excluded portions already included in "Japan's Advertising Expenditures."

(Reference article: "Explanation of the 2018 Estimated Survey of Product-Based E-Commerce Platform Advertising Expenditures" )

● Revised Item: "Events, Exhibitions, Video, and Others"

The estimated range for "Events, Exhibitions, Video, and Others" has been expanded from last year's "Exhibitions, Video, and Others" to ¥567.7 billion.

Due to the broader estimation scope, this is strictly a reference value. However, compared to last year's "Exhibitions, Video, etc." figure of ¥358.5 billion, it shows a sharp increase of 158.4% year-on-year. Using the same estimation method as last year would yield 108.1%.

Numerous celebratory events were held for the new era name, alongside city branding events in areas undergoing major redevelopment in Tokyo. These included events utilizing video technologies like projection mapping, ceremonies, and opening parties. Furthermore, a series of major events—such as the G20 summit in Osaka, the Pope's visit to Japan, and the Rugby World Cup—likely contributed to the strong performance.

Regarding video-related content, the proliferation of smartphones has significantly increased promotions utilizing video content. Its strength lies in its ability to effectively influence consumer attitudes, such as for branding and purchase promotion. Furthermore, the diversification of entertainment through technology is advancing, with an increase in experiential attractions utilizing VR.

Digital Transformation of Mass Media Gains Momentum

In an era where many people search for information on smartphones, internet advertising spending showed high growth rates in 2019, primarily driven by large platform operators.

For advertisers, internet advertising offers significant advantages due to high viewing frequency and large user bases. The trend where performance-based advertising, known for its high efficiency, contributes to overall growth remains consistent year after year.

However, in recent years, issues such as ad fraud and brand risk have emerged as particular challenges for programmatic advertising. In response, advertisers are increasingly shifting their advertising activities to start from their own websites, owned media, and social media.

Amidst this, "digital advertising spending originating from the four major media outlets" has grown at a higher rate than internet advertising spending. In 2019, "digital advertising spending originating from the four major media outlets" reached ¥71.5 billion, a 122.9% year-on-year increase representing double-digit growth. Digital advertising for magazines and TV media-related video (discussed later) saw particularly strong growth.

● Newspaper Digital

In response to the aforementioned challenges in digital advertising, digital editions of newspapers are being recognized as a reliable advertising space. Efforts such as content distribution to platform operators are underway, indicating that companies are steadily transforming toward a digital-first approach.

●Magazine Digital

Currently, the electronic publishing market is growing significantly. Consequently, the "entire market" (combining print and electronic publishing) reached 100.2% of the previous year, surpassing the previous year for the first time since statistics for electronic publishing began (Source: Publishing Monthly Report, January 2020 issue). Digital is not only covering the decline in print media but is also driving further growth.

Against this backdrop, digital magazine advertising grew substantially, reaching 120.2% of the previous year. As magazines themselves undergo digital transformation, a new advertising market is emerging.

Furthermore, planned advertising formats like tie-up ads and video ads expanded significantly alongside ad networks. New digital-driven ventures are also actively developing, including social media and influencer cultivation, establishing content studios, and collaborating with startups.

●Radio Digital

Advertising on platforms like radiko's "radiko Audio Ad" is steadily increasing. With the full-scale rollout of 5G and IoT, this is expected to become a significantly expanded advertising domain, leveraging technologies like geotargeting.

●TV Media Digital

Digital advertising on TV media continues to grow, with "TV media-related video ads" experiencing particularly rapid growth at 148.5% year-on-year. This represents advertising spending on internet video distribution, including TVer (Tee-bar), the official commercial TV portal that has also begun distribution via TV apps.

Beyond TVer, the content strength originating from terrestrial TV appears to be gradually being leveraged in the digital domain. Furthermore, 2020 is expected to see accelerated growth in live and highlight streaming of sports content.

With the imminent full-scale rollout of technologies like 5G and IoT, ad technology will undoubtedly continue to evolve. In this era of data marketing, I believe the future of "advertising" lies not in thinking in terms of individual media outlets as before, but in how precisely we can approach our target audience, keeping them at the center. A cross-platform advertising approach that meticulously captures the preferences and attributes of the target audience will likely become the norm.

Details on "2019 Japan Advertising Expenditures" can be found here (Dentsu Inc. News Release).

*1 "Advertising Expenditures in Japan" - "Advertising Expenditures on Product-Selling E-Commerce Platforms"

This refers to advertising expenditure invested within an e-commerce (EC) platform (referred to as a "retail EC platform" in this report) that sells goods such as home appliances, sundries, books, clothing, and office supplies, by businesses that have "opened a storefront" on that platform (referred to as "businesses with storefronts" in this report). This does not refer to the broader category of "Internet advertising expenditure aimed at sales promotion within the e-commerce domain." Furthermore, while D2C Inc., CCI, and Dentsu Inc. jointly announced "Advertising Expenditure on Product-Selling E-Commerce Platforms" on July 29, 2019, this figure has been newly estimated for the "2019 Advertising Expenditure in Japan" survey by eliminating overlaps with "Advertising Expenditure in Japan" and redefining the scope. 2018: ¥82.2 billion (reference value, not included in "2018 Japan Advertising Expenditure") / 2019: ¥106.4 billion (reference year-on-year change: 129.4%)

Reference) July 29, 2019 Joint Release by D2C Inc., CCI, and Dentsu Inc.

https://www.dentsu.co.jp/news/release/2019/0729-009857.html

2018 Actual: ¥112.3 billion (120.6% YoY)

2019 Forecast: ¥144.1 billion (128.3% YoY projected)

↑Back to main text

※2 "Events, Exhibitions, Video, etc."

Includes production costs for various events, exhibitions, expos, PR pavilions, etc., handled by the advertising industry (including sales promotion campaigns), as well as production and screening costs for cinema ads, videos, etc. The event portion, defined below, has been added to the previously estimated "Exhibitions, Video, etc." category.

Definition of "Event" advertising expenditure in "Japanese Advertising Expenditure" (¥180.3 billion in 2019; not disclosed for 2018 as estimation was not possible): Production costs for promotional campaigns, pop-up stores, sports events, PR events, etc., within the event domain handled by the advertising industry, excluding display advertising, exhibitions, expos, and promotional video production.

↑Back to main text